Introduction

Orbis Financial Corporation Limited, established in 2005, has carved a niche for itself in the realm of financial services, particularly in investor servicing. This article aims to provide an in-depth analysis of the company's performance for the financial year 2022-2023, examining its Asset Under Management (AUM), revenue sources, and valuation.

A) Key Performance Indicators

Asset Under Management (AUM)

Orbis Financial's AUM witnessed a robust growth of 20%, increasing from approximately INR 6500 crores in the previous year to around INR 8100 crores. With an extensive clientele that includes 250+ Foreign Portfolio Investors (FPIs), 300 Portfolio Management Services (PMSs), 150+ Alternative Investment Funds (AIFs), 2 Mutual Funds, and 800+ Non-Resident Indians (NRIs), the company's diversification strategy seems to be paying off.

Geographical Expansion

The company has expanded its geographical presence by opening an office in GIFT City, Gujarat. This strategic move is likely to enhance its global outreach and attract more foreign clients due to the numerous advantages GIFT City offers to financial services.

Customer Base and Assets under Custody

Orbis crossed the 2,700 mark for onboarded custody clients, with assets under custody rising to INR 81,160 crores. This is indicative of the company's strong focus on customer acquisition and retention, despite a high cost of acquisition.

B) Financials and Capital Raising

The company successfully raised another round of capital, amounting to INR 112 crores, from marquee investors in January 2023. This influx of capital is likely to strengthen the company's balance sheet and fund future expansion plans.

