Introduction: The Growing Appeal of IPL for Investors

The Indian Premier League (IPL) has become a significant force in global sports, not just as a cricketing event but as a lucrative business opportunity. The league has caught the attention of global investors, including major conglomerates like Torrent, due to its massive viewership, robust revenue models, and consistent growth over the years. The IPL's appeal lies in its strategic combination of sports and entertainment, creating a product that is both marketable and profitable.

Why IPL is Gaining Popularity Among Investors

Investors are increasingly drawn to IPL franchises due to the high returns and the league's established brand value. The recent example of Torrent Pharmaceuticals showing interest in acquiring a stake in an IPL team highlights the growing attractiveness of these franchises as investment vehicles. Ahmedabad-based Torrent Group has reportedly reached an agreement with CVC Capital Partners to acquire a majority stake in the Indian Premier League (IPL) franchise Gujarat Titans. The deal, which is expected to be formalized after the ownership lock-in period ends in February 2025, is believed to value the IPL team at over $1 billion. This acquisition marks Torrent's entry into the sports industry, a significant move for the group.

The potential for revenue generation through various streams such as broadcasting rights,sponsorships, and merchandise sales makes IPL franchises a hot commodity.

Broadcasting Rights: The Golden Goose of IPL

The central revenue source for IPL teams is the income from broadcasting rights. For the 2023-2027 period, the broadcasting rights were sold for a staggering ~INR 50,000 crore. This amount is split equally between the Board of Control for Cricket in India (BCCI) and the 10 participating teams, ensuring a consistent inflow of approximately INR 500 crore per year for each franchise. For Chennai Super Kings (CSK), this has translated into a direct boost in their financial performance for FY24.

