Haldiram is a no new name to Indian households and families. The brand is highly renowned amongst all classes and sections of the society. The business has grown leaps and bounds through its sheer exemplary efficiency from being extraordinary amongst the ordinary.

The story of the iconic bhujia maker is quite inspirational. It grew from a small namkeen shop in Bikaner, Rajasthan into a multi-billion dollar company. It began in 1918 as a part-time hobby for extra income has today become a behemoth enterprise in the food industry in India generating over to Rs. 7000 crore in annual revenues combining the business of Kolkata, Delhi, and Nagpur Groups

Beginning of the Story and forming Haldiram in 1938

At the age of 12 , when most children went to school, Ganga Bhishen Agarwal spent his days in Bikaner inventing the omnipresent snack Bhujia. Soon Haldiram bhujia became irresistible to customers. The most important changes he made to the bhujia was making it out of 'moth dal' Moth lentils rather than besan.

This amendment in delicacy changed his life overnight as moth is very popular and easily available in Rajasthan. He also focussed on making it the fine crispy bhujia we know today transforming it from the fat, slightly bland version from before his time.

The boy in his early days in business also demonstrated a knack for marketing by setting the price point such that the product was more exclusive and not just considered a commodity, selling for 5 paise a kilo as opposed to the earlier 2 paise under his grandfather Bhikharam.

Determined to take bhujia beyond the boundaries of Bikaner, they shifted base to Nagpur in 1970. Their they had opened first full-production unit to introduce a delectable variety of savouries, sweets and beverages to the market. The success of this venture led them to expand and evolve as a brand, that is an integral part of every Indian household today.

Today, the company has three areas of operations with Delhi-based Haldiram Snacks and Ethnic Foods in the northern region, Nagpur-based Haldiram Foods International in western and southern regions and a much smaller Kolkata-based Haldiram Bhujiawala in the eastern region.

Timeline of History and Family Dispute

-

- 1937 - The Haldiram story began in 1937, when Gangabhisan Agarwal set up shop in Bikaner.

- 1955- Kolkata was the first of the family's forays outside home, when Rameshwarlal Agarwal, Gangabhisan's youngest son, set up the "Haldiram Bhujiawala" in the Burrabazar area.

- 1970 - Success of Kolkata shop and to cater the rising demand of products they had opened their first manufacturing unit in Nagpur.

- 1983 - First retail outlet was setup in Delhi. This has got very good response from Delhi crowd and as well as among the tourists.

- 1990 - The Agarwal siblings split in the early 1990s, dividing business operations in four different zones. While Manoharlal and Madhusudan got the north Indian markets, Shiv Kishan the south and west markets, and Prabhu Shankar and Ashok the markets in east India.

- 1999- The matter had gone to court for the use of Brand name of Haldiram.

From Rags to Riches

The business that began in a small shop now spans not only all regions of the country, but also marks its presence in international markets. It has a tremendous presence across the globe. In contemporary times, Haldiram products are exported to several countries worldwide, including Sri Lanka, United Kingdom, United States, Canada, United Arab Emirates, Australia, New Zealand, Japan, Thailand, and others. Haldiram boast of its portfolio of over 400 products, ranging from

Namkeens and

Snacks,

Sweets,

Refreshment drinks,

Frozen foods,

Ready to cook dishes and

Quick-service restaurants.

Manufacturing Units

The Nagpur headquartered company has manufacturing plants in Nagpur, New Delhi, Kolkata, Bikaner. Haldiram has its own retail chain stores and a range of restaurants in Nagpur and Delhi.

Positioning

The initiatives undertaken by the company helped Haldiram to uniquely position its brand. Haldiram also gained an edge over its competitors by minimizing promotion costs. Success of Haldiram is a sheer example of 'word of mouth' or 'mouth to mouth' publicity.

Appreciating the company's efforts at building a brand, an analyst said, "Haldiram once was just another sweet maker but it has moved into trained brands first by improving the product quality and packaging. Through its clever products and brilliant distribution it had moved into the star category of brands."

Steps ahead in Leadership

In 1994, the unit was awarded the International Award for Food & Beverages by the Trade Leaders Club in Barcelona, Spain. The unit also received the Brand Equity Award15 in 1998.

Manoharlal Agarwal, who played a key role in the success of the Delhi unit, was included in the eighth edition of Distinguished Leadership by the Board of Registrars of The American Biographical Institute16. Haldiram was also admitted as a member of Snack Food Association, US.

From Bikaner shop to French Bakery

While largely remaining closely guarded from the prying eyes of the public, Manohar Lal Agarwal and his brother have been pushing boundaries in the business. The recent venture with the second largest bakery chain in the world, Brioche Dorée, is proof that Haldiram is set on broadening their reach. For the first time, the bakeries will only be serving vegetarian food tailored to the Indian market.

Similar to PepsiCo in the past, breakfast products giant Kellogg’s has also recently shown interest in partnering with or buying a stake in Haldiram (Nagpur and Delhi enterprises), valuing them at $3 billion.

Pricing

Haldiram charge a decent premium owing to the branded and well packaged products. They give a huge importance to good presentation and lively packaging as a way of differentiation from other non-branded unorganised products and thus demand a premium for it. But since the premium is so small that consumers usually don’t mind given the trusted high-quality products.

At the same Haldiram, is facing stiff competition from other branded competitors like Bikaji, Lehar, Bikano etc. Thus the pricing has been the key factor contributing to their success. Thus competitive pricing is the backbone of its marketing mix business strategy.

To charm the more price sensitive customers, Haldiram has come up with small one-time consumption packages of 40 grams which are priced at Rs. 10 for its most famous Bhujia. Company has introduced different products under various weights, which have different pricing.

