From 2020 onwards, capital market businesses lived in a sweet spot.

More demat accounts, higher turnover, nonstop IPO buzz, derivatives frenzy, and a retail wave that made broking earnings look almost linear.

But HDFC Securities latest numbers are a reminder: this is still a cycle business—and we are now seeing the normalisation phase.

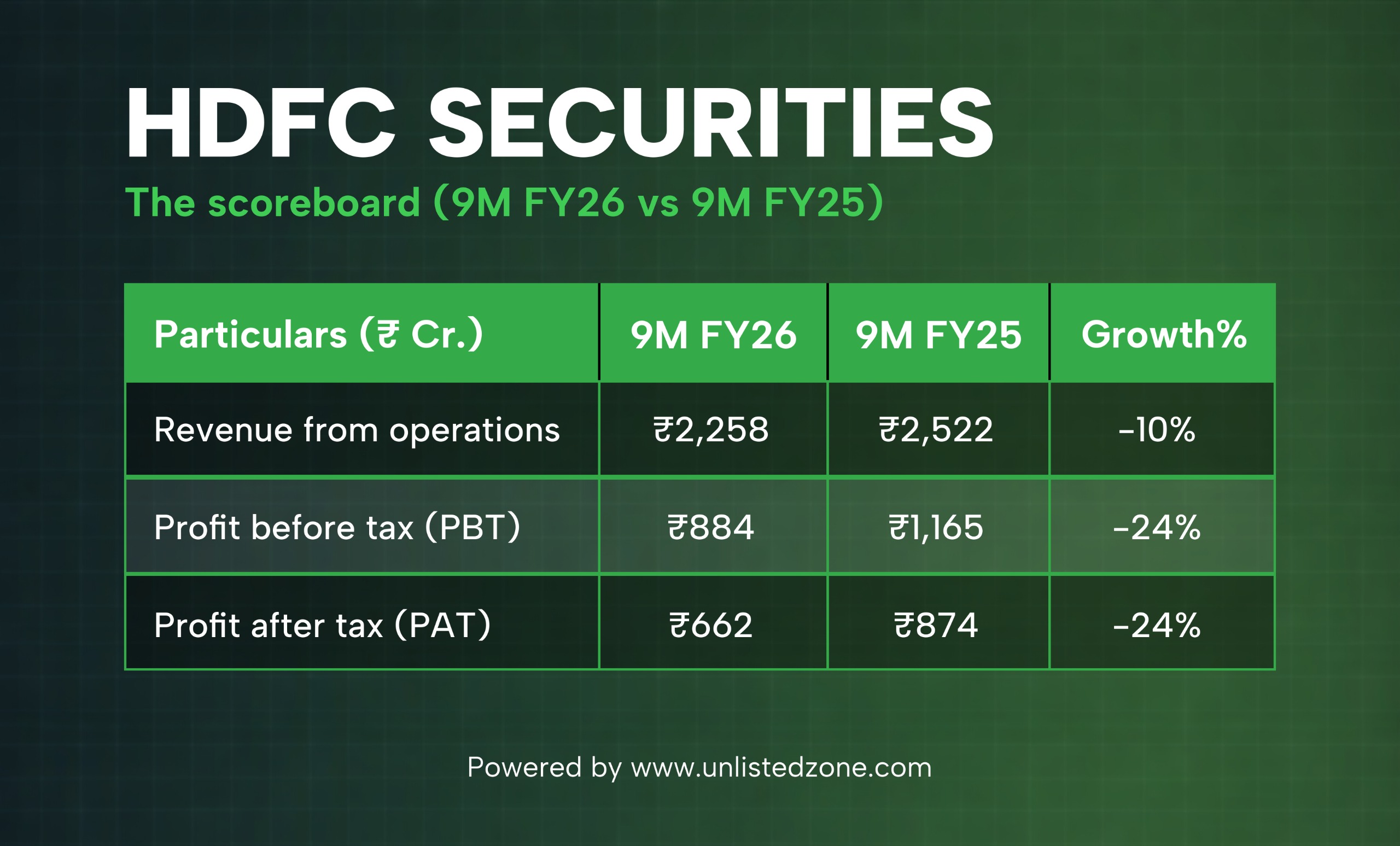

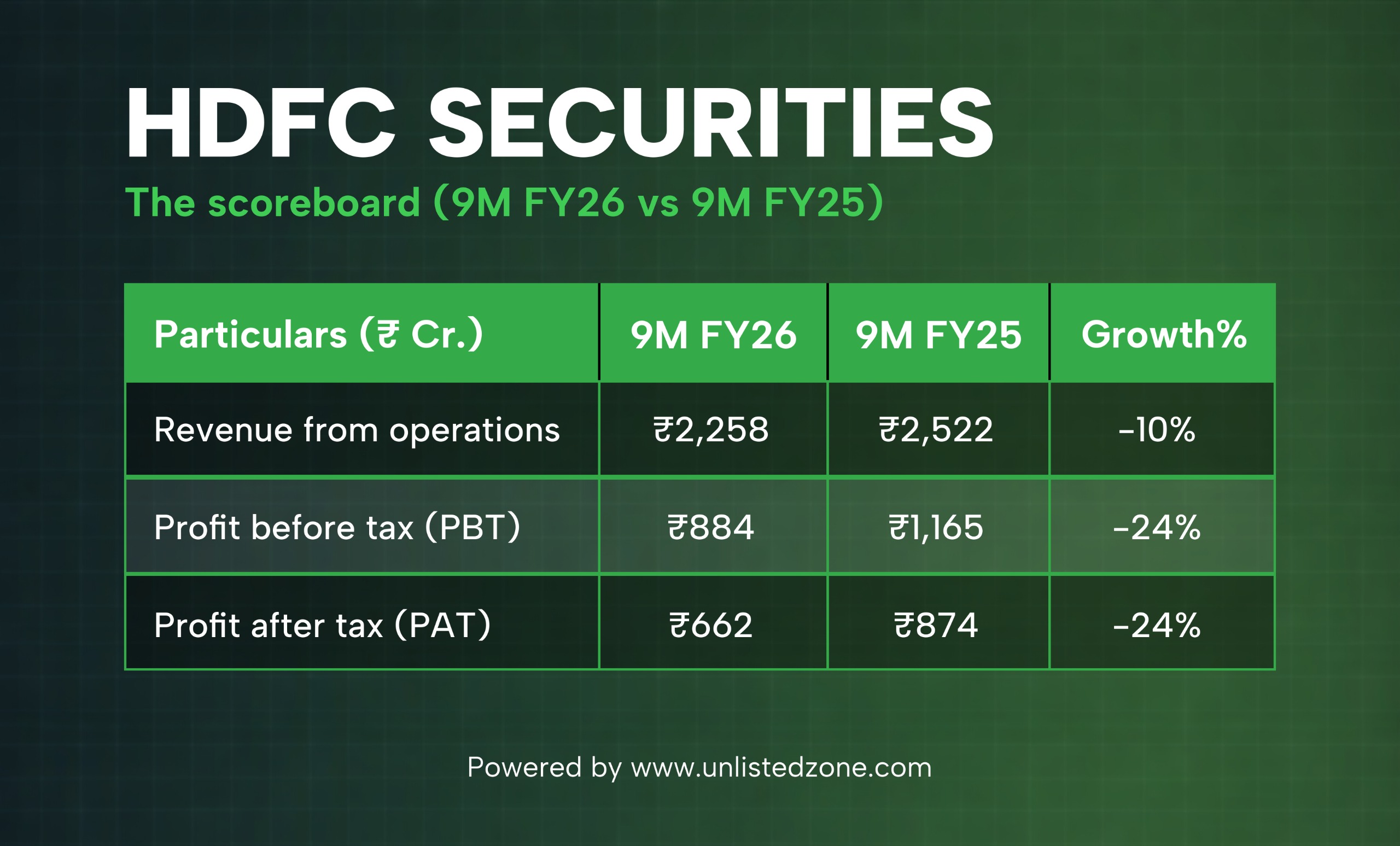

A) The scoreboard (9M FY26 vs 9M FY25)

For the nine months ended 31 December 2025 (9M FY26), HDFC Securities reported:

- Revenue from operations: ₹2,257 cr vs ₹2,521 cr (down ~10.5%)

- Profit before tax (PBT): ₹884 cr vs ₹1,164 cr (down ~24.1%)

- Profit after tax (PAT): ₹661 cr vs ₹873 cr (down ~24.3%)

So yes, revenue softened. But profits fell much faster—the classic sign that operating leverage has flipped.

