Company Overview of ESDS unlisted Shares

ESDS Software Solution Limited (formerly ESDS Software Solution Private Limited) was incorporated on August 18, 2005. Headquartered in Nashik, the company operates across four Indian cities—Nashik, Mumbai, Bengaluru, and Mohali—while extending its footprint across 19 nations in APAC, Europe, the Middle East, the Americas, and Africa. Founded by first-generation entrepreneur Piyush Somani, ESDS began as an outsourced hosting support provider, later transforming into a global web hosting and cloud solutions company. Today, ESDS is positioned as a challenger to global giants like AWS, Microsoft Azure, CtrlS, Sify, Netmagic, NextGen, Rackspace, and Alibaba.

ESDS Business Segments: A Dual Engine for Growth

1. Data Centre Services: The reliable foundation. Offers:

-

Dedicated Hosting (full servers for clients)

-

Colocation (housing client servers)

-

Disaster Recovery Hosting (business continuity)

2. Cloud Business: The growth engine. Built on the eNlight Cloud, India's first patented auto-scalable cloud. Its vast portfolio includes security tools (WAF, SIEM), management suites (eMagic), and specialized solutions (IoT, AI healthcare).

Industries Served: Solutions are used across BFSI, Healthcare, Govt., eCommerce, Manufacturing, and 10+ other sectors.

Subsidiaries Network of ESDS unlisted Shares

-

Spochub Solutions Private Limited : Likely focuses on niche software product development or a specialized technology platform.

-

ESDS Global Software Solution Inc. : Drives international market expansion, sales, and support for ESDS's software and cloud services.

-

ESDS Cloud FZ LLC : Leads global cloud infrastructure and service delivery, supporting overseas data center and hosting operations.

The Engine of Growth: Innovation and Strategy

ESDS's success is underpinned by its innovative technology stack, led by its crown jewel: the eNlight Cloud.

-

Patented Technology: eNlight is India’s first and only cloud computing platform patented in the US and UK for its unique ability to auto-scale CPU and RAM in real-time without any downtime. This converts customer IT expenditure from a high capital outlay (CAPEX) into a flexible operational expense (OPEX).

-

Comprehensive Product Suite: Beyond the core cloud, ESDS offers a wide array of products including:

-

eMagic: Data center management suite.

-

VTMscan & eNlight WAF: Security and vulnerability tools.

-

eNlight IoT: An indigenous IoT platform.

-

AA+: An AI/ML-based solution for detecting lung diseases from X-Rays.

Key Performance Overview of FY 2024-25 of ESDS unlisted Shares

FY 2024-25 was a landmark year for ESDS, marked by explosive growth, global expansion, and stronger financial discipline.

Revenue Performance

-

Total Revenue: Rose by 27% YoY, from ₹287 Cr (FY24) to ₹361 Cr (FY25).