Marketing Strategies:

From the initial days onwards Haldiram never invested much in Marketing and advertising to expand his brand they gained their business majorly through word of mouth. But now due to the intense competition, they realized the importance of marketing and advertisement and started gaining attention from them.

One of the major recent campaigns is with Haldiram tied up with a Bollywood movie under Rajshri production 'Prem Ratan Dhan Payo', starring Salman Khan and Sonam Kapoor. It launched a contest for promotions through which they distributed 1.5 crore packets of snacks.

The family business of Haldiram is divided into 4 main entities having businesses in North India, South & West and East Market and having combined revenue in excess of 7000 crores. Below, we are analyzing the financials of one of the group company called

Haldiram Snacks Private Limited having business in the North Indian markets.

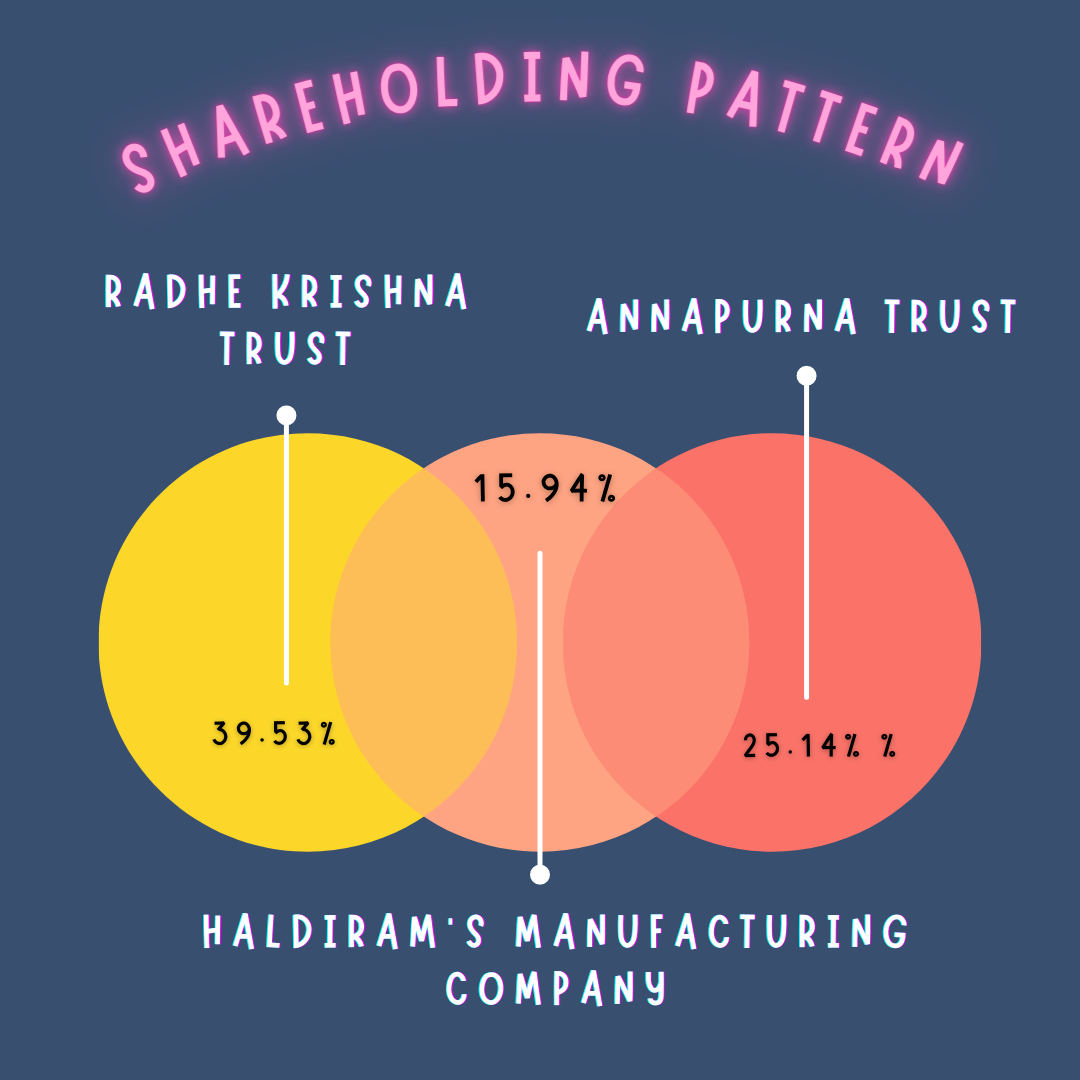

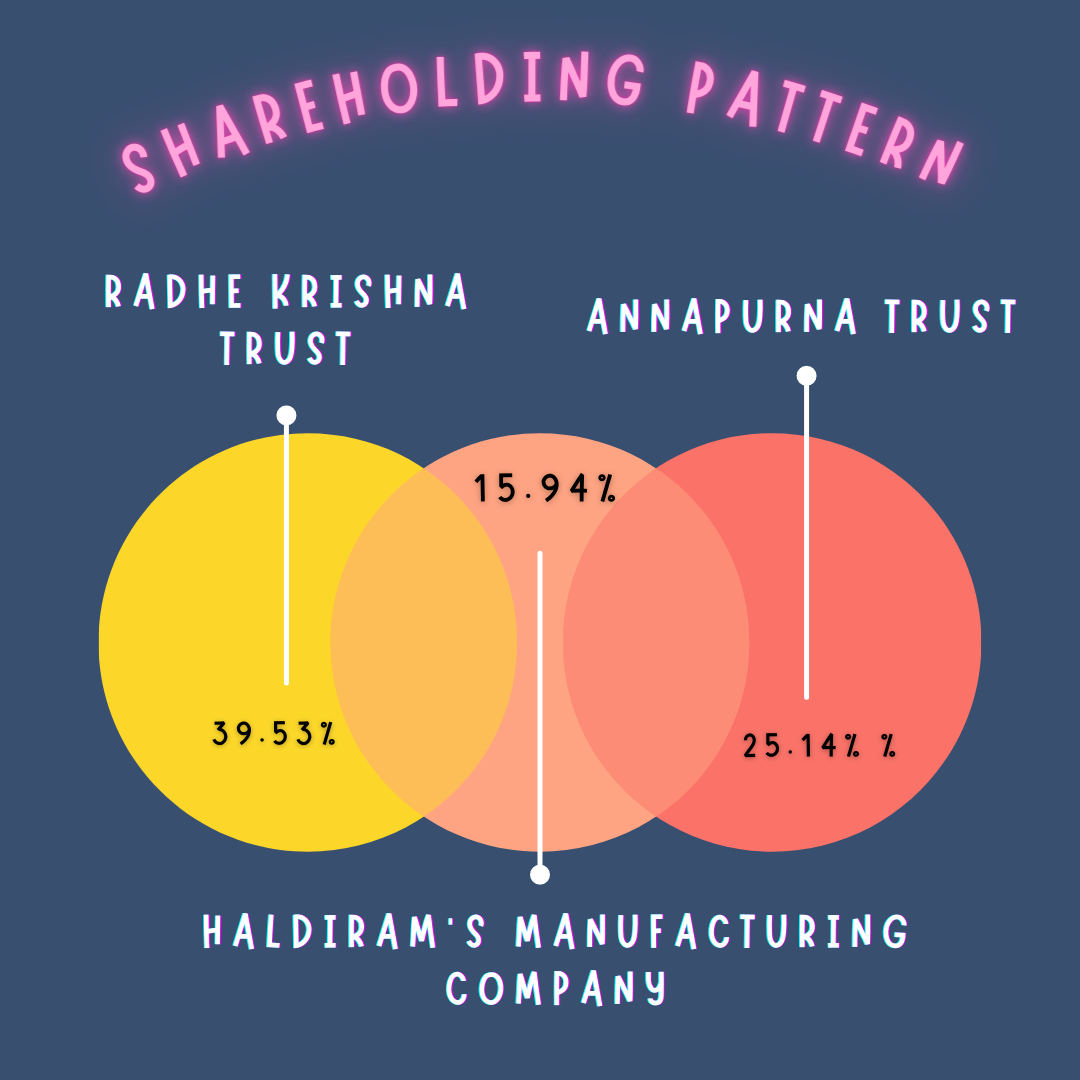

Shareholding Pattern

Haldiram Snacks Private Limited is largely owned by a couple of trusts, holding 64.67% stake in the

Sweets and

Namkeen maker. According to the details till FY 2019-20, Radhe Krishna Trust holds 39.53% and Annapurna Trust holds 25.14% stake in the company. Haldiram manufacturing company has 15.94% stake of the Haldiram Snacks.

Cash Flow (Fig. in Crores)

Cash Flow (Fig. in Crores)

In year 2019 and 2020, the company has generated negative free cash flow due to higher capital expenditure. However, cash flow of the company is constantly rising, except a sharp fall in 2019, when its cash flow plunged 60.8% to Rs 194 crore, compared to Rs 496 crore in 2018. In 2020, it managed a cash flow of Rs 372 crore, 91% higher than the previous year.

| Particulars |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| Cash Flow from Oprating Act |

216 |

334 |

305 |

496 |

194 |

372 |

| Capital Expenditure |

144 |

223 |

233 |

387 |

424 |

494 |

| Free Cash Flow |

72 |

111 |

72 |

109 |

-230 |

-122 |

| Cash Flow from Investing Act |

-140 |

-283 |

-233 |

-344 |

-314 |

-478 |

| Cash Flow from Financing Act |

-72 |

-54 |

-64 |

-68 |

137 |

38 |

Balance Sheet

| Particulars |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| Share Capital |