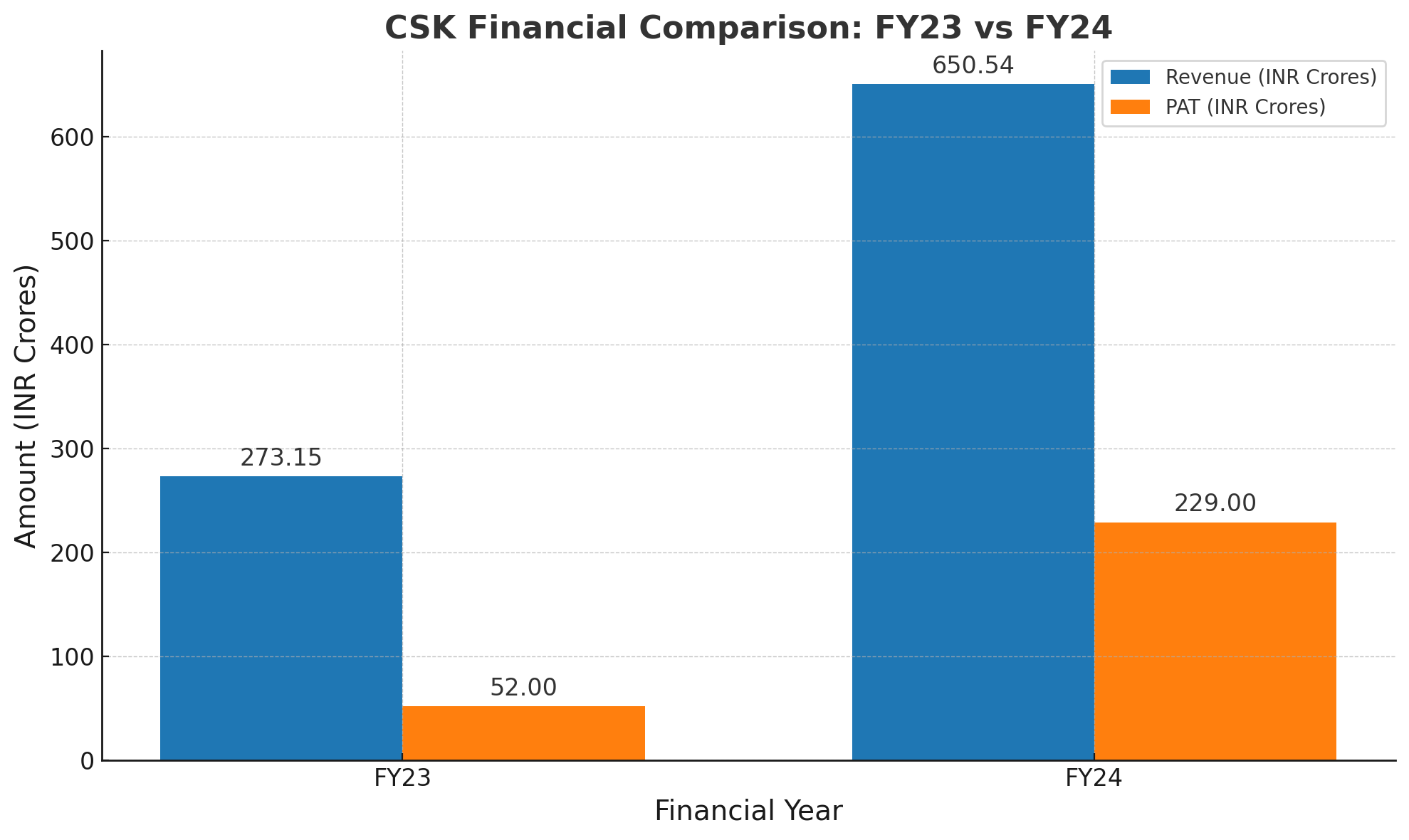

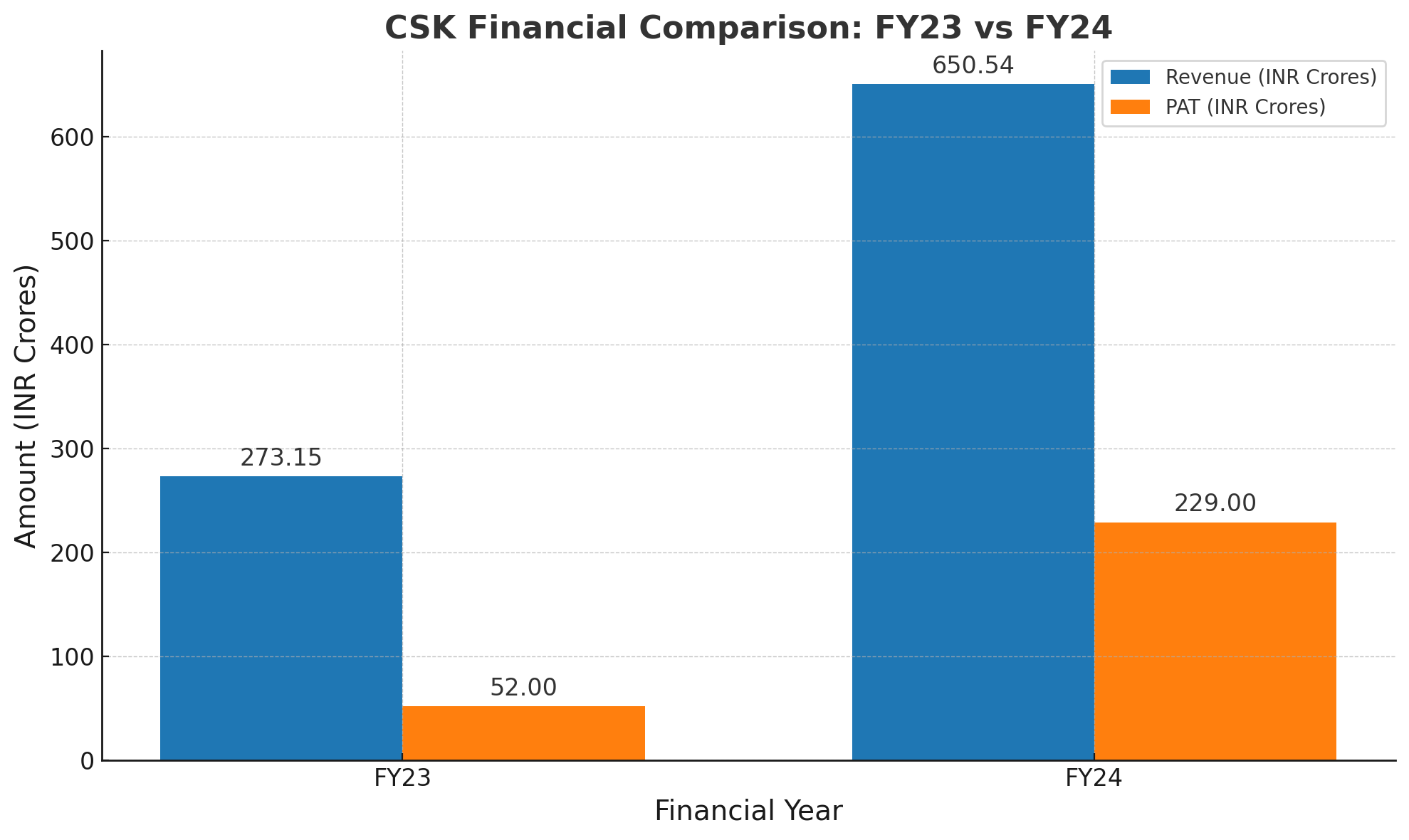

FY24 vs FY23: CSK's Financial Performance

Revenue Growth

The financial results for Chennai Super Kings (CSK) for FY24 paint a picture of significant growth when compared to FY23. The total revenue from operations for FY24 stood at ₹650.54 crores, a dramatic increase from ₹273.15 crores in FY23. This growth is largely attributed to the income from the grant of central rights, which surged to ₹479.21 crores in FY24 from ₹191.52 crores in FY23.

- Income from Central Rights: The central rights income, fueled by the new broadcasting deal, saw a massive jump, contributing significantly to the overall revenue.

- Sponsorship Income: Sponsorship income also increased to ₹95.47 crores from ₹77.75 crores in the previous year, reflecting the growing brand value of CSK.

- Other Tournament-Related Income: Other tournament-related income grew to ₹75.85 crores in FY24 from just ₹3.87 crores in FY23, showcasing an expansion in revenue streams.

Major Expenses

CSK's primary expenses revolve around player acquisition and franchise fees:

- Player Acquisition: The cost of acquiring players increased from ₹92 crores in FY23 to ₹144 crores in FY24, reflecting the franchise's investment in talent to maintain competitive performance.

- Franchise Fees: Franchise fees saw a significant rise from ₹50 crores in FY23 to ₹112 crores in FY24, indicating the growing financial commitments associated with maintaining a top-tier team.

Profit After Tax (PAT)

The Profit After Tax (PAT) for CSK in FY24 was ₹229 crores, a significant increase from ₹52 crores in FY23. This substantial growth in profitability highlights the effective management and strategic investments made by the franchise.

Future Growth Prospects for CSK

While the income from broadcasting rights is fixed until FY27, CSK is actively pursuing other avenues to fuel growth. The franchise has expanded its global footprint by acquiring teams in international leagues and investing in cricket academies.

-

