Introduction

The Indian financial sector is buzzing with the anticipation of HDFC Securities' upcoming IPO. As a leading player in the broking industry, HDFC Securities' pre-IPO financials offer a compelling narrative of growth, resilience, and future potential. This analysis aims to dissect HDFC Securities' financial health and compare it with its listed peer, Angel Broking, to provide a comprehensive view for potential investors.

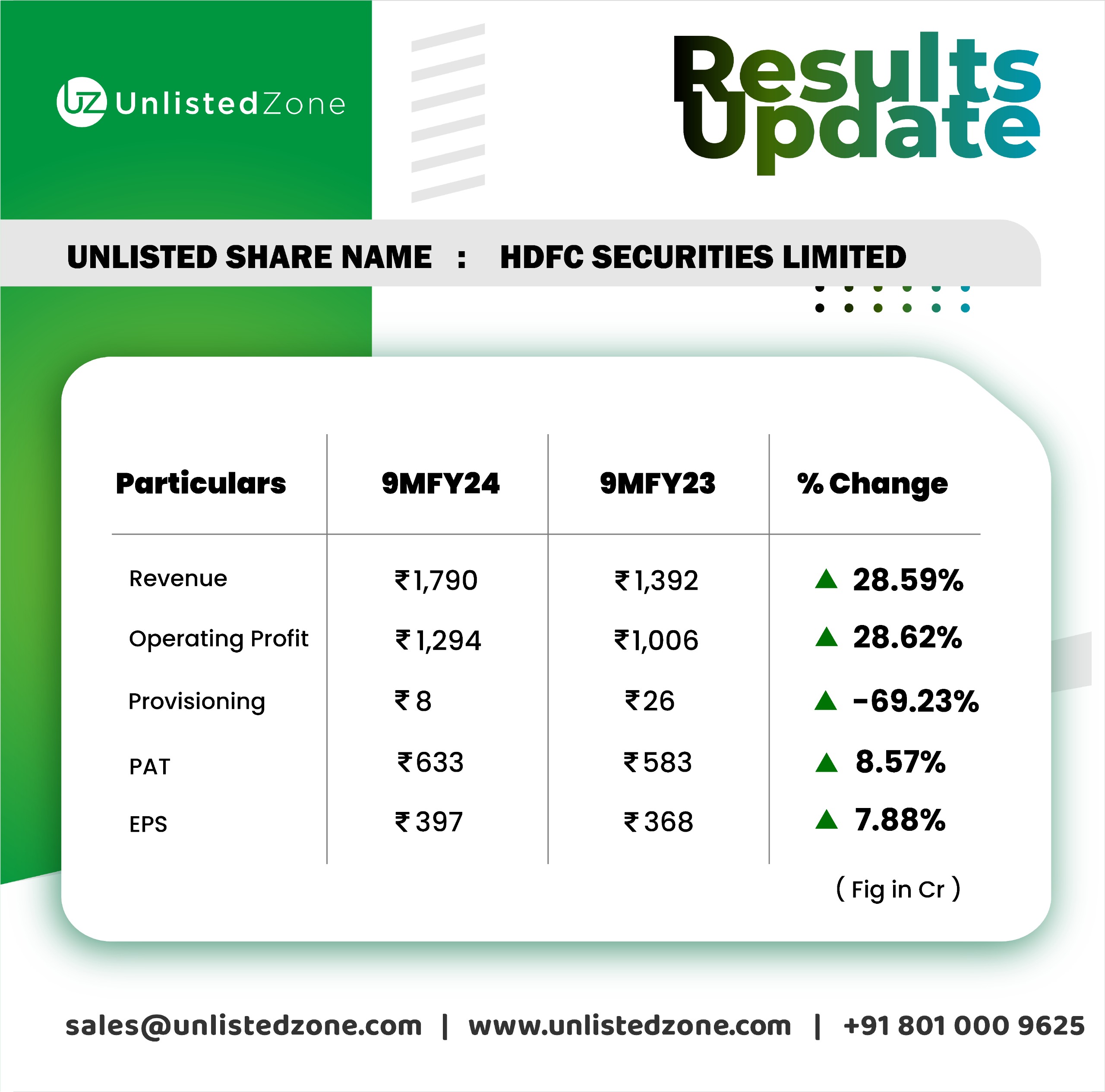

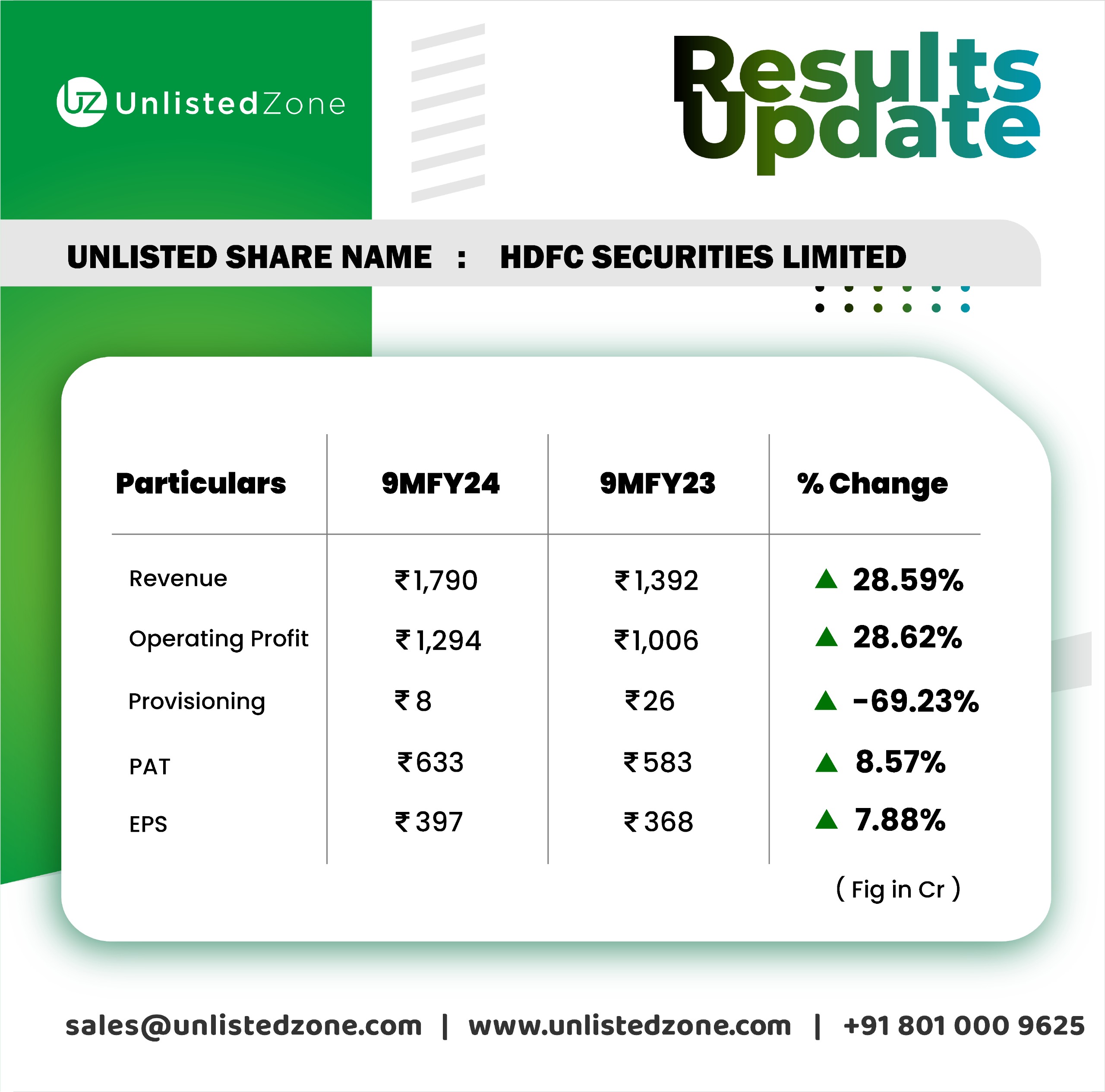

A) HDFC Securities: 9MFY24 Financial Performance Highlights

1. Robust Revenue Growth

HDFC Securities has demonstrated an impressive 28% increase in revenue, soaring from INR 1,400 Crore in 9MFY23 to INR 1,800 Crore in 9MFY24. This surge in revenue is a testament to the company's growing market presence and successful strategic initiatives, marking it as a significant player in the broking industry.

2. EBITDA Margin Analysis

Despite the revenue hike, a decline in EBITDA margin from 58% to 50% signals a need for introspection into the company’s cost management strategies. This decline is attributed to higher finance costs or other operational expenses, potentially linked to expansion strategies or market dynamics.

3. Profit After Tax (PAT) and Earnings Per Share (EPS)

The Profit After Tax growth, at 8%, indicates a modest increase in net earnings, despite the significant revenue growth. This suggests that not all revenue increases have translated into bottom-line profits. However, an EPS of 397 in 9MFY24, with a projection of around 550 for the full fiscal year, points to a strong earning potential.

