In the fast-paced world of finance, HDB Financial Services is gearing up for an IPO, making waves in India's banking scene. Known for its unique journey and place in the market, HDB Financial Services grabs attention. This analysis takes a close look at HDB's financial journey, exploring its growth, revenue, profits, asset quality, and how investors see it. By carefully studying HDB's financial performance, we aim to uncover what's driving its story, giving you a clearer picture of what's shaping its path and how investors view it.

Financial Parameters of HDB Financial Unlisted Shares

Examining HDB Financial Services' revenue streams, we observe a steady uptrend in total revenue, driven by interest earned and other income. In 2024, interest earned reached ₹11,157 crore, reflecting a notable increase of 25.1% compared to the previous year. Conversely, other income experienced a slight decline, attributable to external factors such as market volatility. Despite this, the bank's profitability remained robust, with profit after tax (PAT) soaring to ₹2,461 crore in 2024, marking a substantial growth of 25.7% y-o-y.

The loan book of HDB Financial Services witnessed significant growth from FY23 to FY24. In FY23, the loan book stood at INR 6,63,82.7 crore, while in FY24, it surged to INR 8,67,21.3 crore. This represents a substantial increase of approximately 30.62% growth, over the span of one year. Such robust growth in the loan book reflects HDB Financial Services' aggressive lending activities and potentially indicates increasing demand for its financial products and services.

Net interest margins (NIMs), a key indicator of a bank's profitability, continued to improve over the years at HDB Financial Services, underscoring efficient management of interest income and expenses. HDBFS reported a Net Interest Income (NIP) of 8.33% for FY23, up from 8.20% in the previous year.

Earnings per Share (EPS) witnessed significant growth, climbing from INR 24.75 in FY23 to INR 31.03 in FY24, marking an increase of approximately 25%. This upward trajectory indicates enhanced profitability and value creation for shareholders.

The company's return on equity (ROE) showcased remarkable growth from 4.48% in FY21 to 10.6% in FY22, further climbing to 17.13% in FY23, and ultimately reaching 17.91% in 2024, indicative of sustained shareholder value enhancement. The company's post-COVID recovery and performance, evidenced by its increasing return on equity (ROE) from FY21 to 2024, demonstrates its resilience and adaptability.

From FY21 to FY22, there was a slight increase in Gross NPA, reaching 4.4%, suggesting a deterioration in asset quality. However, in FY23, there was a significant improvement as the Gross NPA decreased to 2.73%, indicating better management of non-performing assets.

Continuing this positive trend, the Gross NPA further declined to 1.9% in FY24, underscoring enhanced credit quality and effective risk management practices. Overall, the trend indicates a notable improvement in asset quality from FY21 to FY24, reflecting the bank's efforts to address non-performing assets and strengthen its balance sheet.

Growth in Advances after Covid

From FY21 to FY22, advances decreased from ₹58,601 crore to ₹57,162 crore, indicating a decline of approximately 2.45%. Then, from FY22 to FY23, advances increased to ₹66,383 crore, reflecting a growth of approximately 16.13%. However, the most significant growth occurred from FY23 to FY24, with advances surging to ₹86,721 crore, representing a substantial increase of approximately 30.62%. This significant growth in advances in FY24, coupled with the decline in gross NPAs, indicates a robust recovery and renewed lending activity post-COVID, underscoring the resilience of the market.

MUFG Interest in HDB Financial Unlisted Shares buying 20% Stakes

MUFG (Mitsubishi UFJ Financial Group), a prominent Japanese financial institution, has expressed interest in acquiring a 20% stake in HDB Financial Services at INR 80000 Cr valuation. This strategic move signifies growing confidence in HDB's performance and potential synergies between the two entities. MUFG's interest in acquiring a significant stake underscores its recognition of HDB's value and the opportunities it sees in partnering with the Indian financial services provider. This development not only highlights HDB's attractiveness to international investors but also suggests potential avenues for collaboration and expansion in the Indian financial market.

