1. About Arohan Financials

Arohan is a leading, digitally advanced, NBFC-MFI, regulated by the Reserve Bank of India. Headquartered in Kolkata, the Company is present in 17 states spanning rural, semi-urban, and urban geographies in India catering to the bottom of the socio - economic pyramid through a range of financial inclusion products.

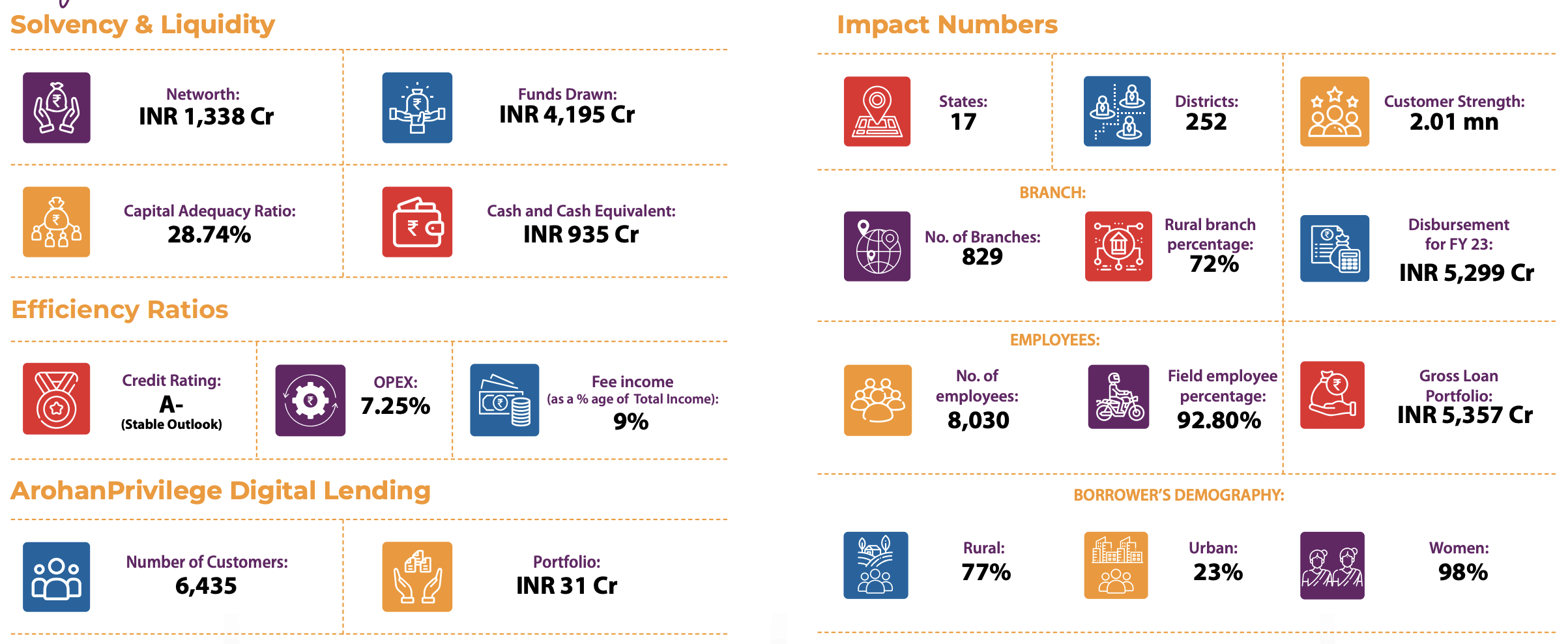

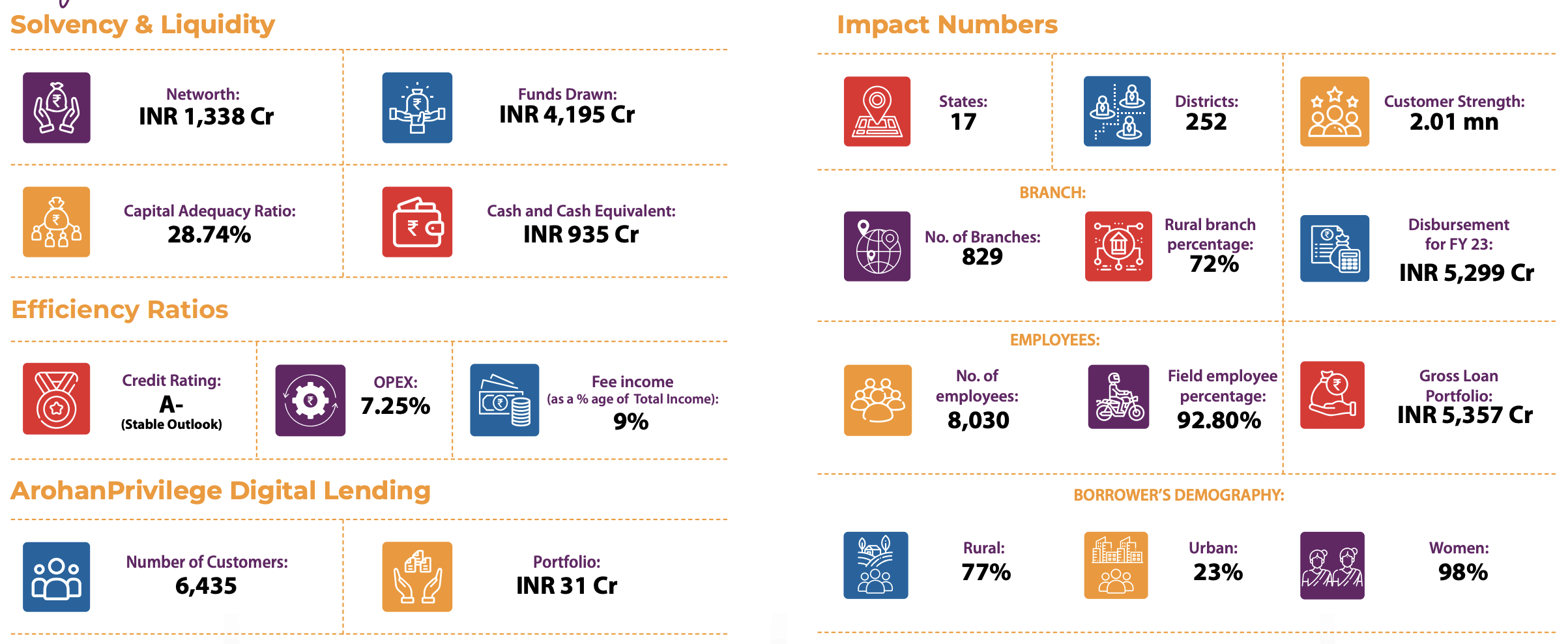

2. Key Performance Indicator in Fy23

3. Updates on Business of Arohan Financials in Fy23

a) During the year, total disbursed loans amounting to approximately INR 5300 Cr, which helped millions of families in starting their own businesses, pay for their children’s education, build their own homes, or meet their medical expenses.

b) They have dedicated to upholding top-tier corporate governance standards and have introduced 'Nirnay', their credit scoring system, using data analytics to evaluate client creditworthiness and reduce chances of NPA.

c) In Fy22-23, they started operations in Rajasthan, Haryana, and Uttarakhand. To serve the 'missing middle' segment, Arohan hs introduced Micro-Enterprise Loans under its 'Bazaar' product, with loan amounts between INR 1,05,000 and INR 1,50,000.

d) In April 2023, Arohan Financial secured one of the sector's largest fund raises of over INR 730 Cr, with four new investors backing the management and business model. This funding is raised INR 85 per share.

