Annual Report Analysis – ASK Investment Managers Limited FY 2025

About the Company

ASK Investment Managers Limited (ASK IM), part of the ASK Group, is one of India’s leading asset and wealth management firms. With over 45 years of legacy, the company operates as a pure-play wealth advisor, focusing on annuity-driven revenue instead of transactional broking or lending.

ASK follows an advice-led, open architecture business model, catering to both domestic and international investors. Its product portfolio spans asset management, wealth advisory, real estate funds, long-short strategies, and international UCITS platforms.

The company has a strong global presence with offices in 25+ locations across India and hubs in Singapore, GIFT City, Dublin UCITS, and DIFC Dubai.

Business Model Of ASK Investments Unlisted Share

-

Core Operations: Asset & wealth management, real estate & long-short funds, and financial product distribution.

-

Revenue Model:

-

95% annuity-based sticky income (advisory fees, management fees).

-

Distribution through 600+ domestic distributors and a global network.

-

No broking/lending, ensuring predictable revenue.

-

Ownership: Backed by a global private equity manager; management & employees own ~15% via ESOPs.

-

Management Team:

Key Highlights of FY 2025 ASK Investments Unlisted Share

-

Launched DIFC Wealth Office (Dubai International Financial Centre).

-

Received in-principle approval for a Mutual Fund license.

-

Real Estate & Long-Short Funds AUM surged 122% YoY to ₹6,072 Cr.

-

UCITS International AUM crossed US$100 Mn.

-

Client base expanded to 3,600+ wealth families & ~18,000 asset management folios.

-

ASK Foundation impact: ~8,500 households benefitted, 33% women employees, 45% renewable energy usage.