-

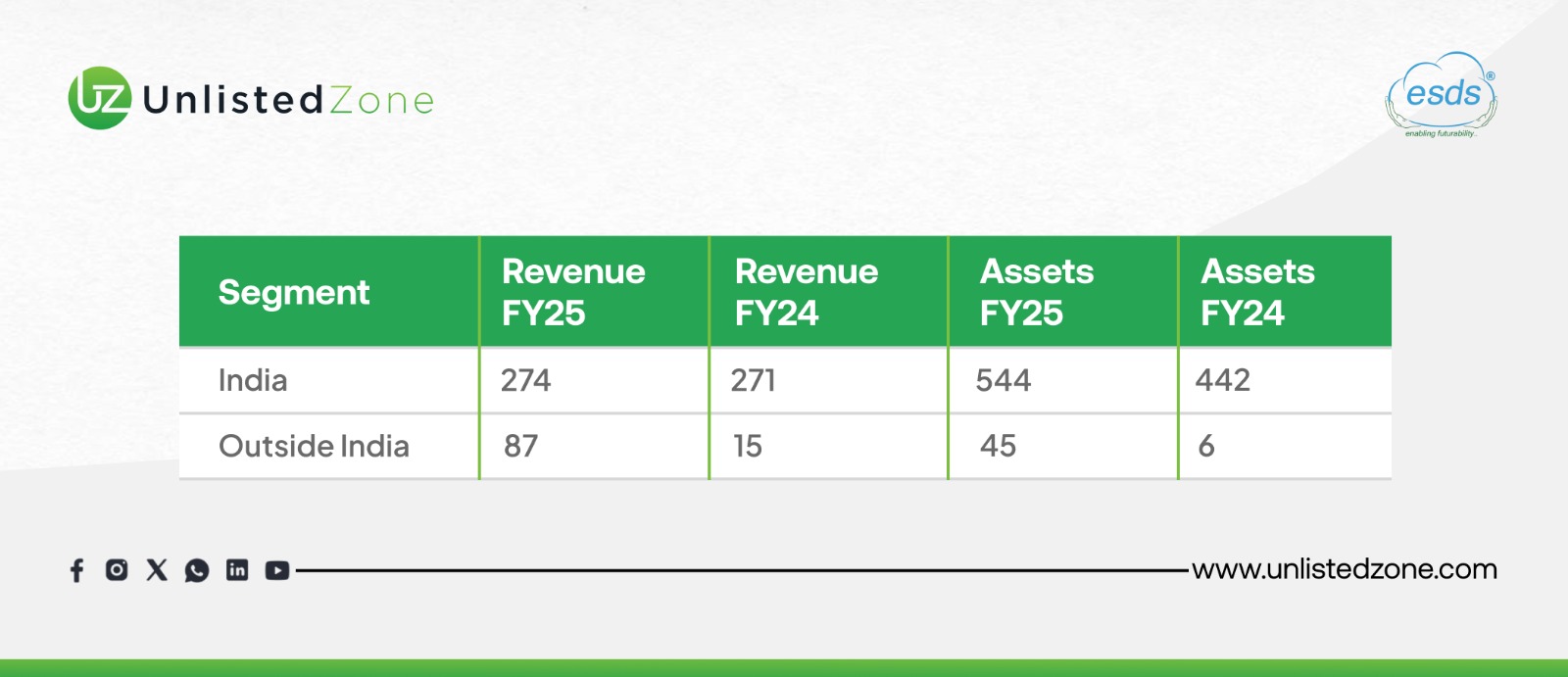

Domestic Sales: Increased by 6%, reinforcing its dominance in India.

-

International Revenue: Surged nearly 600%, from ₹15 Cr to ₹ 87 Cr.

Impact: International revenue contribution rose from 3.6% to 19.5%, establishing a new growth engine and diversifying geographic risks.

Strengthened Financial Foundation

-

Equity Infusions: Raised ₹76 Cr (Oct ’24) and ₹65.2 Cr (Feb ’25).

-

Debt Reduction: Redeemed Non-Convertible Debentures (NCDs), significantly lowering debt and interest burden.

-

Improved Collections: Customer collections rose 29% to ₹385.2 Cr, boosting liquidity and operational efficiency.

Strategic Expansion

-

International Foray: Invested ₹38.6 Cr in ESDS Cloud FZ LLC, cementing its global ambitions.

-

New Orders: Secured 116 new orders worth ₹42.5 Cr, adding visibility for future revenues.

-

Marquee Clients: Acquired Honeywell Automation India Ltd. and Terumo India Pvt. Ltd., reinforcing market credibility.

-

STPI Partnership: Generated 40 new contracts with TCV of ₹6 Cr and ACV of ₹5 Cr, adding valuable recurring revenue.

