In the latest budget announced by the Indian government, a significant change was introduced regarding the taxation of Long-Term Capital Gains (LTCG) on unlisted shares. Previously, LTCG on unlisted shares was taxed at 20% with the benefit of indexation. However, the new policy has reduced the tax rate to 12.5%, but the benefit of indexation has been removed. This article will analyze how this change impacts investors, using an example to illustrate the differences and show that even for shares purchased as far back as 2012, the new tax regime proves to be more beneficial.

Understanding the Change

Old Tax Regime:

- LTCG on unlisted shares: 20%

- Indexation benefit: Available

New Tax Regime:

- LTCG on unlisted shares: 12.5%

- Indexation benefit: Not available

Note: Short-Term Capital Gains (STCG) tax remains unchanged.

Example Scenario

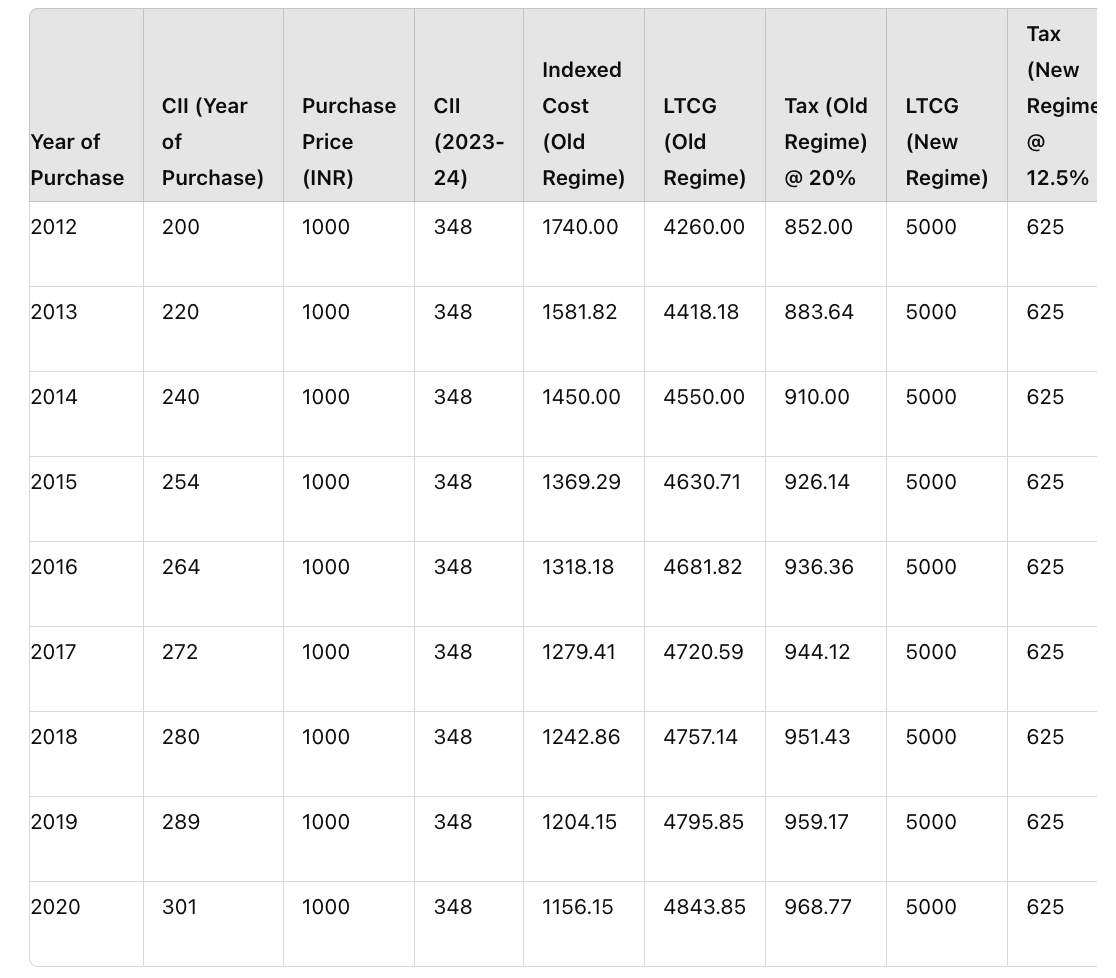

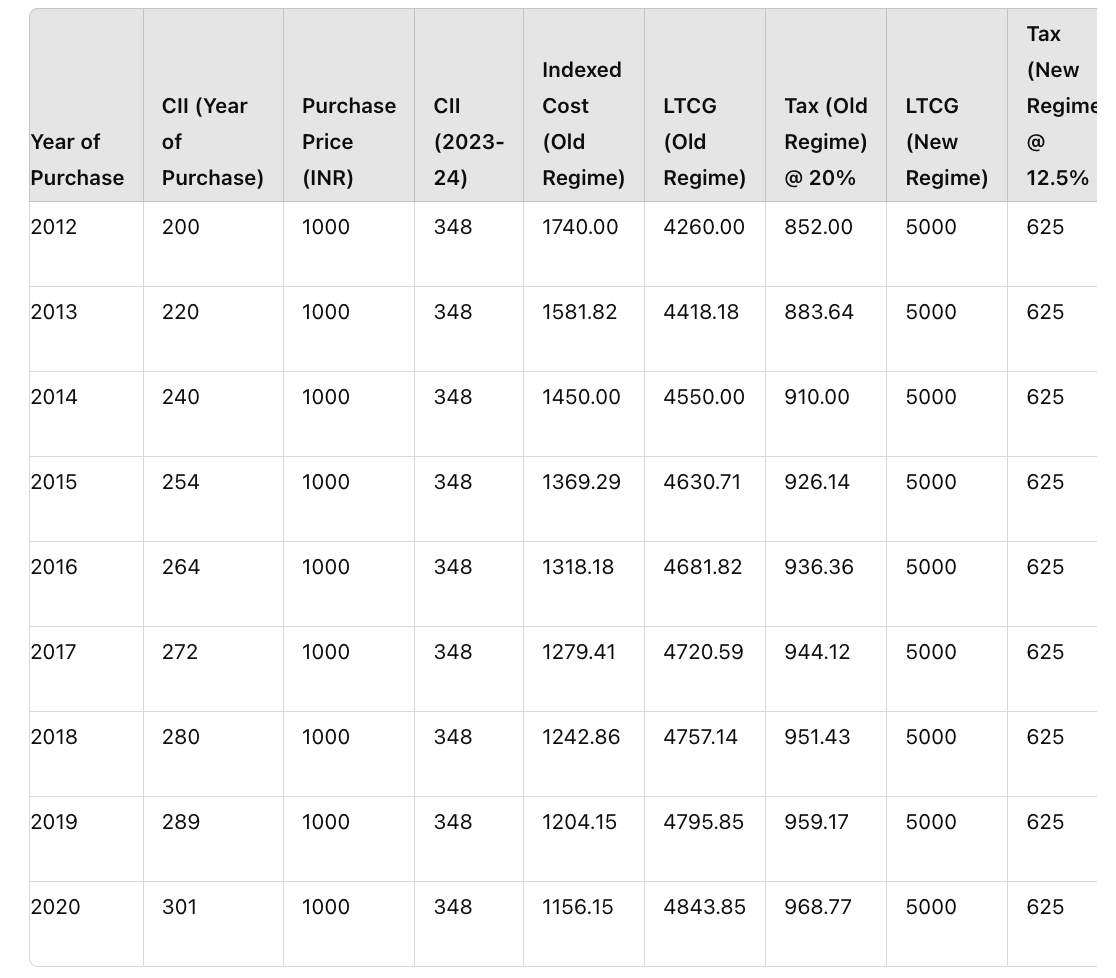

Let's consider an investor who bought NSE shares in various years (from 2012 to 2020) at INR 1000 per share. The investor sells these shares in 2024 at INR 6000 per share. We will calculate the LTCG under both the old and new tax regimes.

Assumed CII Values:

- 2012-13: 200

- 2013-14: 220

- 2014-15: 240

- 2015-16: 254

- 2016-17: 264

- 2017-18: 272

- 2018-19: 280

- 2019-20: 289

- 2020-21: 301

- 2023-24: 348 (for calculation purposes)