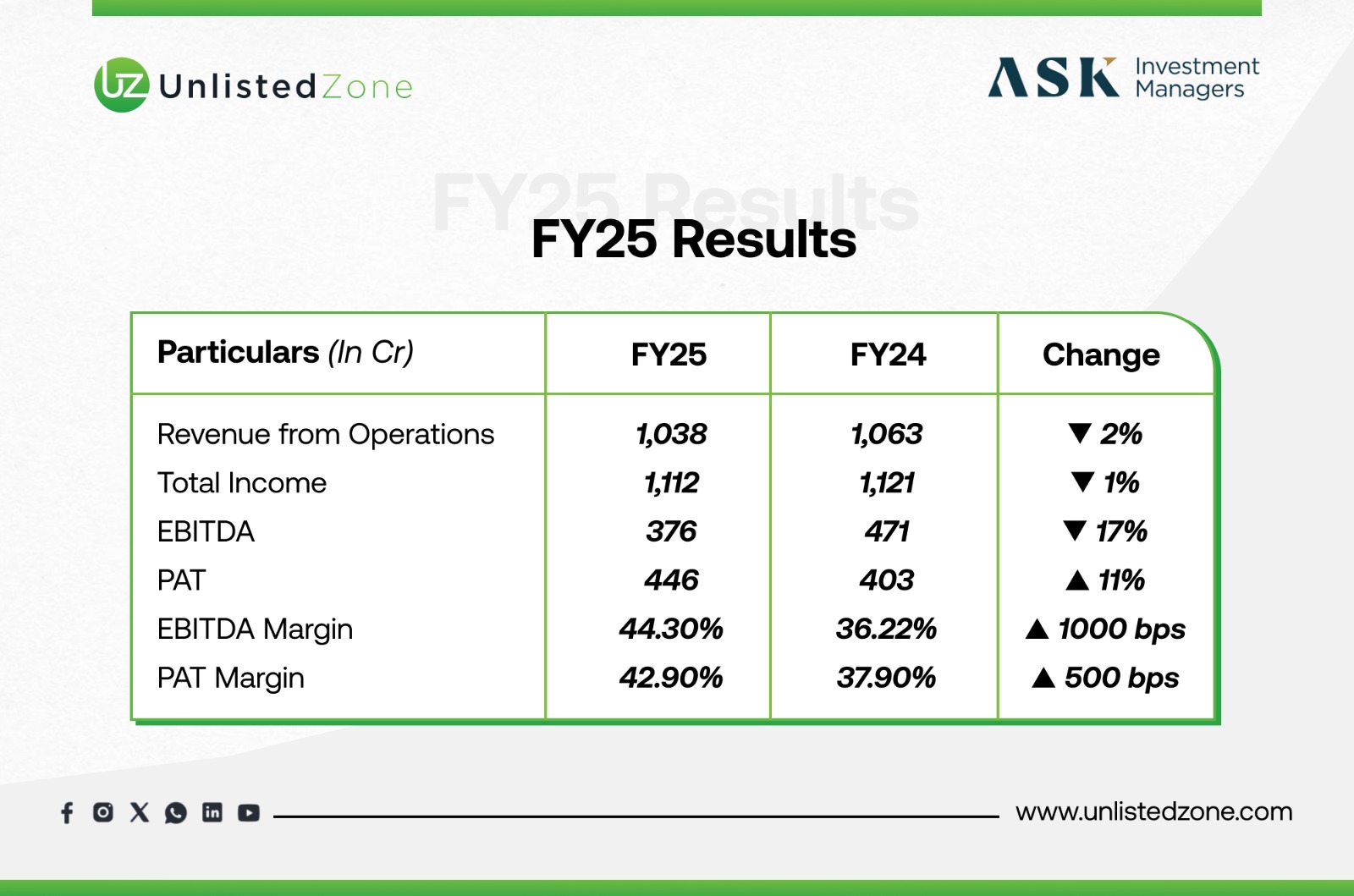

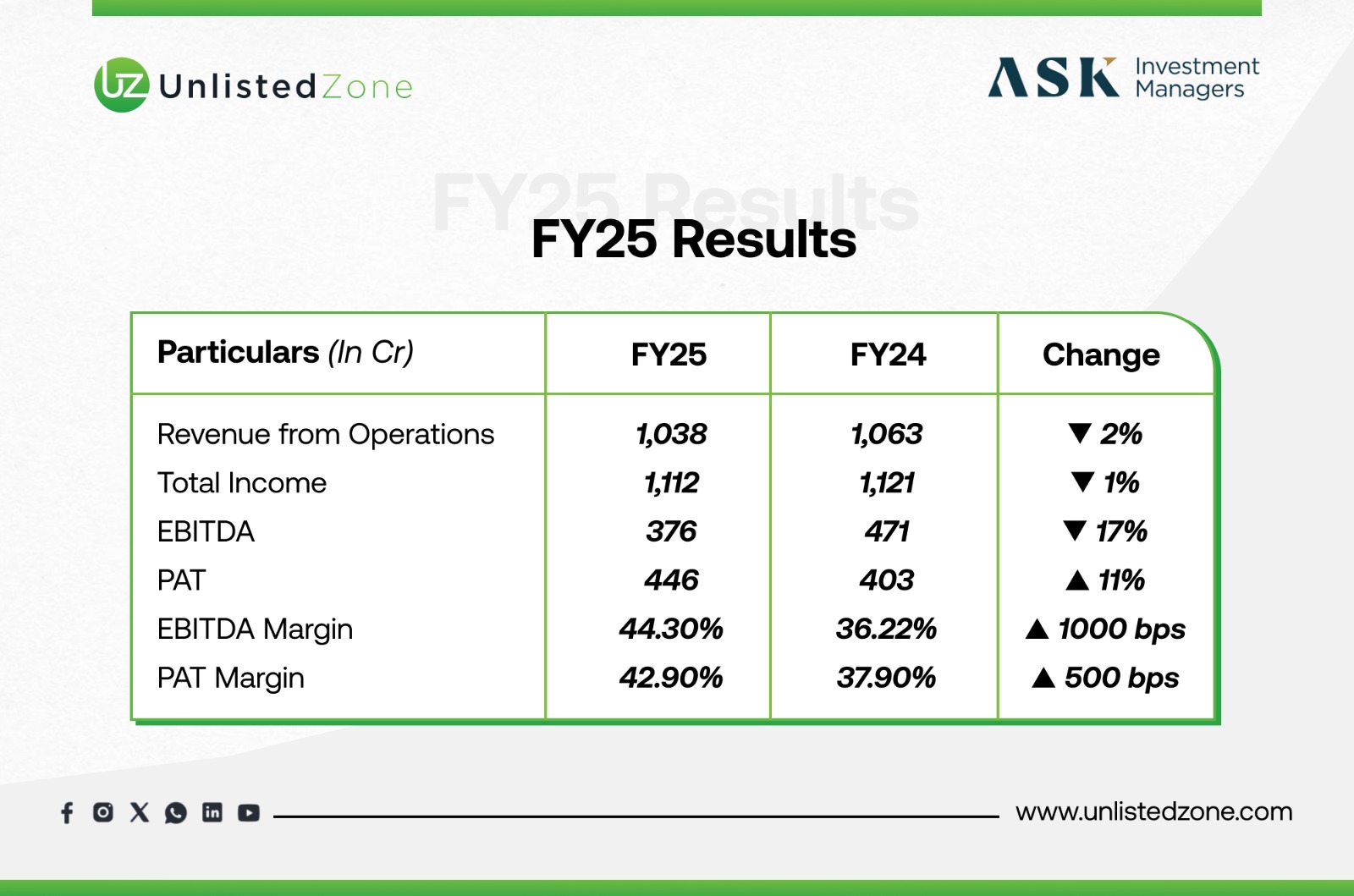

Financial Performance (Consolidated) of ASK Investments Unlisted Share

Profit & Loss (₹ Cr)

Despite a marginal decline in topline, ASK improved its bottom line due to lower tax expense and higher profitability from wealth distribution.

Cash Flow (₹ Cr)

-

CFO: ₹211 Cr (vs ₹511 Cr in FY24, due to working capital changes).

-

Capex: ₹17 Cr.

-

Dividends Paid: ₹223 Cr.

-

Net Change in Cash: -₹16 Cr (ending balance ₹128 Cr).

