The company began its operations in 1973. It is remarkable from where the company has come from, manufacturing 7 million helmets each year from a garage. It has continually innovated in the past five decades so that we remain focused on delivering safety to a two-wheeler rider. As a result, the company is the world’s largest helmet manufacturer of helmets. The four manufacturing facilities are located in Faridabad which is strategically situated in the vicinity of the market. The company also has a strong global presence across Europe, Asia, Latin America and the Middle East, spanning over 40 countries.

Some Stats of Studds Accessories Unlisted Shares in FY2021?

1. Total helmets manufactured by Studds stands at ~64 lakh.

2. Exported to more than 45 countries.

3. Largest manufacturer of helmet in the world.

4. Studds Accessories has 4 manufacturing units in Haryana.

5. Having human capital of 2722.

Covid-19 Impact?

Despite of washout of business and almost shutdown of manufacturing units in the first quarter of FY2021 due to nation wide lockdown announced by government of India to mitigate the spread of corona virus, Studds in the second half of the fiscal managed to deliver all the orders received during the year. Because of Covid, the availability of raw materials remained a challenge for the company throughout a year. However, Studds worked closely with their suppliers and tried to get all the raw materials in time so to complete the orders in time.

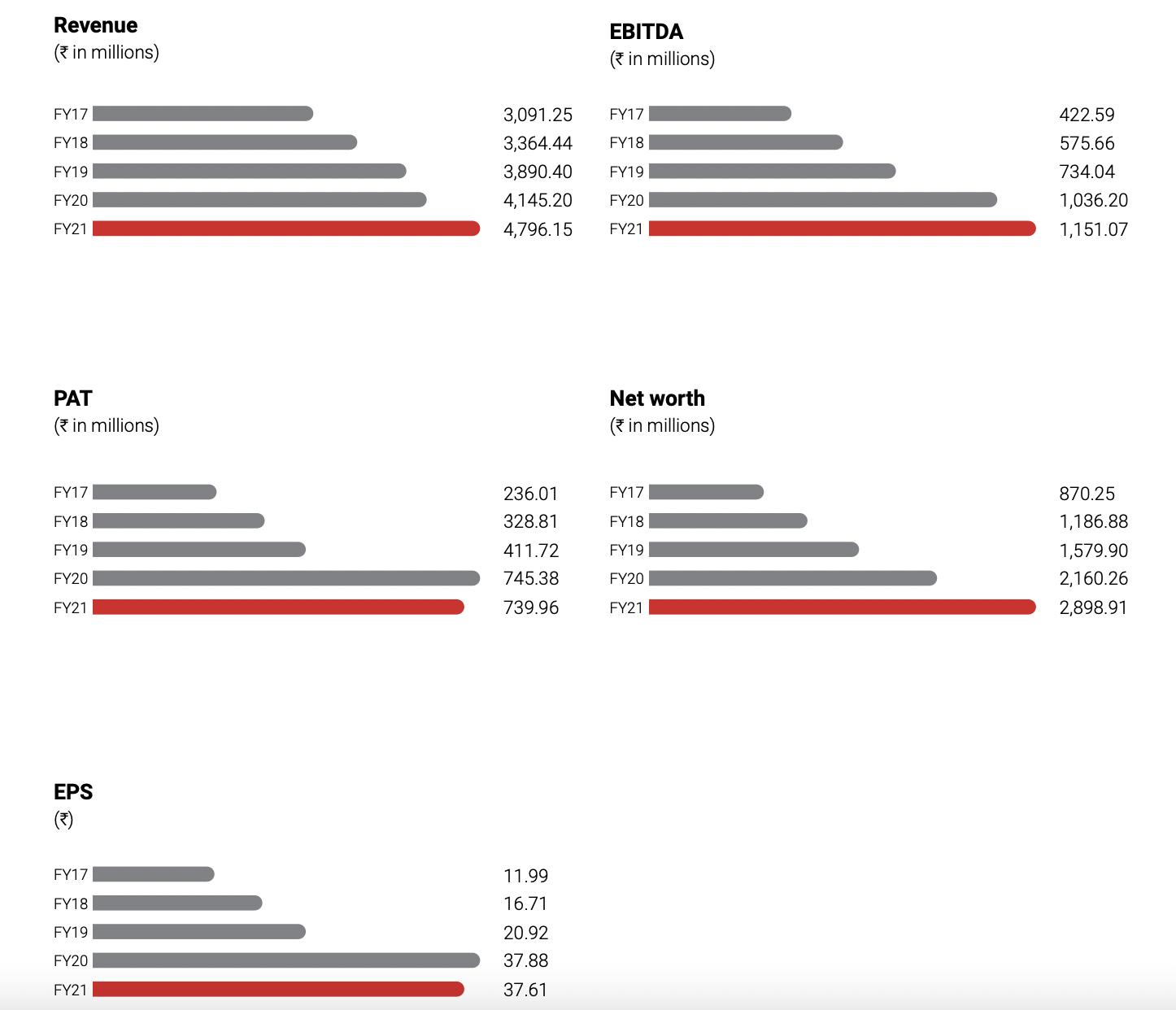

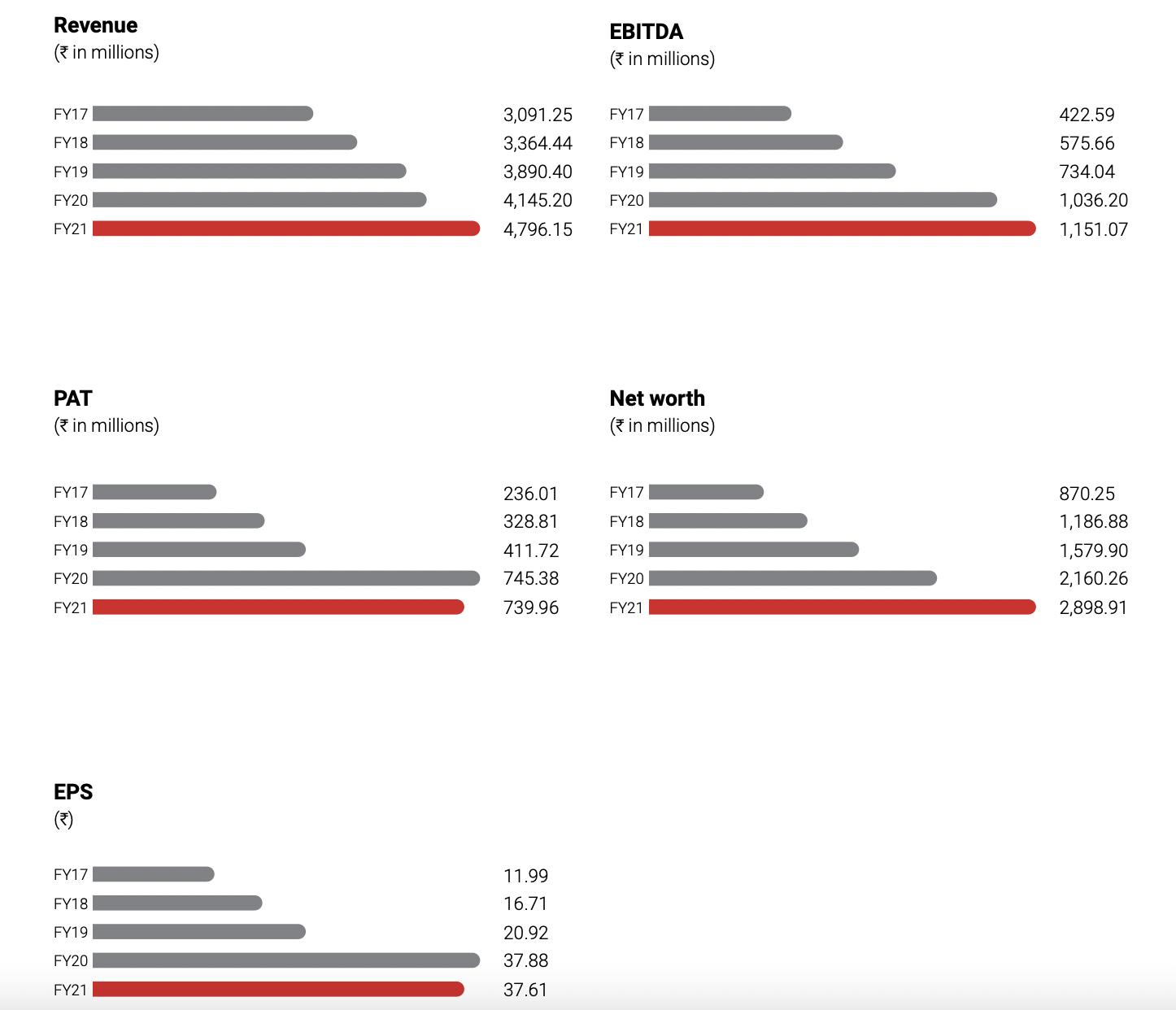

