BVG India Limited, a prominent player in the integrated services sector, demonstrated strong financial and operational performance in FY24. With its vast service offerings and strategic growth initiatives, the company managed to sustain momentum in revenue and profitability despite challenges in certain business segments.

1. BVG FY24 Financial Performance

Strong Revenue Growth

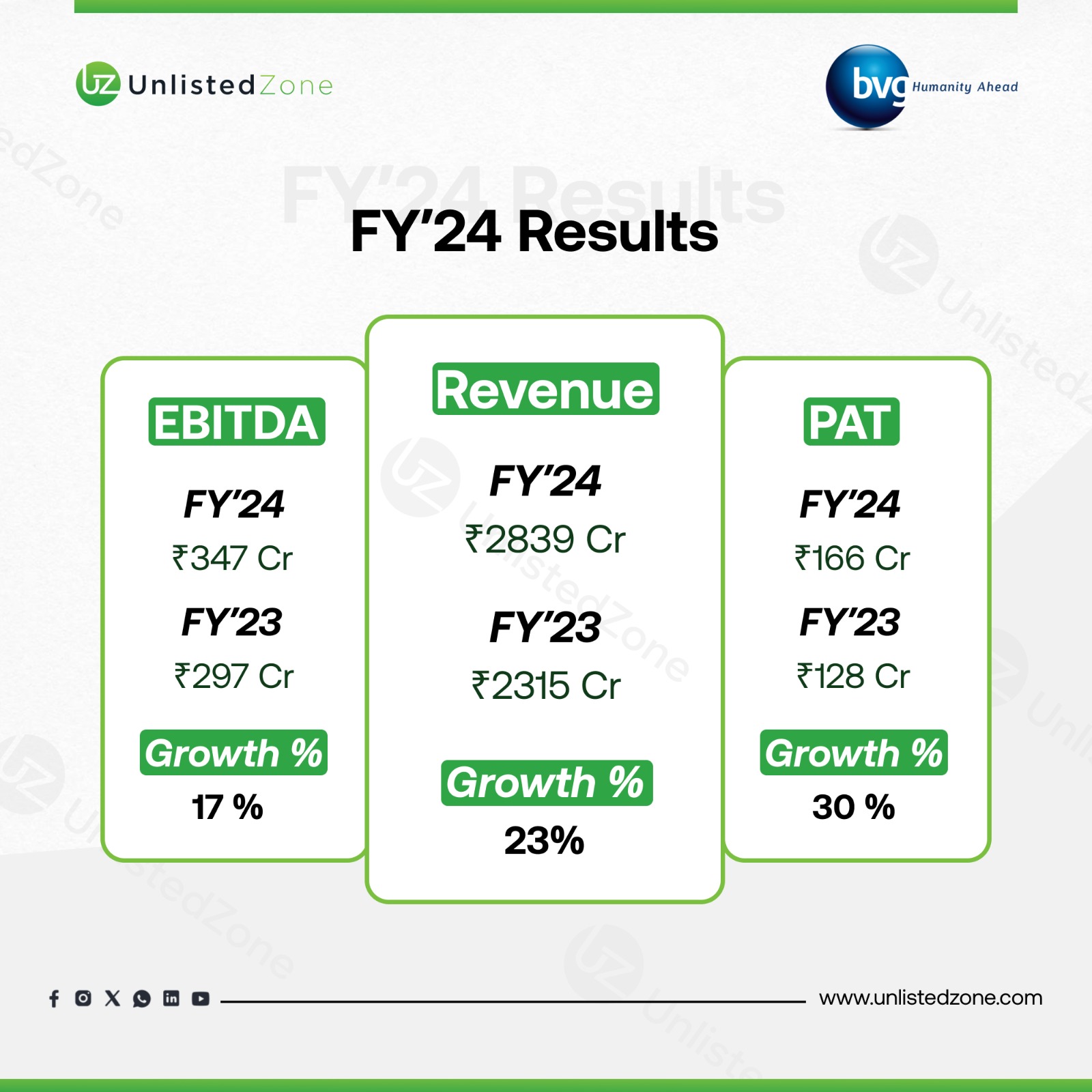

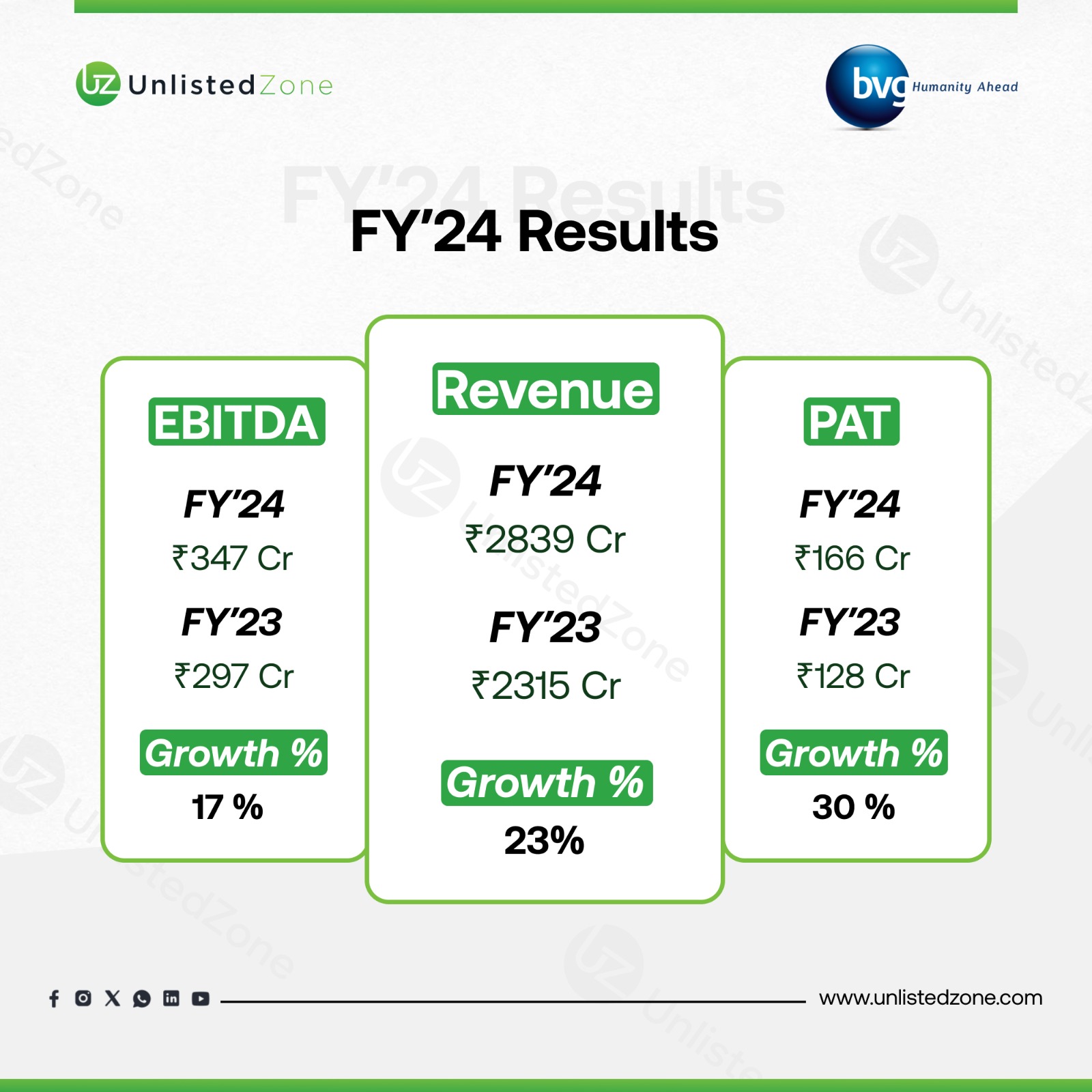

BVG India Limited achieved a total revenue of ₹2839 Cr in FY24, marking an impressive year-on-year growth of 22.66%. This growth can be primarily attributed to the Facility Services segment, which showed robust demand across various industries, including industrial, healthcare, commercial offices, and transportation. The company's focus on expanding its service offerings in sectors like airports, railways, education, and retail further drove the revenue increase.

