About the Company

Brief History and Overview

Founded in 2008, Chennai Super Kings (CSK) is one of the most successful and popular franchises in the Indian Premier League (IPL). The team plays its home matches at the M.A. Chidambaram Stadium, Chennai, and has been led by the legendary Mahendra Singh Dhoni for most of its journey.

With 5 IPL titles, 10 final appearances, and 12 playoff qualifications, CSK stands as one of the most consistent teams in the tournament’s history. Despite facing a two-year suspension in 2016-17, the franchise made a triumphant comeback by winning the IPL 2018 title.

As of late 2023/early 2024, the Chennai Super Kings (CSK) franchise was valued at approximately $1.5 billion (around ₹12,500 crores), according to a report by Houlihan Lokey.

This makes it the second-most valuable franchise in the Indian Premier League (IPL), behind only the Mumbai Indians.

The Chennai Super Kings won their fifth IPL title in 2023, equaling the record of their biggest rivals, the Mumbai Indians, for the most championships in IPL history.

Business Model (Core Operations, Segments)

-

Central Rights (Media Rights, BCCI Grants) – Largest revenue contributor.

-

Sponsorships – Driven by CSK’s brand appeal and fan loyalty.

-

Tournament Earnings – Includes prize money and other tournament-related income.

-

Merchandise & Licensing – Jerseys, fan gear, and licensing/talent management.

-

Academy Ecosystem – Memberships, training fees, and facilities utilization.

-

Fan Engagement – Initiatives such as Fan Parks in 36 cities and strong digital presence (200M+ Hotstar viewership).

Key Highlights of FY 2024-25

-

Sporting Performance: Did not qualify for the IPL XVIII Knockouts.

-

Academy Growth: Membership income grew 78.7% YoY; facility utilization rose 92.9% YoY.

-

Merchandise Boom: Sales doubled to ₹194.25 Lakhs.

-

Licensing/Talent Management: Up 77.7% YoY to ₹191.04 Lakhs.