Profitability & Shareholder Value

-

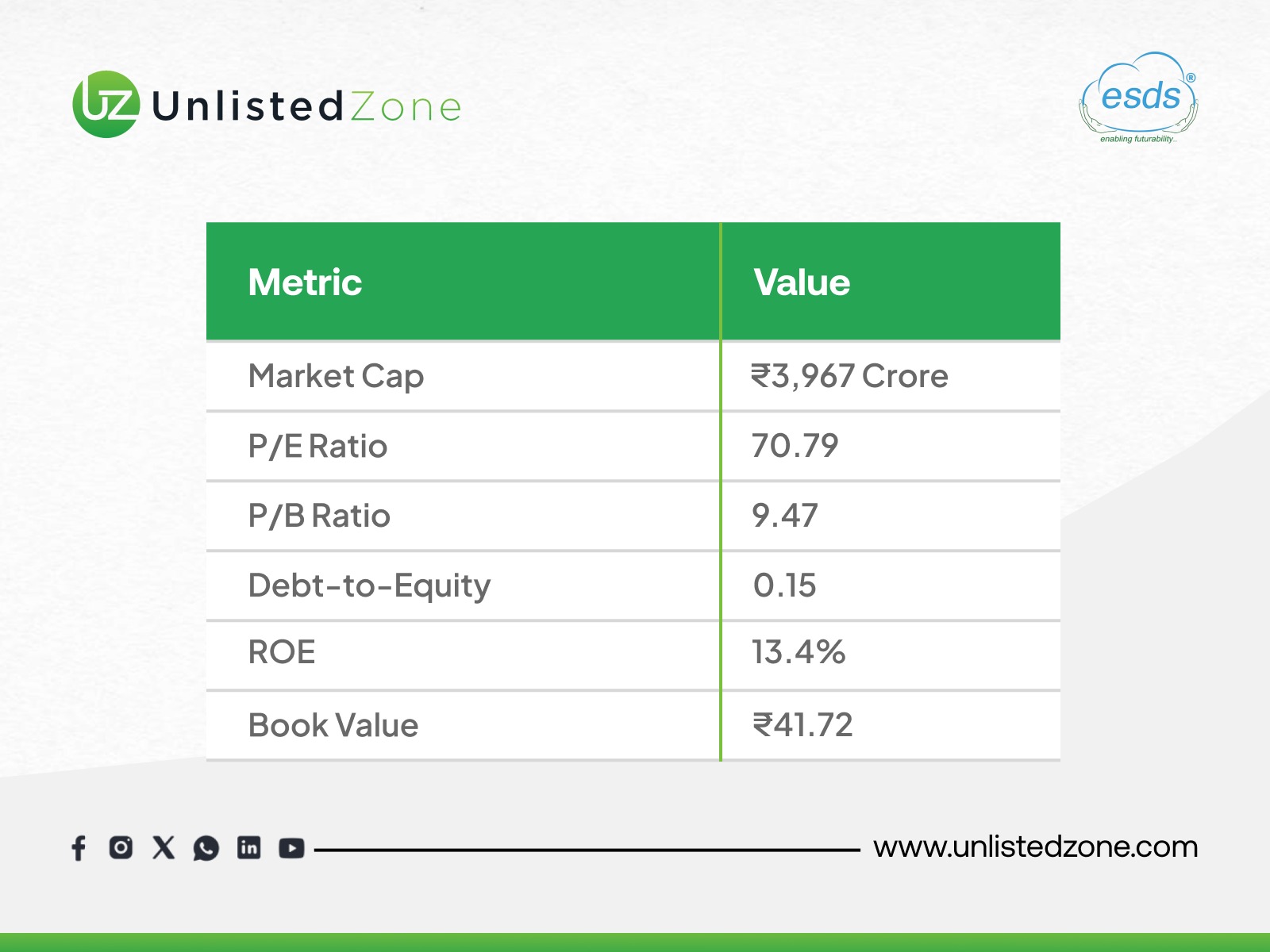

Shareholder Returns: Jumped from 6.45% (FY24) to 13.40% (FY25).

-

Leverage: Debt-to-equity ratio improved from 0.66 to 0.15.

-

Net Profit Margin (NPM): Rose from 4.75% to 15%.

-

Return on Capital Employed (ROCE): Increased sharply to 24.73% (FY25) from 14.53% (FY24).