Studds Accessories 5 years Financial performance at glance?

Opportunities available for Studds Accessories?

With growing safety concerns, governments around the world have mandated the use of helmets for riders. It has added impetus to a largely fragmented helmet market and continues to open newer opportunities in domestic as well as international markets for Studds Accessories.

New Products Launches in FY2021

Industry Overview of 2W and helmet Market

1. The two-wheeler market in India shrank significantly in 2020 due to the COVID-19 pandemic, resulting in several state and national level lockdowns across the nation.

2. In the month of March-2021, Scooters, motor cycles, and mopeds all posted increases in sales as compared to the same period a year ago, with gains of 74.0%, 74.1%, and 36.2% respectively. This is mainly due to very less activity done last year in the same period.

3. India is the largest market for 2-wheelers (e.g. scooterettes, mopeds, and motorcycles) as well as home to one of the world’s most competitive manufacturers of 2-wheeler helmets with 3.5 Crores units produced each year.

4. In India, the market for two-wheeler helmet is expected to grow around 25% by 2022 . As consumers become more aware of safety, coupled with advanced safety features being introduced in two-wheeler helmets, the market for two-wheeler helmets is expected to grow significantly.

5. According to the Motor Vehicle Act, it is mandatory for all two-wheeler riders to wear helmets. Furthermore, the government has adopted a policy that prohibits the production, sale, and use of helmets that lack an ISI certification. The policy became effective on June 1, 2021. This will be a major step for improving the safety of riders of two-wheelers. The government has taken a number of steps aimed at ensuring the safety of riders, which is a positive development. The helmet industry will benefit from all these factors.

Financial Analysis by UnlistedZone Team

1. In FY20-21, the revenue of Studds Accessories has increased by 15% despite problems in the economy due to COVID-19. In FY20-21, they clocked a revenue of Rs.484 Crores as compared to 420 Crores last year.

2. EBITDA for FY21 stands at 115 Crores as compared to 103 Crores in FY20. This translate into margins of 23.7% in FY21 as compared to 24.5% last year.

3. PAT remains flat at 73 Crores similar to last year. PAT remains same, due to high depreciation as they have added new manufacturing plants and increase of finance cost.

Balance Sheet Analysis

a. In FY20-21, the Property, Plants and Equipment has increased from 154 Crores to 260 Crores, as company is focussing on Capex.

b. They have a debt of ~27 Crores in FY21 and Net-worth of 290 Crores. So, D/E is less than 1.

c. Current ratio = 1.43x ( Very comfortable)

4. ROE stands at 25% which is quite decent.

5. In FY20-21, Studds has generated a Free cash flow of 37 Crores. Last year it was Zero.

Valuation of Studds Accessories

Total Outstanding Shares = 1.96 Crores

Studds Unlisted Market Price = 2000

Mcap = ~4000 Crores

The current valuation looks stretched.