Hero Motors isn’t just another auto component maker—it’s a global powertrain specialist straddling ICE, EVs, and next-gen mobility, now heading towards a ₹1,200 crore public issue.

Hero Motors Limited (HML) is a technology-led automotive component company focused on advanced powertrain solutions. Unlike traditional auto ancillaries that depend heavily on ICE vehicles, Hero Motors has built a powertrain-neutral portfolio, serving:

Its customers span India, Europe, the US, and ASEAN, making it a genuinely global auto-tech supplier rather than a domestic ancillary player.

What Exactly Does Hero Motors Make?

Hero Motors operates across the entire powertrain value chain—from precision gears to fully integrated electric drive systems.

1️⃣ Powertrain Solutions – Gears & Transmissions (G&T)

This is the company’s traditional backbone.

2️⃣ Powertrain Solutions – Bike Powertrain (BPT)

This is where Hero Motors pivots sharply toward electrification.

Strategic edge:

Since 2019, this segment has positioned Hero Motors as a first-mover in global e-bike powertrains.

3️⃣ Alloys & Metallics (A&M)

A quieter but crucial business.

-

Manufactures high-precision alloy components

-

Serves both ICE and EV platforms

-

Capabilities include: Welding , Machining, Painting

Strategic role:

👉 Importantly, this segment is powertrain-neutral, protecting revenues during the EV transition.

Global Footprint: Built for Exports

Hero Motors operates 6 manufacturing facilities and 2 technology centers across 3 countries.

Manufacturing Plants (6)

-

GB Nagar, India

-

Ludhiana, India (3 plants)

-

Samut Prakan, Thailand

-

Maidenhead, United Kingdom

Technology Centers (2)

-

GB Nagar, India

-

Southam, United Kingdom

Why this matters:

-

Customer proximity for global OEMs

-

Faster product co-development

-

Cost-efficient manufacturing with global quality standards

Subsidiaries & Strategic JVs: The Hidden Strength

Hero Motors isn’t operating alone—it has built a tightly integrated group structure.

-

Hewland Engineering (UK) – High-performance & motorsport gearboxes

-

Hero Motors Thai Ltd – ASEAN-focused gearbox assembly hub

-

HYM Drive Systems (JV with Yamaha) – Advanced electric motors with Japanese-grade quality systems

-

Hero EDU Systems – Integrated EDUs under the ‘ESYNC’ brand

-

Spur Technology – Components for premium bikes and e-bikes

👉 These entities push Hero Motors up the value chain—from components to systems and solutions.