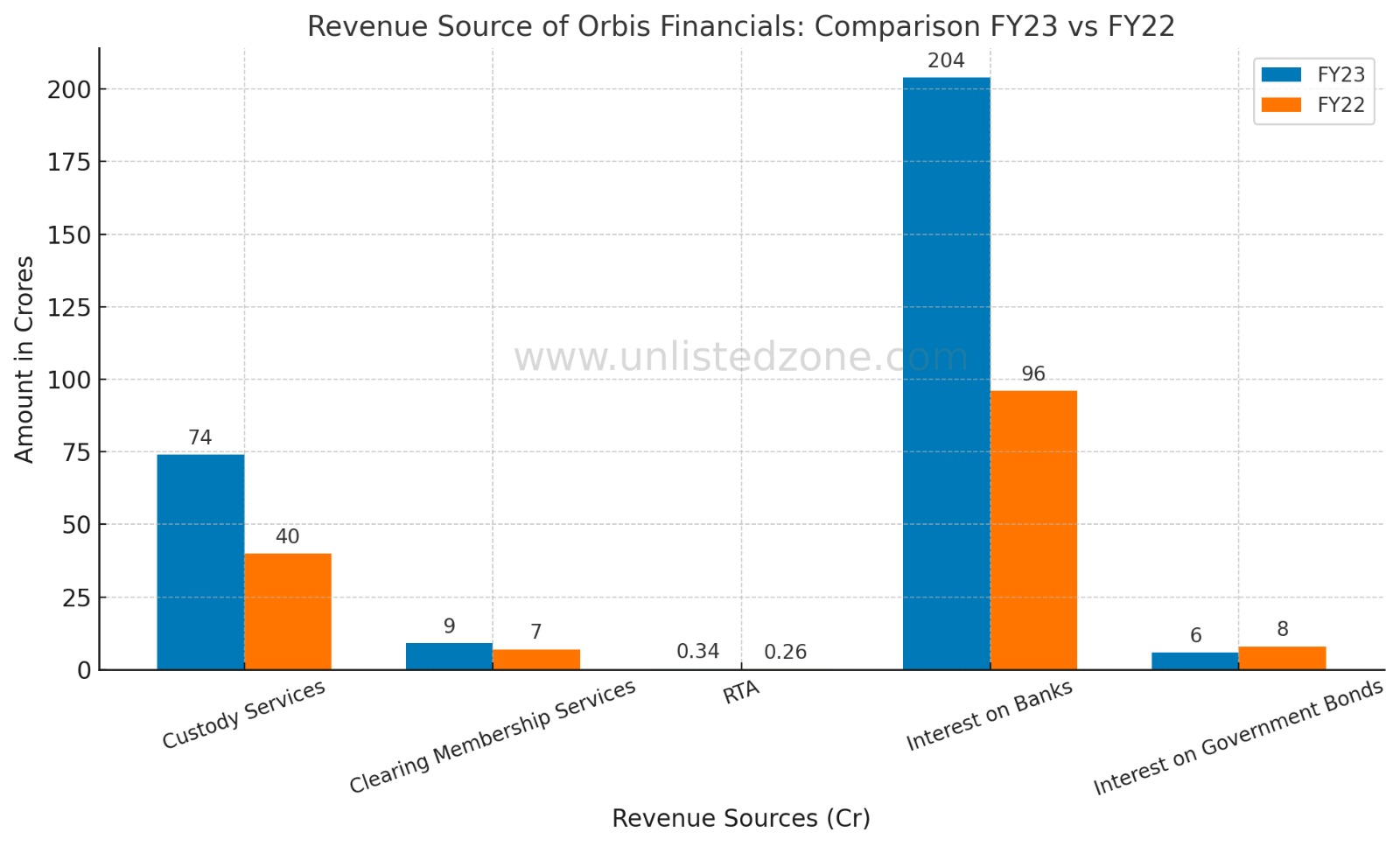

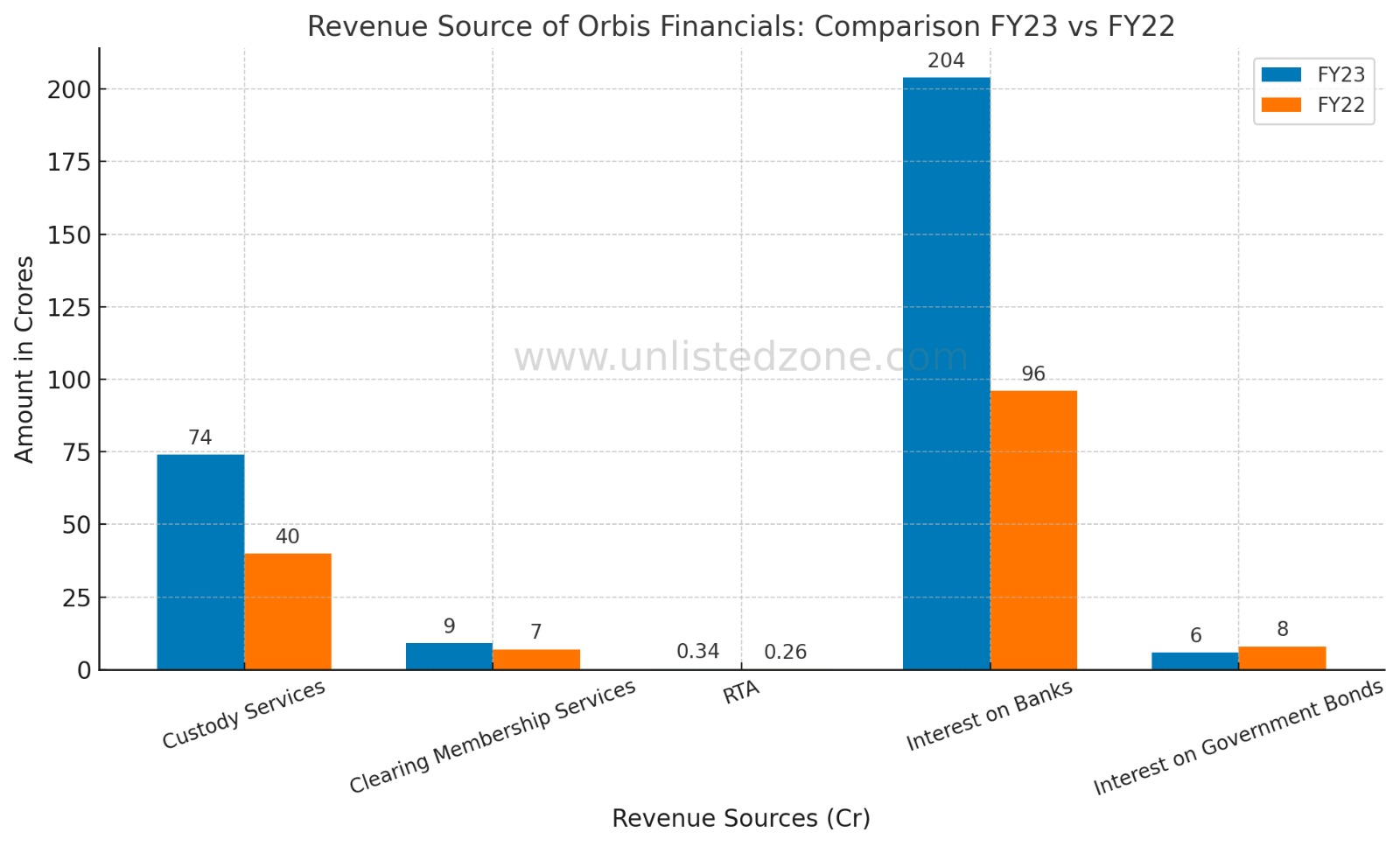

C) Revenue Sources

1. Custodian and Clearing Services

These operational revenue sources showed significant growth, rising from INR 47 crores in FY22 to INR 83 crores in FY23.

2. Interest Income

Another major driver of revenue has been the interest income from bank fixed deposits, which shot up from INR 96 crores to INR 204 crores. This suggests that the company has been effective in treasury management and optimizing its float income.

D) Valuation and Share Price of Orbis Financials

At present, shares of Orbis Financial are unlisted and are trading at INR 110 per share. Looking ahead to FY24, the management is optimistic about achieving a topline revenue of INR 500 crores and a Profit After Tax (PAT) ranging from INR 100 to 125 crores. Assuming a Price-to-Earnings (P/E) ratio of 25x for Orbis Financial's unlisted shares, the projected market capitalization would be approximately INR 2500 crores. Given the 11.36 crore outstanding shares, this would translate to a share price of INR 220. This represents a substantial upside potential compared to the current share price, making it an intriguing option for investors.

E) Risks in Orbis Financials

It's essential to consider the inherent risks in Orbis Financial’s business model. Regulatory changes and a decline in client trading volumes could pose challenges to the company's financial performance.

F) Conclusion

Despite a competitive and challenging market, Orbis Financial has demonstrated strong performance in FY22-23. With diversified sources of revenue, a broadening customer base, and strategic geographic expansion, the company appears to be on a solid growth trajectory. Its current valuation suggests that there is substantial room for growth, making it an attractive investment option. However, potential investors should be cautious of the associated risks and conduct thorough due diligence.

https://unlistedzone.com/shares/orbis-financial-corporation-limited/

Disclaimer: This article is intended for informational purposes only and should not be construed as financial advice. Consult a financial advisor before making any investment decisions