-

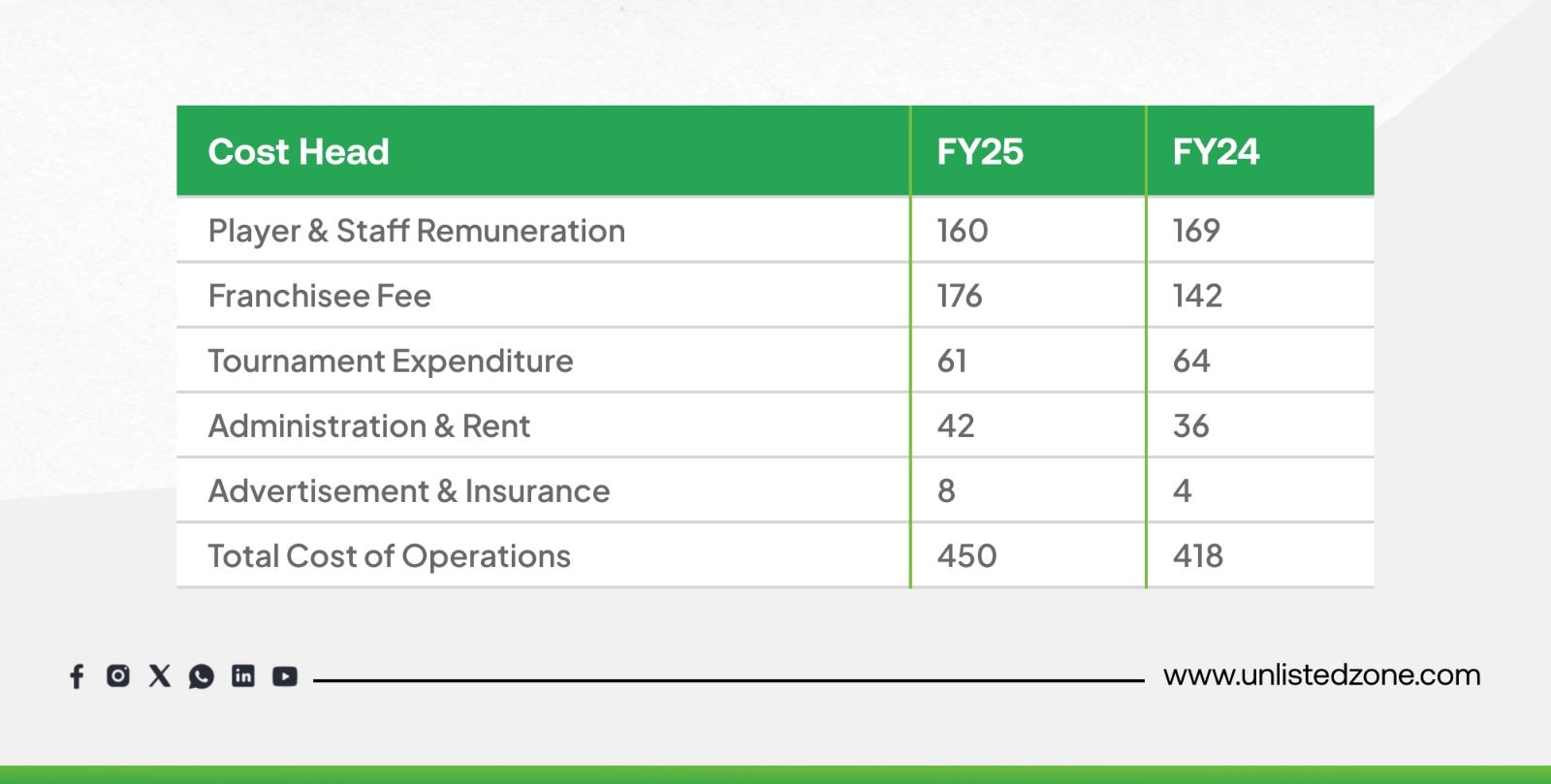

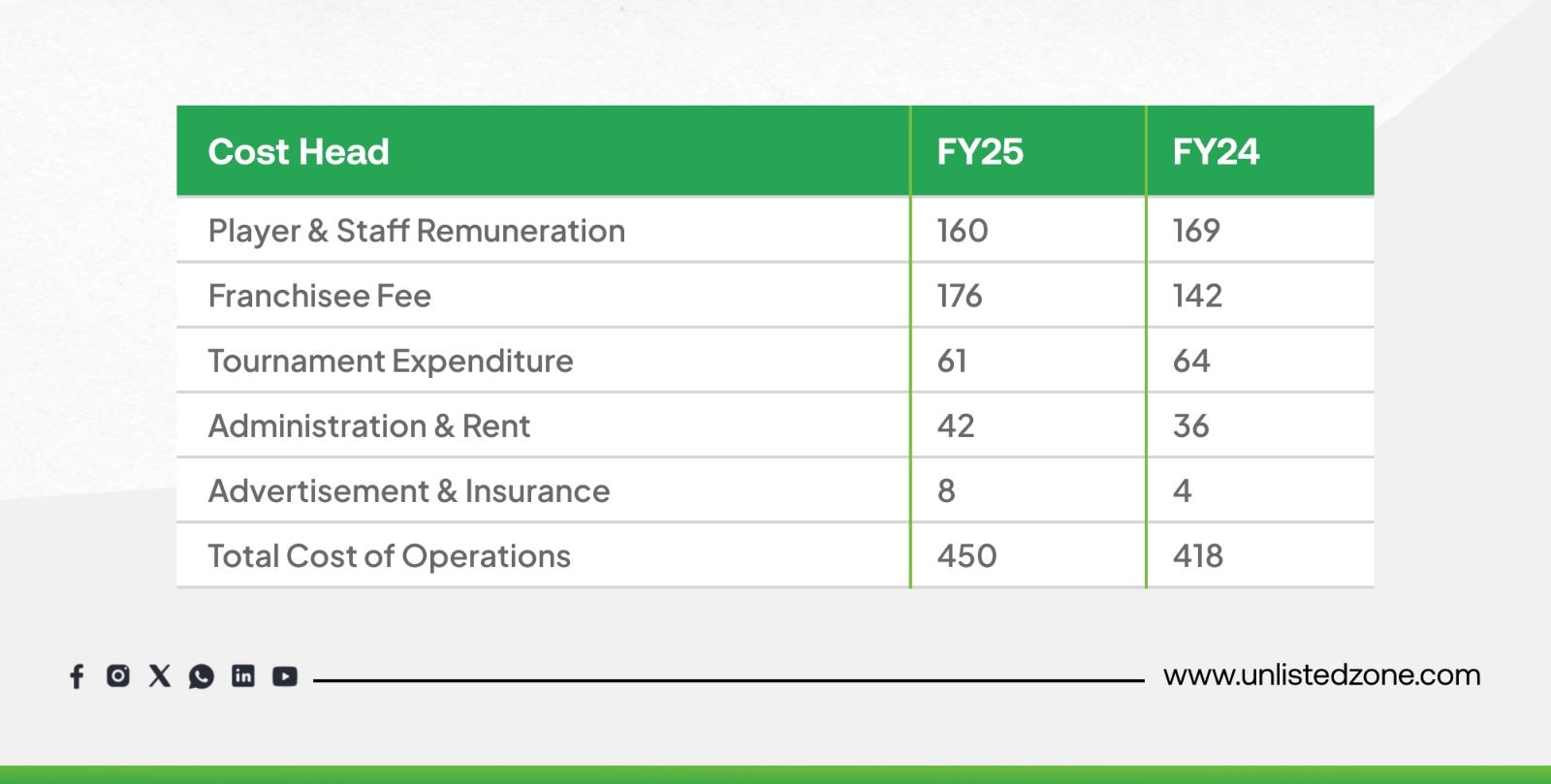

Cost Pressure: Franchisee fees and administration costs surged significantly.

