Introduction

In a strategic move reflecting sharper business focus, Apollo Green Energy Limited has officially transferred its fashion division to a new entity — Apollo Fashion International Limited — under a Business Transfer Agreement (BTA).

This transaction marks a key corporate restructuring within the Apollo Group, separating its fashion and renewable energy interests for greater operational independence and value creation.

Background: The Rationale Behind the Transfer

Apollo Green Energy, primarily known for its renewable energy operations, previously housed a growing fashion business manufacturing footwear, leather garments, and accessories for global brands.

To streamline operations and enable sector-specific growth, Apollo Green spun out the fashion vertical into a standalone company — Apollo Fashion International Limited (AFIL).

The move aligns with a broader strategy seen across Indian conglomerates — divesting non-core businesses to unlock value, attract dedicated investors, and strengthen financial transparency.

Key Highlights of the Business Transfer Agreement

1. Nature of Transaction

-

The deal is categorized as a Business Transfer Agreement and treated as a common control business combination under Ind AS 103.

-

Both entities remain under the same promoter ownership, but Apollo Fashion now operates as a separate legal and operational unit.

2. Assets and Liabilities Transferred

Apollo Fashion acquired net assets worth ₹62.66 crore, including:

-

Property, Plant & Equipment: ₹23.54 crore

-

Inventories: ₹52.33 crore

-

Trade Receivables: ₹49.19 crore

Offset by:

-

Short-Term Borrowings: ₹28.76 crore

-

Trade Payables: ₹30.32 crore

-

Other Liabilities: Remaining portion

This comprehensive transfer ensures Apollo Fashion inherits the full operating base of the former division — manufacturing facilities, inventories, receivables, and obligations.

