Key Highlights

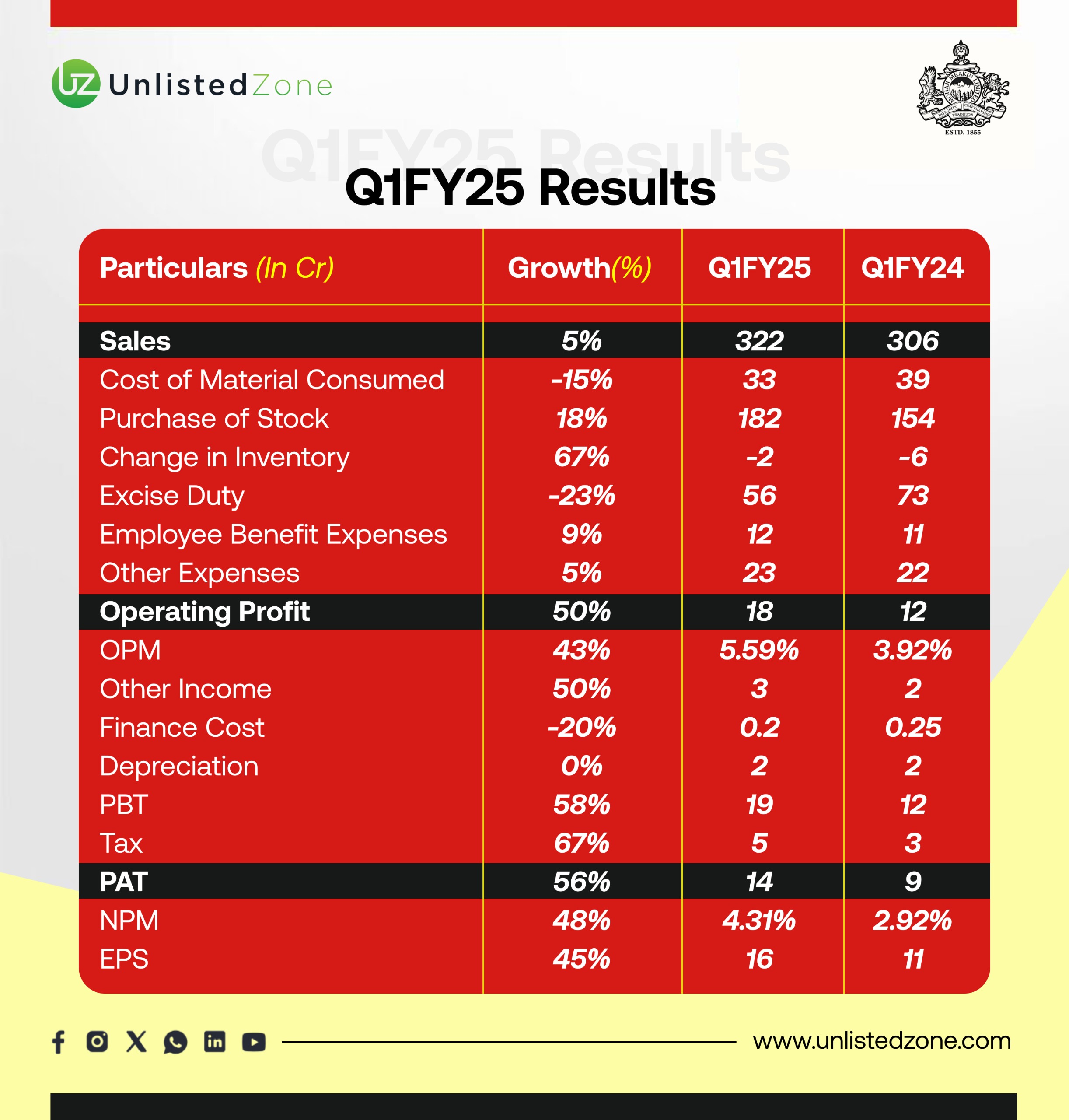

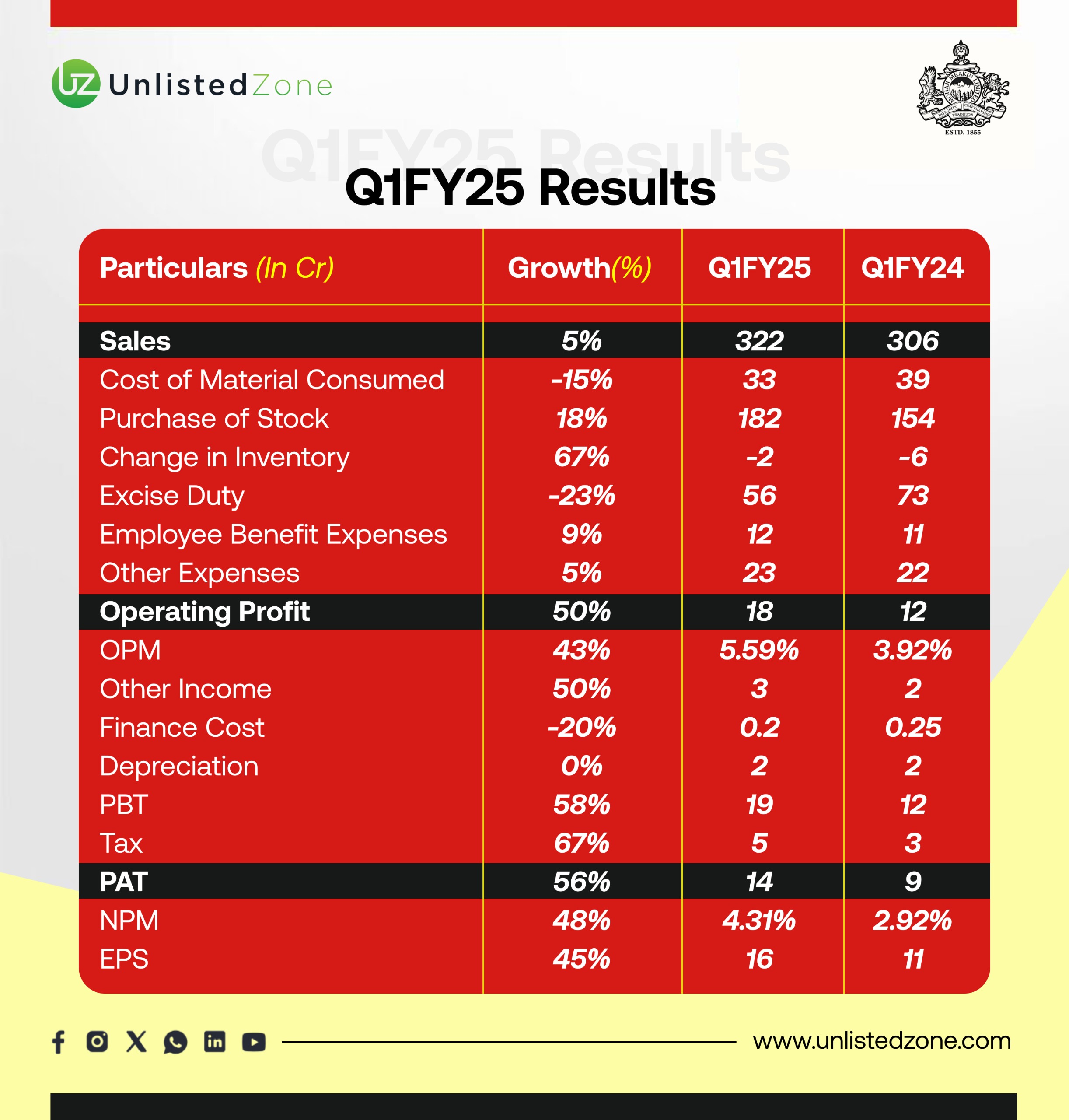

Mohan Meakin Limited has announced its financial results for the first quarter of FY2025, showcasing notable growth. The company's total income rose by 6.4% to ₹325.12 crore, compared to ₹305.56 crore in the same quarter of the previous year. Compared to the last quarter (₹603.64 crore for quarter March 31, 2024), there was a 46.2% decrease.

The Revenue from Operations reached ₹321.80 crore, reflecting a 5.3% increase from ₹305.56 crore in Q1 FY2024 but a significant 46.2% decrease from ₹599.06 crore in Q4 FY2024.

Overall, Total Expenses for the quarter stood at ₹305.65 crore, reflecting a 5.5% increase from ₹289.67 crore in Q1 FY2024, but a 45.8% decrease from ₹564.35 crore in Q4 FY2024.

Profit Before Tax (PBT) stood at ₹18.61 crore, an increase of 13.8% from ₹16.35 crore in Q1 FY2024, but a 53.6% decrease from ₹40.17 crore in Q4 FY2024.

Profit After Tax (PAT) came in at ₹13.68 crore, marking a 9.7% increase compared to ₹12.48 crore in Q1 FY2024, though it decreased by 54% compared to ₹29.69 crore in the previous quarter.

Earning per share stood at Rs. 11.08 as against Rs. 11 in Q1FY24 and Rs. 34.90 in the previous quarter.

Despite some quarterly decreases, Mohan Meakin Limited has demonstrated a strong year-on-year growth trajectory, underpinned by increased revenue and efficient cost management. The company continues to exhibit solid financial health and remains well-positioned for sustainable growth.

Why they are not able to grow much as compared to competitors?