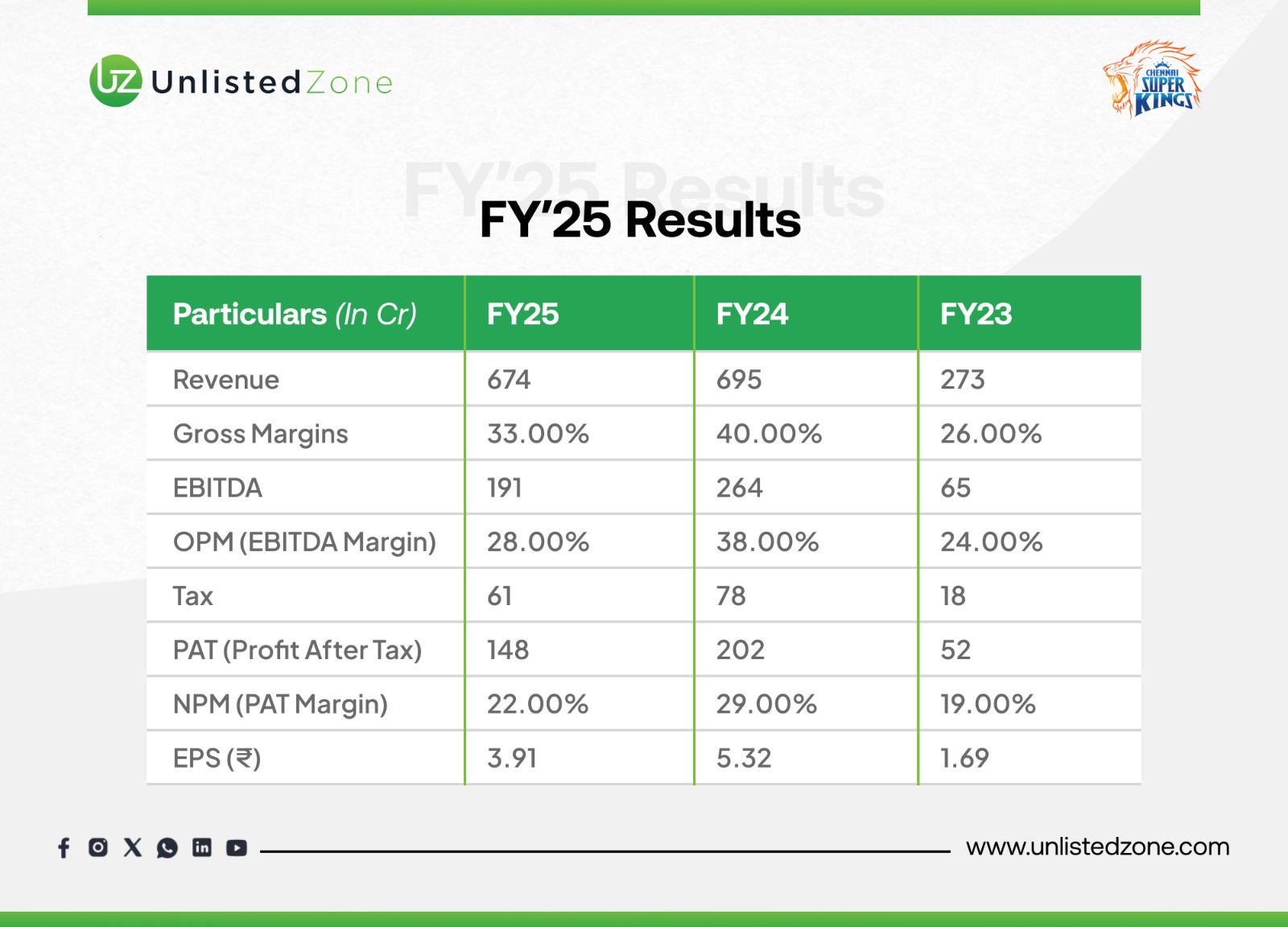

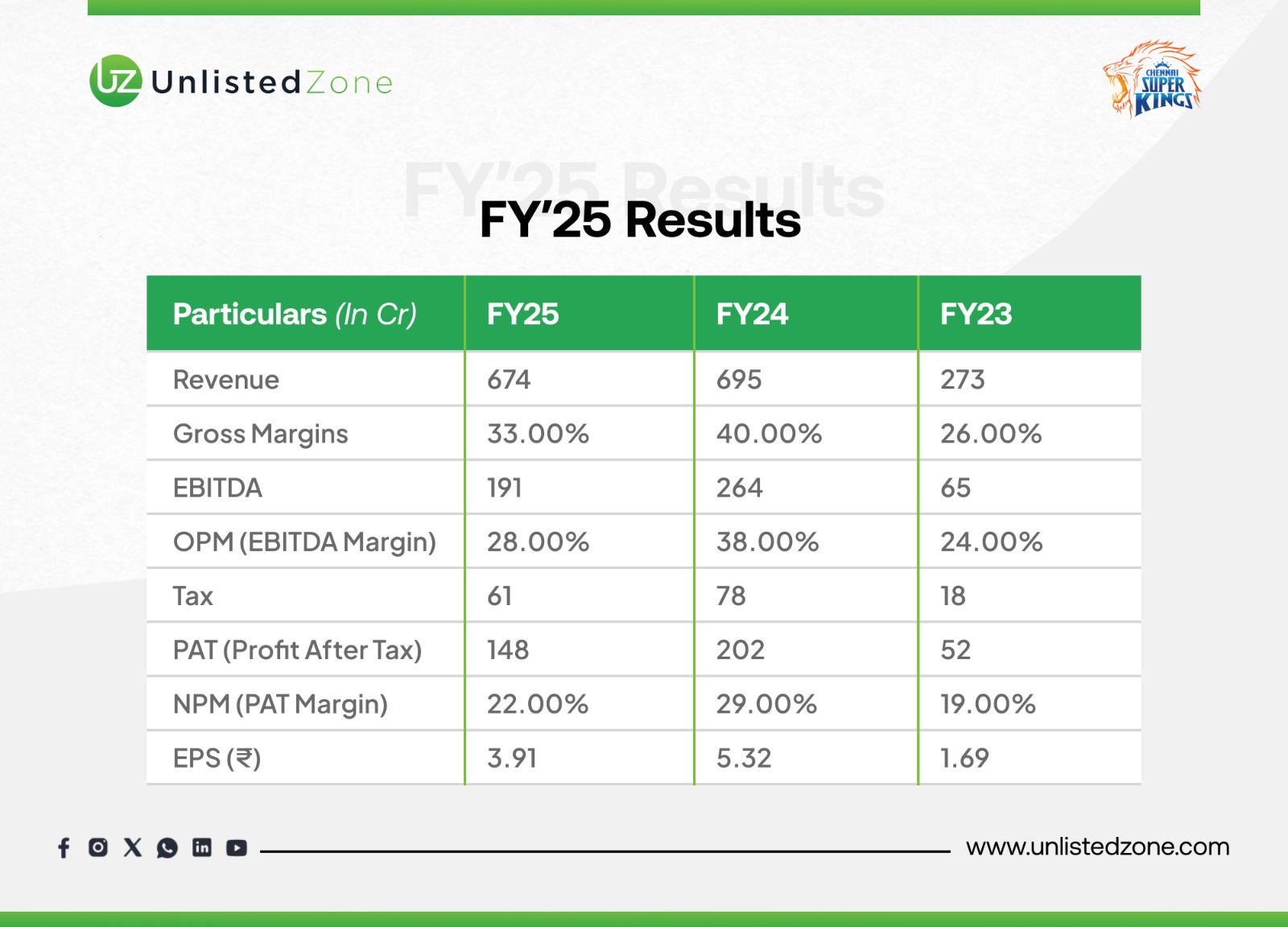

Financial Performance (Consolidated)

Revenue Growth (YoY % Change): Total turnover fell 4.8% YoY from ₹695 Cr in FY24 to ₹674 Cr in FY25, driven by a ₹19 Cr drop in tournament-related income (primarily due to no prize money in FY25).

-

Profit After Tax (PAT) and Margins: PAT declined 21.0% YoY to ₹18,094.22 Lakhs from ₹22,910.70 Lakhs, with margins contracting due to lower revenue and higher costs.