e) In FY 2023, they have opened about 100 branches, totaling 829 by March 31, 2023. Arohan plans to expand into Gujarat and Maharashtra by establishing branches in adjacent regions.

4. Financials Performance of Arohan Financials in Fy23

| Particulars (in Cr) |

FY23 |

FY22 |

| Net Interest Income |

931 |

859 |

| Other Income |

21 |

19 |

| Total Income |

1,091 |

920 |

| Operational Cost |

804 |

696 |

| Profit Before Provisioning |

287 |

224 |

| Provisioning |

193 |

135 |

| Profit After Provisioning |

94 |

89 |

| PBT |

90 |

83 |

| Tax |

19 |

22 |

| PAT |

71 |

61 |

| Particulars (in Cr) |

FY23 |

FY22 |

| Loan Book |

4,782 |

3,710 |

| Revenue |

1,091 |

920 |

| PAT |

71 |

61 |

| NIM |

9.60% |

13.40% |

| ROA |

1.18% |

1.17% |

| Gross NPA |

2.80% |

4.50% |

| Net NPA |

0.21% |

1.32% |

5. Valuation of Arohan Financials

(i) As on 31.03.2023, total shares outstanding is ~15 Cr and total Net-worth is ~1340 Cr.

(ii) Book Value = 1340/15 = INR 89 per share

(iii) Arohan Financials Unlisted Share Price ( as on 21.08.2023 ) = INR 160 per share

(iv) P/B = 1.74x which in line with other listed peers in the market.

https://unlistedzone.com/shares/arohan-financial-services-unlisted-shares/