33 |

33 |

33 |

33 |

33 |

33 |

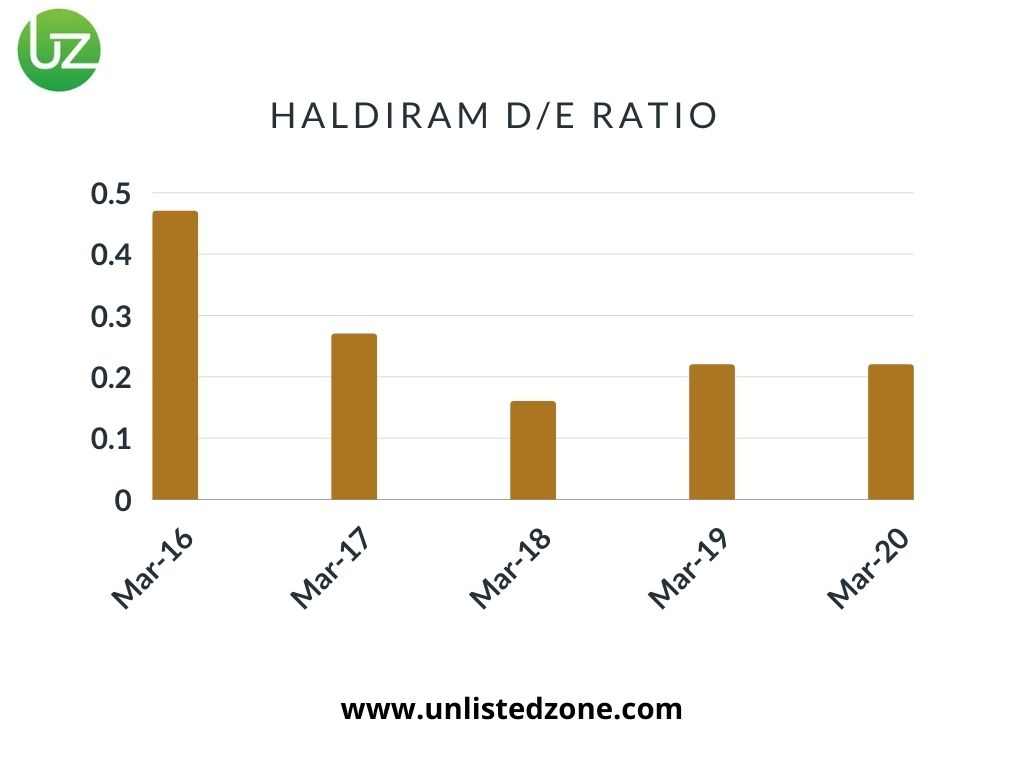

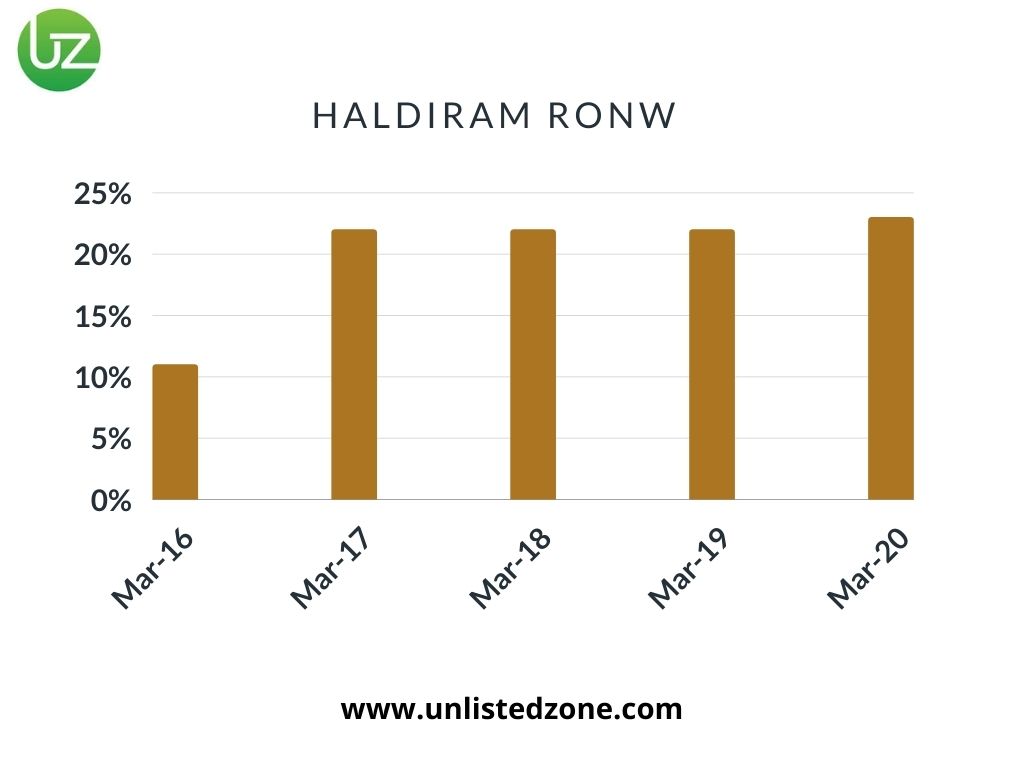

| Reserves |

542 |

604 |

852 |

1107 |

1469 |

1774 |

| Borrowings |

320 |

286 |

238 |

183 |

335 |

401 |

| Other Liabilities |

187 |

216 |

250 |

353 |

404 |

533 |

| Total Liabilities |

1083 |

1139 |

1372 |

1676 |

2240 |

2741 |

| Fixed Assets |

653 |

755 |

813 |

802 |

888 |

1103 |

| Capital WIP |

38 |

68 |

83 |

265 |

380 |

446 |

| Investments |

24 |

68 |

70 |

159 |

222 |

217 |

| Other Assets |

369 |

248 |

406 |

451 |

750 |

975 |

| Total Assets |