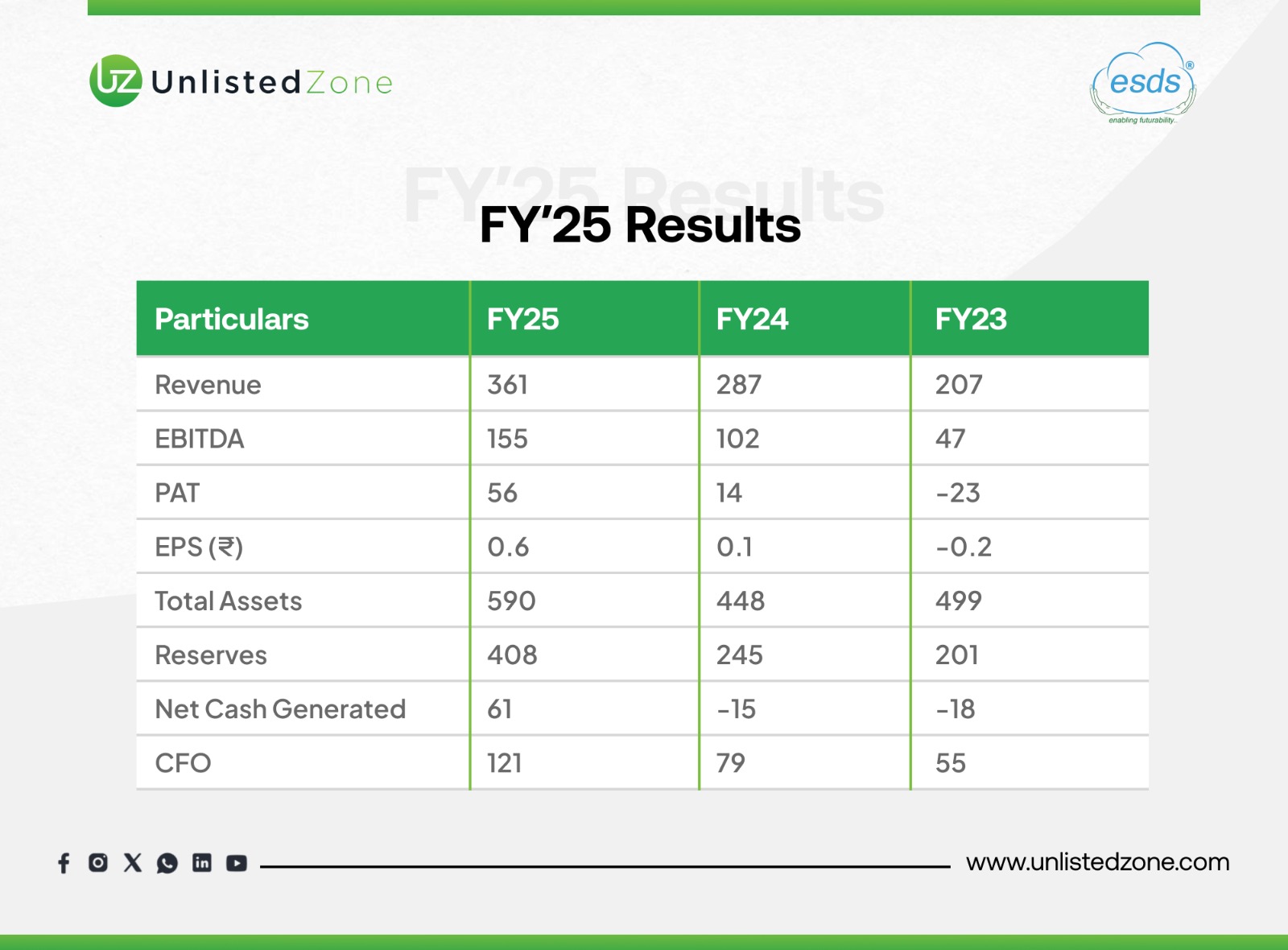

Key Financial Metrics (₹ in Cr) of ESDS unlisted Shares

Strong Revenue Growth : Revenue has increased consistently year-over-year, rising from ₹207 Cr in FY23 to ₹361 Cr in FY25, reflecting strong demand and successful business expansion.

Remarkable Profitability Turnaround :The company shifted from a net loss of ₹23 v in FY23 to a profit of ₹56Cr in FY25, demonstrating significant operational improvements and cost management.

Enhanced Operational Efficiency : EBITDA surged from ₹47 Cr in FY23 to ₹155 Cr in FY25, indicating better control over operating costs and higher profitability from core business activities.

Improved Shareholder Value : Earnings per share (EPS) turned positive, rising from -₹2.48 in FY23 to ₹5.6 in FY25, showcasing increased returns for shareholders.

Strengthened Financial Position : Total assets grew from ₹499 Cr in FY23 to ₹656 Cr in FY25, supported by a near-doubling of reserves (from ₹201 Cr to ₹408 Cr), highlighting retained earnings and financial stability.

Positive Cash Flow Generation : After burning cash in FY23 and FY24, the company generated ₹61 Cr in net cash in FY25, with operating cash flow (CFO) also rising steadily, underscoring sustainable financial health.

