Introduction

Ixigo, one of India's leading travel and hotel booking e-commerce websites, has emerged as a formidable player in the Online Travel Agency (OTA) sector. With its diverse suite of services including flight bookings, hotel reservations, and railway ticketing, Ixigo has been at the forefront of disrupting the Indian travel market. The company has further strengthened its position through strategic acquisitions like ConfirmTkt and AbhiBus. In this blog, we delve into the financial performance of Ixigo’s unlisted shares, offering a comprehensive analysis for prospective investors.

Impressive Milestones

As of March 2023, Ixigo has surpassed the commendable milestone of 6.6 Crore monthly active users across all its platforms. This is a testament to the company's growing influence in the Indian travel industry. Ixigo processes around 5 Crore bookings annually, catering to over 8 Crore passenger segments.

Financials: A Five-Fold Growth

For the Financial Year 2023, Ixigo recorded an operating revenue exceeding Rs. 500 crores, marking nearly a five-fold growth compared to its pre-COVID levels. Most OTAs have only managed a 1-2x growth in the same period. The company attributes this success to its customer-centric approach during the pandemic and strategic acquisitions that were culturally and economically aligned. ConfirmTkt and AbhiBus, the acquired businesses, are operating at a significantly higher scale in terms of both revenue and profitability compared to their pre-COVID levels.

Market Position

According to the recent VIDEC travel industry report, Ixigo stands as India’s 2nd largest OTA by revenue for FY22 and FY23. The company leads the market in train bookings, holding nearly a 50% market share, and is the 2nd largest OTA for bus bookings.

Revenue and Expenses

Revenue increased from 384 Cr in FY22 to 517 Cr in FY23. Major expenses include Customer refunds (~100 Cr), Advertising and Sales Promotion (~93 Cr), and Partner support costs (~67 Cr). These together make up around 50% of the revenue. Gross revenue from operations saw an increase of 41.87% from 451 Cr in FY22 to 640 Cr in FY23.

Cash EBITDA and Profitability

The Cash EBITDA for FY23 stands at 60 Cr, a significant rise from last year's 11 Cr. The company also moved from an EBITDA loss of 7 Cr in FY22 to a profit of 45 Cr in FY23.

