A) About Vikram Solar

1. Expansion of Manufacturing Capacity: The company has expanded its manufacturing capacity to 3.5 GW in FY 2023-24 and is targeting an increase to 4.5 GW by FY 2024-25 and 10.5 GW by FY 2025-26. Apart from this, they are also doing EPC business in the solar segment.

2. Eligibility for Key Subsidies: The company is eligible for significant subsidies, including the Production Linked Incentive (PLI) for their 2.4 GW solar facility and the TNGO scheme, bolstering its growth and innovation prospects.

3. Integration of Advanced Technology: The company has integrated new n-TOPCon technology in its latest product, the Hypersol, indicating a focus on advanced technological adoption.

4. Broad Market Presence: The company is present across all market segments, including utility-scale projects, C&I (Commercial & Industrial), residential, ground mount, rooftop, and floating solar projects, showcasing a diversified portfolio. The opportunity in the C&I is explained by Team of UnlistedZone https://x.com/UnlistedZone/status/1828645450703933776

5. Continuous R&D Investment and Latest Tech: The company is continuously upgrading its R&D initiatives with substantial investments, utilizing their NABL-accredited lab to bring innovative products to market consistently. They excel in high-efficiency photovoltaic module manufacturing with advanced PERC, TOPCon, and HJT technologies.

6. Cost Competitiveness: The company maintains cost competitiveness through optimizing efficiencies, advanced processes, and favorable supplier terms, ensuring strong financial management and operational efficiency.

