Ramaraju Surgical Cotton Mills Limited, part of the renowned Ramco Group, has released its Q1 FY26 (June 2025) financial results, offering a detailed view of the company’s performance across segments. Known for absorbent cotton, surgical products, and premium cotton yarn, the company delivered strong revenue growth but continues to face profitability challenges.

A) Company Overview

Founded in 1939 in Rajapalayam, Tamil Nadu, Ramaraju Surgical Cotton Mills Limited is one of Southern India’s largest producers of absorbent cotton, gauze, and wound-care products. Alongside its surgical offerings, it manufactures premium cotton yarns for shirting, bed linens, and Jacquard cloth, catering to both domestic and international markets.

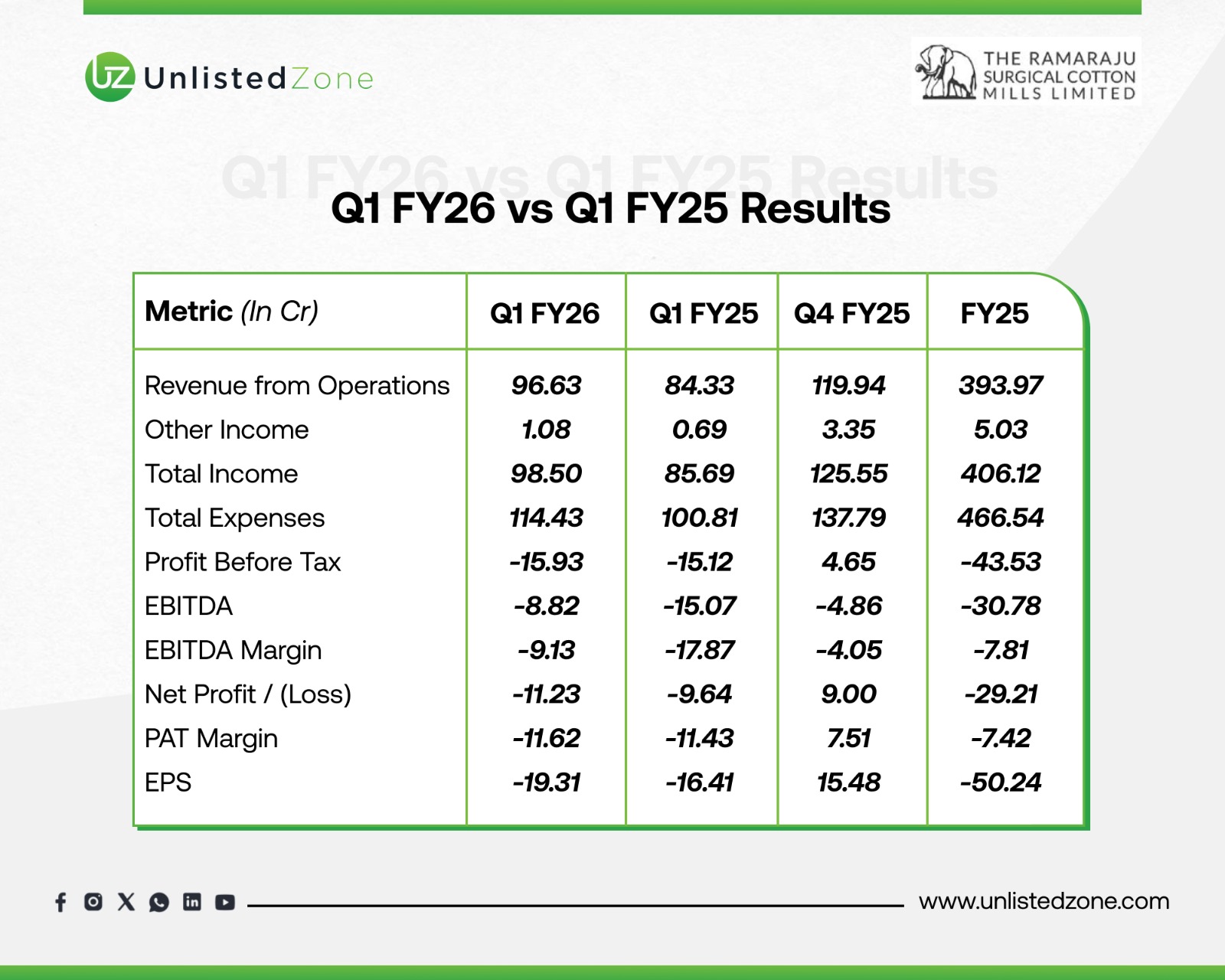

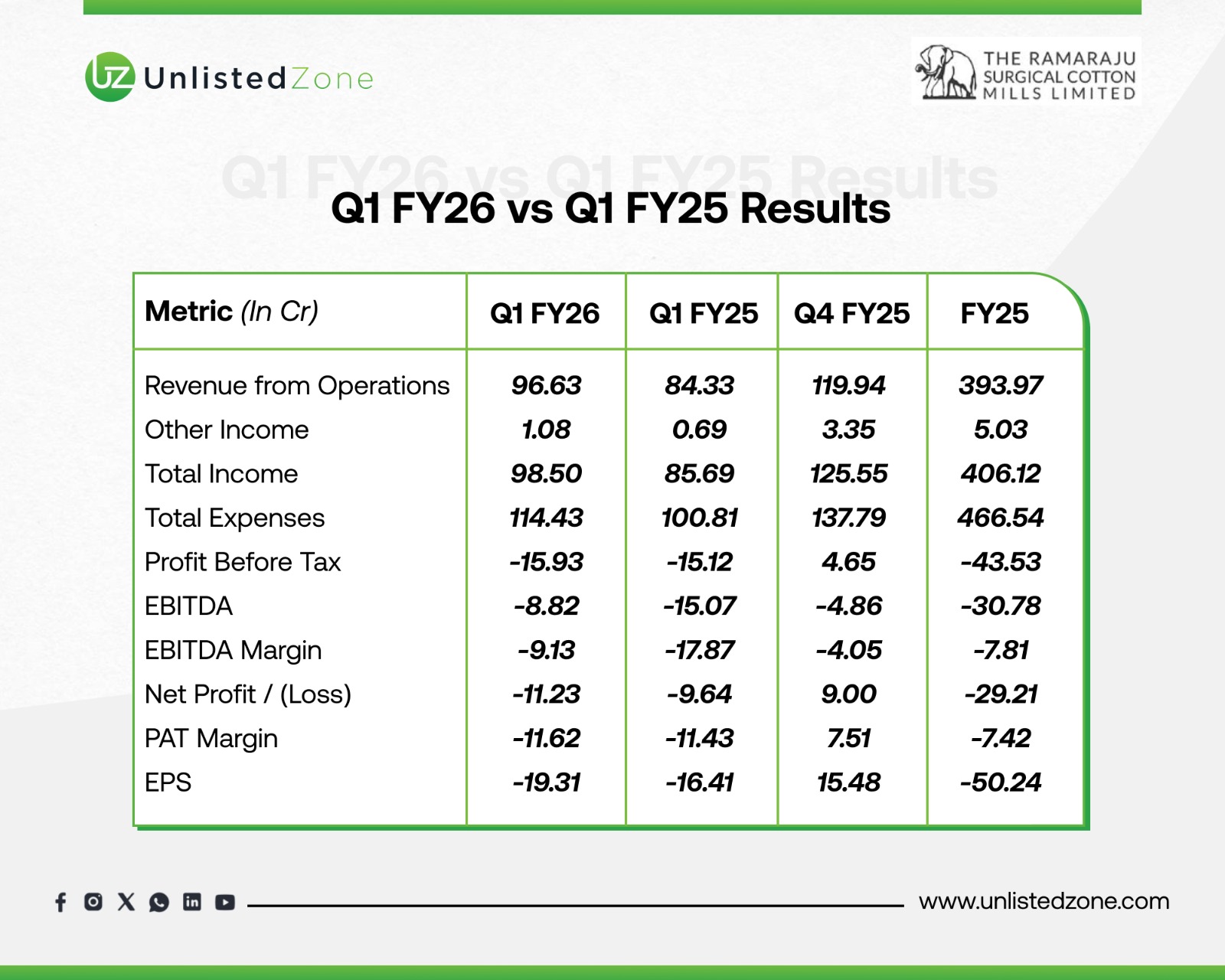

B) Q1 FY26 vs Q1 FY25 Financial Highlights

Key Observations:

-

Revenue Growth: Up nearly 15% YoY, driven by strong textile demand.

-

EBITDA Loss Reduction: Improved from -17.87% margin to -9.13%, showing better cost control.

-

Net Loss Impact: Slightly widened YoY due to increased expenses.