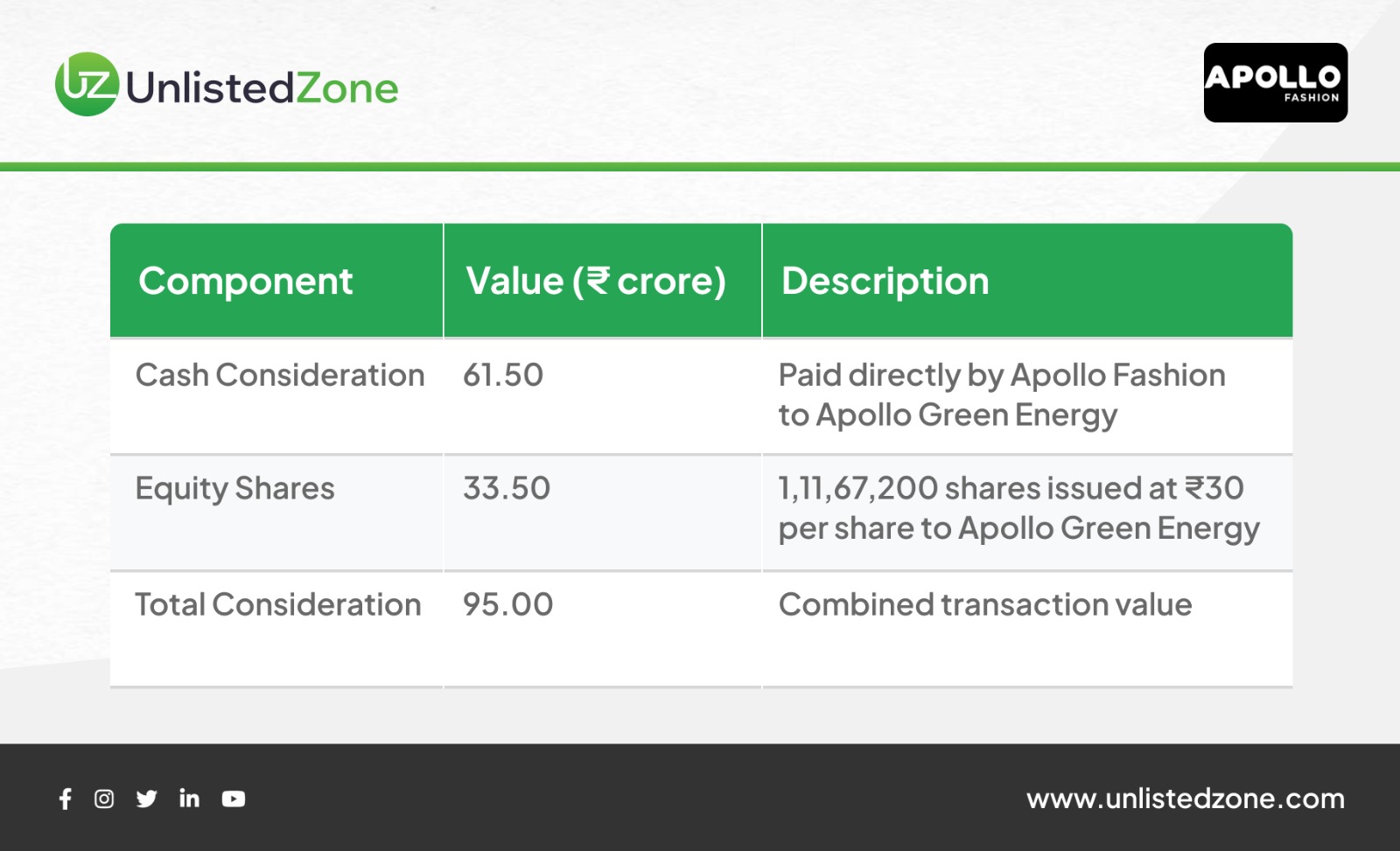

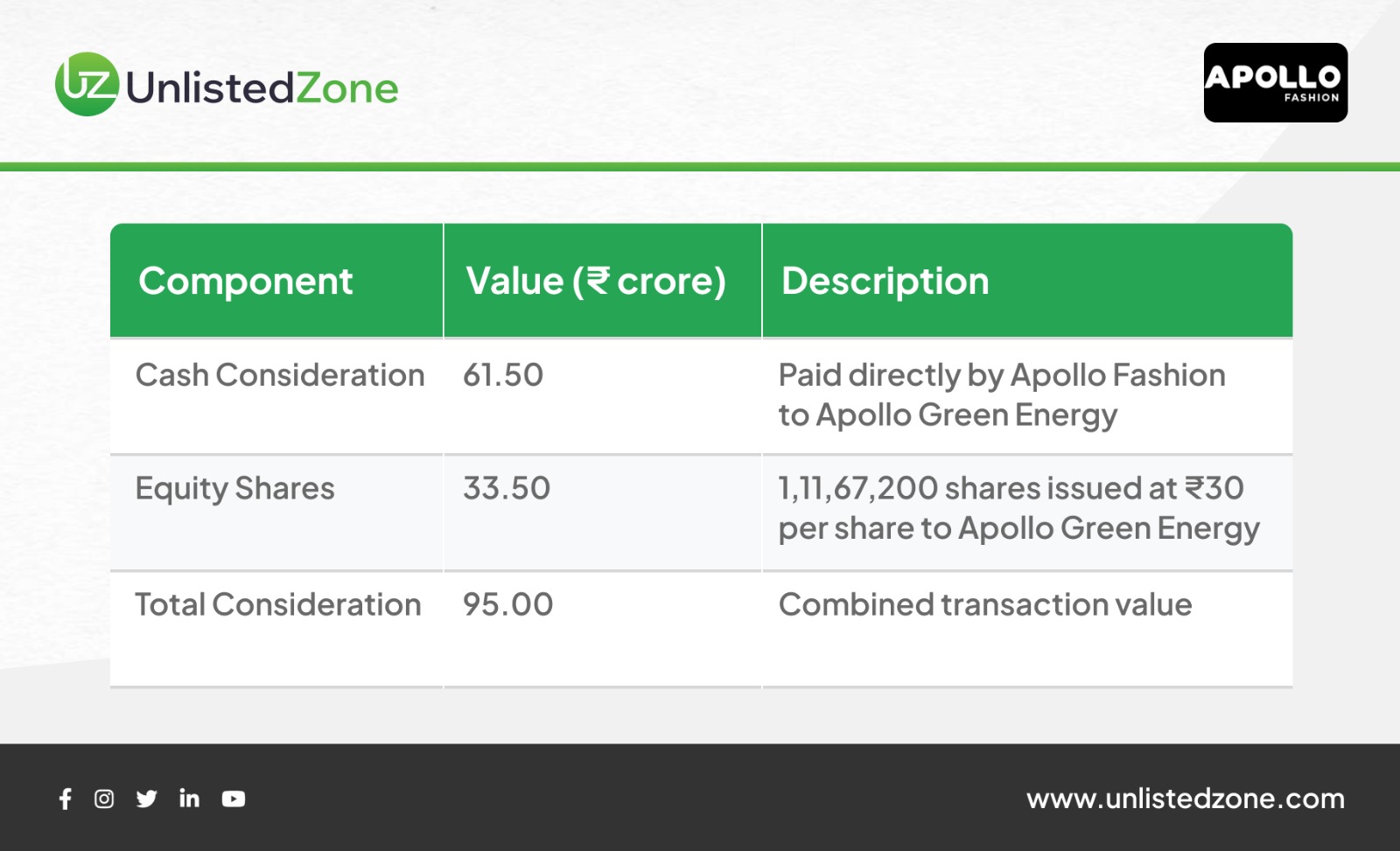

3. Deal Consideration

The total deal value stood at ₹95 crore, comprising both cash and equity:

The share allotment on February 14, 2025, gave Apollo Green Energy a 37.52% equity stake in Apollo Fashion, ensuring continued strategic alignment.

