India’s health insurance market is booming. More people are buying medical cover, hospitals are charging more than ever, and insurers are racing to grow. Right in the middle of this rush is Care Health Insurance (formerly Religare Health Insurance) — a company backed by Religare Enterprises, Union Bank of India and Corporation Bank.

Care sells everything from basic health plans to maternity covers, personal accident, critical illness, travel plans and corporate group policies. And in the first half of FY26, the company clearly grew. But growth alone doesn’t decide the winner in health insurance. The real test is whether an insurer can pay its claims efficiently.

Growth Is Coming In, But Carefully

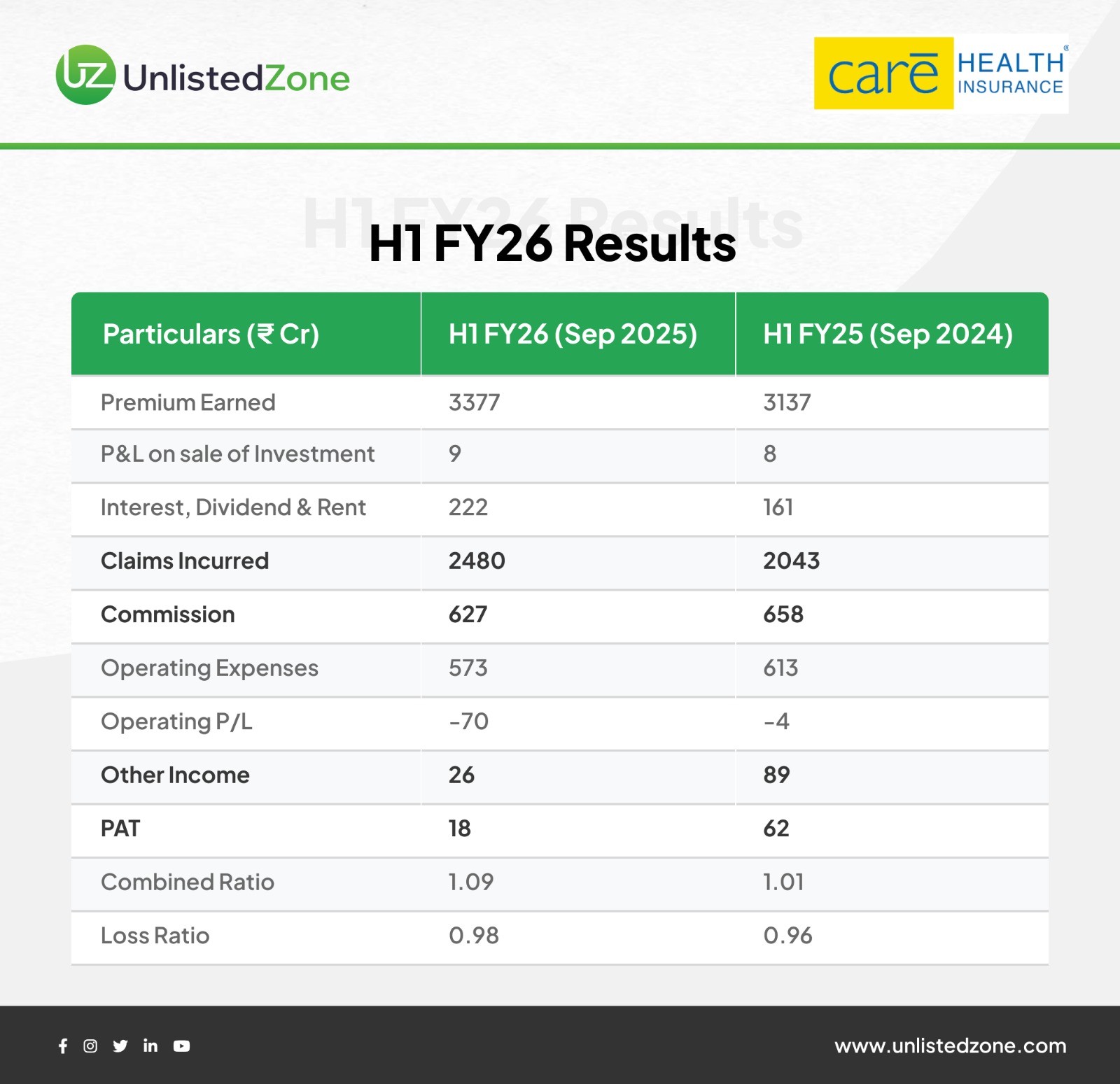

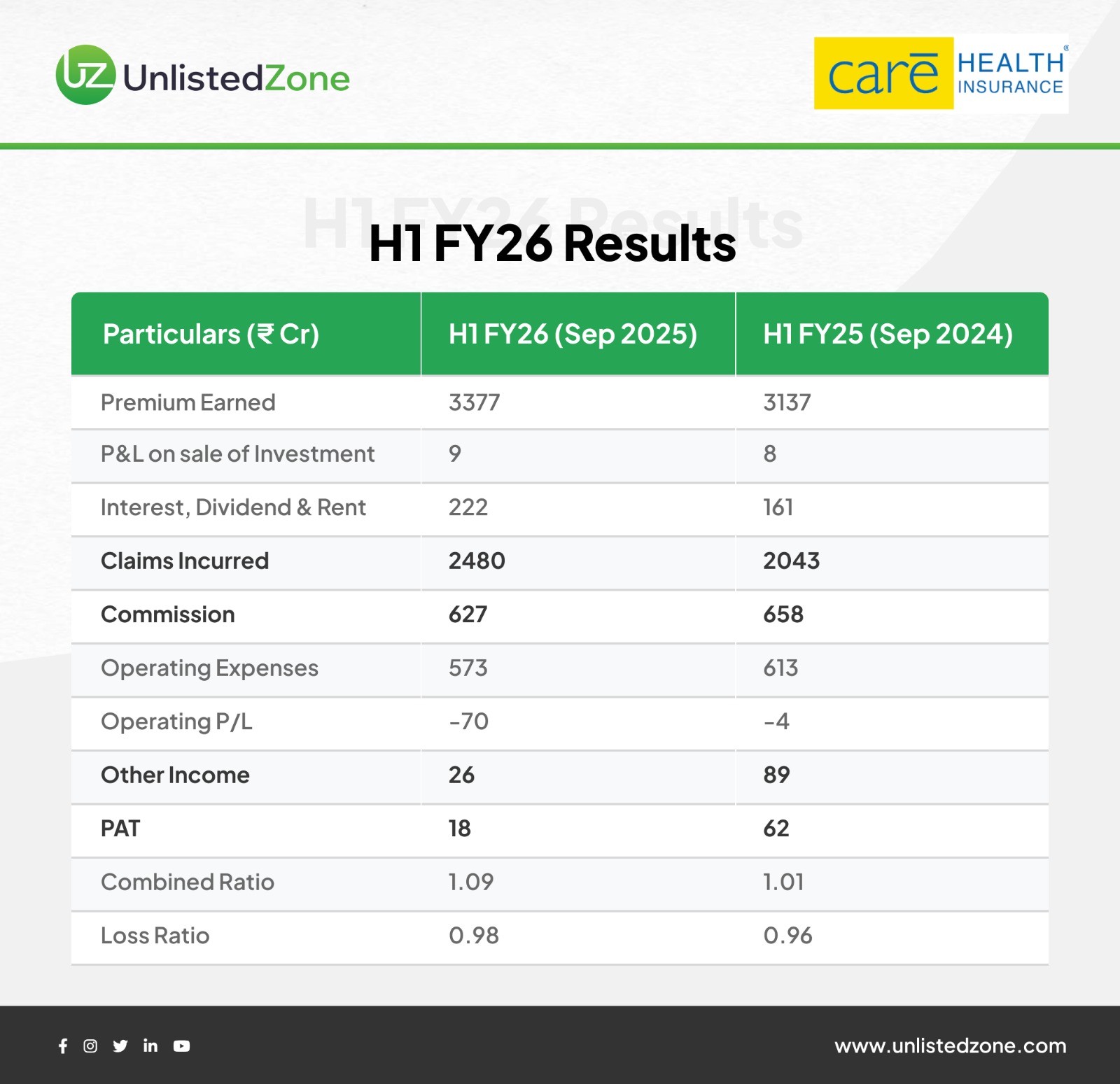

Between April and September 2025, Care earned ₹3,377 crore in premiums, compared to ₹3,137 crore in the same period last year. More people bought policies, distribution continued to work well, and demand is definitely not a problem.

However, even while selling more, the company played safe. It passed a higher portion of risk to reinsurers — a move insurers generally take when they sense medical payouts are rising. In other words, Care grew, but didn’t want to keep all the risk on its books.

One thing clearly worked in its favour — investment income. Thanks to high interest rates, Care earned ₹222 crore from interest and dividend income, up from ₹161 crore last year. This investment cushion actually rescued the company from a much worse bottom-line outcome.

Hospitals Had Other Plans

Hospitals are becoming expensive faster than insurers can adjust pricing. That reality hit Care hard. Claims rose sharply to ₹2,480 crore, compared to ₹2,043 crore a year ago. Meanwhile, other costs didn’t help much. Commission outgo stood at ₹627 crore, while fee and operating expenses were ₹573 crore.

