Annual Report 2019-20 Highlights

1. In FY20, Hero-Fin Corp has become India’s No.1 two-wheeler financing company.

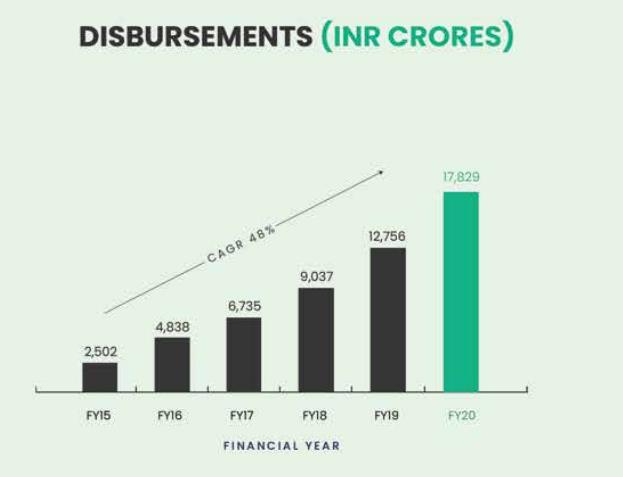

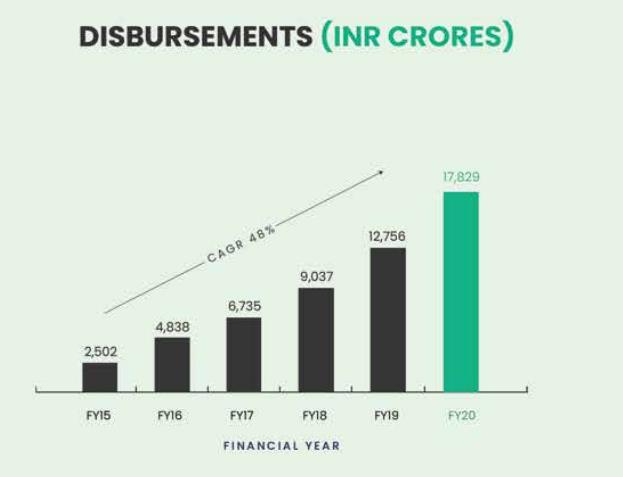

2. In FY19-20, Hero-Fin Corp has crossed a milestone of covering 50 Lakhs customers, network at 2000 locations, and registered a growth of 40% in loan disbursement as compared to last year.

