Employee Petition Sparks Governance Crisis

In a dramatic turn of events, over 250 employees of B9 Beverages, the maker of India’s popular craft beer brand Bira 91, have petitioned the company’s board and major investors — including Kirin Holdings and Peak XV Partners — seeking a change in leadership.

The employees allege serious lapses in corporate governance, non-payment of dues, and lack of financial transparency, directly naming founder and CEO Ankur Jain in their appeal. The petition highlights that production has been halted since July 2025, with employees claiming nearly ₹50 crore in pending salaries, reimbursements, and statutory payments.

Investors and Funding Struggles

Bira 91’s troubles come at a critical time when its planned ₹500 crore debt infusion from BlackRock reportedly fell through. This setback has exacerbated the company’s cash-flow problems.

According to the latest data, Kirin Holdings remains the largest shareholder with about 20.1%, while Ankur Jain and his family hold 17.8%. The company has been trying to restructure operations and focus on fewer markets, but the liquidity crunch has significantly impacted vendor and employee confidence.

Financial Performance Deteriorates

B9 Beverages reported a net loss of ₹748 crore in FY24 on revenue of ₹638 crore, reflecting operational stress and falling market demand. Volumes declined from approximately 9 million cases in FY23 to 6–7 million cases in FY24.

The management attributes disruptions to licensing delays, policy changes, and funding uncertainty, while claiming that production at Gwalior and Nagpur breweries would restart soon.

However, with suppliers, employees, and investors losing faith, the company’s credibility has been severely impacted.

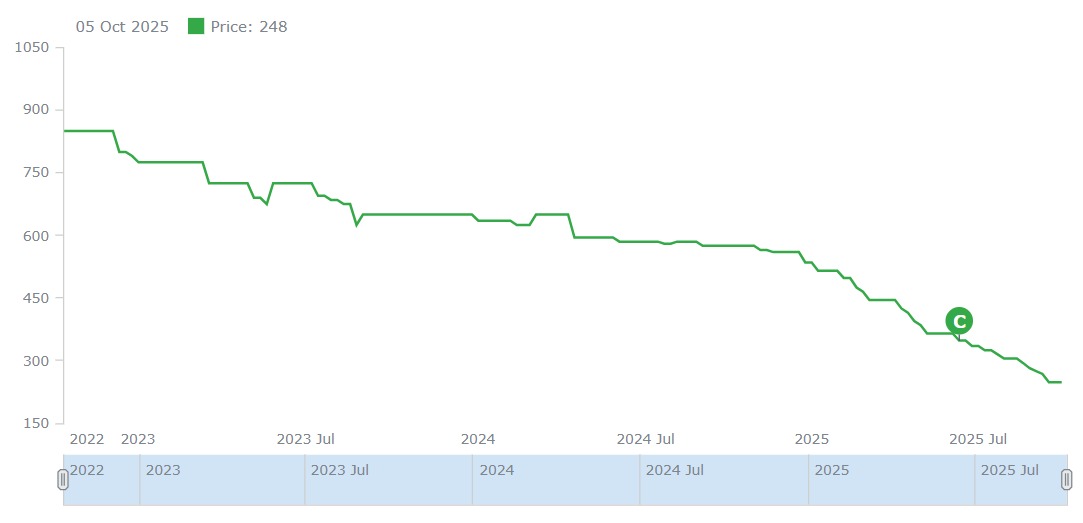

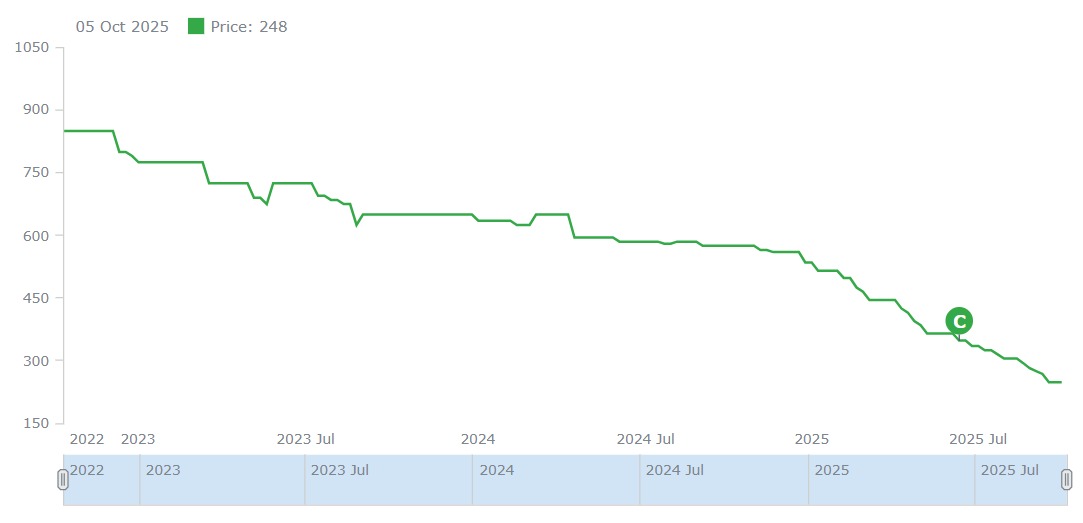

Unlisted Share Price Mirrors the Crisis

The sentiment around Bira 91 is clearly visible in its unlisted share price, which has crashed nearly 70% in three years.