International Ventures: CSK has acquired the Joburg Super Kings franchise in South Africa's SA20 league and has also ventured into the Major League Cricket in the USA through Texas Super Kings International LLC. These international ventures not only diversify CSK's revenue streams but also enhance its brand visibility on a global scale.

-

Joburg Super Kings: The Joburg Super Kings finished as semi-finalists in Season 2 of the SA20, with total revenues increasing from ₹30.39 crores to ₹40.23 crores. Despite the operating loss of ₹26.22 crores, this venture holds long-term potential.

-

Texas Super Kings: Participating in the inaugural season of Major League Cricket, the Texas Super Kings also finished as semi-finalists. The team generated revenues of ₹1.17 crores with a profit of ₹0.22 crores.

-

Cricket Academies: CSK's cricket academies, operated under Superking Ventures Private Limited (SVPL), have also seen growth. SVPL's turnover doubled to ₹5.47 crores in FY24 from ₹2.56 crores in FY23. Although the academy recorded an operating loss of ₹1.61 crores, the expansion into new geographies and increased student enrollments signal a promising future.

Conclusion

Chennai Super Kings (CSK) has demonstrated robust financial growth in FY24, driven by increased revenue from broadcasting rights and strategic expansions into international markets and cricket academies. While the broadcasting deal secures a stable income stream until FY27, CSK's foray into global leagues and academies provides additional growth opportunities.

Investors eyeing the IPL and its franchises like CSK should consider the long-term potential of these ventures, especially with the brand value and diversified revenue streams that franchises are building. The ongoing expansion and strategic investments ensure that CSK remains not just a cricketing powerhouse but also a strong contender in the business of sports.

As the IPL continues to grow, both in terms of viewership and financial clout, franchises like CSK are well-positioned to capitalize on this momentum, offering promising returns for investors and stakeholders alike.