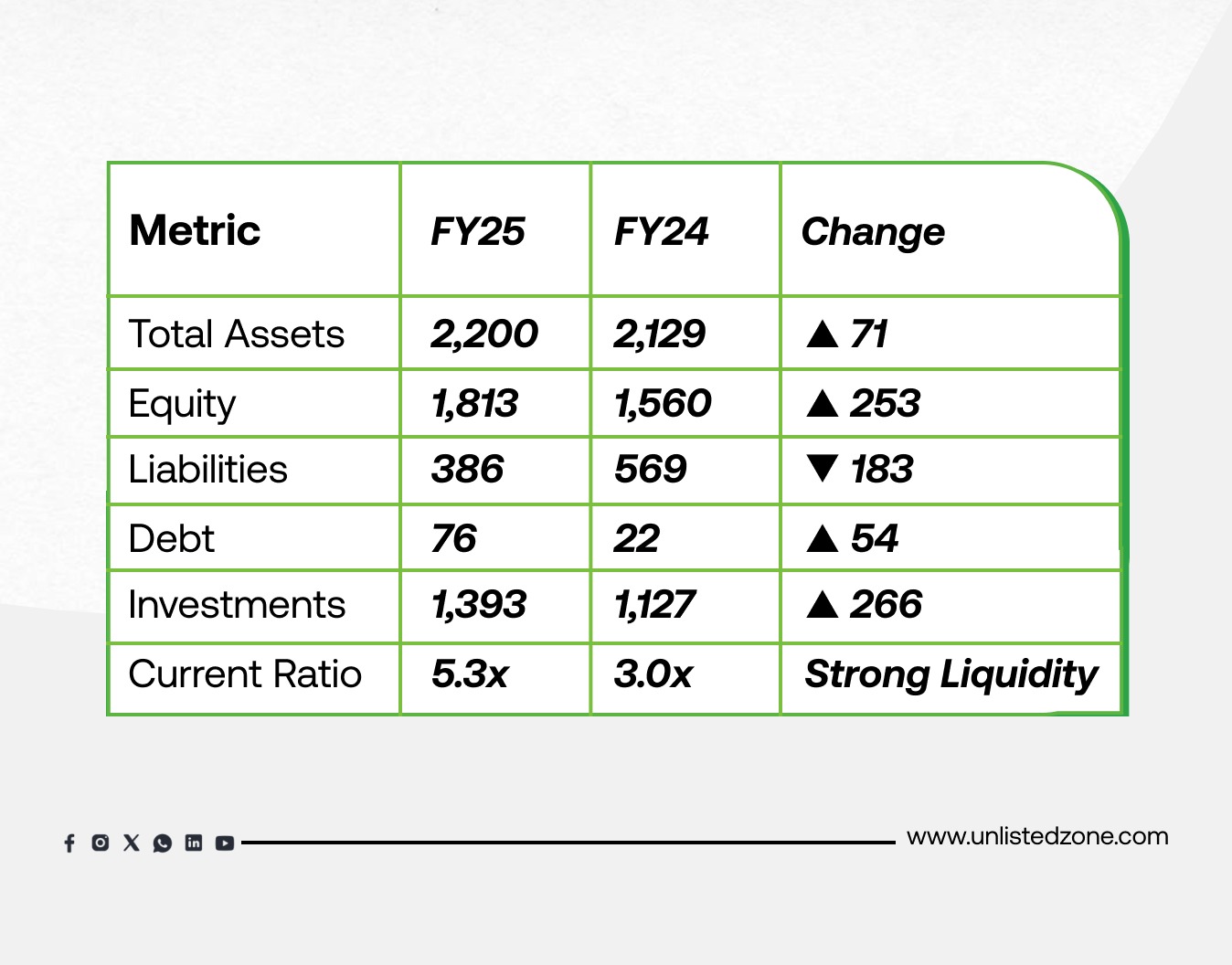

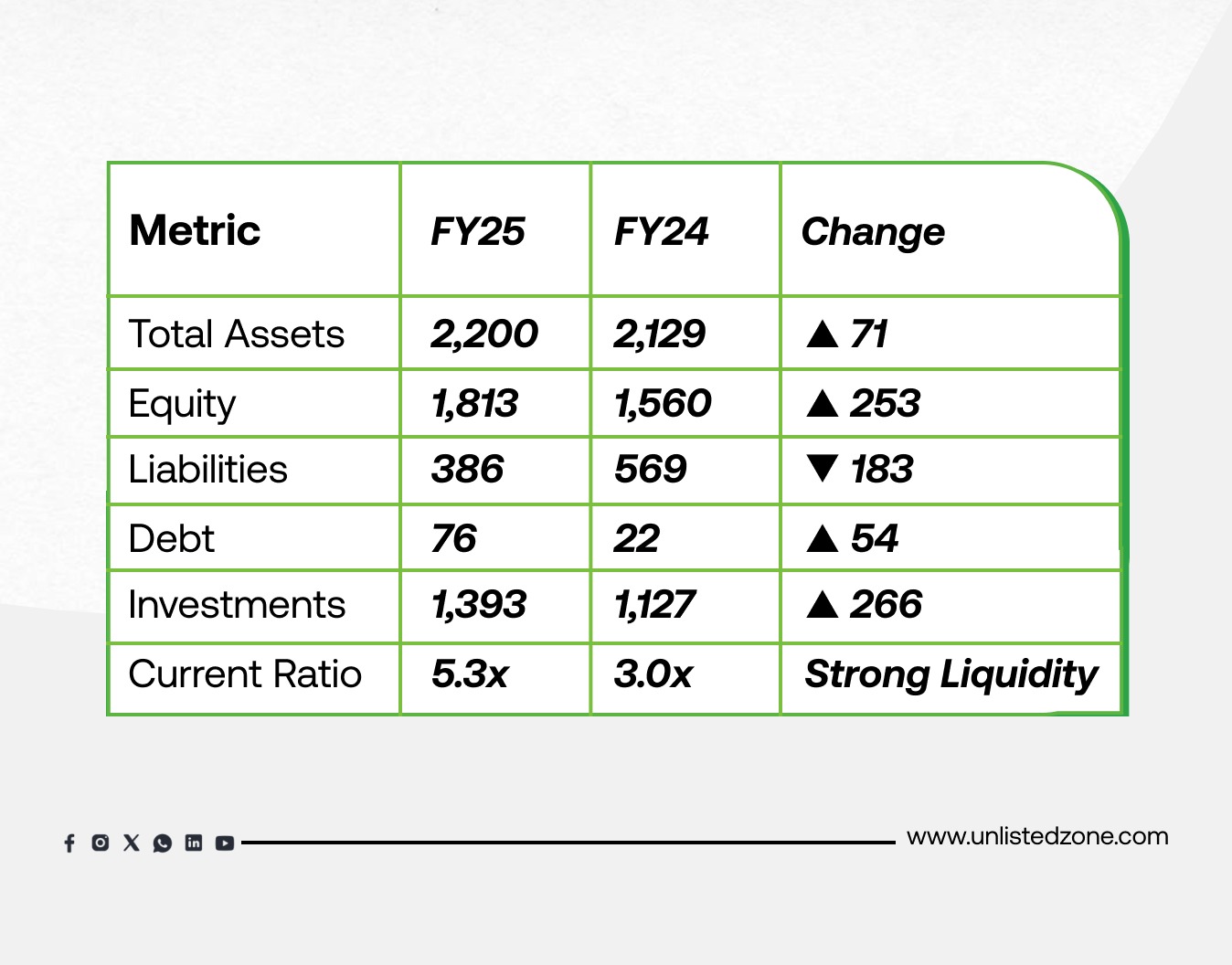

Balance Sheet Strength (₹ Cr)

