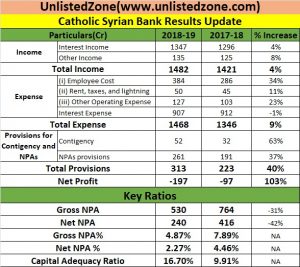

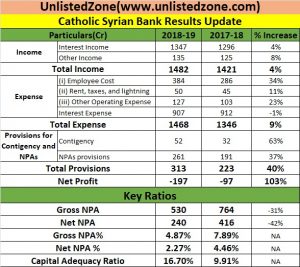

(i) The company has very high employees benefit expense.

(ii) They have close to 25% of employees expense in FY18-19 as compared to 20% last year.

(iii) The average employee expense in the industry is only 10%.

(iv) Plus this year they have done NPA provisioning of 261 Cr which is more than 94 Cr as per RBI guidelines. Had they not have done this they would have easily added 94 Cr in the bottom line. The Gross NPA and Net NPA have come down to 4.87% and 2.27% from 7.89% and 4.46%, last year which is big positive for the bank. The CAR improvement from 9% to 16% also augur well for the company going forward.

(v) The company has issued close to 8 Cr shares to Fairfax this year and now Fairfax holds 51% stakes in the bank. By doing this the CSB has become India's first foreign-owned bank.

(vi) The Fairfax, investment of Arm of Billionaire Prem-Watsa, has infused close to 1200 Cr in CSB.

(vii) The new management of Fairfax will be very positive for the functioning of the bank and CSB could be a very good turnaround story to watch out for.

(viii) The management is planning for IPO in 2019 as Fairfax eventually has to reduce the holdings in the bank from 51% to 41% as per RBI guidelines.