LTCG Tax Calculation for Different Purchase Years

Comparative Analysis

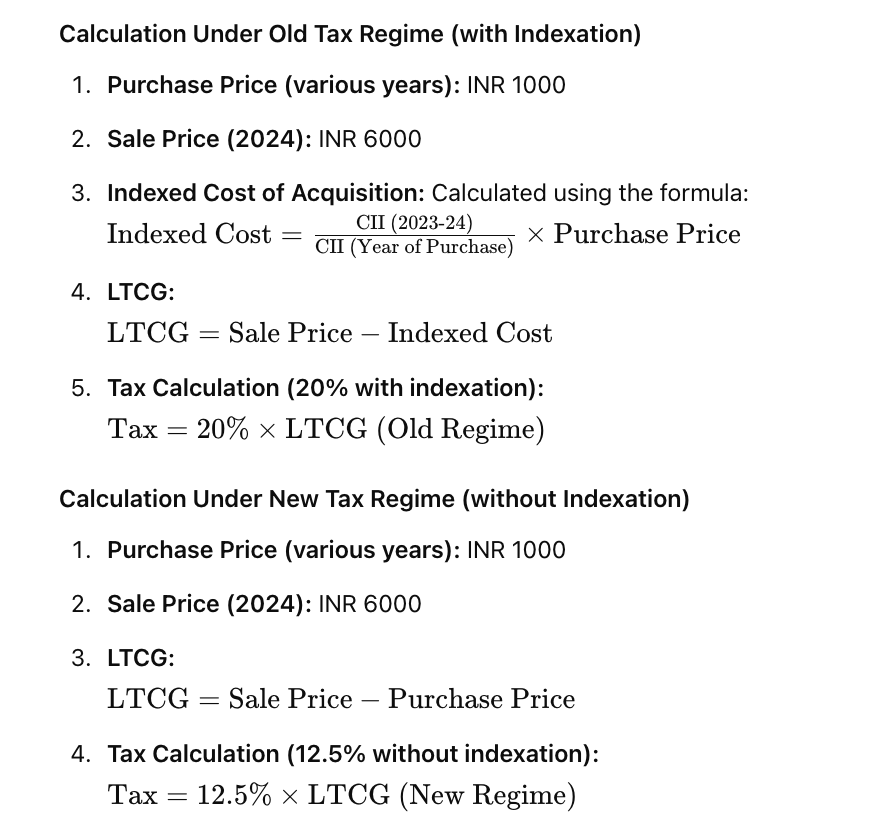

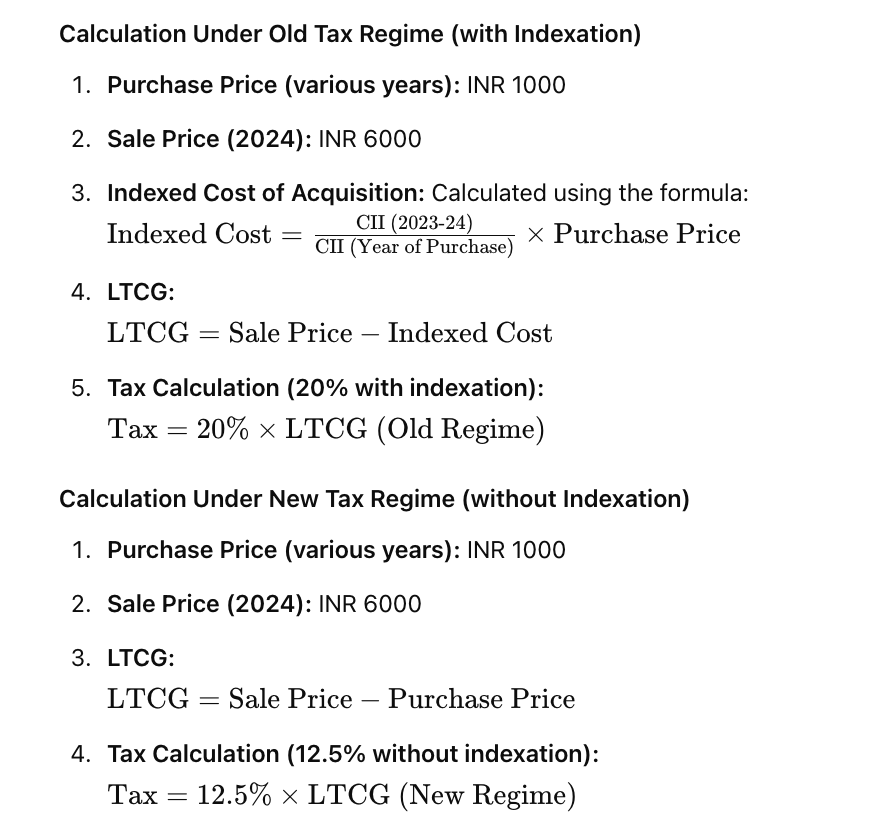

Let's break down the calculations to understand the impact of the change:

Observations

From the table, it is evident that in none of the years (2012 to 2020) the old tax regime with indexation is more beneficial compared to the new tax regime with a reduced rate of 12.5% without indexation. The new tax regime always results in lower tax payable.

Implications for Investors

-

Simplified Calculation: The removal of the indexation benefit simplifies the tax calculation process, making it easier for investors to compute their tax liability without needing to adjust for inflation.

-

Lower Tax Rate: The reduced tax rate of 12.5% offers immediate tax savings compared to the previous 20% rate. As demonstrated in the example, the investor saves significantly in taxes across all purchase years.

-

Long-Term Impact: For long-term investors, the removal of indexation could mean higher taxable gains as the benefits of adjusting for inflation are no longer available. However, the lower tax rate still results in overall tax savings.

-

Investment Decisions: Investors might find unlisted shares more attractive due to the reduced tax burden, potentially increasing investments in startups and private companies.

Conclusion

The recent budget changes bring a mix of benefits and considerations for investors in unlisted shares. The reduction in LTCG tax from 20% with indexation to 12.5% without indexation generally results in tax savings for investors. However, the magnitude of these savings varies depending on the year of purchase due to the effect of indexation.

By understanding these changes, investors can make more informed decisions about their investments in unlisted shares, potentially optimizing their tax liabilities and enhancing returns. Investors should consult with their financial advisors to understand the full impact of these changes on their portfolios and make informed decisions based on their specific financial situations.