1. Brand Reliance on Old Monk Limited Product Diversification: Mohan Meakin's heavy reliance on Old Monk has restricted its ability to diversify its product portfolio. While Old Monk has a loyal following, the company's failure to innovate and introduce new products that resonate with younger consumers has limited its growth potential. Brand Image: Old Monk, though iconic, is often seen as a nostalgic brand. Competing brands have invested heavily in rebranding and appealing to a younger demographic, something Mohan Meakin has struggled with.

2. Marketing and Distribution Lack of Aggressive Marketing: Unlike competitors like United Spirits (with brands like McDowell’s) or Pernod Ricard (with Royal Stag), Mohan Meakin has not invested aggressively in marketing. This has impacted its visibility, especially among newer generations of consumers. Distribution Challenges: Competitors have developed extensive distribution networks, ensuring their products are widely available across all market segments. Mohan Meakin’s distribution network is comparatively limited, affecting its market penetration.

UnlistedZone View

While Mohan Meakin enjoys strong brand loyalty and a debt-free balance sheet, its growth has been hindered by a combination of reliance on a single iconic product, insufficient marketing, lack of innovation, and slower adaptability to market and regulatory changes. To catch up with competitors, Mohan Meakin would need to revamp its strategy, focusing on product diversification, aggressive marketing, and aligning itself more closely with current consumer trends.