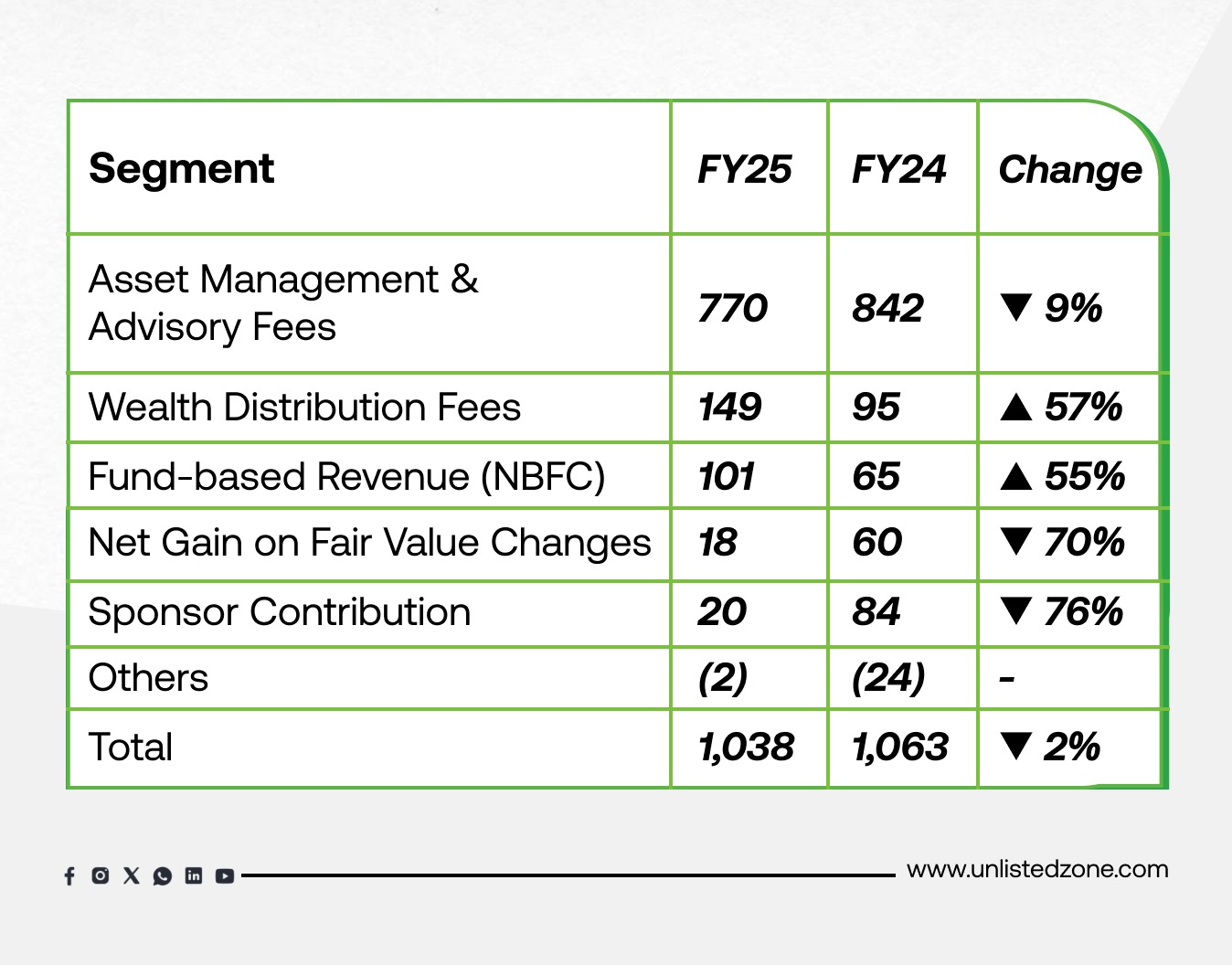

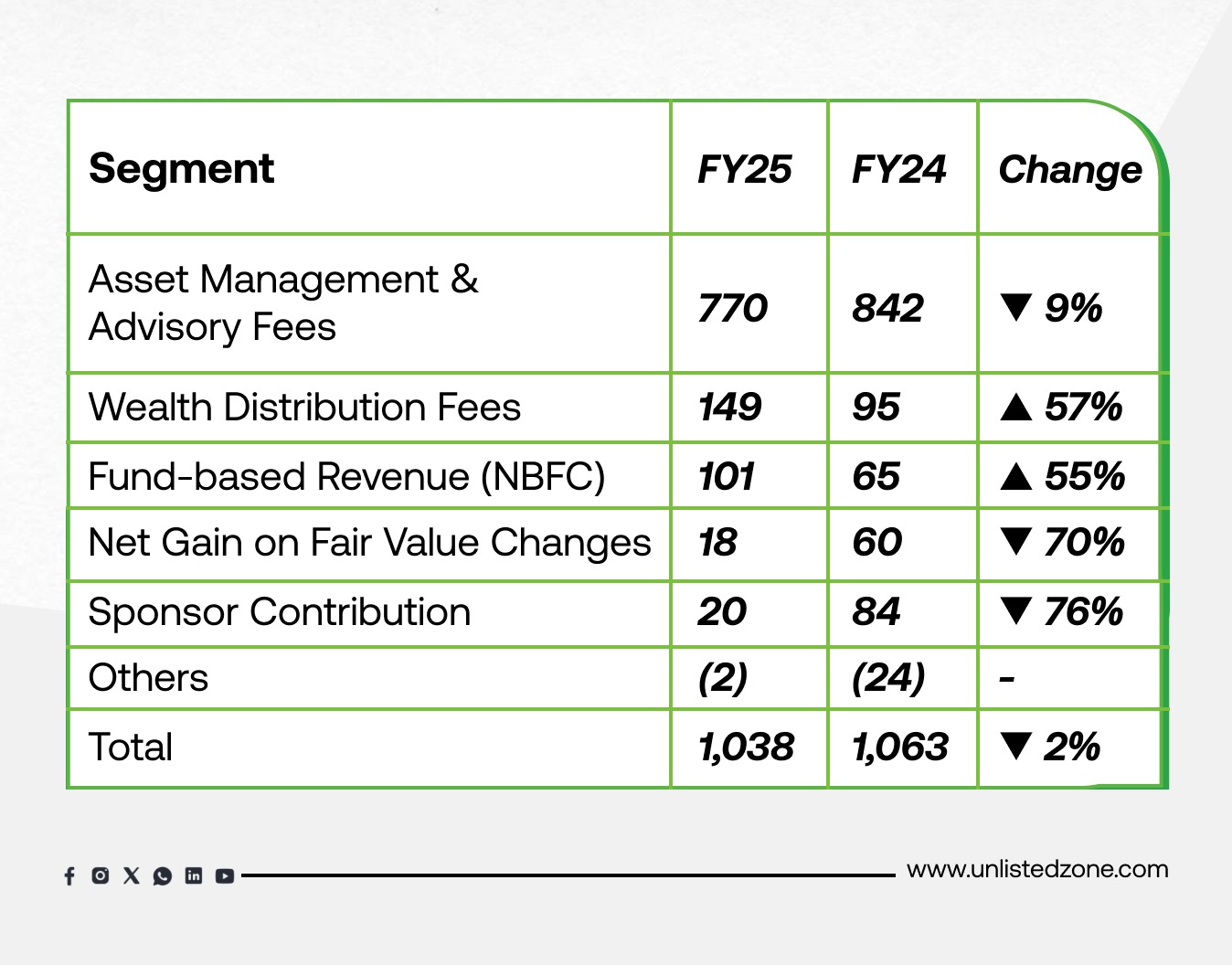

Segment-Wise Revenue (₹ Cr)

Commentary:

-

Distribution fees grew sharply (57%), showing traction in wealth advisory.

-

Sponsor contribution declined, impacting revenue mix.

-

NBFC-based income strong at 55% growth.

Management Discussion & Analysis (MD&A) of ASK Investments Unlisted Share

-

Market Outlook: India’s financial savings growth (SIP inflows of ₹25,926 Cr/month) presents strong tailwinds for wealth managers.

-

Risks: Dependence on affiliated bank for distribution may pose conflict of interest. Regulatory changes in asset management fees can also impact revenue.

-

Strategy: Expanding global presence (DIFC, UCITS, GIFT City), scaling mutual fund business (approval in progress), and strengthening wealth distribution.