B) Key Highlights of FY24

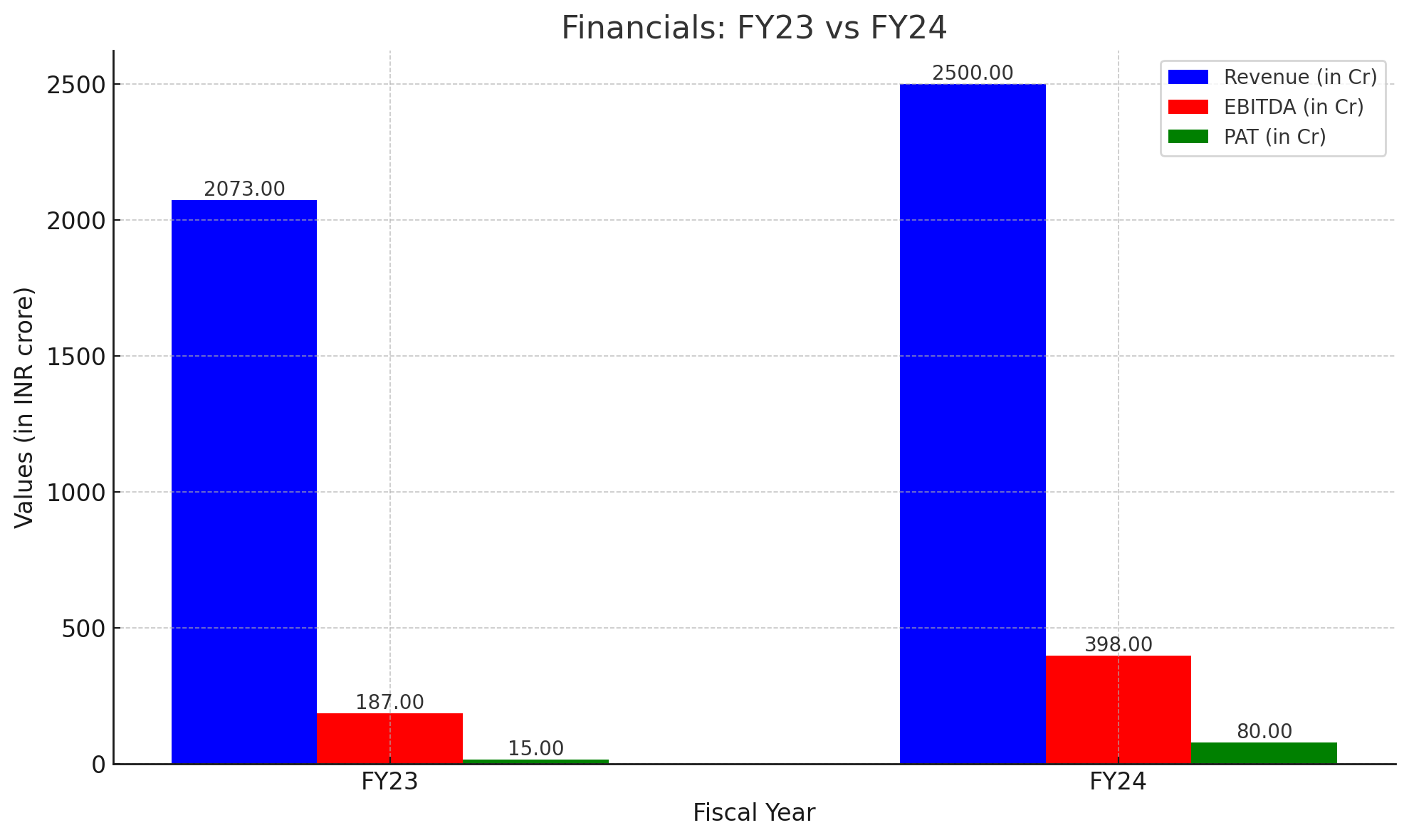

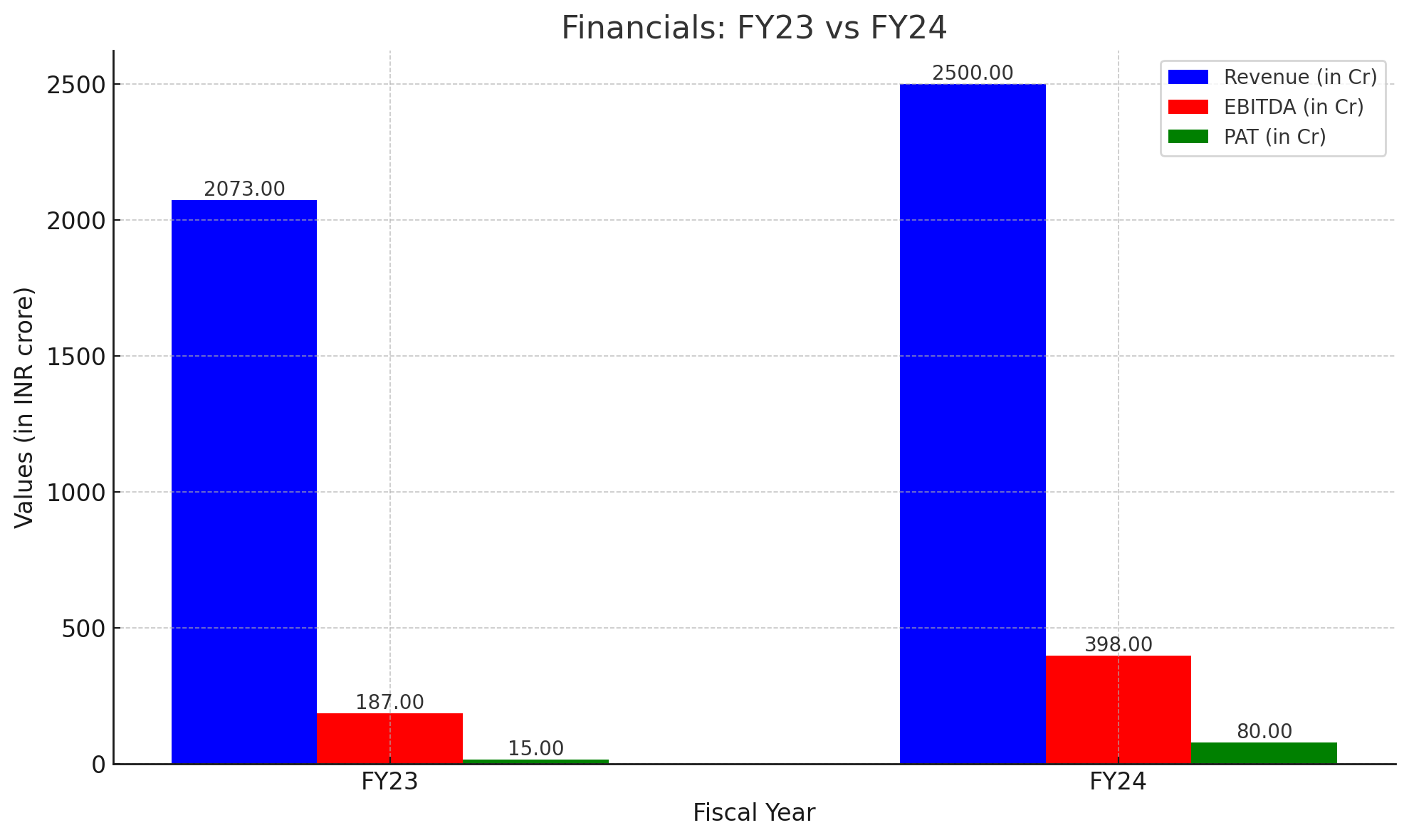

Financial Highlights:

- Revenue: INR 2510 Cr

- EBITDA: INR 398 Cr

- PAT (Profit After Tax): INR 79 Cr

- Share of Exports in Revenue: 61.58%

Operational Highlights:

- Total Modules Manufactured: 16,11,014 modules in FY 2023-24

- Modules Shipped Globally: 878 MW in FY 2023-24

- Cumulative MW Modules Shipped Globally: Over 5 GW from FY 2010-11 to FY 2023-24

- EPC Projects in Portfolio (Commissioned): Over 1,400 MW

- O&M Projects in Portfolio (Ongoing): Over 700 MW

C) Manufacturing Facility

Operational Facilities:

- Falta SEZ, Kolkata, West Bengal:

- Capacity: 2.2 GW

- Advantages: Strategic location in SEZ with proximity to ports, rail, and road networks, facilitating seamless distribution to domestic and international markets.

