Reliance Industries on 23.01.2021 has come up with the Q3FY21 numbers update and results are very good. However, we in unlisted market are more concerned about Reliance Retail performance, the favorite share among the investors in the unlisted market. So, let us see how it has performed in the Q3FY21.

Reliance Retail Financial Performance:

Reliance Retail has clocked the net-revenue of Rs.30187 Crores in the Q3FY21 and EBITDA of Rs.3087 Crores. This translates into EBITDA Margins of 9.35%. In this quarter, due to COVID-19, the revenue has come down by 18% as compared to Q3FY20, wherein the company had clocked revenue of Rs.40660 Crores.

In Q3FY21, Reliance Retail has clocked an EBITDA margins of 9.3% as compared to 6.80% last year in the same period. You must be wondering, how Reliance Retail has almost doubled the EBITDA margins? This boost in EBITDA margins is due to "Investment income" of Rs 775 Cr, excluding this underlying operating margin are at 7.0%. which is still good.

| Date |

Revenue |

EBITDA |

OPM |

PAT |

NPM |

| Quarter Ended |

| 31-Dec-19 |

40660 |

2,736 |

6.80% |

1,753 |

4% |

| 30-Sept-20 |

36566 |

2006 |

5.5% |

973 |

2.73% |

| 31-Dec-20 |

33,018 |

3,087 |

9.35% |

1,830 |

5.54% |

Overall, we can say it is a very good performance considering the kind of slow-down is there in the Indian economy.

Business Performance Highlights:

a) Consumer Electronics:

Strong growth is seen in consumer electronics business due to festive season and tier-2 and 3 cities leading the way. Due to work from home, schools from home, etc have boosted the sales of Laptops, Tablets, HETVs and Small Appliances categories and same has delivered strong double-digit growth.

b) Fashion & Lifestyle

Apparel and footwear revenues stage shows strong bounce back and growth here also has led by Tier-2 and 3 cities. Fashion and Style online e-commerce website Ajio orders has shown 5X growth YoY. Jewels registers high-double digit growth YoY and doubles sequentially.

c) Grocery

Grocery business continue to grow, however, overall revenue impacted by COVID restrictions, local issues and Market stores transition. Footfall is still not same as pre-covid level, but higher billing per order compensated that. Grocery business has shown robust growth during festive period driven by Staples, FMCG and Indian Sweets. Kirana partnerships extended to 23 cities; 2X more business with growing adoption.

Other Highlights

a) Strong profit delivery despite a challenging operational context.

b) Sharp recovery in Fashion & Lifestyle business – getting back to pre-COVID levels.

c) Overall revenues dragged down by transfer out of Fuel retailing and one-off factors impacting Grocery.

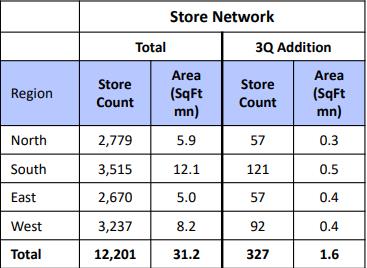

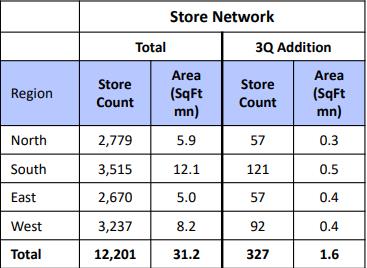

d) Business continues on its path of expansion - store count crosses 12,000 mark.

e) Steady progress on building Digital and New Commerce – investing for growth.

COVID-19 Update:

a) In this quarter, 96% stores of Reliance Retail are opened now which was just 85% in the last quarter. This shows that impact of COVID-19 is slowly fading and economy is coming to normal.

b) Overall footfall at 75% of Pre-COVID levels, at par with last quarter.

c) Fashion & Lifestyle and mall stores still significantly lower.

Store Count of 12000+