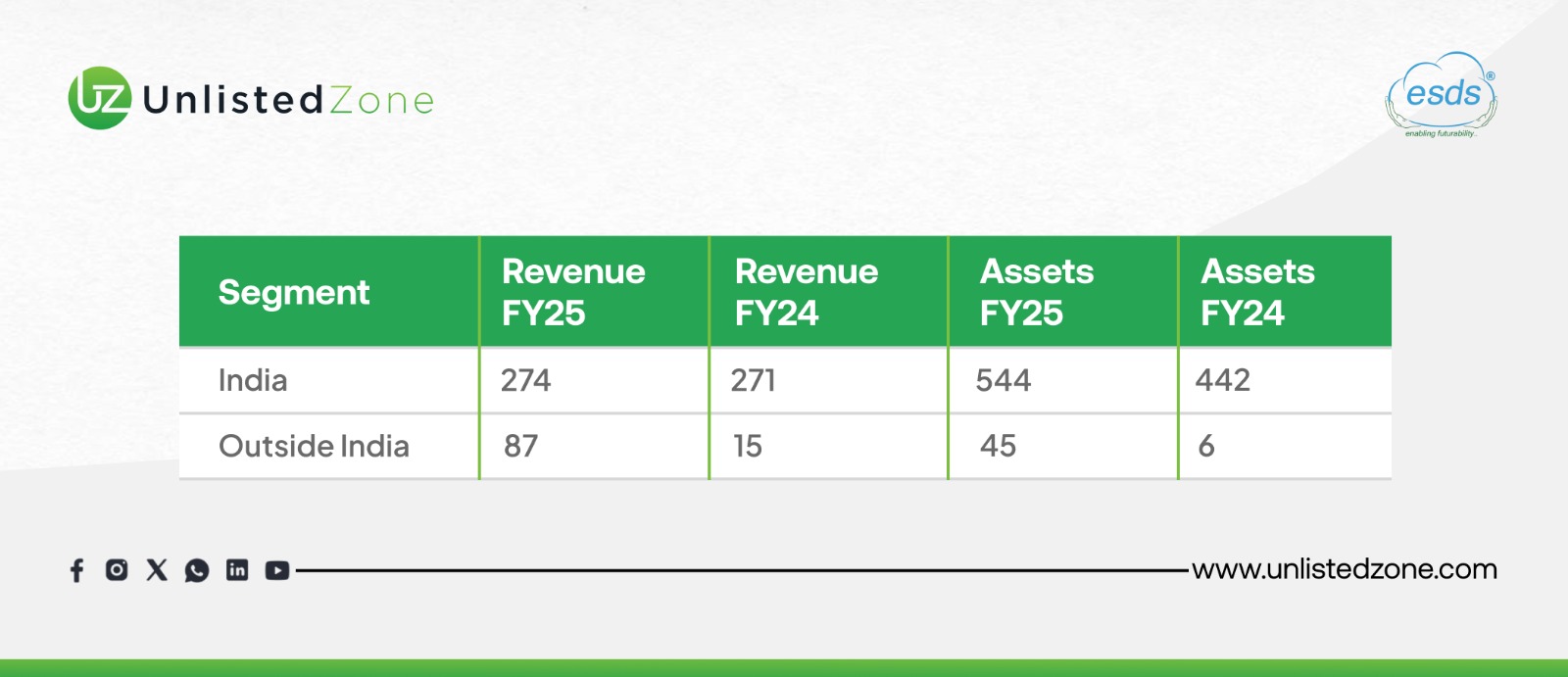

Geographic Performance of ESDS unlisted Shares

Insight: While India remains the core revenue contributor, international growth of 474% positions ESDS as a global player.

IPO Plans of ESDS unlisted Shares

-

Proposed Issue: Fresh issue of up to ₹6,000 Cr.

-

Listing: To be listed on BSE and NSE.

-

Regulatory Status: Awaiting SEBI clearance on DRHP; in-principle approvals received from both exchanges.

-

IPO Costs: ₹46.12 Cr incurred up to March 31, 2025, shown under current assets.

