1. History of NSE:

The National Stock Exchange of India Limited (NSE) was established in 1992, commencing operations in 1994. It was set up to introduce transparency into the Indian equity market. Before NSE's inception, trading on the stock exchange in India was primarily conducted via open outcry, primarily at the Bombay Stock Exchange (BSE). NSE brought about a significant transformation by introducing a fully automated screen-based electronic trading system.

2. Revenue Sources of NSE:

The NSE has diversified revenue streams:

a) Trading Fees: Revenue generated from the buying and selling of securities.

b) Listing Fees: Income from companies that opt to list their shares on the exchange.

c) Data Feed Fees: Earnings from selling market data to entities like brokers, institutions, etc.

d) Membership Registration and Annual Fees: From its registered brokers.

e) Depository Services: Through its subsidiary, NSDL.

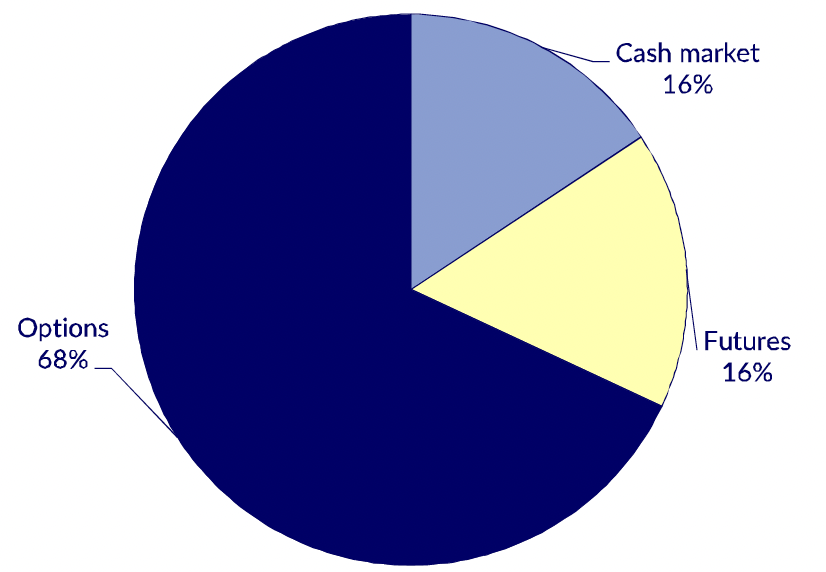

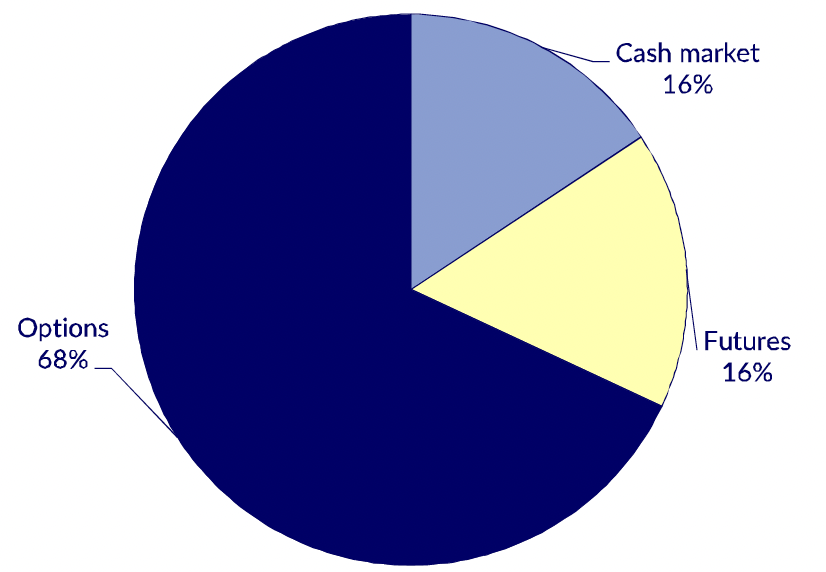

f) Clearing and Settlement Fees: Revenue from these vital services. A significant portion, 80% to be precise, of NSE's revenue is derived from trading fees. The revenue distribution is further categorized based on the trading of various products.