3. Hero-Fin Corp has disbursed 17827 Crores of loans in FY19-20.

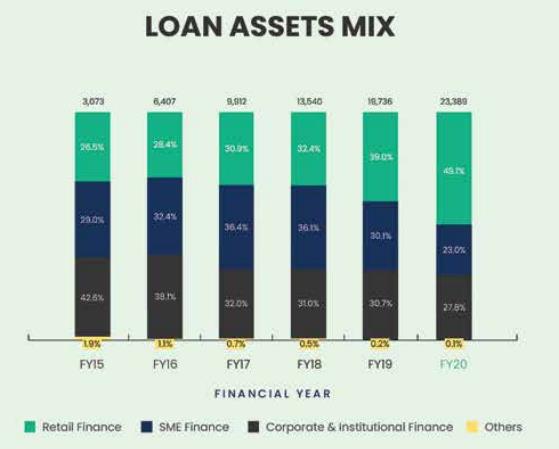

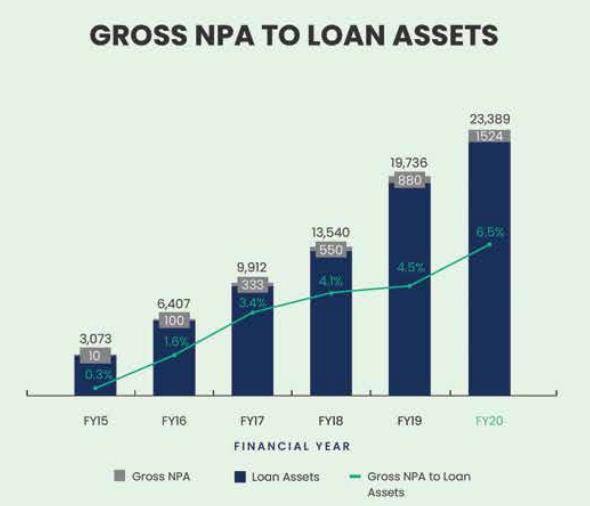

4. Total AUM as on 31.03.2020 stands at 25182 Crores.

5. PAT at 310 Crores up by 16% as compared to 268 Crores last year.

6. Employees strength as on 31.03.2020 stands at over 7500.

7. Hero-Fin Corp has recommended a final dividend of Rs. 2.55/- per equity share for the financial year ended March 31, 2020.