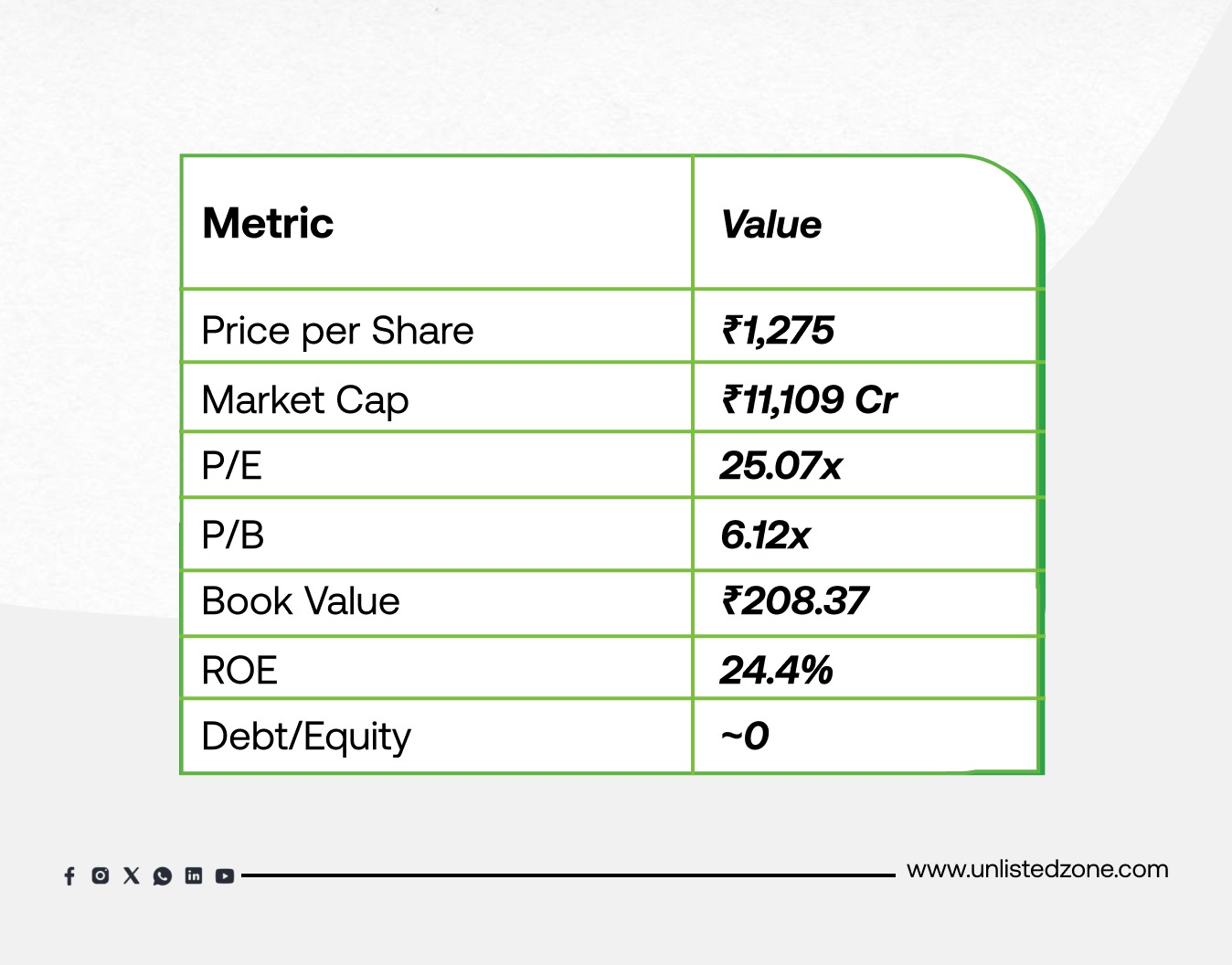

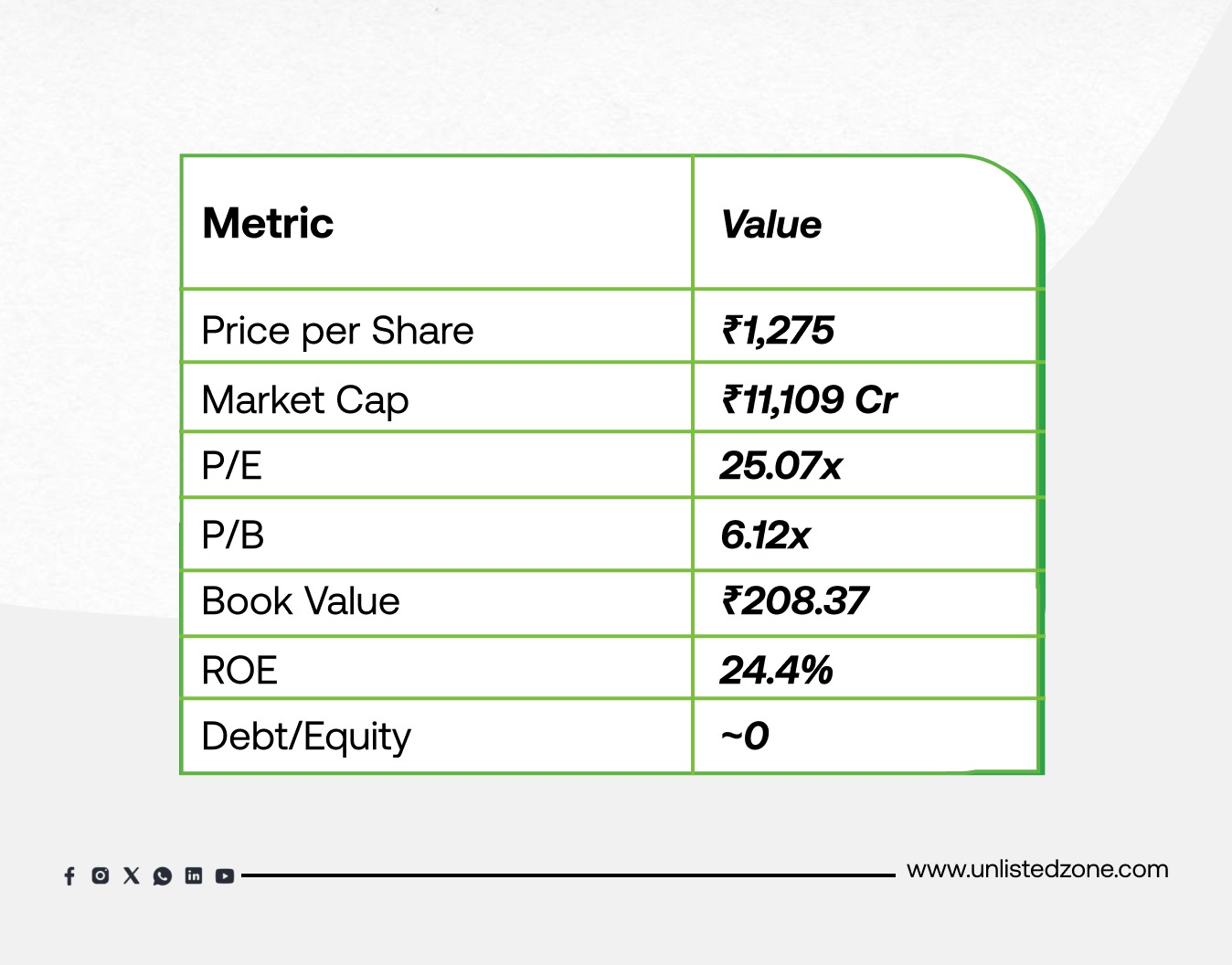

Valuation Insights of ASK