1083 |

1139 |

1372 |

1676 |

2240 |

2741 |

Profit and Loss

| Particulars |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| Sales |

1,770 |

2,004 |

2,449 |

2,623 |

3,094 |

3,801 |

| Cost of Materials Consumed |

1,078 |

1,196 |

1,529 |

1,363 |

1,800 |

2,194 |

| Purchase of Stock in Trade |

21 |

20 |

37 |

215 |

133 |

246 |

| Change in Inventory |

-10 |

-0.05 |

-0.28 |

6.20 |

-32.80 |

-3.53 |

| Employee Benefit Expenses |

110 |

124 |

159 |

174 |

255 |

326 |

| Other Expenses |

290 |

469 |

455 |

305 |

412 |

464 |

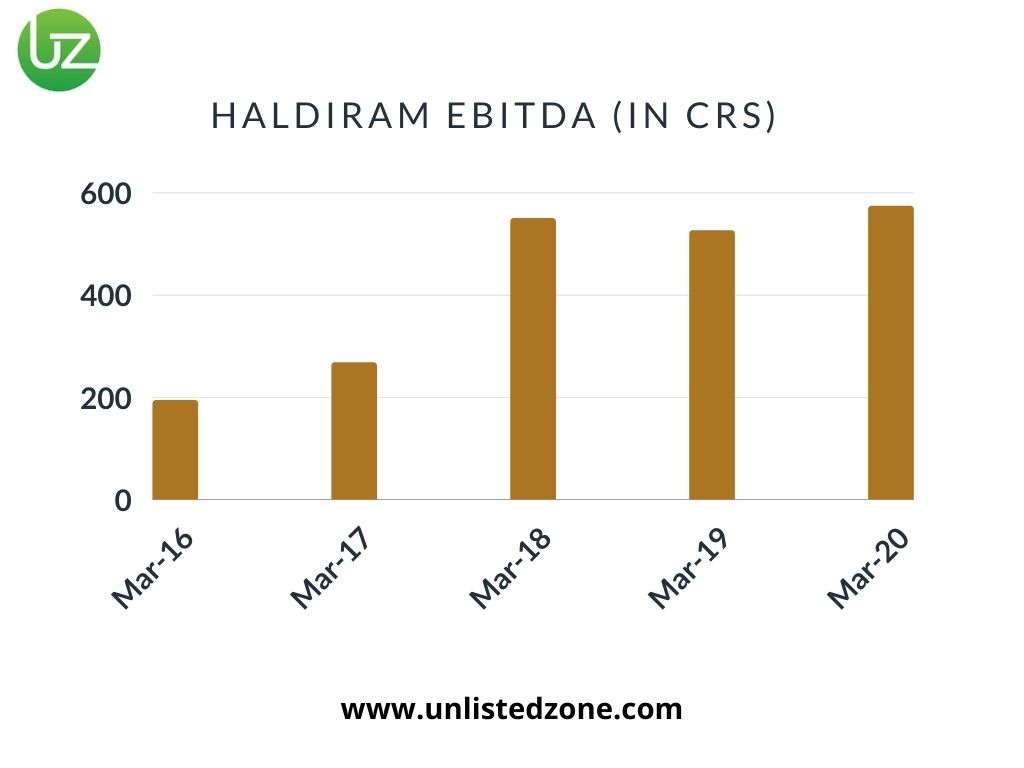

| Oprating Profit |