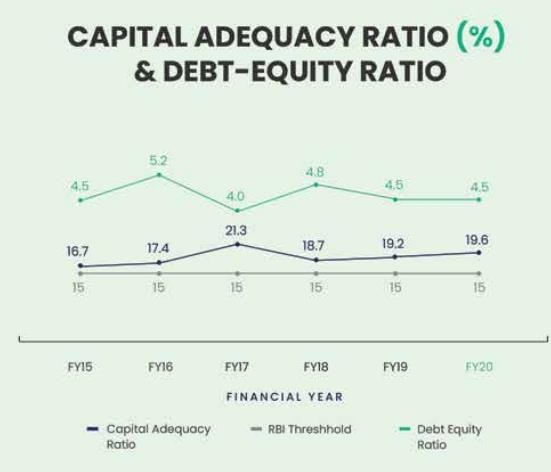

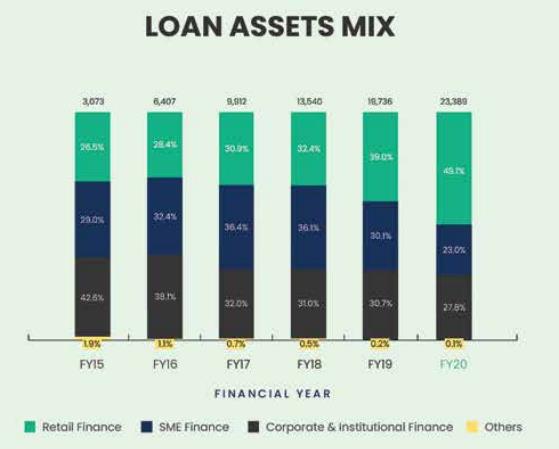

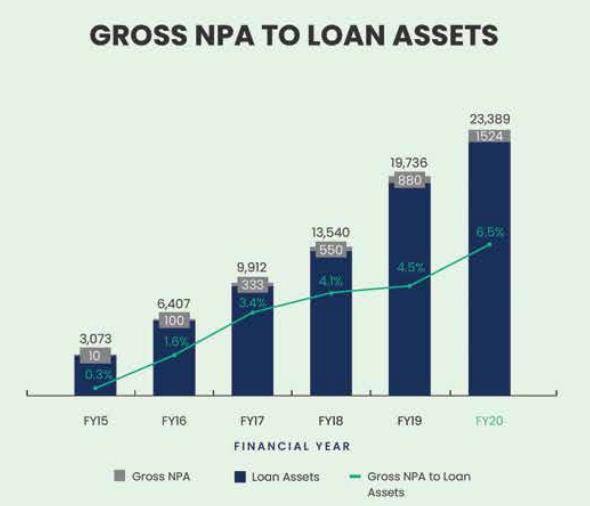

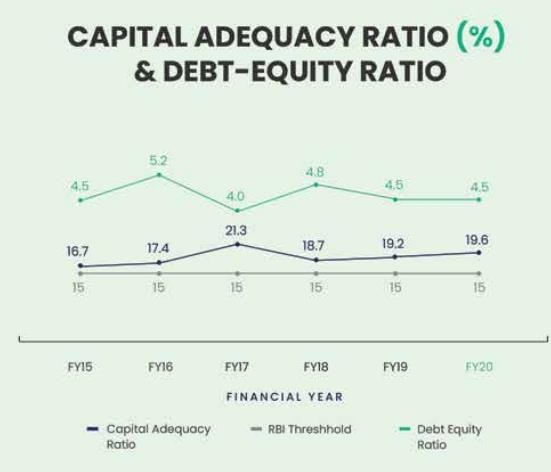

Last 5 years Growth of Hero-Fin Corp

Subsidiary Performance

Subsidiary Performance

Hero-Fin Corp has one subsidiary called Hero Housing Finance Limited.

1. HHFL has Revenue from operations of Rs. 137.81 crore in financial year 2019-20 as compared to Rs. 26.27 Crore in previous year 2018-19, registering a growth of 425% over the previous year.

2. However, the net losses for the year after tax from operations has increased from Rs. 22.62 Crore in financial year 2018-19 to Rs. 32.14 crore in financial year 2019-20

3. HHFL has shown a tremendous growth and touched an asset under management (AUM) of Rs. 1793.06 Crore during the FY 2019-20.

Equity Dilution in FY19-20

In FY19-20, the Company has issued 13,109,753 partly paid up equity share, of face value of Rs. 10 each at a premium of Rs. 810 per equity share, with Rs. 460 paid up issue of shares ( including a premium of Rs. 454.40 per partly paid up equity share) on private placement basis.

Allotted 824405 shares to Otter Limited, 170732 shares to Credit Suisse, and 2048781 shares to Apis Growth II (hibiscus) Pte. Ltd.

Subsidiary Performance

Hero-Fin Corp has one subsidiary called Hero Housing Finance Limited.

1. HHFL has Revenue from operations of Rs. 137.81 crore in financial year 2019-20 as compared to Rs. 26.27 Crore in previous year 2018-19, registering a growth of 425% over the previous year.

2. However, the net losses for the year after tax from operations has increased from Rs. 22.62 Crore in financial year 2018-19 to Rs. 32.14 crore in financial year 2019-20

3. HHFL has shown a tremendous growth and touched an asset under management (AUM) of Rs. 1793.06 Crore during the FY 2019-20.

Equity Dilution in FY19-20

In FY19-20, the Company has issued 13,109,753 partly paid up equity share, of face value of Rs. 10 each at a premium of Rs. 810 per equity share, with Rs. 460 paid up issue of shares ( including a premium of Rs. 454.40 per partly paid up equity share) on private placement basis.

Allotted 824405 shares to Otter Limited, 170732 shares to Credit Suisse, and 2048781 shares to Apis Growth II (hibiscus) Pte. Ltd.

Subsidiary Performance

Hero-Fin Corp has one subsidiary called Hero Housing Finance Limited.

1. HHFL has Revenue from operations of Rs. 137.81 crore in financial year 2019-20 as compared to Rs. 26.27 Crore in previous year 2018-19, registering a growth of 425% over the previous year.

2. However, the net losses for the year after tax from operations has increased from Rs. 22.62 Crore in financial year 2018-19 to Rs. 32.14 crore in financial year 2019-20

3. HHFL has shown a tremendous growth and touched an asset under management (AUM) of Rs. 1793.06 Crore during the FY 2019-20.

Equity Dilution in FY19-20

In FY19-20, the Company has issued 13,109,753 partly paid up equity share, of face value of Rs. 10 each at a premium of Rs. 810 per equity share, with Rs. 460 paid up issue of shares ( including a premium of Rs. 454.40 per partly paid up equity share) on private placement basis.

Allotted 824405 shares to Otter Limited, 170732 shares to Credit Suisse, and 2048781 shares to Apis Growth II (hibiscus) Pte. Ltd.