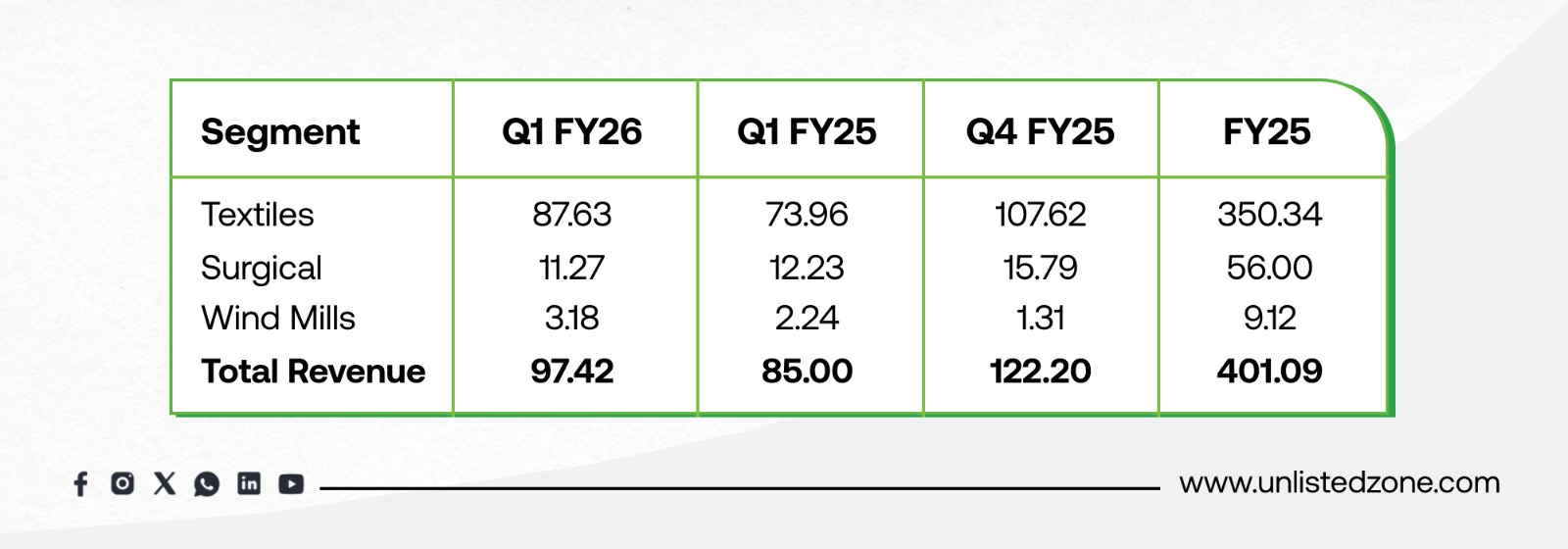

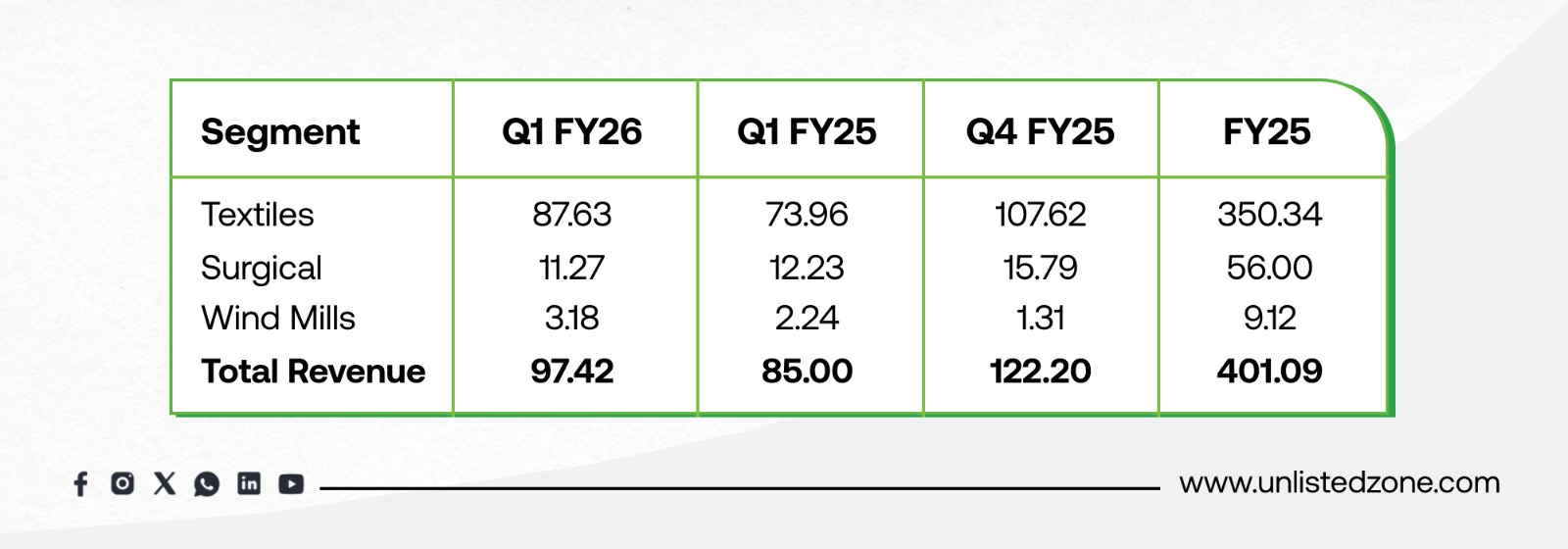

C) Segment-Wise Performance

Insights:

-

Textiles: Revenue surged 18.5% YoY, maintaining dominance in overall sales.

-

Surgical Products: Sales dropped 7.9% YoY, suggesting competition or pricing pressures.

-

Wind Energy: Revenue jumped 42% YoY, strengthening diversification efforts.

D) Investor Takeaways

-

Positive: Strong revenue momentum led by textiles; margin improvement is a healthy sign.

-

Challenges: Net loss persists; surgical segment decline needs strategic intervention.

-

Opportunities: Expanding renewable energy operations could become a steady revenue stream.

For more information Visit: UnlistedZone

Conclusion

Ramaraju Surgical Cotton Mills posted a robust revenue growth in Q1 FY26, primarily driven by textiles and wind energy gains. However, profitability remains under pressure, and the dip in surgical product sales calls for renewed strategic focus. The company’s success will hinge on balancing cost control with market expansion in the coming quarters.

Disclaimer: UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information shared is for educational purposes only. We do not provide any buy/sell recommendations. Investors should do their own due diligence or consult a SEBI-registered advisor before making investment decisions. Investments in unlisted and pre-IPO shares are subject to market risks, including liquidity risk.