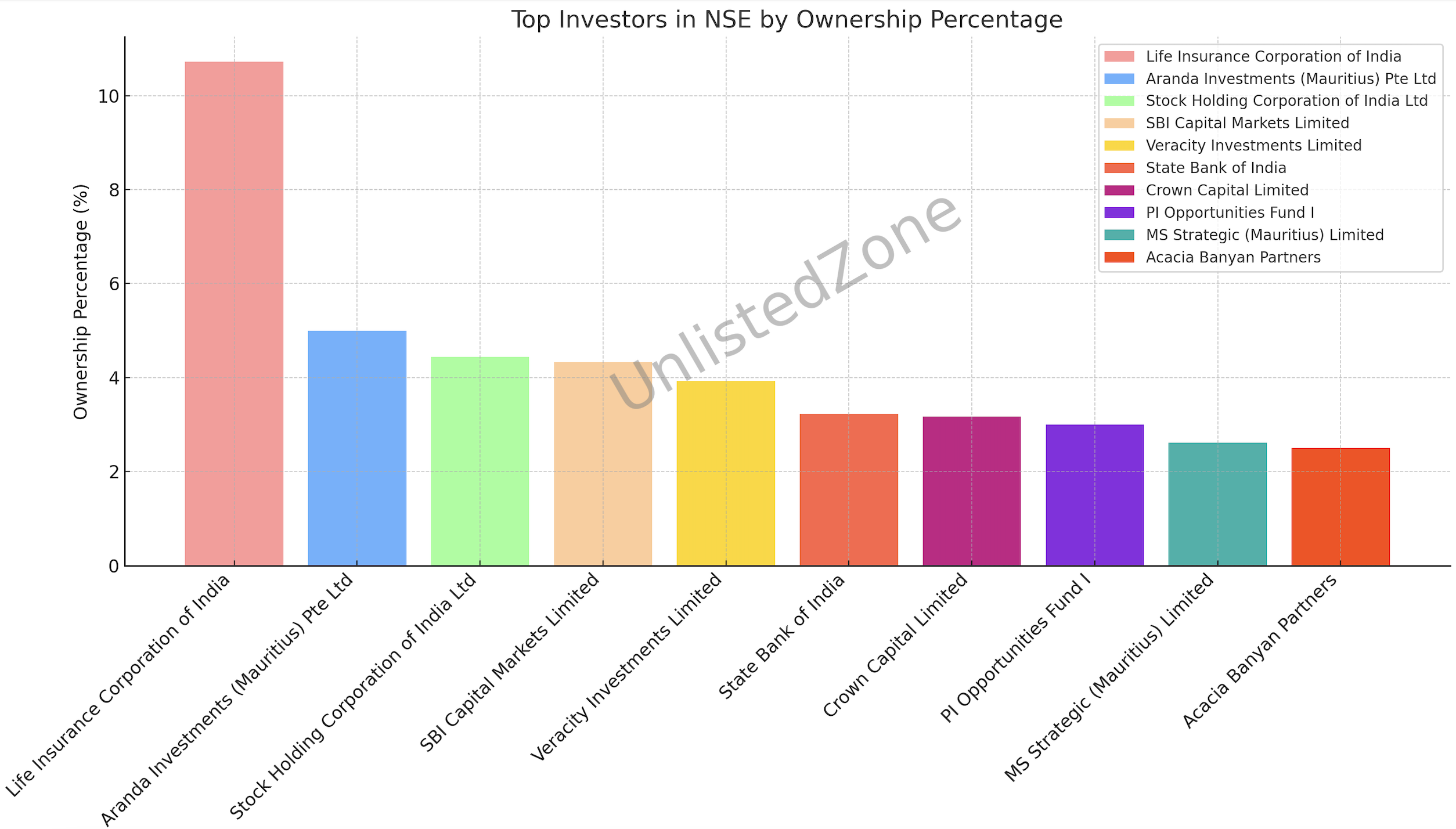

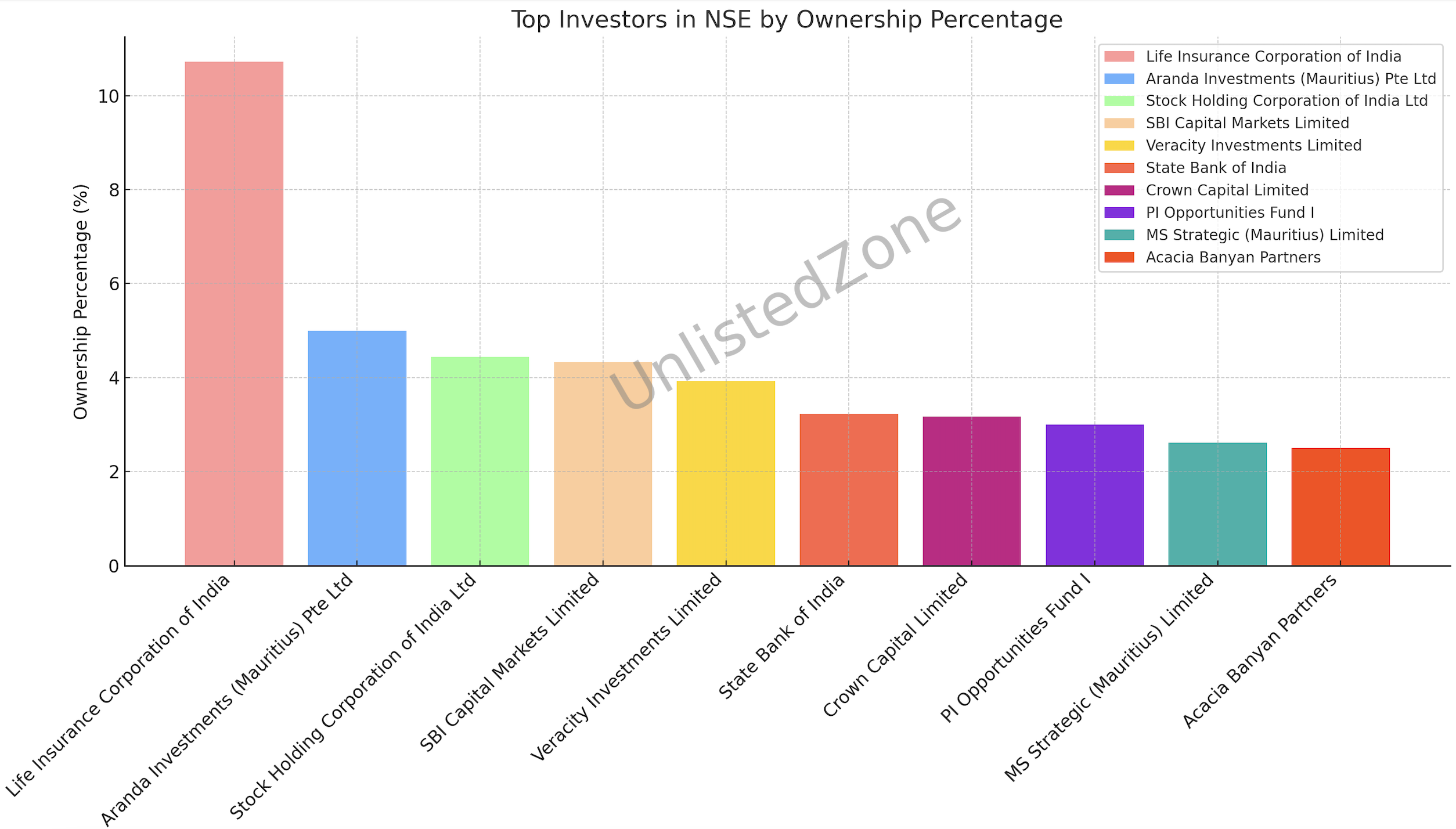

3. Top Investors in NSE Unlisted Share:

Prominent stakeholders in the NSE include:

From 2019 to 2023, NSE exhibited a significant growth trajectory:

a) 2019: Total Revenue of 3,514 Crores

b) 2020: Total Revenue of 3,896 Crores

c) 2021: Total Revenue of 6,202 Crores

d) 2022: Total Revenue of 9,500 Crores

e) 2023: Total Revenue of 11,586 Crores This indicates a robust growth rate, especially in the years post-2020.

5. NSE vs BSE Comparison:

a) Market Capitalisation:

(i) NSE: 1.80 Lakh Crores (ii) BSE: 11,000 Crores

b) P/E Ratio:

(i) NSE: 24x (ii) BSE: 44x

c) Revenue (Fy23):

(i) NSE: 12,000 Crores (ii) BSE: 990 Crores

The comparison showcases that while NSE has a much larger market capitalisation and revenue than BSE, its P/E ratio is nearly half, indicating better earnings relative to its share price.

6. Valuation of NSE Unlisted Shares

The NSE Unlisted Shares are currently available at UnlistedZone priced at INR 3,600 per share. This price gives it a market capitalization of 1.76 Lakh Crores and a P/E ratio of 24x. This valuation, when compared to its performance metrics and growth trajectory, indicates a strong and stable financial position for NSE.

7. How to Buy NSE Unlisted Shares?

NSE shares are unlisted, meaning they aren't publicly traded on any stock exchange. Interested investors can purchase "Unlisted shares of NSE as they are accessible through UnlistedZone. For purchase inquiries, please reach out us at Sales@unlistedzone.com. It's crucial to exercise caution and conduct thorough research before buying unlisted shares due to potential risks such as lack of liquidity and transparency.

8. FAQs on NSE Unlisted Shares:

Q1: What's the latest price for NSE Unlisted shares in India?