📉 As per data from UnlistedZone, the stock has fallen from around ₹825 in 2022 to just ₹248 as of October 2025, wiping out significant investor wealth.

This continuous decline reflects investor concerns about governance issues, weak cash flows, and the absence of a clear turnaround roadmap.

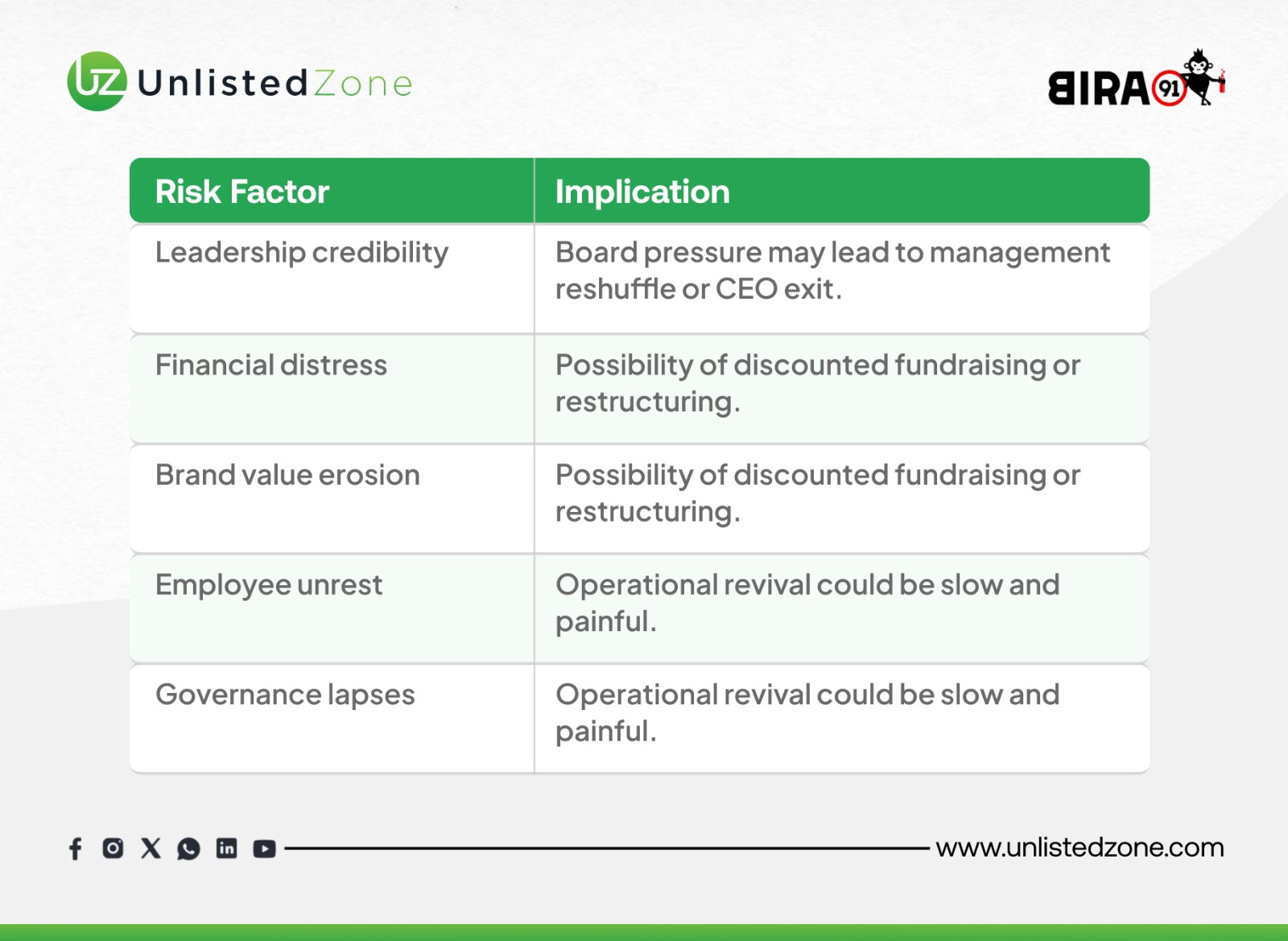

Corporate Governance at the Forefront

Employee petitions against founders are rare in India’s startup ecosystem — making this development particularly significant. The allegations raise serious questions about how governance and internal controls are handled in venture-backed companies that once commanded premium valuations.

For context, Bira 91 was valued at over $400 million (≈ ₹3,300 crore) during its 2021 fundraise. Today, its unlisted market capitalization has eroded sharply as confidence in the business model wanes.

Investor Takeaways

Conclusion: A Cautionary Tale for the Startup Ecosystem

The Bira 91 episode serves as a stark reminder that rapid growth without governance discipline can derail even the most promising brands.

While the craft beer segment in India still holds long-term potential, the immediate outlook for Bira 91 remains uncertain — hinging on whether the company can restore trust among employees, vendors, and investors through transparent restructuring and credible leadership change.