Add all this up and you get a painful number: Care reported an operating loss of nearly ₹70 crore in the first half of FY26. Last year, it was closer to a break-even number of ₹–3.58 crore. More business came in, but it got eaten up by medical bills.

Profit Didn’t Just Fall… It Shrunk

The real squeeze becomes clear when you look at the core insurance business. Care’s operating profit from underwriting slipped into a deeper loss of ₹–70 crore, compared to a near breakeven ₹–3.58 crore last year. That means the company sold more policies, but medical payouts rose so sharply that the insurance business itself turned unprofitable.

The only reason the bottom line didn’t look worse was other income, which stood at ₹88 crore, slightly higher than last year’s ₹80 crore. Thanks to that cushion, Care managed to report a PAT of ₹17 crore, though that still looks tiny when compared to ₹61 crore a year ago.

In simple terms, profits didn’t decline because business was weak. They shrunk because hospitals got expensive.

The Real Problem Isn’t Growth. It’s Inflation.

Care is still selling policies, premiums are rising, and investment performance is strong. But the one metric that tells the whole truth — the combined ratio — is now above 1. That means Care is paying more in claims and expenses than it earns from underwriting. The business is surviving because investments are supporting it — which won’t always remain favourable.

So the real question isn’t:

“How fast can Care grow?”

It is:

“How quickly can Care control its medical payouts?”

If the company tightens pricing, improves claims management and uses reinsurance more strategically, profitability can bounce back. Until then, the business will keep growing… just not profitably.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.