281 |

195 |

269 |

559 |

526 |

575 |

| OPM % |

15.87% |

9.71% |

10.98% |

21.32% |

17.01% |

15.12% |

| Finance Cost |

24 |

20 |

16 |

11 |

19 |

33 |

| Depreciation |

71 |

84 |

103 |

87 |

120 |

152 |

| Profit Before Tax |

191 |

91 |

281 |

401 |

507 |

434 |

| Tax Expenses |

63 |

29 |

90 |

151 |

162 |

118 |

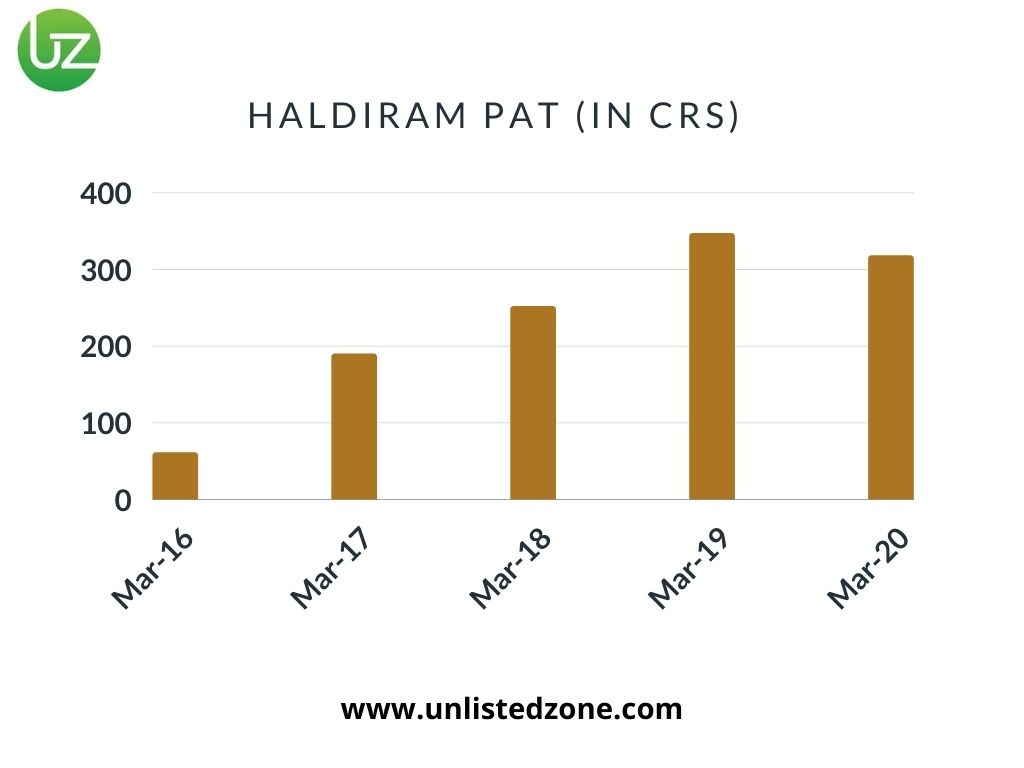

| Profit After Tax |

128 |

62 |

191 |

253 |

347 |

319 |

| NPM |

7.23% |

3.08% |

7.80% |

9.64% |

11.23% |

8.38% |

| EPS |

39 |

19 |

58 |

77 |

105 |

95 |

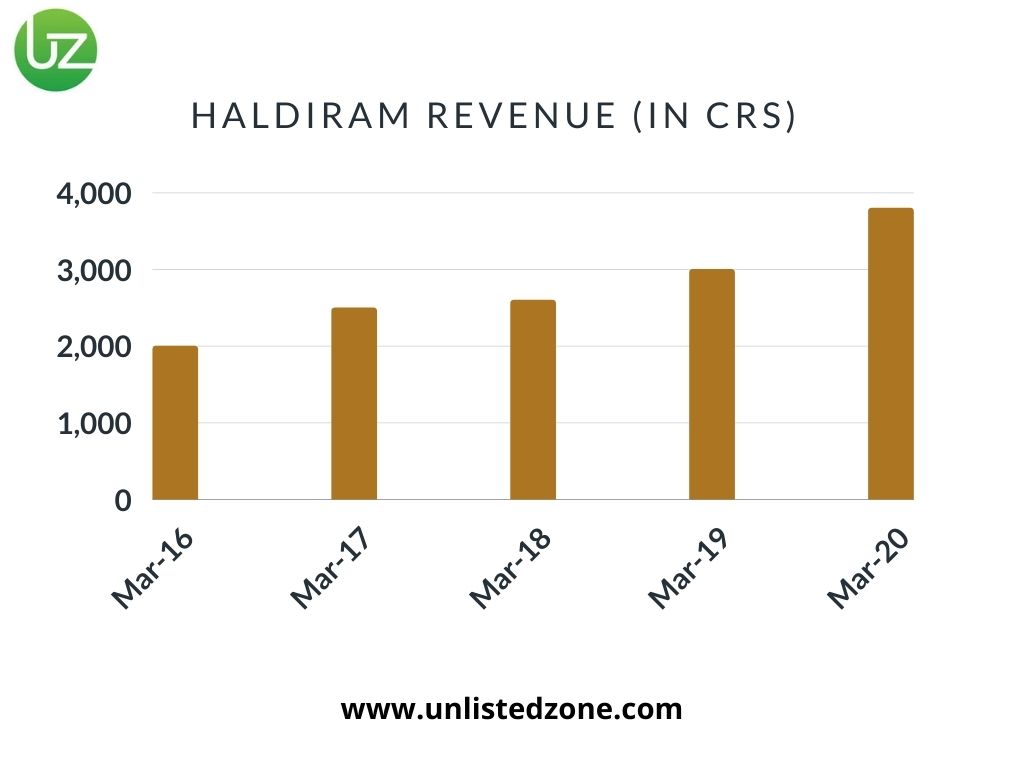

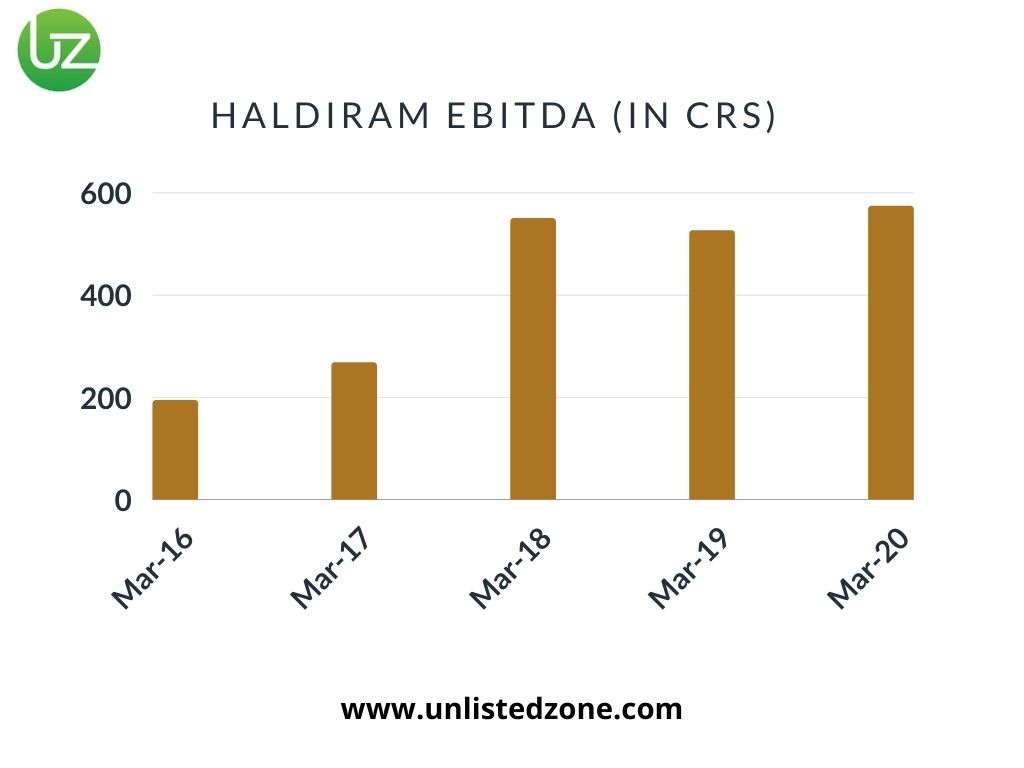