Investments Unlisted Share (Unlisted Market)

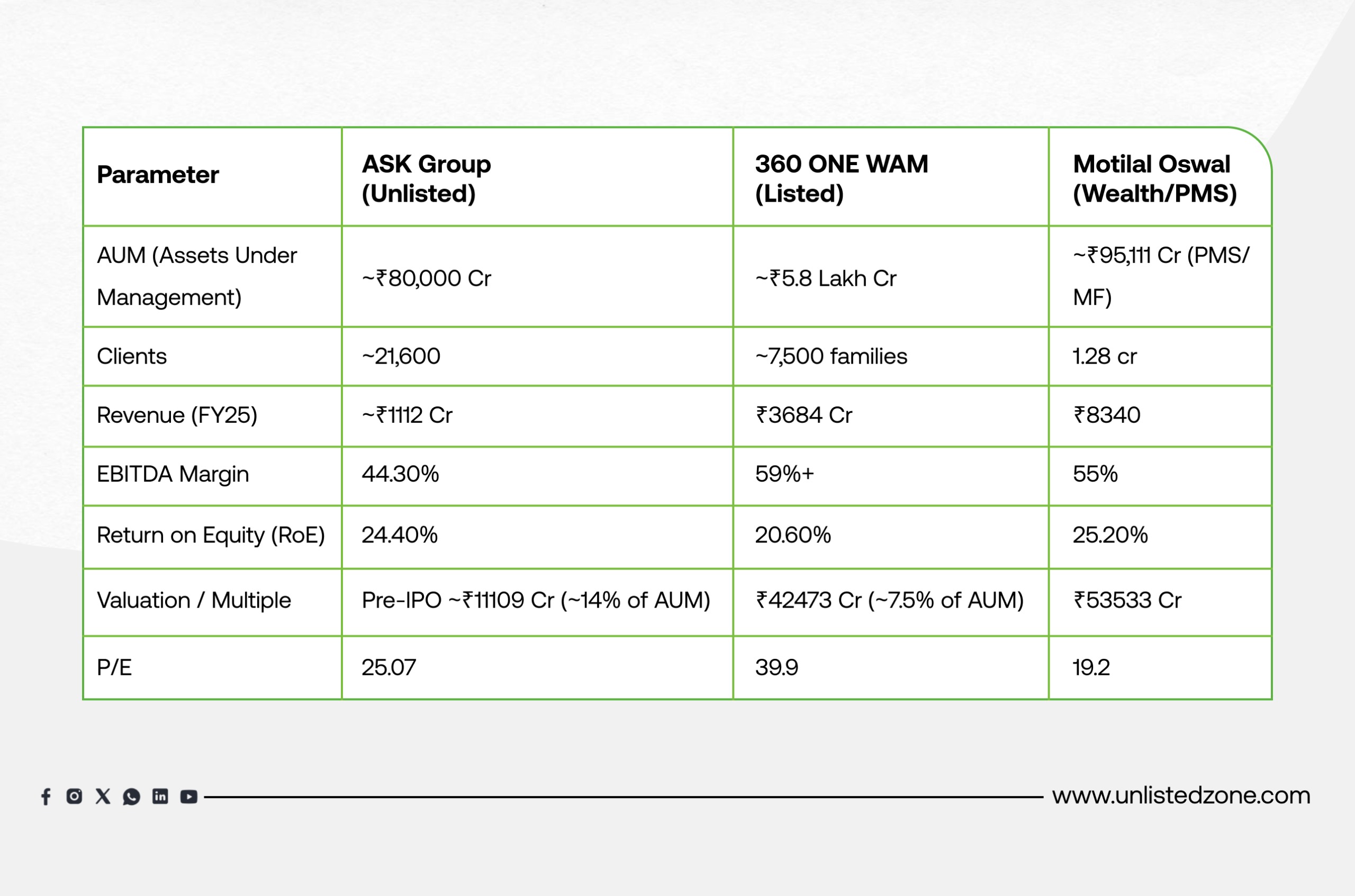

Relative Positioning:

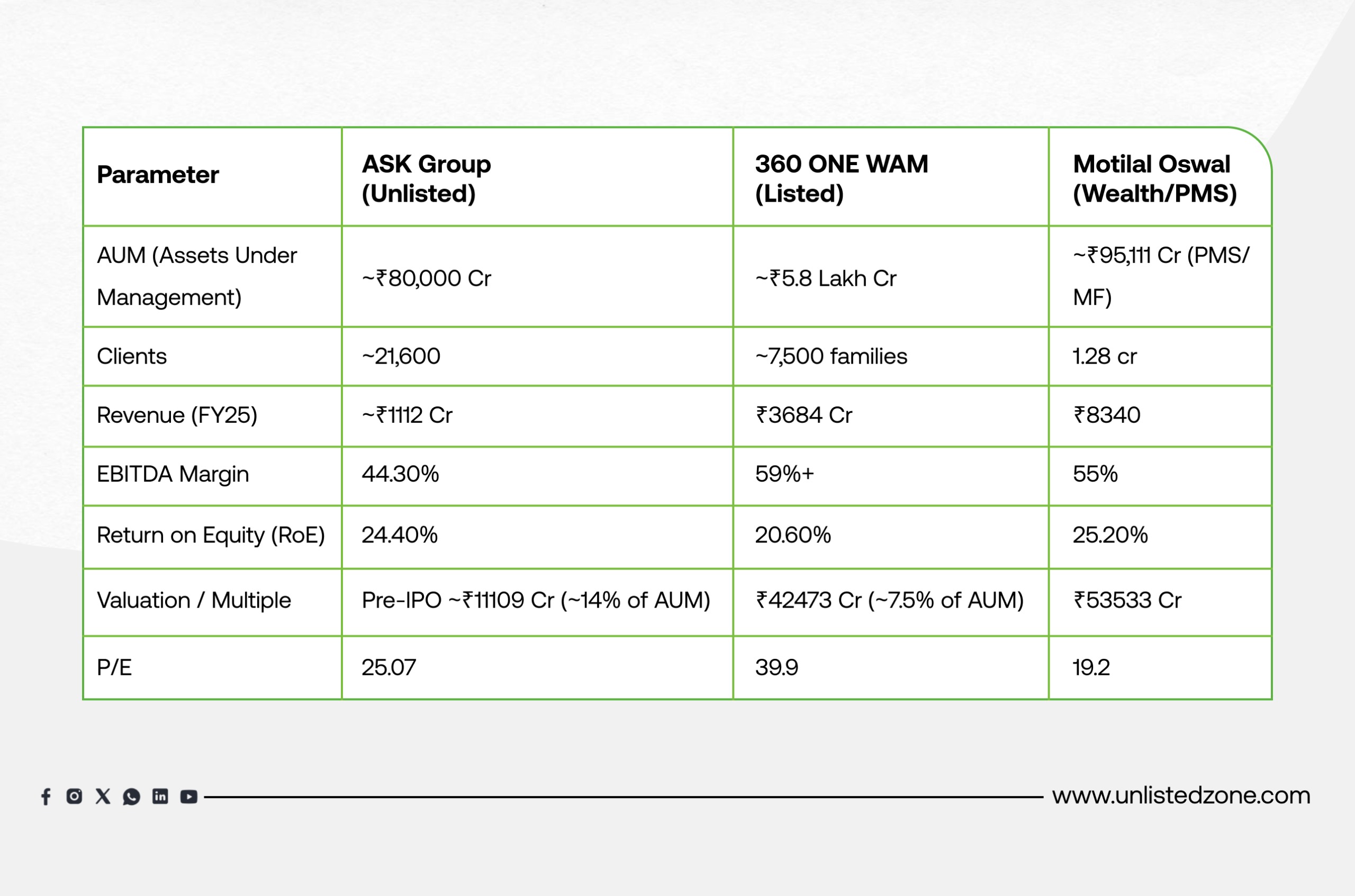

Peer Analysis Comparison of Ask Unlisted Share

Client Focus vs. Scale: 360 ONE serves a tiny, ultra-wealthy clientele with enormous assets, leading to the highest profitability (59% margin). Motilal Oswal uses a volume model with millions of clients, resulting in the highest revenue.

-

High-Performing Sector: All three show stellar margins and returns (RoE), proving the wealth management business in India is highly lucrative.

-

Valuation Difference: The market values these strong performers differently. ASK's high "% of AUM" valuation suggests investors see major growth potential, while 360 ONE's large size commands the highest absolute market value.

Future Outlook ASK Investments Unlisted Share

-

Mutual Fund launch to diversify earnings and attract retail SIP flows.

-

Global wealth hubs expansion (DIFC, Singapore, Dublin) to add HNI & NRI clients.

-

Digital platforms to strengthen distribution efficiency.

-

Risks include market volatility, regulatory fee caps, and competition from large AMCs/wealth managers.

UnlistedZone View on ASK Investments Unlisted Share

ASK Investment Managers is a high-quality, annuity-driven wealth & asset management business with:

✅ Strong governance & professional management.

✅ Sticky revenue (95% annuity).

✅ High profitability with PAT margins >40%.

✅ Expansion into mutual funds & global hubs adding growth levers.

Risks: Dependence on markets, sponsor contribution decline, working capital fluctuations.

Investment Thesis:

-

Attractive for HNIs & long-term investors seeking exposure to India’s wealth management growth story.

-

At ₹1,275/share, valuations appear fair (P/E ~25x, in line with listed peers).

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.