4. Valuation Metrics

At a current market price of INR 11,000 per share, leading to a market capitalization of INR 17,500 Crore and a Price-to-Earnings (P/E) ratio of 20x, HDFC Securities is priced reasonably. This valuation necessitates a comparison with industry standards and peers for a well-rounded assessment.

B) Comparative Analysis with Angel Broking

1. Revenue and PAT Growth

Angel broking in the first 9MFY23 has clocked a revenue of 2915 Cr vs 2176 Cr in 9MFY24. Jump of 34%. Angel Broking's revenue growth at 34% marginally surpasses that of HDFC Securities.

PAT has also gone up from 624 Cr in 9MFY23 to 785 in 9MFY24. Jump of 25%. Angel Broking's 25% increase in PAT significantly outshines HDFC Securities, suggesting more efficient cost management or a varied revenue mix.

2. Market Capitalization

Angel Broking stands at a higher market valuation with a capitalization of INR 28,000 Crore and a P/E of 26x. This disparity in valuation might reflect the market's perception of the companies' growth potential and investor confidence in Angel Broking.

C) Investment Considerations for HDFC Securities

1. Market Positioning

As a well-established name in the financial services sector, HDFC Securities holds the potential for robust growth, particularly considering its current valuation in the unlisted market.

2. Financial Health

The dip in EBITDA margin is a red flag for potential investors. It is crucial to monitor HDFC Securities' approach to cost management and its impact on overall profitability.

3. Comparative Performance

Angel Broking’s performance in the listed market serves as a valuable benchmark. Differences in business models, market strategies, and customer segments should be considered when analyzing HDFC Securities’ potential.

4. Potential Upside

With its current market valuation and growth trajectory, HDFC Securities may present a lucrative investment opportunity, especially if it continues its growth momentum post-IPO.

D) Conclusion

HDFC Securities exhibits strong growth potential in its pre-IPO phase, though concerns around cost management require careful analysis. The comparison with Angel Broking sheds light on its market positioning and potential in the broader financial services landscape. Investors are advised to consider market dynamics, investor sentiment, and strategic initiatives before making an investment decision in HDFC Securities. The upcoming IPO could mark a significant milestone in the company's journey, potentially unlocking value for investors willing to delve into the nuances of the broking sector.

This analysis offers a snapshot of HDFC Securities in the pre-IPO phase and should not be construed as investment advice. Investors are encouraged to conduct their research or consult a financial advisor for personalized guidance.