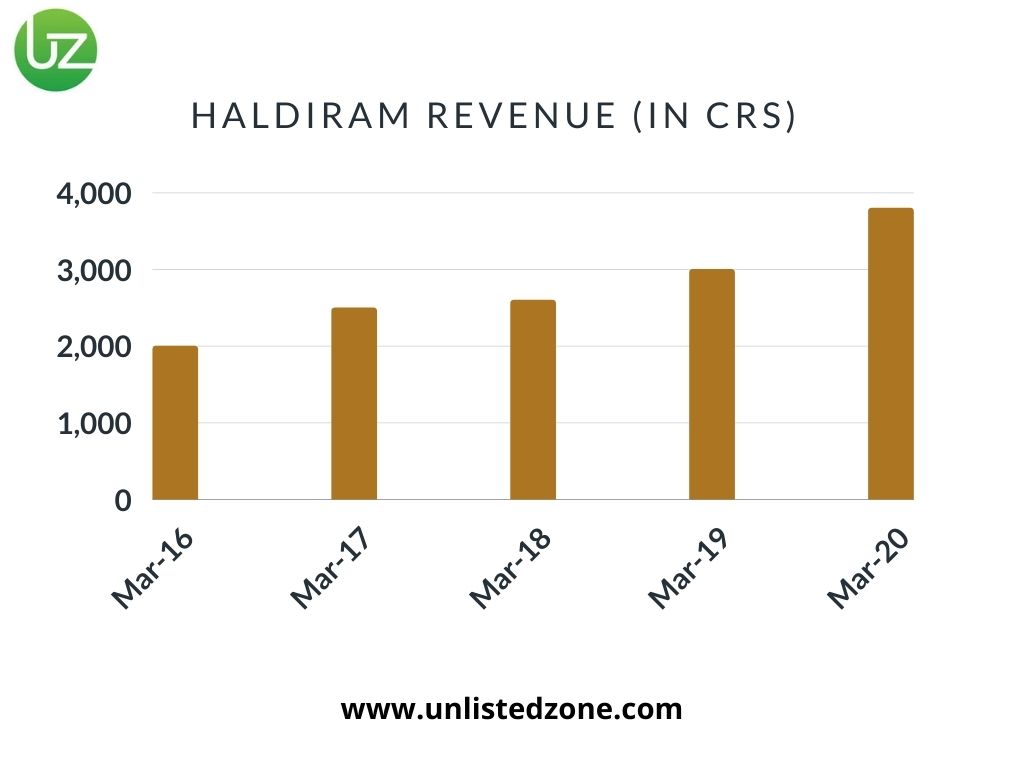

The sales of the company have been rising consistently from year 2015 to 2020. The total revenue during the period has surged up to 115% to Rs 3,801 crore from Rs 1,769 crore. The operation profit margin has remained in double digits, barring year 2016.

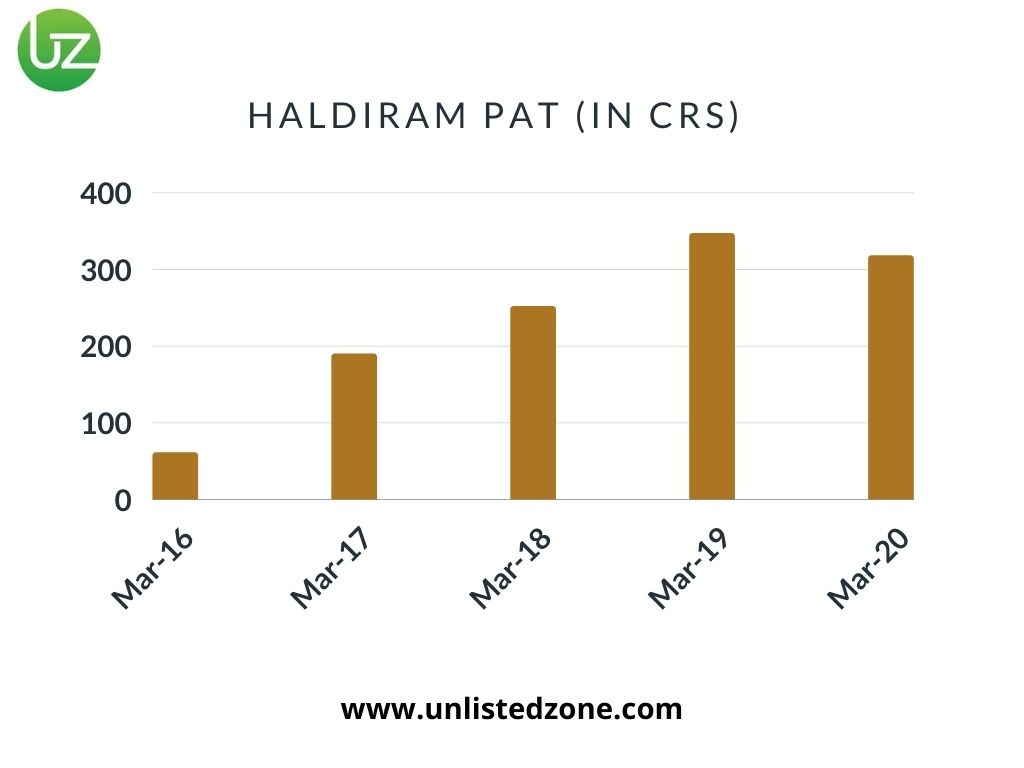

The company has witnessed a consistent rise in Profit after Tax (PAT), which increased up to 150% between 2015 to 2020. The company generated a PAT of Rs 128 in 2015 and Rs 318 in 2020. The net profit margin has remained near double digits during the period under review.