B) What exactly slowed?

1) The most “market-linked” line item got hit: Fees & commission income

Fees & commission fell to ₹1,095.3 cr from ₹1,356.8 cr (down ~19.3%)

This is the line most sensitive to:

- trading activity / churn,

- broking yields and pricing pressure,

- distribution economics,

- overall investor risk appetite.

When this number falls, it usually means the business is moving from “hot market” to “steady market.”

2) Interest income stayed steady, but couldn’t offset the drop

Interest income was ₹1,071 cr vs ₹1,092 cr (down ~2%)

So the “balance-sheet/interest” leg didn’t collapse.

But the “activity/fee” leg did—and that’s what matters in broking cycles.

C) Costs: the silent profit killer in a cooling cycle

Here’s the part investors often miss. In capital-market businesses, when revenue slows, costs don’t automatically come down.

Employee benefit expense rose to ₹449 cr from ₹345 cr (up ~30%)

And management also disclosed a specific driver: a ₹29 cr provision towards past service cost on gratuity (linked to Labour Codes) recognised during the quarter ended 31 Dec 2025 and included in employee benefit expense.

So even if market activity cools, compliance and provisioning can still push costs higher.

D) Margins tell the real story

- Operating margin (PBT / Revenue from ops): 39% vs 46%

- Net profit margin: 29% vs 35%

This is why the profit drop looks sharper than the revenue drop: margins compressed.

E) So what’s happening to capital-market stocks now?

The broader “capital markets rally” that began in 2020 was built on a simple formula:

More investors + more trades + more leverage + more IPOs

= higher revenues

= operating leverage

= EPS compounding

= valuation re-rating

But cycles mature.

Today, the sector is dealing with:

- volume normalisation (growth rate, not the absolute level),

- pricing pressure in broking,

- rising tech + compliance costs,

- and investors demanding “growth + margins” rather than “just growth”.

In short:

Capital-market businesses haven’t become bad businesses.

They’ve just stopped looking like guaranteed high-growth compounders every quarter.

F) The valuation lens (Unlisted vs Listed)

Now comes the interesting part.

1. HDFC Securities (Unlisted market)

The current unlisted valuation of HDFC Securities is around ₹16,800 cr market cap.

Using assumption of FY26 expected PAT ~₹900 cr, the implied multiple is:

- P/E ≈ 18.66x (₹16,800 cr / ₹900 cr)

2. Angel One (Listed)

Angel One’s P/E is being quoted around ~29x in the market currently.

G) Why is HDFC Securities cheaper?

Because the market is pricing in three things:

- Unlisted discount

Liquidity, price discovery, and exit timelines are uncertain in unlisted space—so multiples stay lower.

- Growth visibility is softer right now

9M FY26 shows a clear slowdown in fees & commission income and a profit correction.

- Operating leverage has turned negative in this phase

Margins compressed from 46% to 39% at the operating level, and 35% to 29% at net level.

So the market’s message is basically:

“HDFC Securities is a strong franchise, but right now it’s not being priced like a high-growth momentum broker.”

H) The investor takeaway

If the 2020–2024 rally was the “party phase” for capital-market stocks, FY26 is looking more like the “hangover phase”—where growth must be earned, not assumed.

For HDFC Securities, the key variables to watch going forward are:

- Fees & commission stabilisation (because that’s the most cycle-sensitive engine)

- Cost control / one-offs normalising (employee cost spike + provisioning impact)

- Margin recovery (because that decides whether earnings bounce faster than revenue)

- And finally, whether the sector gets a fresh tailwind from a stronger market cycle.

And if your unlisted valuation math holds—~18.7x forward P/E for HDFC Securities vs ~29x for Angel One—then the debate becomes simple:

Is HDFC Securities a “slower growth but stronger franchise” play that deserves re-rating when the cycle turns, or is the market right to keep it discounted due to growth/visibility?