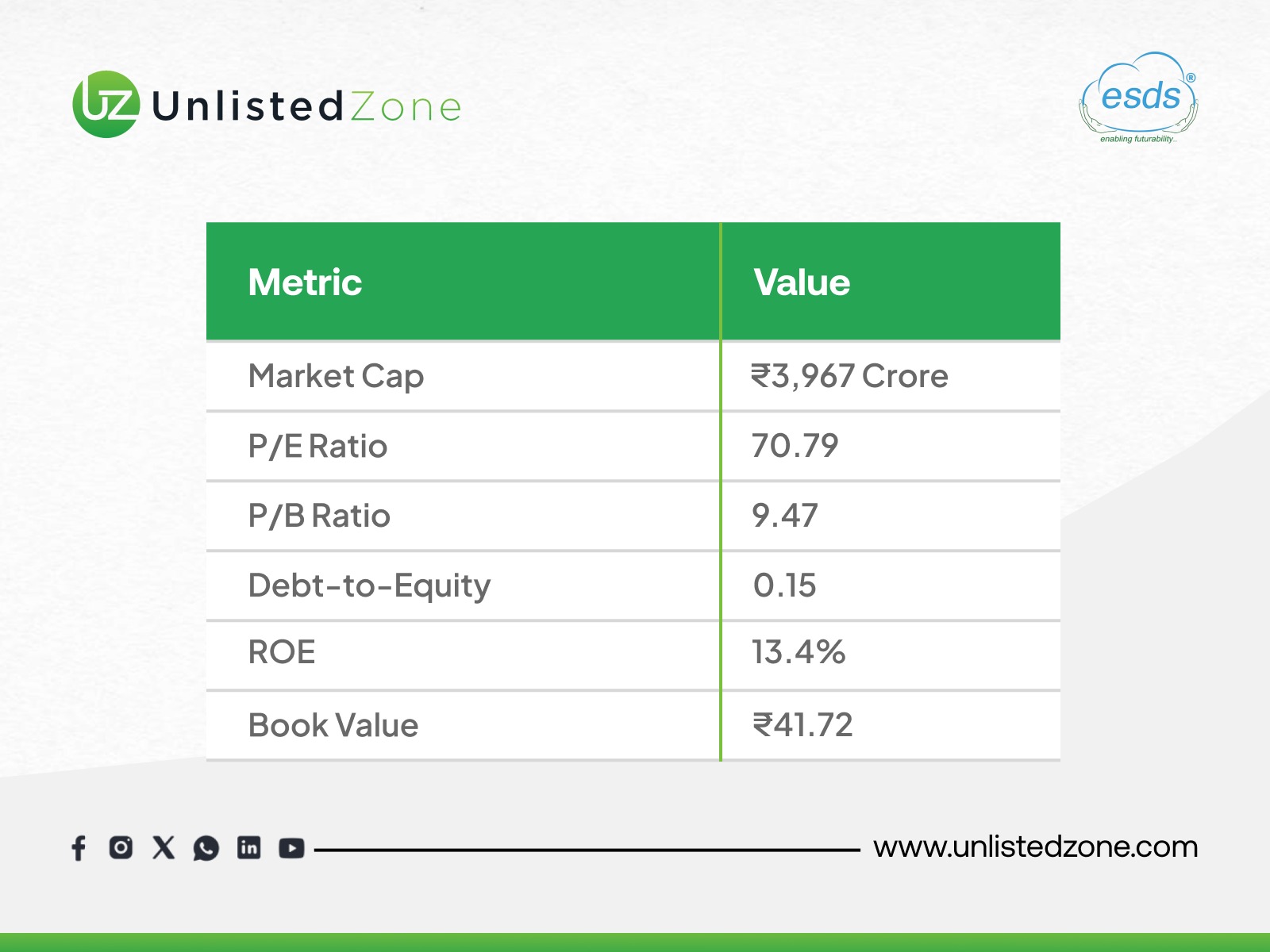

Unlisted Market Valuation Insights of ESDS unlisted Shares

Interpretation: The high P/E and P/B ratios reflect strong investor confidence and growth expectations, while the low debt-to-equity and healthy ROE indicate financial strength and efficiency.

Conclusion

FY 2024-25 has been transformative for ESDS Software Solution Limited. With 600% growth in international revenues, strategic debt reduction, improved profitability, and marquee client wins, ESDS has built a strong foundation for long-term growth. Its innovative cloud offerings, strong financial discipline, and upcoming IPO make it a company to watch in India’s IT and cloud services landscape.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.