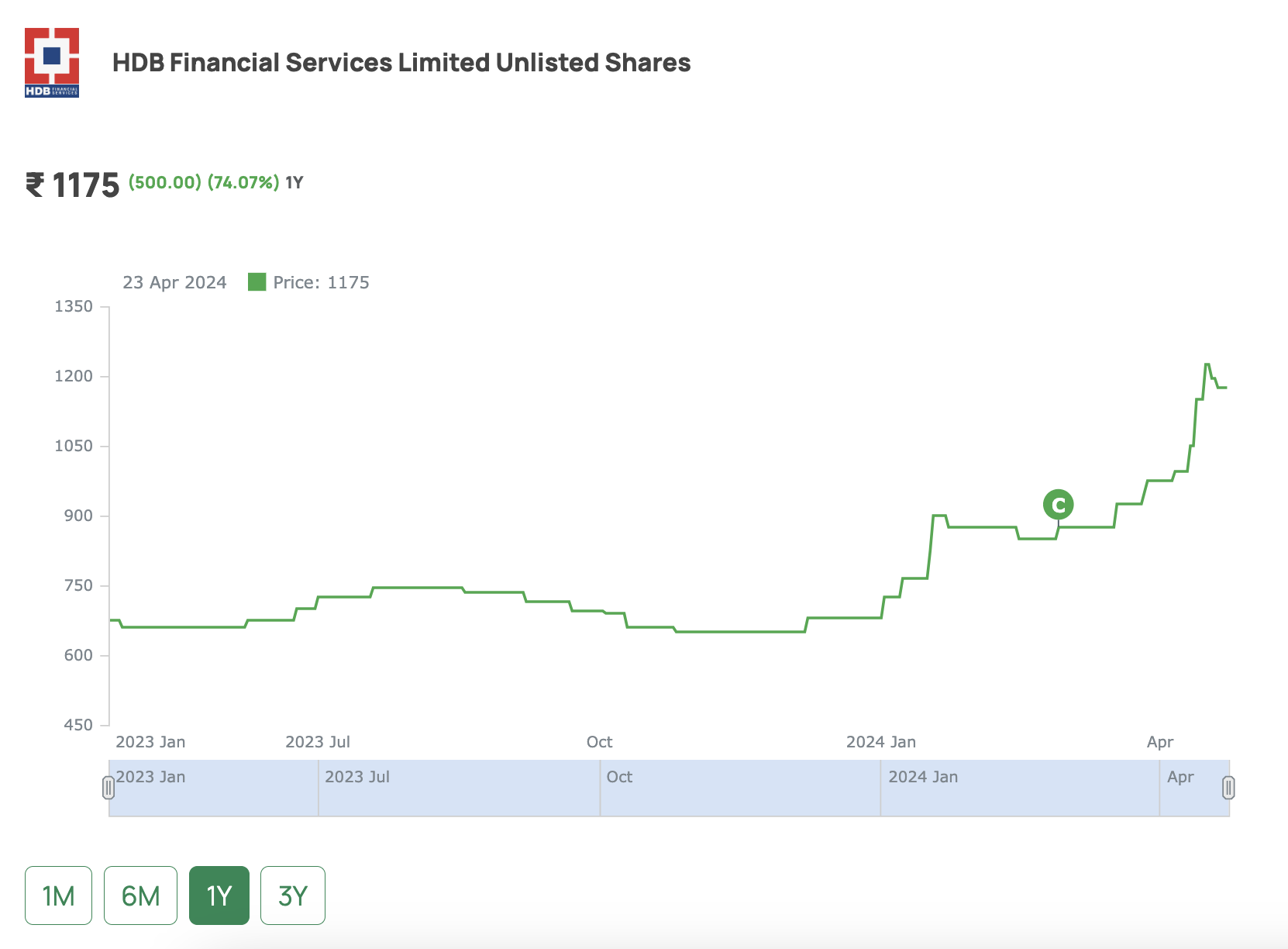

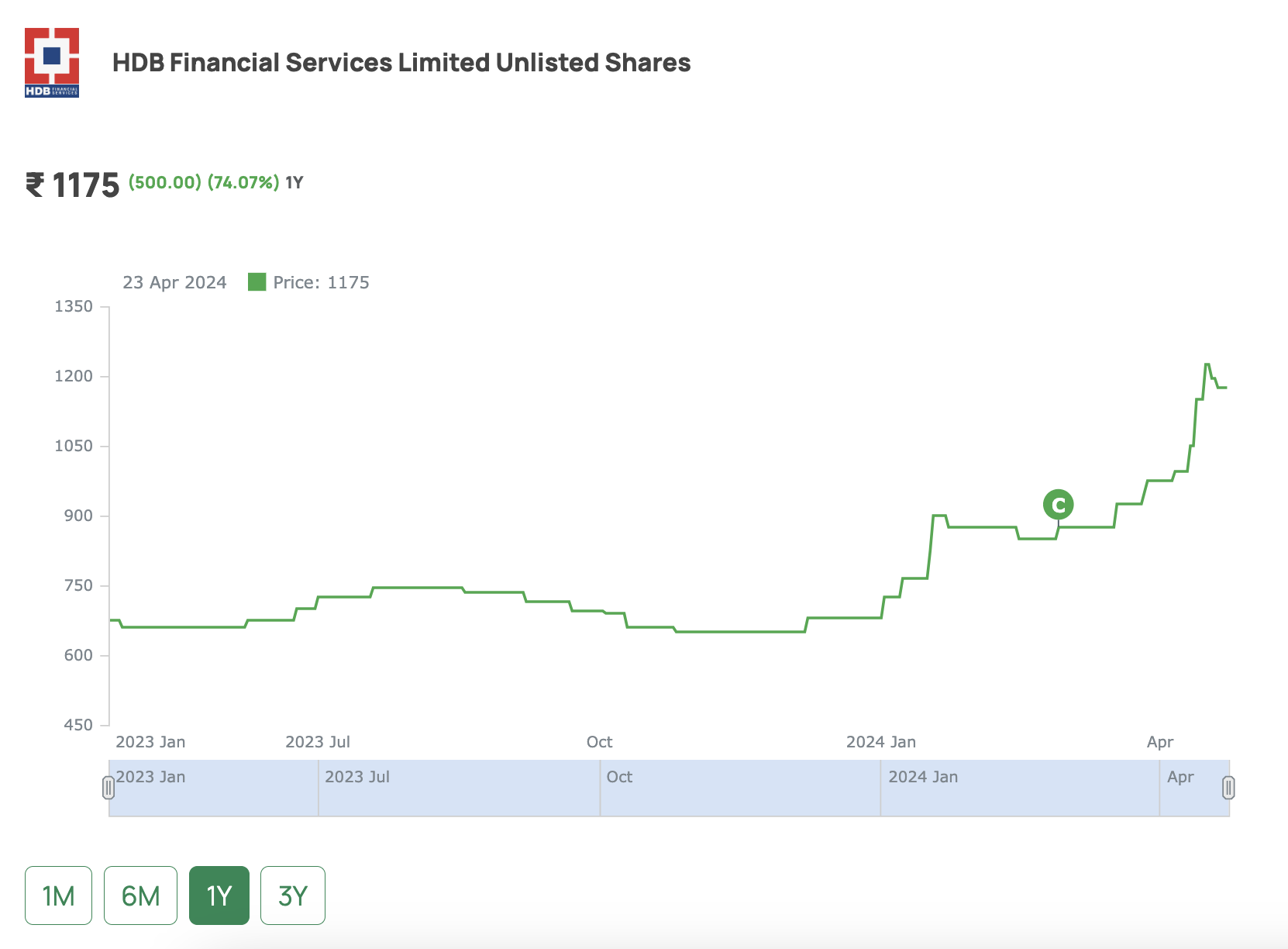

Past One Year Return of HDB Financial Unlisted Shares

Over the past year, from April 2023 to April 2024, the price of HDB shares has experienced a significant increase. One year ago, in April 2023, the share price was INR 660. However, as of today, April 2024, the price has risen to INR 1150. This represents a remarkable return on investment (ROI) of approximately 74.2% over the last year. Investors who held HDB shares during this period have seen substantial growth in the value of their investment, reflecting positive market sentiment and potentially strong financial performance by HDB Financial Services.

Current Valuation of HDB Financials

Currently, HDB Financial Services Limited's shares are trading in the unlisted market at ₹ 1,195, leading to an estimated market capitalization of approximately ₹94,775 Crores. At the current rate, the valuation of HDB Financial Services appears to be on the higher side, primarily due to its elevated price-to-book (P/B) ratio of 6.9. With a market capitalization of INR 93,189.25 crore and a P/B ratio of 6.9, the company's valuation seems relatively high. A P/B ratio of 6.9 suggests that investors are valuing HDB Financial Services at approximately 6.9 times its book value. This high P/B ratio implies that the market perceives the company's assets to be significantly more valuable than their book value.