- Oragadam, Chennai, Tamil Nadu:

- Capacity: 1.3 GW

- Focus: Catering to increasing demand in the solar energy sector, promoting sustainable progress.

Upcoming Facilities:

- Gangaikondan, Tamil Nadu:

- Capacity: 3 GW cell and 6 GW module manufacturing. Manufacturing plant to be operational by FY 2025-26.

- Purpose: Significant capacity expansion.

- Status: Site selection stage for a new solar PV manufacturing facility.

- Goal: To meet the growing demand for renewable energy in the United States.

D) Financial Analysis of Vikram Solar

Balance Sheet and Cash-Flow Analysis

As of 31st March 2024, the company has a total debt of ₹600 crore in long-term debt and ₹200 crore in short-term debt. Outstanding dues to creditors amount to ₹582 crore. On the asset side, the company holds ₹112 crore in trade receivables, ₹114 crore in cash, and ₹388 crore in inventory. The total current liabilities stand at ₹141 crore, while total current assets amount to ₹197 crore, resulting in a current ratio of 1.39x, which is considered manageable. The total equity is ₹460 crore, leading to a debt-to-equity (D/E) ratio of approximately 1.73x—on the higher side. However, after a recent ₹700 crore private placement in June 2024, the D/E ratio is expected to drop below 1.

The company generated approximately ₹170 crore from operations. Out of this, ₹68 crore was allocated for purchasing property, plant, and equipment (PPE), ₹25 crore was used to repay long-term debt, and ₹137 crore was spent on interest costs. Additionally, the company took out a short-term loan of ₹93 crore. In total, the ₹170 crore from operations, combined with the ₹93 crore loan, amounted to ₹260 crore, which was used to purchase ₹68 crore in assets and pay off ₹198 crore in debt.

In summary, due to the high debt levels and capex, the company generated only ₹7 crore in cash.

P&L Analysis

1. The company's top line has grown by 21% in FY24, reaching INR 2,523 crore. Notably, 61% of the revenue has been generated from exports, with a significant contribution from the US market. The US ban on Chinese module companies has opened up opportunities for countries like India, Indonesia, and Vietnam. The US market also offers higher margins. Additionally, Vikram Solar is establishing a manufacturing unit in the US to capitalize on the new solar policy, which makes local production more profitable than exporting from India.

2. The company has achieved an EBITDA of INR 398 crore in FY24, a significant increase from INR 200 crore in the previous year.

3. The company recorded a PAT of INR 80 crore in FY24, up from INR 13 crore in the previous year.

4. The company is currently valued in the unlisted market at approximately INR 9,000 crore market capitalization.

UnlistedZone’s View

Vikram Solar is positioned as a significant player in the global solar energy market, showing impressive growth and strategic advancements. The company has successfully expanded its manufacturing capacity to 3.5 GW in FY 2023-24, with plans to reach 10.5 GW by FY 2025-26, reflecting its commitment to scaling operations and meeting increasing demand. Their involvement in both manufacturing and EPC business further diversifies their revenue streams and market reach.

A key strength of Vikram Solar is its eligibility for major subsidies, such as the Production Linked Incentive (PLI) for its 2.4 GW solar facility and the TNGO scheme. These financial incentives support its growth, allowing for more aggressive expansion and innovation. The integration of advanced technologies like the n-TOPCon technology in their Hypersol product demonstrates the company’s focus on staying at the forefront of technological advancements in the industry.

Financially, Vikram Solar reported strong performance in FY24, with revenue of INR 2,510 crore, EBITDA of INR 398 crore, and a PAT of INR 79 crore. The significant contribution of exports, particularly to the U.S. market, where margins are higher, underlines the company’s strong international presence. The decision to establish a manufacturing unit in the U.S. aligns with the new solar policies there, potentially boosting profitability further.

However, the company faces challenges with a high debt-to-equity ratio, standing at approximately 1.73x as of March 2024. The recent ₹700 crore private placement is expected to alleviate some of this financial pressure, lowering the D/E ratio below 1. Despite the high debt, the company has managed its finances efficiently, maintaining a manageable current ratio of 1.39x.

Looking ahead, Vikram Solar’s strategic investments in R&D, coupled with its broad market presence across various solar segments, position it well for continued growth. The upcoming expansion of their manufacturing facilities in India and the U.S. will likely enhance their capacity to meet global demand. With its valuation at approximately INR 9,000 crore in the unlisted market, Vikram Solar stands as a promising player, poised for significant future growth in the renewable energy sector.