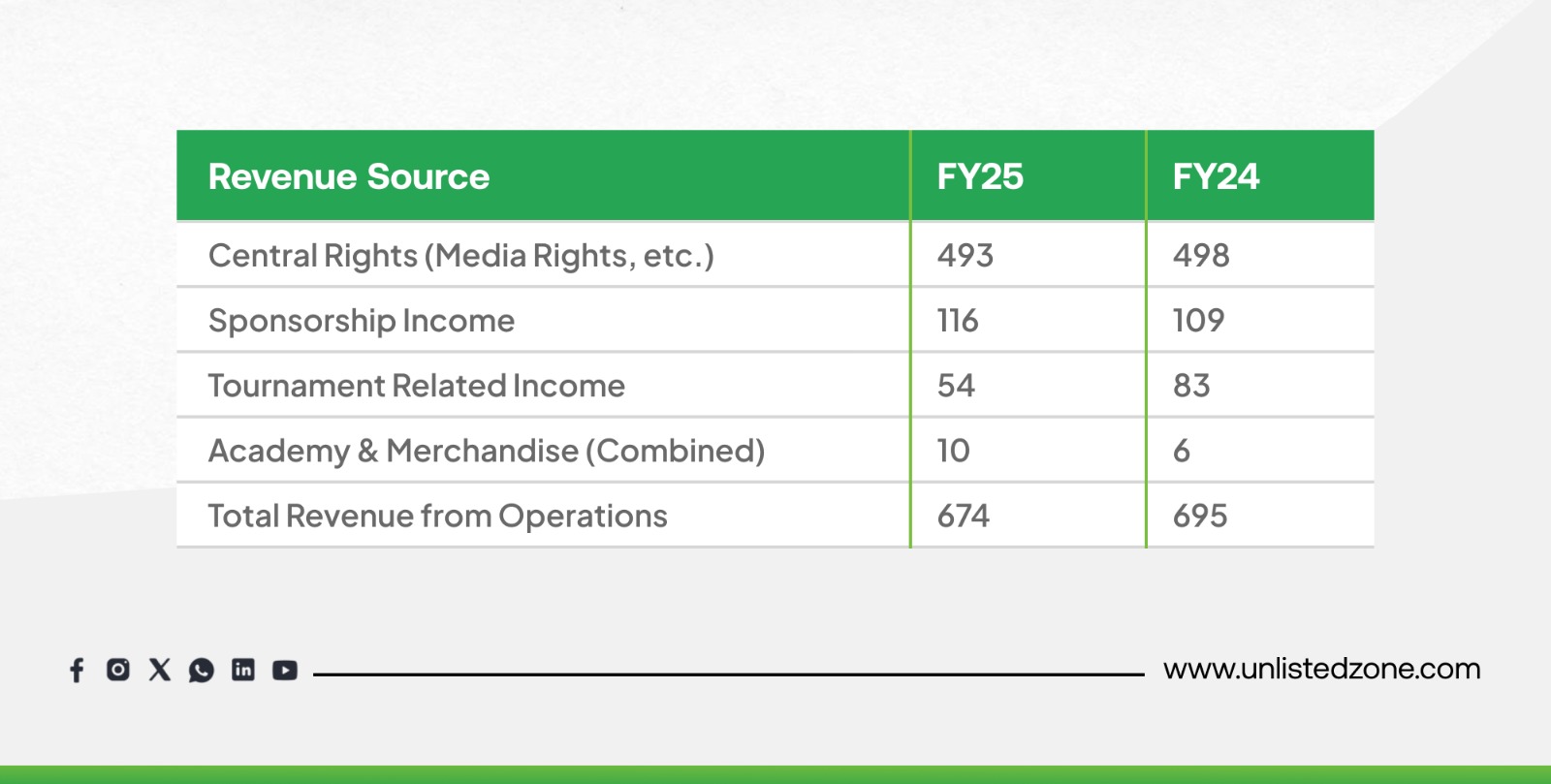

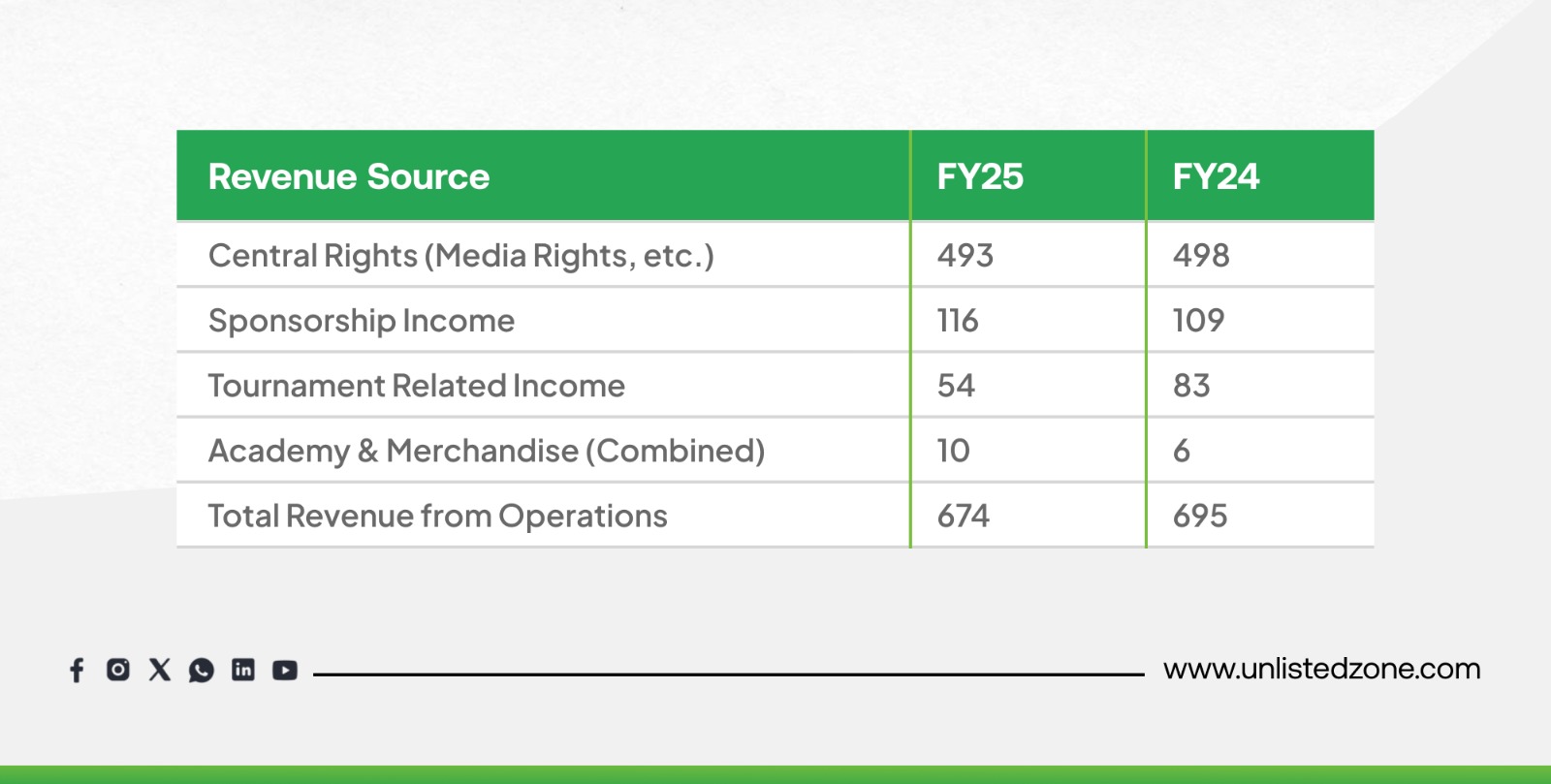

Revenue Breakdown (₹ in Cr)

Key Insight: Revenue fell 3.1% YoY (~₹19 Cr), mainly due to no prize money in FY25.

Cost Breakdown (₹ in Cr)

📌 Key Insight: Costs rose 7.5% YoY (+₹31 Cr ), led by franchisee fee (+24.0%) and admin expenses (+15.9%).

Balance Sheet Strength

Segment/Division-Wise Analysis

-

Central Rights: 73.2% of revenue (₹493 Cr).

-

Sponsorship: 17.3% share, growing steadily.

-

Tournament Income: 8.0%, down sharply due to no prize money.

-

Academies & Merchandise: 1.8%, but growing fast with YoY gains above 75%-100%.

Insight: Diversification into academies, licensing, and merchandise is paying off, though media rights remain the dominant stream.

