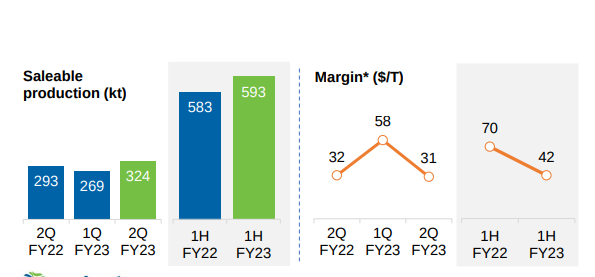

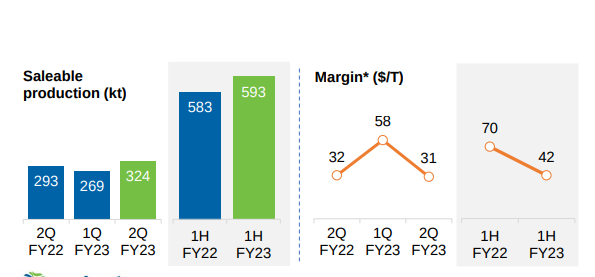

1. In the second quarter, the saleable production up 11%YoY on account of completion of debottle-necking activity in blast furnace -3 in 1Q FY23.

2. Half yearly saleable production increased by 2%YoY despite decrease in hot metal due to improvement in yield.

3. ESL Margins have decreased amidst softening of steel prices post imposition of export duties by GOI and higher Coking coal prices.

4. The margins have reduced from $70 dollar per ton to $19 dollars per ton due to reason mentioned at point number 3. ( Reduction of 72% in Margins)

5.

5. ~2500 Crores CAPEX is planned for ESL to increase the production capacity from 1.5 to 3 MTPA hot metal. Out of this, ~ 400 CAPEX has been done.

6. Total debt on ESL as of 30.09.2022 is Rs. 2106 Crores after subtracting cash from it.

7. Total revenue generated in the H1FY23 is ~3400 Crores which is up from ~2600 Crores in H1FY22.

8. But due to margin pressure, the EBITDA has gone down from 295 Crores in H1FY22 to just 82 Crores in H1FY22. ( Reduction of 72% in Margins ).

5. ~2500 Crores CAPEX is planned for ESL to increase the production capacity from 1.5 to 3 MTPA hot metal. Out of this, ~ 400 CAPEX has been done.

6. Total debt on ESL as of 30.09.2022 is Rs. 2106 Crores after subtracting cash from it.

7. Total revenue generated in the H1FY23 is ~3400 Crores which is up from ~2600 Crores in H1FY22.

8. But due to margin pressure, the EBITDA has gone down from 295 Crores in H1FY22 to just 82 Crores in H1FY22. ( Reduction of 72% in Margins ).

5. ~2500 Crores CAPEX is planned for ESL to increase the production capacity from 1.5 to 3 MTPA hot metal. Out of this, ~ 400 CAPEX has been done.

6. Total debt on ESL as of 30.09.2022 is Rs. 2106 Crores after subtracting cash from it.

7. Total revenue generated in the H1FY23 is ~3400 Crores which is up from ~2600 Crores in H1FY22.

8. But due to margin pressure, the EBITDA has gone down from 295 Crores in H1FY22 to just 82 Crores in H1FY22. ( Reduction of 72% in Margins ).