Employee Stock Option Plans (ESOPs) have become an increasingly popular tool for companies, especially startups and tech firms, to attract and retain top talent. These plans allow employees to own a piece of the company, aligning their interests with those of the organization. But what exactly is an ESOP, how do they work, and what are the tax implications? In this article, we'll explore ESOPs in detail, covering key concepts and addressing common questions.

1. What is an ESOP?

An Employee Stock Option Plan (ESOP) is a program that allows employees to purchase company shares at a predetermined price, typically lower than the market value. The primary purpose of an ESOP is to provide employees with a stake in the company's success, leading to greater job satisfaction and motivation. By offering stock options, companies can align the interests of employees and shareholders, fostering a sense of ownership and long-term commitment.

2. What Does Vesting Mean in an ESOP?

Vesting is a crucial concept in ESOPs, referring to the process by which employees earn the right to exercise their stock options. Typically, ESOPs have a vesting schedule, meaning that employees do not immediately own the stock options. Instead, they gradually gain ownership over a period, usually a few years.

For example, a company might offer an employee 1,000 stock options with a four-year vesting schedule. This could mean that the employee will vest 25% of their options (250 options) at the end of each year. By the end of the fourth year, the employee would have fully vested and be able to exercise all 1,000 options.

Vesting schedules are designed to retain employees, as they need to stay with the company for a certain period to fully benefit from the ESOP.

3. How Are ESOPs Valued?

Valuation of ESOPs is a critical aspect, particularly for unlisted companies where there is no readily available market price for shares. The value of the shares offered through ESOPs is typically determined by a qualified independent valuer. There are several methods to value ESOPs, but one of the most popular ones is the Black-Scholes method.

Black-Scholes Method

The Black-Scholes method is widely used to estimate the fair value of options, including ESOPs. This model considers factors such as the current price of the stock, the exercise price of the option, the time to expiration, the risk-free interest rate, and the volatility of the stock. By applying this method, companies can determine a fair value for the ESOPs, which is crucial for financial reporting and tax purposes.

Example of Black-Scholes Calculation

Let’s consider an example where an employee is granted an ESOP with the following parameters:

- Current stock price (S0S_0S0): INR 100

- Exercise price (XXX): INR 90

- Time to maturity (TTT): 1 year

- Risk-free interest rate (rrr): 5% or 0.05

- Volatility (σ\sigmaσ): 20% or 0.20

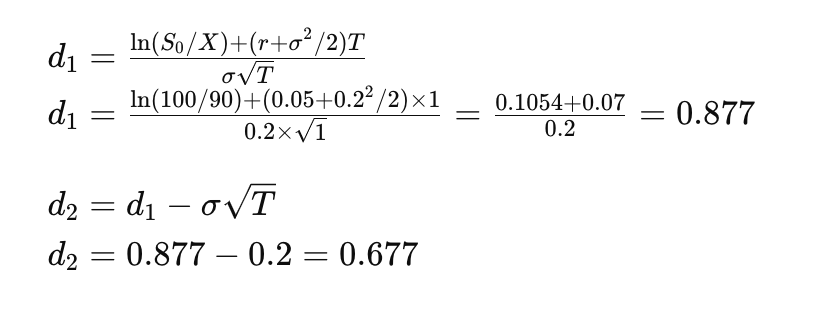

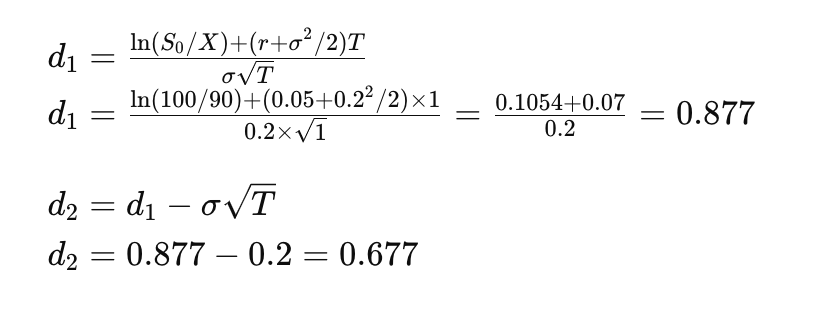

Using the Black-Scholes formula, we first calculate:

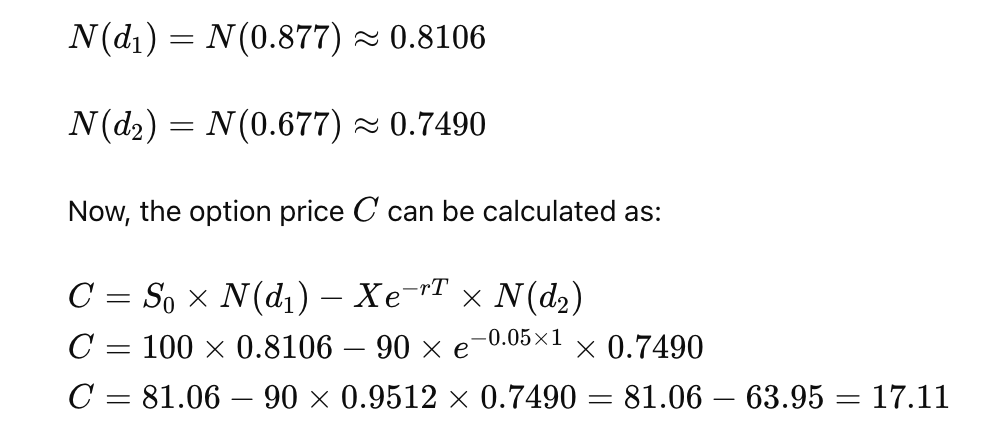

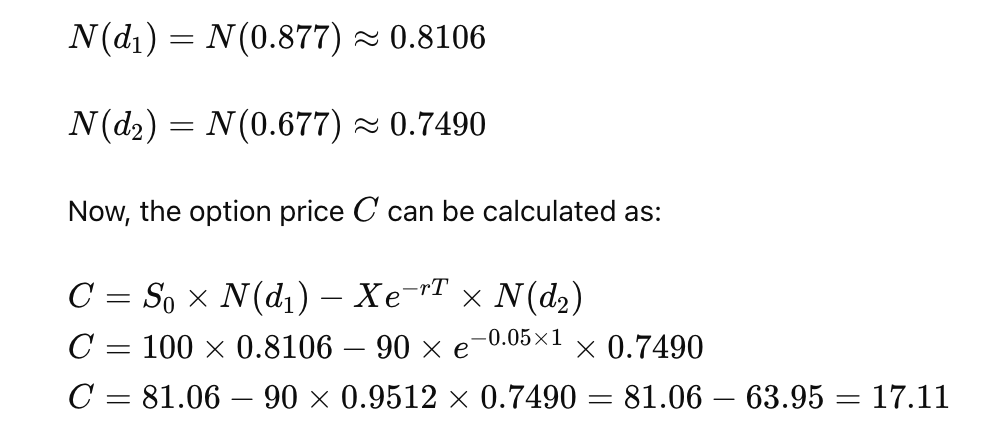

Next, we use the cumulative distribution function N(d1) and N(d2), which are standard values from a statistical table for the normal distribution:

So, the value of the ESOP using the Black-Scholes model is approximately INR 17.11 per option.

4. Do ESOPs Always Come at a Discount Compared to Actual Valuation?

Yes, ESOPs are often issued at a discount compared to the current market price or valuation of the company's shares. The discount acts as an incentive for employees, providing them with a financial benefit and making the ESOPs more attractive.

For instance, if a company's share is valued at INR 100, the ESOPs might be offered to employees at INR 70 or INR 80. This discount allows employees to profit from the appreciation of the company's stock value over time, assuming the company performs well.

However, it's important to note that the discount is not mandatory and varies depending on the company's policy. In some cases, ESOPs might be offered at the current market price or even at a premium, though this is less common.

5. Why Are ESOPs Subject to Double Taxation in India? An Example

One of the most significant challenges of ESOPs in India is the issue of double taxation. This means that employees may face tax liabilities at two different stages:

-

At the time of exercising the options: When an employee exercises their ESOPs, the difference between the exercise price and the fair market value (FMV) of the shares is considered as a perquisite and taxed as part of the employee's salary under the "Income from Salary" category.

Example: Suppose an employee is granted ESOPs at an exercise price of INR 50 per share, and the FMV at the time of exercising is INR 100 per share. The difference of INR 50 per share is considered as taxable income, and the employee is required to pay tax on this amount as per their applicable income tax slab.

-

At the time of selling the shares: If the employee later sells the shares, any gain (the difference between the sale price and the FMV on the exercise date) is subject to capital gains tax. The tax rate depends on the holding period of the shares—long-term or short-term capital gains tax rates apply accordingly.

Example: Continuing from the previous example, if the employee sells the shares later for INR 150, the capital gain would be INR 50 per share (INR 150 sale price minus INR 100 FMV). This gain is subject to capital gains tax.

This double taxation can significantly impact the net benefit employees receive from their ESOPs, and it's essential to plan accordingly.

6. How Can I Liquidate My ESOPs If My Company is Unlisted?

Liquidating ESOPs in an unlisted company can be more challenging than in a publicly listed one, as there is no readily available market for the shares. However, there are a few options employees can consider:

-

Buyback by the Company: Some companies offer to buy back the shares from employees at a predetermined price or at the current market valuation. This is often the most straightforward way to liquidate ESOPs in an unlisted company.

-

Sale to Other Investors: Employees may be able to sell their shares to private investors or through secondary market transactions. This could include selling to other employees, institutional investors, or private equity firms interested in acquiring shares in the company.

-

Wait for an IPO or Acquisition: If the company plans to go public or is likely to be acquired, employees can hold onto their ESOPs and sell them once the shares are listed on a stock exchange or as part of the acquisition deal.

-

UnlistedZone: UnlistedZone is India's largest platform for facilitating the exit of ESOPs in unlisted companies. They offer a robust marketplace where employees can find buyers for their ESOPs, ensuring a smooth and efficient exit process.

7. Are ESOPs Subject to Lock-In Periods?

Unlike other pre-IPO shares, ESOPs are generally not subject to a lock-in period once they are vested and exercised. This means that employees can sell their shares as soon as they are eligible to do so, without having to wait for a specified period. This flexibility makes ESOPs an attractive option for employees looking to benefit from their company's growth.

Conclusion

ESOPs are a powerful tool for companies to incentivize and retain employees while offering them a stake in the company's success. However, they come with complexities, particularly around vesting schedules, valuation, taxation, and liquidity. Understanding these aspects is crucial for employees to maximize the benefits of their ESOPs and avoid potential pitfalls.

Whether you're part of a startup or a well-established firm, navigating the world of ESOPs requires careful planning and a clear understanding of how these stock options fit into your overall financial strategy. With the right approach, ESOPs can be a rewarding part of your compensation package, providing both financial gain and a sense of ownership in your company's journey.