Parag Parikh Mutual Fund (PPFAS) has always been known for one thing: sensible investing with global exposure. For years, the Parag Parikh Flexi Cap Fund has been one of the few Indian mutual funds that invests directly in international giants such as Alphabet, Meta, Amazon, and Microsoft.

Until now, this global access was offered only from India. But that is changing.

PPFAS has entered India’s international financial hub — GIFT City. And this step could change how the company earns money, who it serves, and how investors access global markets.

1) A New Subsidiary for a Bigger Role

PPFAS has created a new company:

PPFAS Alternate Asset Managers IFSC Pvt. Ltd.

This subsidiary has received approval from the International Financial Services Centres Authority (IFSCA) to manage funds in GIFT City. While the existing PPFAS AMC continues to operate domestic mutual funds, the new entity will focus on a different set of products and investors.

In simple terms:

The company now has two separate business engines instead of just one.

2) What Kind of Funds Will Operate from GIFT City?

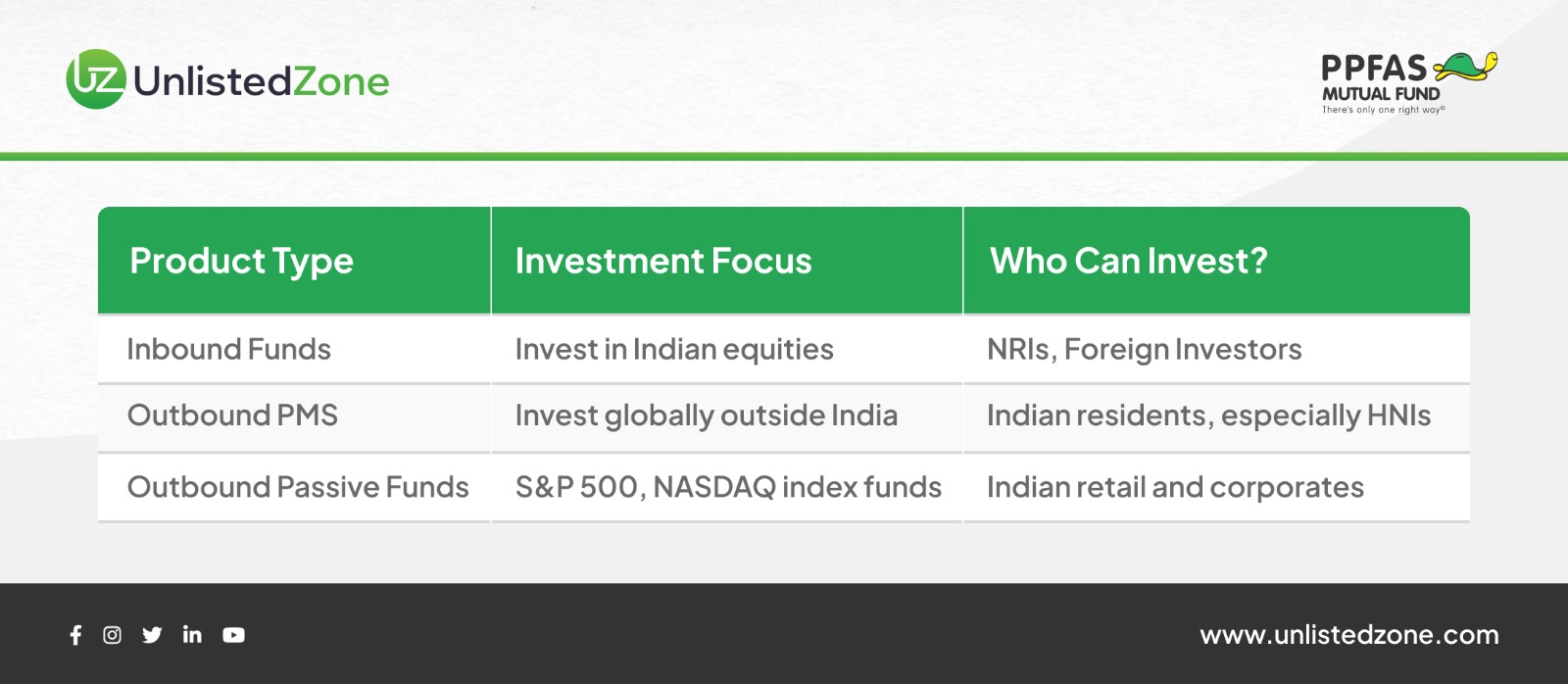

Unlike Indian mutual funds, which are constrained by limits on overseas investments, GIFT City funds can invest freely in global markets. This allows PPFAS to launch three kinds of products:

All products are denominated in US dollars. That means investments, returns, and withdrawals happen in dollars, which is particularly useful for NRIs and global investors.

3) Will Existing Flexi Cap Investors Get More Global Allocation?

Not automatically.

The Flexi Cap Fund will work exactly as it does today. It will continue to invest globally, but still within RBI’s overall international investment limit for Indian mutual funds.

The GIFT City products are designed as additional choices, not replacements. Investors who want more global exposure can choose to invest separately through the new funds.

4) Why Set Up Funds in GIFT City?

There are three core reasons.

a) No Restrictions on Global Investing

Indian mutual funds must follow SEBI and RBI limits when investing abroad. GIFT City funds are regulated separately by IFSCA, which allows:

-

No cap on international exposure.

-

Free access to markets like the US, Europe, and Asia.

b) Tax and Currency Benefits

For many investors, particularly NRIs:

-

Certain investments may be tax-free in India.

-

Investments are made in US dollars, removing forex conversion loss.

-

Fund structure avoids complex international paperwork for investors.

c) A New Revenue Stream for PPFAS

Until now, PPFAS earned primarily through its Indian mutual fund business. With GIFT City operations:

-

It can manage money for NRIs, foreign institutions, and global retail investors.

-

High ticket PMS and US index funds provide larger fee income.

-

The business is no longer dependent only on Indian mutual fund inflows.

This expansion makes PPFAS a global asset manager rather than just an Indian AMC.

5) Why Launch an S&P 500 Fund?

PPFAS is launching S&P 500 index FoFs from GIFT City. The S&P 500 includes leading companies that represent almost 80% of the US equity market and over 40% of global market capitalization. It is considered a low-cost way to participate in global innovation and business growth without stock-picking risks.

With low expense ratios and USD-based investing, these FoFs offer an internationally competitive structure that Indian investors typically access through foreign brokers or ETFs.

6) What Does This Mean for PPFAS as a Business?

-

It expands beyond India and gains a global client base.

-

It earns from PMS, index funds, inbound India funds, and not only domestic mutual funds.

-

It can scale without regulatory bottlenecks that restrict international investment from India.

PPFAS is no longer just a mutual fund house. It is building a platform where both domestic and foreign investors can participate in global markets through Indian soil.

In Simple Words

PPFAS has moved into GIFT City to do what it could not do fully from India:

-

Invest freely in global markets

-

Serve NRIs and international investors

-

Create more high-margin investment products

-

Earn through a wider business model

Investors get more choice. The company gets more opportunity. And India gets one more global asset manager.