Answer: As of now, NSE unlisted shares are priced at Rs. 3,600 each at UnlistedZone Platform.

Q2: What's the procedure to purchase NSE Unlisted shares in India?

Answer: Acquiring NSE unlisted shares involves a two-stage process that spans approximately 2 months.

The two stages are:

a) Name Clearance

b) Credit of Shares.

Notably, the NSE board has recently expedited this process, leading to quicker share transfers.

Q3: On what basis is the NSE unlisted shares price set?

Answer: In the short term, the price of NSE unlisted shares is primarily influenced by market demand and supply. Over the long term, the company's fundamentals play a pivotal role in determining the price.

Q4: How secure is it to transact NSE unlisted shares in India?

Answer: Engaging in transactions of NSE Unlisted shares always carries inherent risks. Yet, these risks can be significantly reduced when dealing through a reputable platform like UnlistedZone.

Q5: How can I monitor the price of NSE unlisted shares?

Answer: With UnlistedZone, it's convenient to stay updated on unlisted share prices. By downloading our app from the Play-store and completing the registration, you'll gain access to the latest news, videos, and insights on NSE on a regular basis.

Conclusion:

The NSE has showcased strong growth, particularly in recent years, and holds a dominant position in the Indian securities market. Its diversified revenue streams, along with the backing from prominent investors, position it as a key player in the industry. The valuation suggests that it's a significant entity in the financial world, and its comparison with BSE further cements its dominant position. As always, potential investors should conduct their due diligence and consult with financial professionals before making investment decisions.