Healthy Profitability

The company's operational efficiency translated into increased profitability. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) saw a growth of 17.36%, reaching ₹352 Cr. This healthy rise in EBITDA was complemented by a significant 30.19% increase in Profit After Tax (PAT), which amounted to ₹166 Cr in FY24. These figures reflect BVG's strong focus on optimizing costs and maximizing operational performance.

Improved Debt-Equity Ratio

BVG India Limited made considerable strides in strengthening its balance sheet. The debt-equity ratio improved from 0.47 in FY23 to 0.39 in FY24, indicating a lower reliance on debt financing. This improvement reflects the company’s prudent financial management and its ability to generate consistent cash flows. They have generated close to INR 174 cr cash from Operations.

2. Segment-Wise Revenue Performance

Facility Services: The Primary Revenue Driver

The Facility Services division remained the core of BVG India Limited’s operations. This segment generated a substantial revenue of ₹2669 Cr in FY24, driven by increasing demand for integrated facility management, mechanized housekeeping, transportation, and manpower supply. With substantial investments across industries like healthcare, industrial, and commercial offices, BVG has been able to scale its operations and secure long-term contracts.

Facility Projects: A Supportive Contributor

Although relatively smaller in comparison to the Facility Services segment, the Facility Projects division contributed ₹170 Cr in revenue. This segment handles projects like horticulture, gardening, landscaping, solar EPC contracts, and turnkey projects. While it contributed a smaller share to overall revenue, it remains a critical segment with potential for future growth as demand for these specialized services continues to rise.

Engineering Projects (Discontinued Segment)

BVG had exited its Rural Electrification (RE) projects business in FY19. While the segment is no longer active, the company continued to incur costs related to the operation and maintenance of previously completed projects. The discontinuation has allowed BVG to focus on its core services and reduce exposure to volatile project-based businesses.

3. Key Business Highlights

Market Leadership in Integrated Services

BVG India Limited continues to maintain its position as one of India's largest integrated services companies. With over 75,000 employees and a widespread presence across sectors, BVG’s dominance in the facility management sector remains unmatched. Its scale and operational expertise allow it to cater to some of the largest institutions and enterprises in the country.

Strategic Acquisitions

In FY24, BVG India Limited made several strategic moves, including the acquisition of BVG Security Services Private Limited as a wholly owned subsidiary. Additionally, the company incorporated BVG Property Management KBT Private Limited, expanding its service capabilities and providing more comprehensive solutions to its clients.

4. Revenue Bifurcation

BVG’s revenue streams are dominated by the Facility Services division, but its diversified approach ensures stable cash flows across multiple verticals.

- Facility Services Revenue: ₹2669 Cr in FY24, this is the largest revenue-generating segment, providing essential services like integrated facility management, housekeeping, and transportation.

- Facility Projects Revenue: ₹170 Cr, this segment undertakes specialized projects in areas like horticulture, landscaping, and solar EPC contracts.

5. Valuation of BVG Unlisted Share

As of FY24, BVG India Limited’s market capitalization (Mcap) stood at ₹4,300 crore. The company’s valuation on a price-to-earnings (P/E) basis is 25x, which reflects investor confidence in BVG’s ability to maintain its growth trajectory. While the valuation may seem on the higher side, it is justified by the company’s market leadership, strong revenue growth, and profitability.

6. Strategic Outlook and Conclusion

BVG India Limited has firmly established itself as a leader in the integrated services sector. The company’s ability to consistently deliver robust financial performance, its strategic focus on expanding service offerings, and its prudent financial management make it well-positioned for sustained growth in the coming years. With strong sectoral tailwinds, particularly in industries like healthcare, education, and industrial services, BVG is expected to continue its upward trajectory.

The continued strengthening of the balance sheet, with reduced debt levels and increased profitability margins, provides a solid foundation for future investments. Additionally, the company's strategic acquisitions, such as BVG Security Services and BVG Property Management, highlight its proactive approach toward broadening its service portfolio and reinforcing its competitive edge.

In conclusion, BVG India Limited’s performance in FY24 reflects its resilience, operational excellence, and strategic foresight, positioning it well for sustained growth in the years to come.