Introduction

Maharashtra Knowledge Corporation Limited (MKCL) has recently published its annual financial report for the fiscal year 2022-23. The report showcases significant financial growth across various metrics, including total income, revenue from operations, and profits before and after tax. This blog aims to provide a comprehensive analysis of MKCL's financial performance for the last fiscal year, focusing on key indicators that would be of interest to investors and stakeholders.

Highlights of Financial Performance

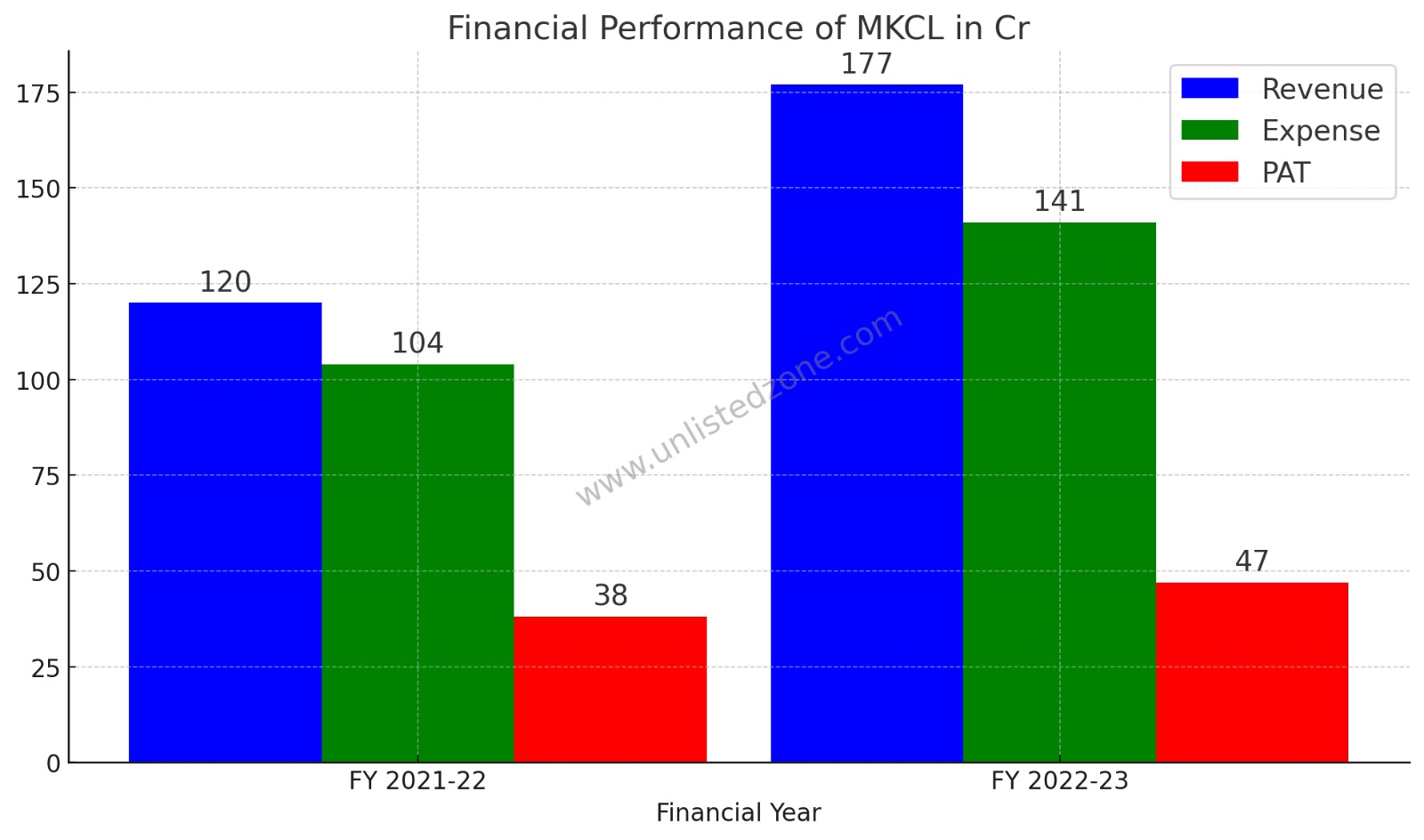

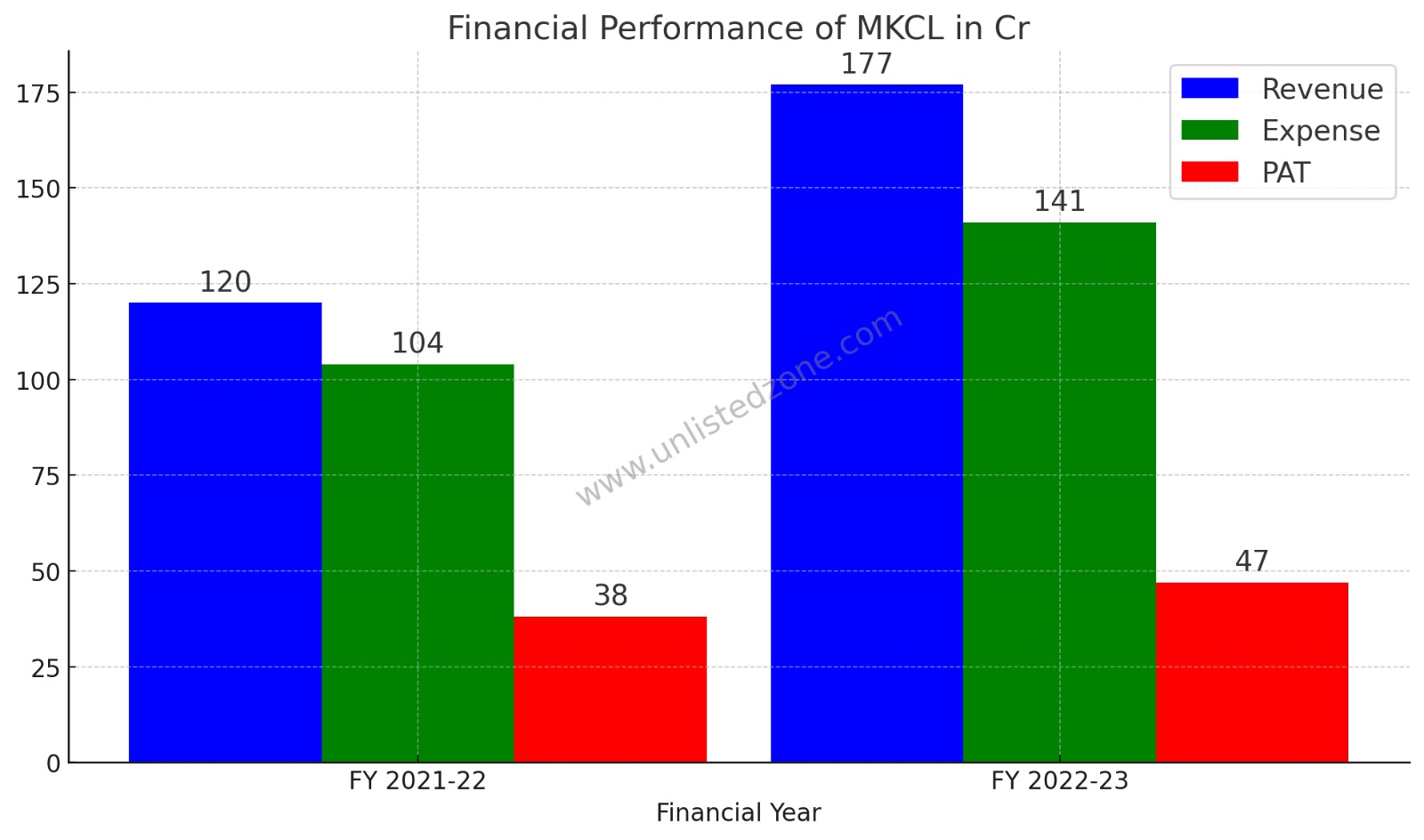

1. Substantial Growth in Total Income

For the fiscal year 2022-23, MKCL's total income saw an impressive hike of 33.75%, standing at Rs. 20,323.90 lakhs compared to Rs. 15,195.51 lakhs in FY 2021-22. This rise represents an increase of Rs. 5,128.39 lakhs year-over-year.

2. Spike in Revenue from Operations

MKCL's revenue from operations for FY 2022-23 amounted to Rs. 17,750.84 lakhs, marking a 47.71% growth compared to Rs. 12,017.23 lakhs in the previous fiscal year. This represents an increase of Rs. 5,733.61 lakhs.

3. Increase in Expenditure

The company's total expenditure also went up by 36%, escalating from Rs. 10,404.47 lakhs in FY 2021-22 to Rs. 14,194.45 lakhs in FY 2022-23.