4. Resulting Capital Reserve

Since the consideration (₹95 crore) exceeded the net assets acquired (₹62.66 crore), Apollo Fashion recorded a capital reserve of ₹32.34 crore — a reflection of the premium attributed to the brand value, customer relationships, and business potential of the fashion division.

Operational Continuity and Related Party Transactions

Even after the transfer, operational interlinkages remain.

-

Around 45.7% of Apollo Fashion’s FY25 revenue stems from sales to Apollo Green Energy.

-

Until all contracts are fully novated, Apollo Green continues handling certain administrative and supply chain functions on behalf of Apollo Fashion, without profit margins.

This ensures a smooth transition while maintaining commercial continuity.

Ownership and Corporate Structure

Post-transaction, the promoter group (including Apollo Green) collectively holds about 77% of Apollo Fashion’s equity.

This ownership pattern ensures both entities remain strategically aligned, while allowing Apollo Fashion to independently raise capital or pursue partnerships in the fashion domain.

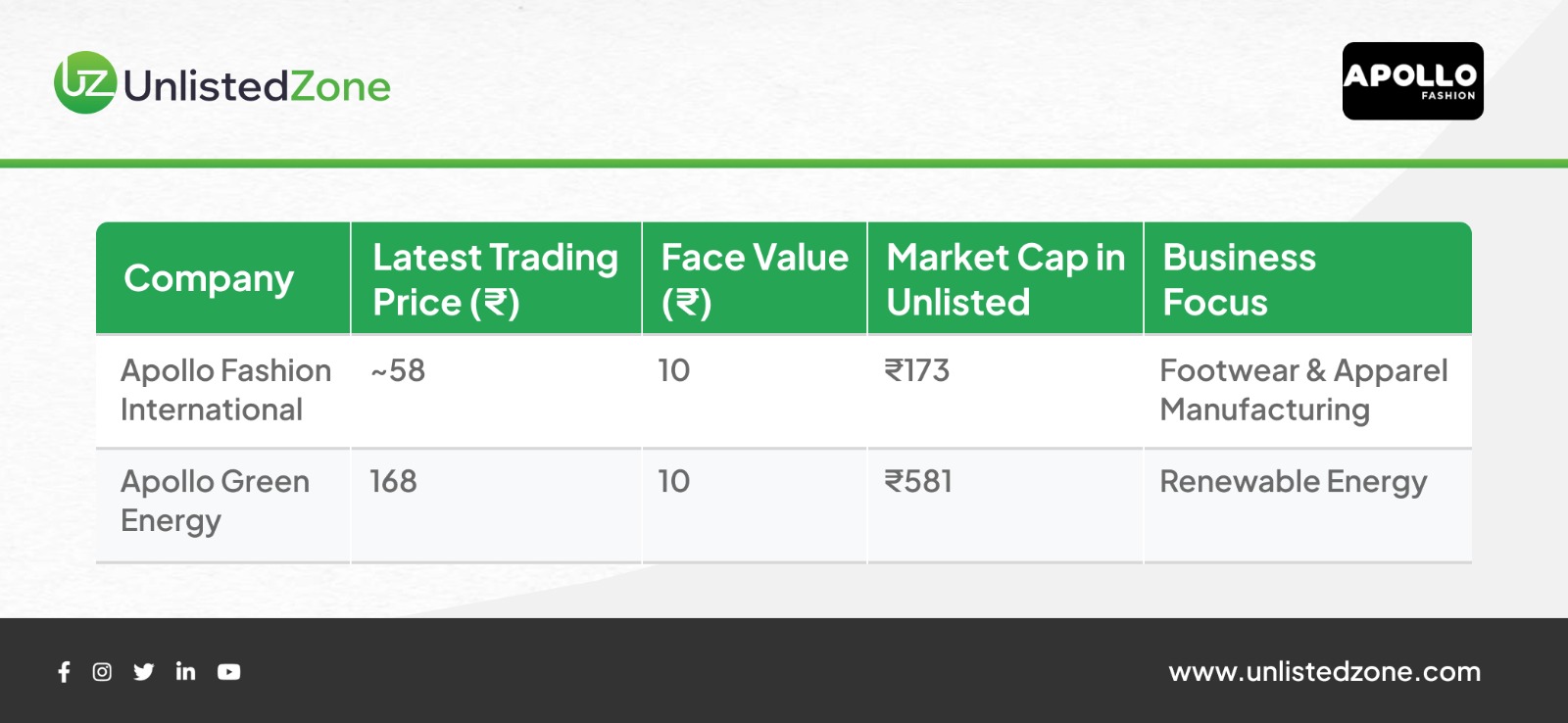

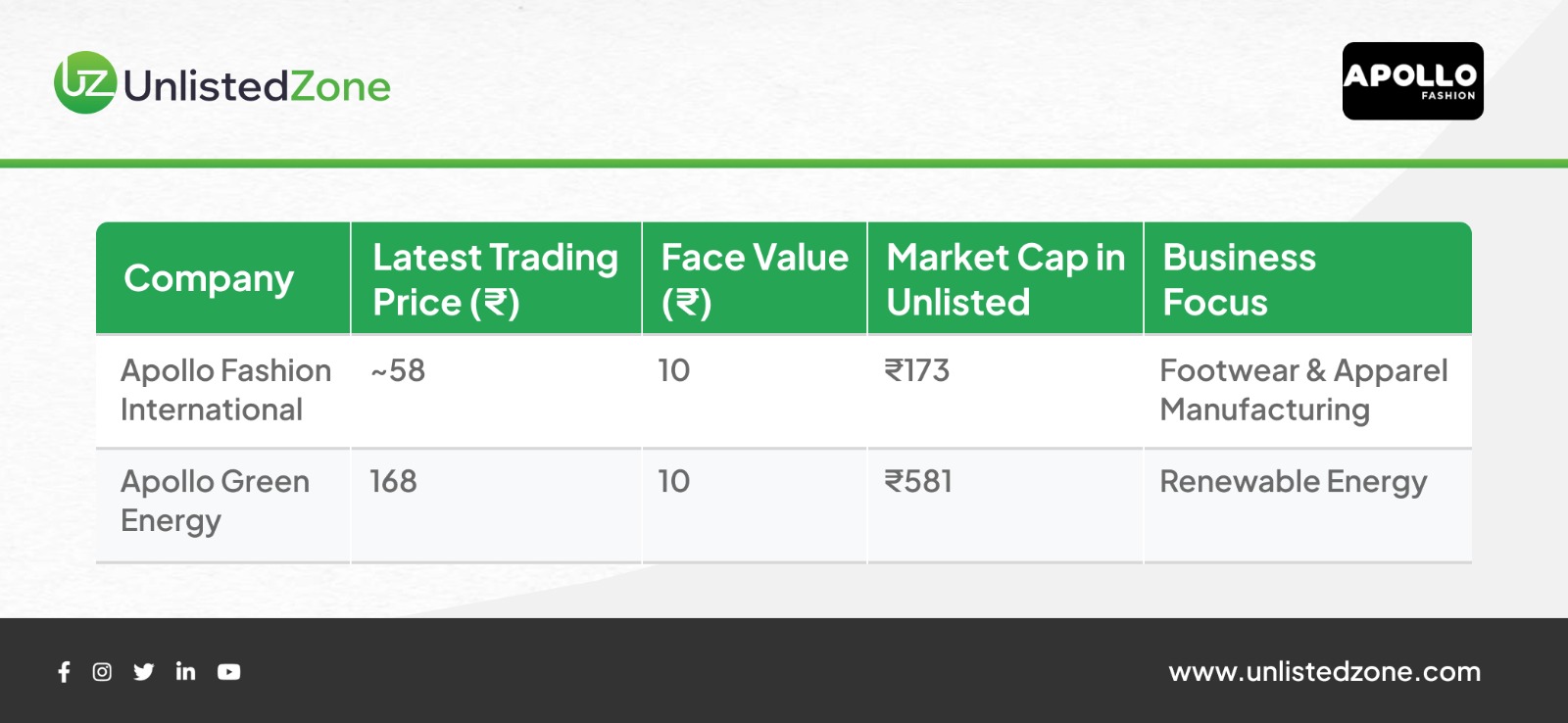

Unlisted Market Performance (as of November 2025)

Both entities — Apollo Green Energy and Apollo Fashion International — remain unlisted but actively trade on leading pre-IPO platforms.

Prices are driven by investor sentiment, financial performance, and sector outlooks. The separation enables investors to value each business independently — fashion as a consumer growth story, and energy as a sustainable infrastructure play.

Strategic Impact

-

Apollo Green Energy: Gains sharper focus on its renewable energy expansion, especially in EV charging, solar EPC, and battery tech.

-

Apollo Fashion International: Benefits from dedicated management, brand partnerships, and operational agility.

-

Investors: Gain clearer visibility into each segment’s financial performance and risk profile.

This move mirrors a growing corporate trend in India — unlocking value through business carve-outs — similar to how conglomerates like Aditya Birla or Tata Group separate sector-specific units.

Conclusion

The Apollo Green–Apollo Fashion restructuring represents a textbook case of strategic business segregation under common control.

By carving out the fashion division into an independent entity valued at ₹95 crore, the Apollo Group enables focused growth, cleaner financials, and distinct investor propositions.

While Apollo Green deepens its green energy focus, Apollo Fashion steps forward as a specialized player in India’s fast-growing fashion manufacturing space — both poised to benefit from this realignment.