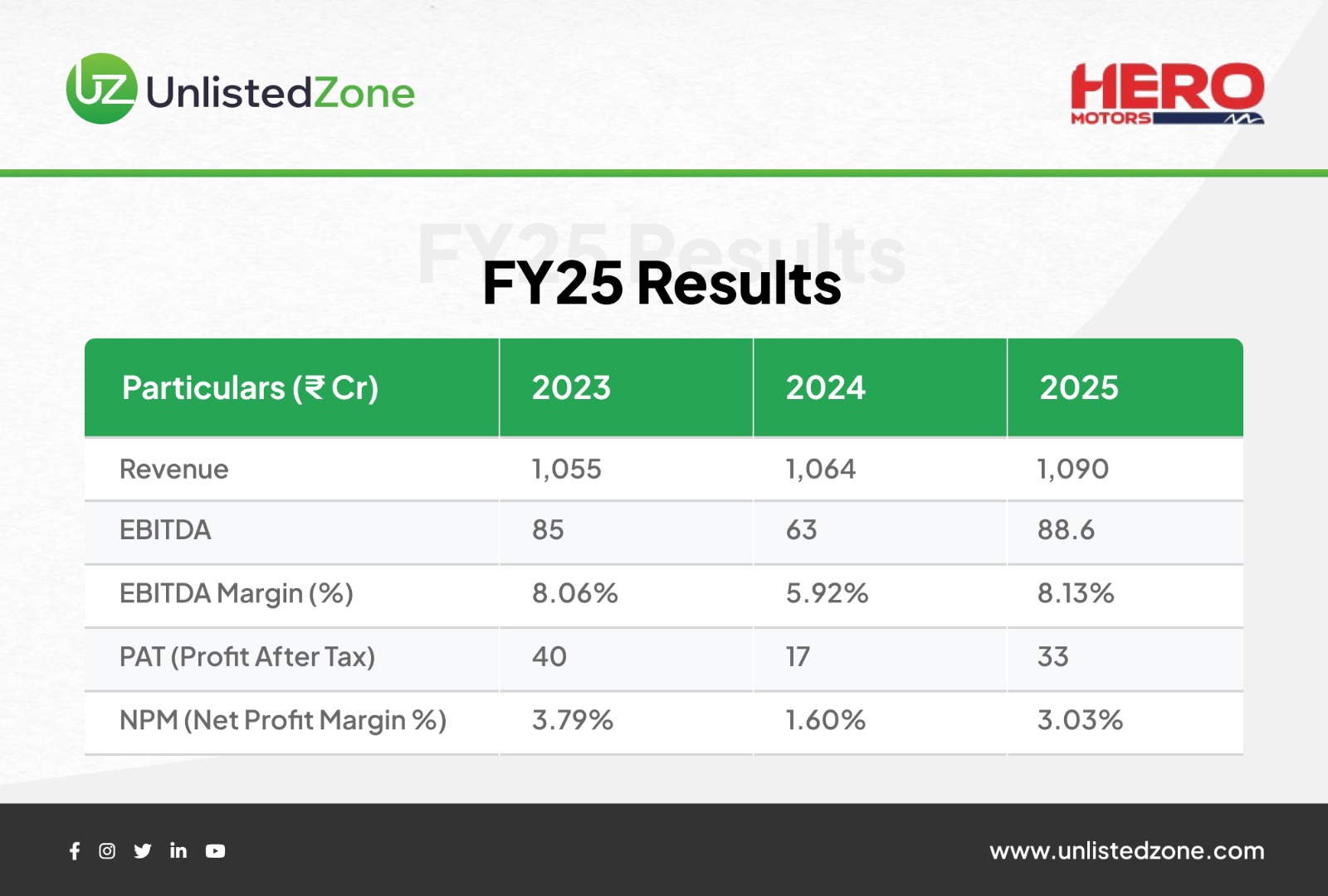

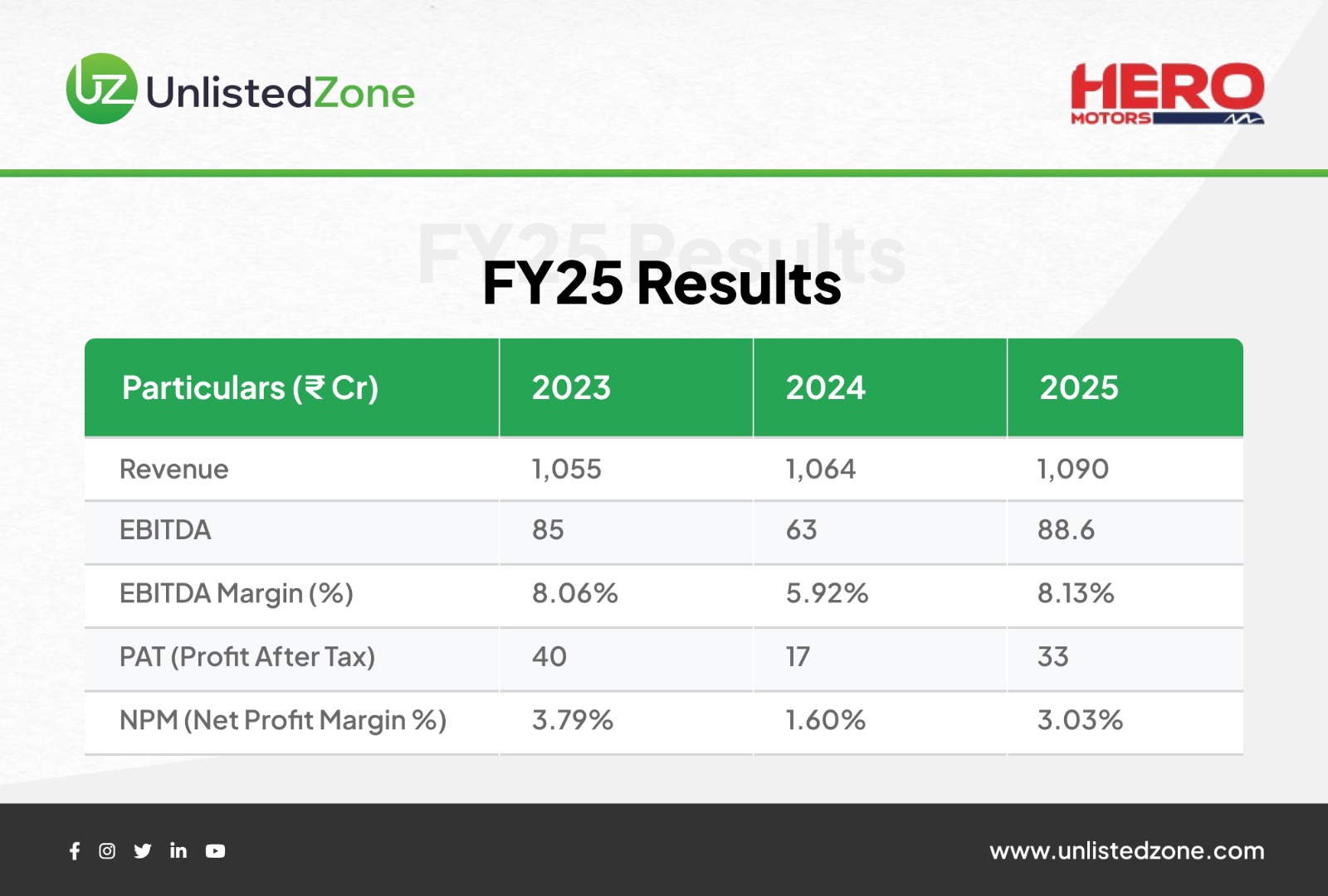

Financial Snapshot: Stable Revenues, Uneven Profits

Revenue (₹ Cr)

-

FY23: 1,055

-

FY24: 1,064

-

FY25: 1,090

👉 Revenue growth has been steady but modest.

Profitability Volatility

-

EBITDA margin fell sharply in FY24 (5.9%) before recovering to 8.1% in FY25

-

PAT dropped from ₹40 Cr (FY23) to ₹17 Cr (FY24), then rebounded to ₹33 Cr (FY25)

What happened?