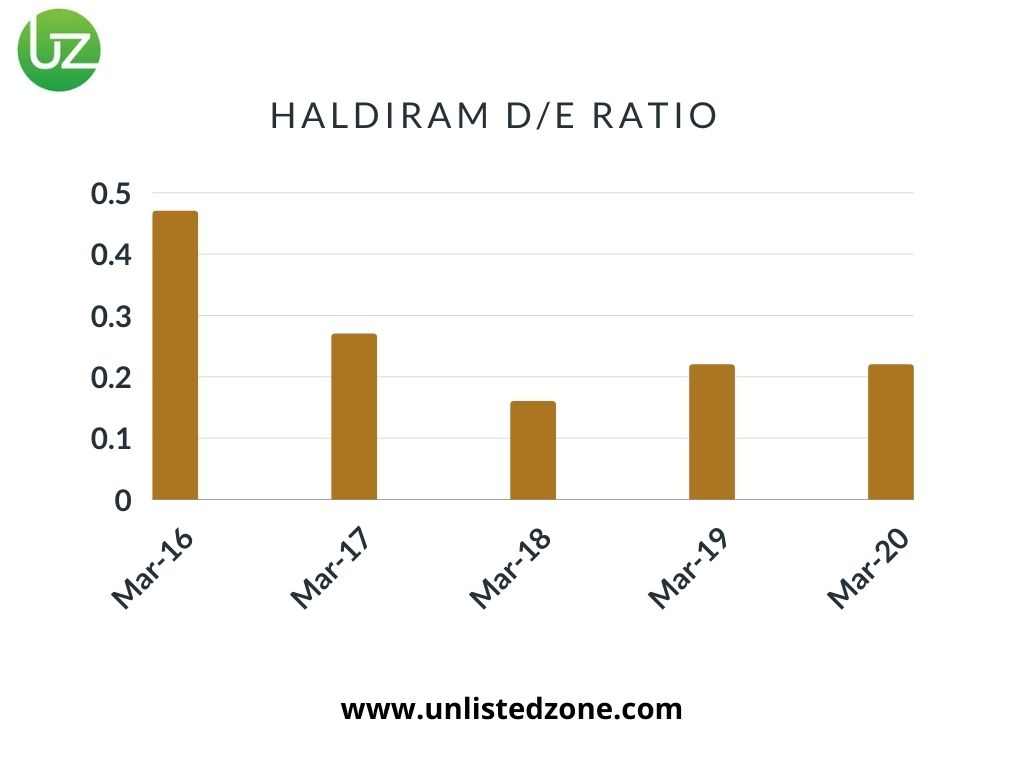

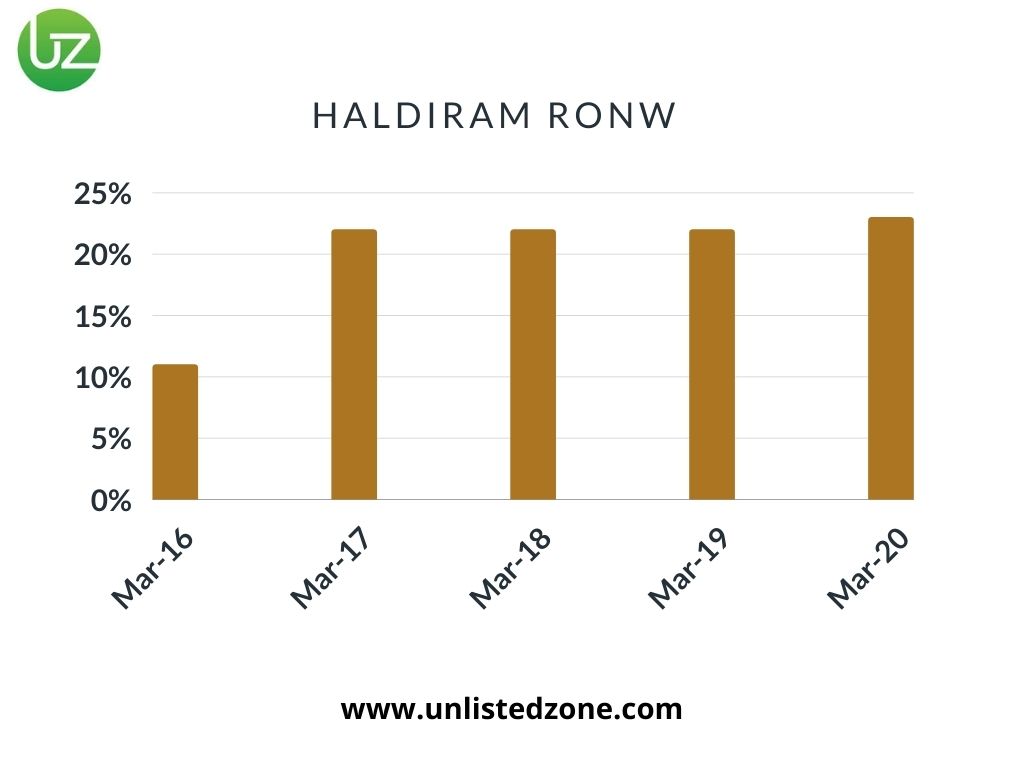

Graphical Representation of Haldiram Snacks Private Limited Financials

Valuation of Haldiram Group

Valuation of Haldiram Group

In 2019, Kellogg had made an interest in the growth story of Haldiram and at that time it was valued at $3Billion of the whole group. However, things didn't work out due to some complications in the business structure of Haldiram and the ongoing dispute in the court. Kolkata Group has taken Delhi and Nagpur entities to the court for the fight of brand ownership and trademark.

Annual report of Haldiram Snack Private Limited 2020

Annual Report of Halidram Snack Private Limited 2019

Annual Report of Haldiram Snack Private Limited 2018

Annual Report of Haldiram Snack Private Limited 2017

Annual Report of Haldiram Snack Private Limited 2016

Cash Flow (Fig. in Crores)

In year 2019 and 2020, the company has generated negative free cash flow due to higher capital expenditure. However, cash flow of the company is constantly rising, except a sharp fall in 2019, when its cash flow plunged 60.8% to Rs 194 crore, compared to Rs 496 crore in 2018. In 2020, it managed a cash flow of Rs 372 crore, 91% higher than the previous year.

Cash Flow (Fig. in Crores)

In year 2019 and 2020, the company has generated negative free cash flow due to higher capital expenditure. However, cash flow of the company is constantly rising, except a sharp fall in 2019, when its cash flow plunged 60.8% to Rs 194 crore, compared to Rs 496 crore in 2018. In 2020, it managed a cash flow of Rs 372 crore, 91% higher than the previous year.

Valuation of Haldiram Group

In 2019, Kellogg had made an interest in the growth story of Haldiram and at that time it was valued at $3Billion of the whole group. However, things didn't work out due to some complications in the business structure of Haldiram and the ongoing dispute in the court. Kolkata Group has taken Delhi and Nagpur entities to the court for the fight of brand ownership and trademark.

Valuation of Haldiram Group

In 2019, Kellogg had made an interest in the growth story of Haldiram and at that time it was valued at $3Billion of the whole group. However, things didn't work out due to some complications in the business structure of Haldiram and the ongoing dispute in the court. Kolkata Group has taken Delhi and Nagpur entities to the court for the fight of brand ownership and trademark.