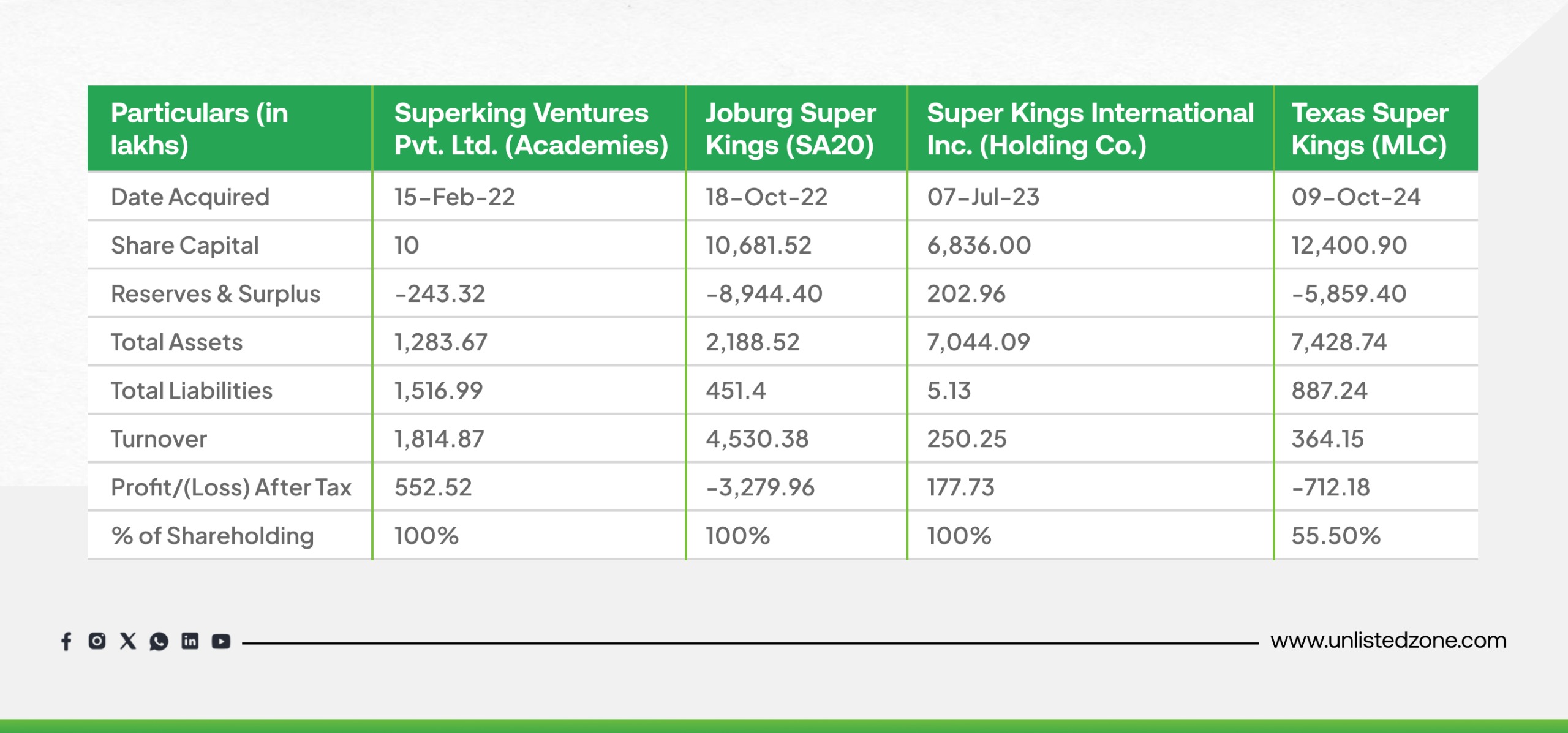

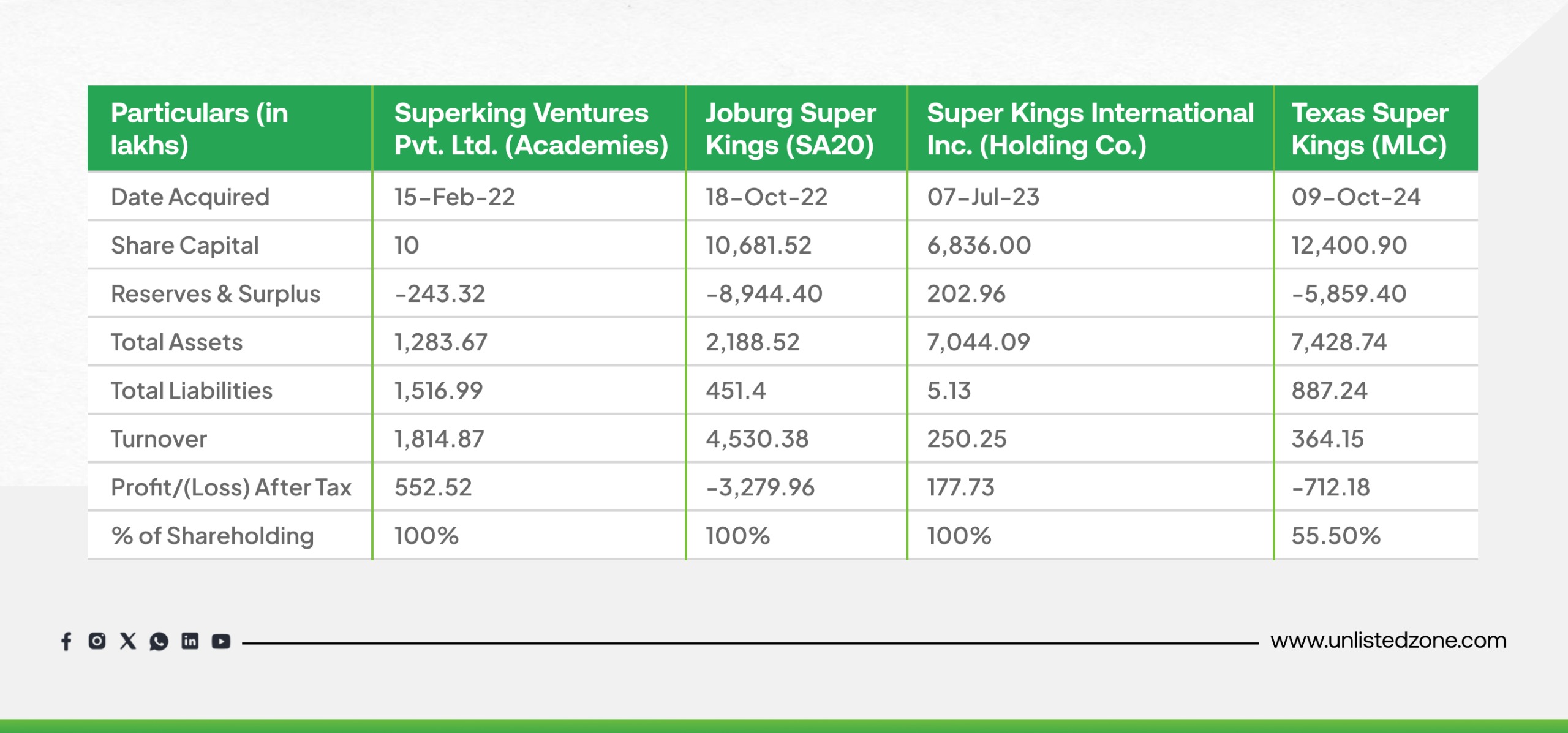

CSK's Subsidiaries

Key Performance Insights (in points):

-

Superking Ventures (Academies):

-

Financial Health: Despite negative reserves, it is the only profitable subsidiary, reporting a PAT of ₹552.52 Lakhs.

-

Leverage: Has the highest liabilities, indicating it may be using debt to fund its rapid expansion.

-

Joburg Super Kings (SA20):

-

Scale: Has the highest turnover (₹4,530.38 Lakhs) among the subsidiaries.

-

Losses: Incurs the largest loss (₹3,279.96 Lakhs), which is a common characteristic of sports franchises in a growth phase, investing heavily in player costs.

-

Texas Super Kings (MLC):

-

Super Kings International Inc.:

-

Holding Company: Acts as the US holding entity that owns 55.5% of Texas Super Kings.

-

Profitability: Reported a small profit at the holding level, but this is offset by the losses of its subsidiary (Texas Super Kings) which are consolidated.

-

Global Strategy: CSK's strategy of expanding its global footprint by investing in overseas T20 leagues (SA20, MLC) and building a network of cricket academies. The newer sports franchises are currently loss-making as they build their brand and fanbase, while the academy business has become profitable.

Management Discussion & Analysis (MD&A)

-

Outlook: Confident of a strong comeback in future IPL seasons, driven by brand power and fan loyalty.