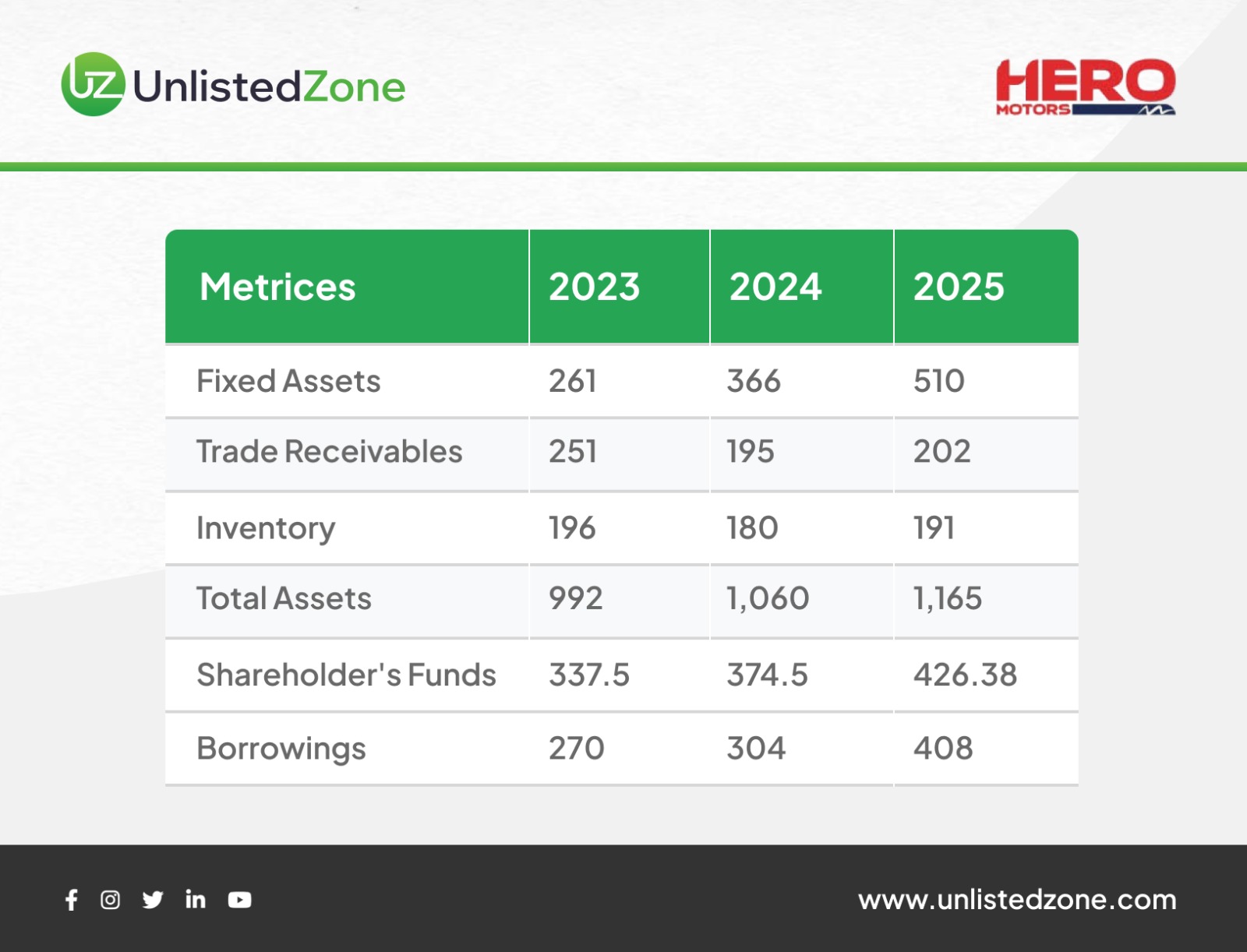

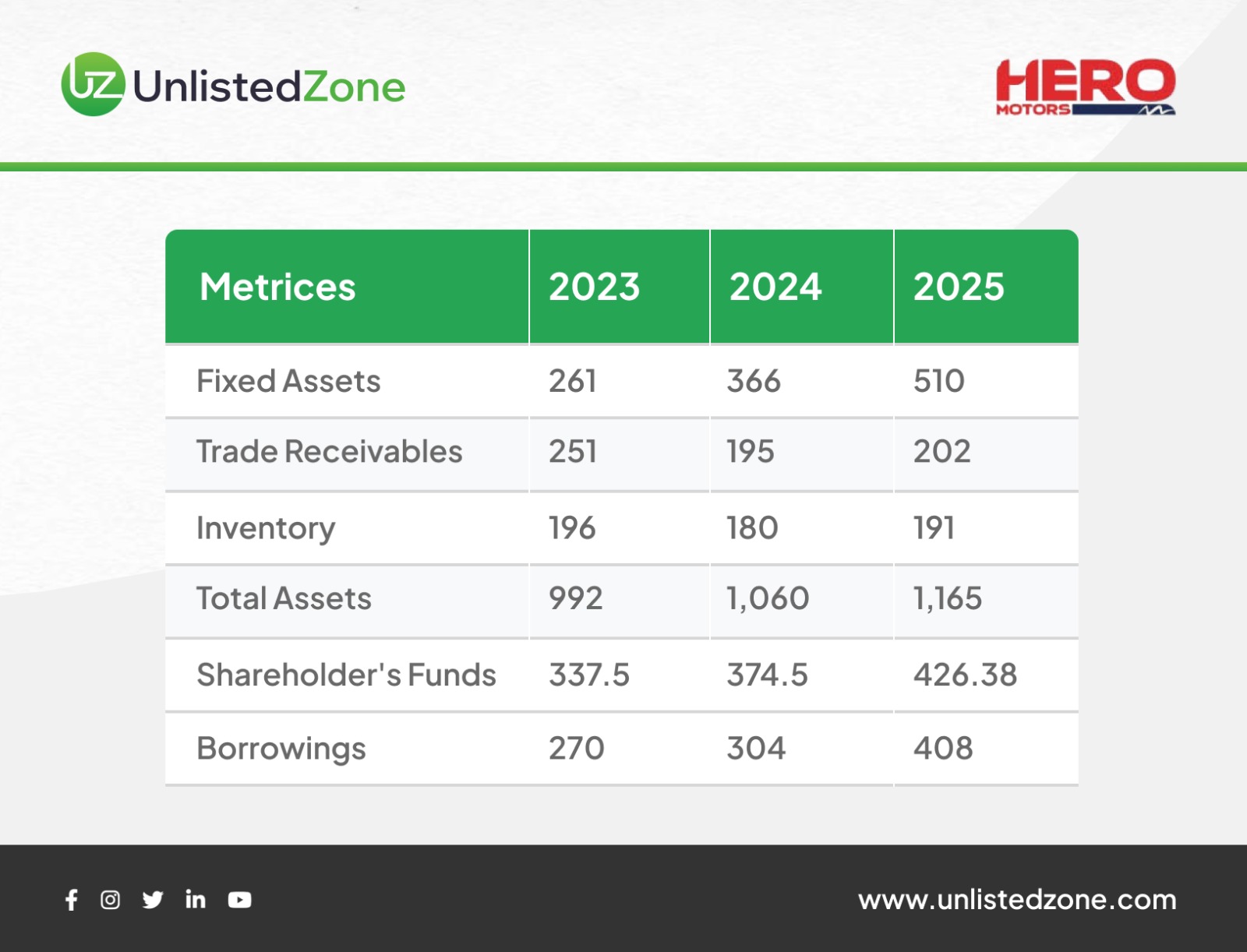

Balance Sheet: Growth Fueled by Capital

👉 This tells a clear story: capacity expansion funded largely by debt.

Cash flows reflect this:

The IPO Structure: Who Gets the Money?

🔹 Fresh Issue – ₹800 Crore

Money goes to the company for:

🔹 Offer for Sale – ₹400 Crore

Money goes to selling shareholders, mainly:

-

O P Munjal Holdings

-

Bhagyoday Investments

-

Hero Cycles

👉 Important: OFS does not strengthen the company’s balance sheet.

Shareholding: Promoters Still in Control

Post-IPO, promoters are expected to retain majority control.

The UnlistedZone Take

What’s working:

-

Strong positioning in EV + ICE

-

First-mover advantage in e-bike powertrains

-

Global manufacturing and R&D footprint

-

High entry barriers due to system-level capabilities

What to watch:

Hero Motors is not a cyclical auto ancillary—it’s a long-term mobility technology play. The IPO is less about growth today and more about funding the next decade of electrified and global powertrain expansion.