4. Profit Metrics: Before and After Tax

The PBT for the fiscal year 2022-23 stood at Rs. 6,129.45 lakhs, a 27.94% growth over last year's Rs. 4,791.04 lakhs. This increase amounts to Rs. 1,338.41 lakhs.

5. Profits After Tax (PAT)

MKCL's Profit After Tax for the fiscal year 2022-23 was Rs. 4,776.24 lakhs, up by 23.49% from Rs. 3,867.65 lakhs in FY 2021-22. The increase amounts to Rs. 908.59 lakhs.

Balance Sheet Indicators

1. Growth in Total Assets and Liabilities

Balance Sheet Indicators

1. Growth in Total Assets and Liabilities

Both the total assets and the total equity and liabilities of MKCL increased by 12%, each reaching Rs. 55,929.75 lakhs compared to Rs. 49,835.48 lakhs in the previous fiscal year.

Cash Flow Statement Insights

1. Cash Generated from Operating Activities

The net cash generated from operating activities was Rs. 4,538.23 lakhs, a significant improvement over the cash used of Rs. (569.37) lakhs in FY 2021-22.

2. Cash Used in Investing and Financial Activities

The company used Rs. 4,273.92 lakhs in investing activities and Rs. (327.04) crore in financial activities during FY 2022-23, compared to Rs. (694.50) crore and Rs. (103.84) crore, respectively, in the previous year.

Conclusion

MKCL's financial performance in FY 2022-23 reflects a robust growth trajectory across various financial metrics. The company has shown an admirable ability to increase revenues while effectively managing expenditures. The significant upticks in PBT and PAT further highlight the company's profitability. With a stable balance sheet and positive cash flow from operating activities, MKCL appears well-positioned for future growth. These factors make it an entity worth considering for investors looking for sustainable and profitable investment opportunities.

https://unlistedzone.com/shares/buy-sell-share-price-maharashtra-knowledge-corporation-mkcl-limited-unlisted-shares/

Balance Sheet Indicators

1. Growth in Total Assets and Liabilities

Both the total assets and the total equity and liabilities of MKCL increased by 12%, each reaching Rs. 55,929.75 lakhs compared to Rs. 49,835.48 lakhs in the previous fiscal year.

Cash Flow Statement Insights

1. Cash Generated from Operating Activities

The net cash generated from operating activities was Rs. 4,538.23 lakhs, a significant improvement over the cash used of Rs. (569.37) lakhs in FY 2021-22.

2. Cash Used in Investing and Financial Activities

The company used Rs. 4,273.92 lakhs in investing activities and Rs. (327.04) crore in financial activities during FY 2022-23, compared to Rs. (694.50) crore and Rs. (103.84) crore, respectively, in the previous year.

Conclusion

MKCL's financial performance in FY 2022-23 reflects a robust growth trajectory across various financial metrics. The company has shown an admirable ability to increase revenues while effectively managing expenditures. The significant upticks in PBT and PAT further highlight the company's profitability. With a stable balance sheet and positive cash flow from operating activities, MKCL appears well-positioned for future growth. These factors make it an entity worth considering for investors looking for sustainable and profitable investment opportunities.

https://unlistedzone.com/shares/buy-sell-share-price-maharashtra-knowledge-corporation-mkcl-limited-unlisted-shares/

Balance Sheet Indicators

1. Growth in Total Assets and Liabilities

Both the total assets and the total equity and liabilities of MKCL increased by 12%, each reaching Rs. 55,929.75 lakhs compared to Rs. 49,835.48 lakhs in the previous fiscal year.

Cash Flow Statement Insights

1. Cash Generated from Operating Activities

The net cash generated from operating activities was Rs. 4,538.23 lakhs, a significant improvement over the cash used of Rs. (569.37) lakhs in FY 2021-22.

2. Cash Used in Investing and Financial Activities

The company used Rs. 4,273.92 lakhs in investing activities and Rs. (327.04) crore in financial activities during FY 2022-23, compared to Rs. (694.50) crore and Rs. (103.84) crore, respectively, in the previous year.

Conclusion

MKCL's financial performance in FY 2022-23 reflects a robust growth trajectory across various financial metrics. The company has shown an admirable ability to increase revenues while effectively managing expenditures. The significant upticks in PBT and PAT further highlight the company's profitability. With a stable balance sheet and positive cash flow from operating activities, MKCL appears well-positioned for future growth. These factors make it an entity worth considering for investors looking for sustainable and profitable investment opportunities.

https://unlistedzone.com/shares/buy-sell-share-price-maharashtra-knowledge-corporation-mkcl-limited-unlisted-shares/