-

Risks: Rising franchisee fees, dependence on central revenue, and performance-linked prize money.

-

Strategy: Expand academy ecosystem, boost merchandise sales, and deepen digital fan engagement.

Valuation Insights (Unlisted Market)

-

CSK is among the most demanded unlisted shares in India.

-

Backed by consistent profits, strong fan engagement, and iconic branding.

-

Current Price: ₹185

-

Valuation (Unlisted): ~ ₹7091 Cr

-

P/E: 47.31

-

P/B: 9.37

Future Outlook

Opportunities

-

IPL expansion and rising sponsorship pool.

-

Strong digital monetization opportunities.

-

Growing academy and licensing revenues.

Headwinds

-

Rising costs (franchisee fees, admin expenses).

-

Performance-linked earnings volatility.

-

Competitive IPL sponsorship environment.

UnlistedZone View

CSK remains a cash-rich, consistently profitable franchise with strong fundamentals. Short-term dips in profitability (like FY25) are linked to tournament outcomes, but the brand’s financial stability is unquestionable.

📌 Our Take:

-

Rating: Strong Buy (Long-Term)

-

Investment Thesis: Premium brand, resilient cash flows, and growth from academies & merchandise.

-

Risks: Performance volatility and rising franchisee fees.

CSK continues to be a defensive yet growth-oriented unlisted investment for those looking to tap into India’s sports economy.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report