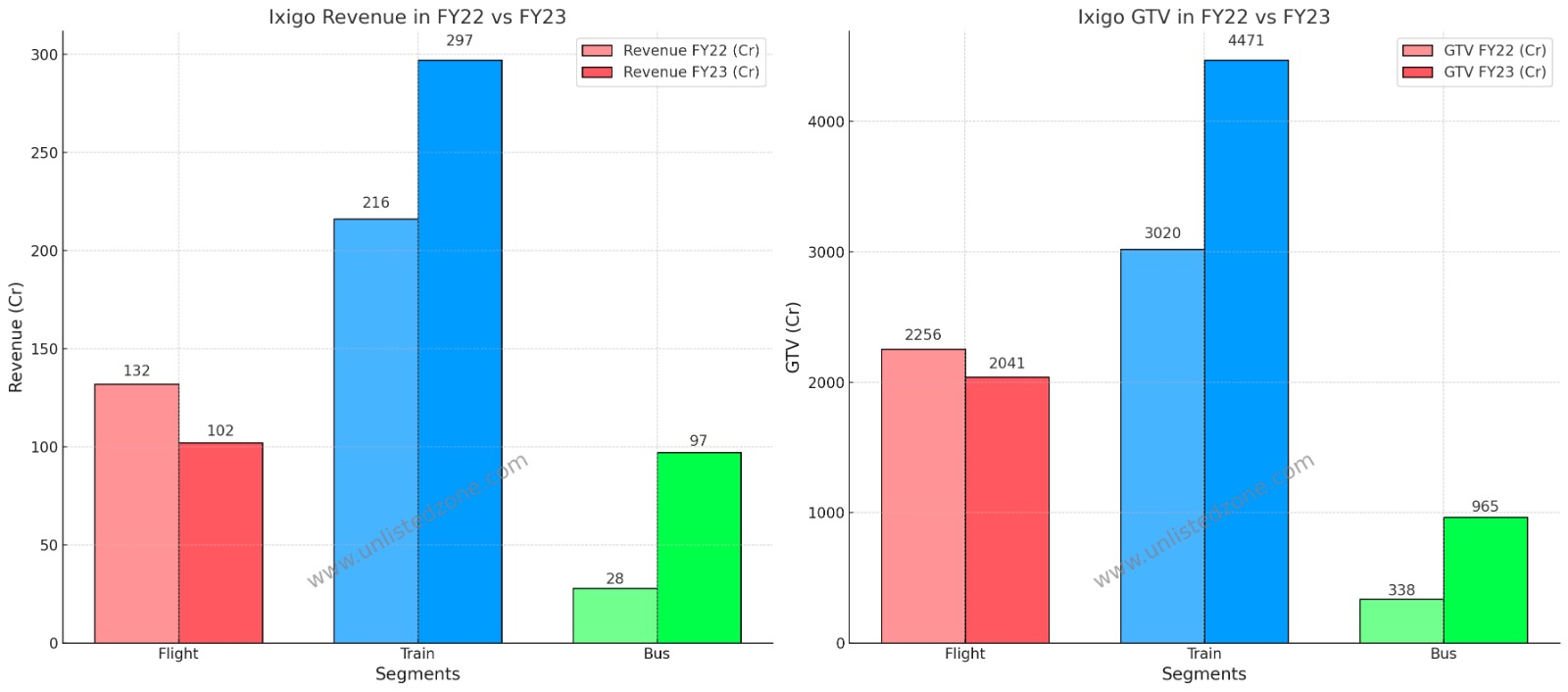

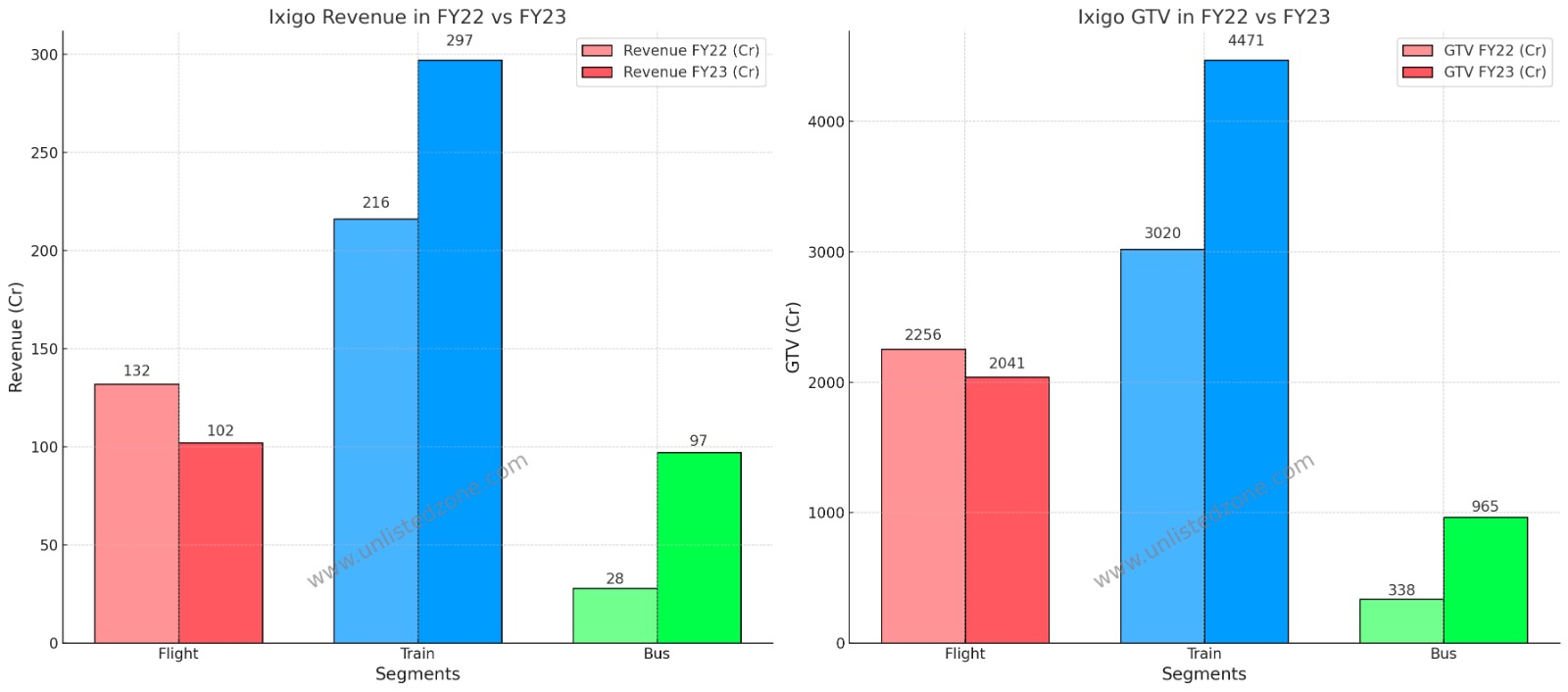

Revenue Segmentation

Ticket revenue increased to 467 Cr in FY23 from 361 Cr in FY22. Advertising income also saw a boost, moving from 14 Cr to 24 Cr. The company saw revenue and GTV growth across multiple segments - Flights, Trains, and Buses, with trains emerging as a significant contributor.

Valuation and Comparison

In the current market scenario, Ixigo unlisted shares are available at Rs. 100 with a market capitalization of 3800 Cr. With a PAT of 23 Cr, the P/E ratio stands at 165x, which is expected to rationalize with future growth. For comparison, EaseMyTrip trades at a P/E of 48x with a market cap of 6300 Cr.

Conclusion

Ixigo has demonstrated a robust financial performance, backed by strategic moves and a customer-centric approach. While the company has deferred its plans for an IPO due to market conditions, its unlisted shares offer an intriguing opportunity for investors. With a high growth trajectory and strong market position, Ixigo is well-poised for future success in the ever-growing Indian travel industry. For investors looking at pre-IPO opportunities, Ixigo presents a compelling case for consideration.

Disclaimer: This blog is for informational purposes only and should not be construed as financial advice. Always consult with your financial advisor before making any investment decisions.