For decades, Balaji Wafers has been one of those rare Indian brands that didn’t just sell snacks — it sold pride.

Started in a Rajkot cinema canteen, the company became a regional cult brand before quietly emerging as one of India’s most profitable snack makers.

Now, it’s in the headlines again — this time for a big-ticket deal.

General Atlantic is reportedly acquiring a 7% stake in Balaji Wafers for ₹2,500 crore, valuing the company at roughly ₹35,700 crore.

So what does this mean for Balaji, the snacking industry, and investors eyeing India’s next FMCG unicorn?

Let’s break it down.

A) The Humble Beginnings — Rajkot’s Snack Revolution

In the early 1980s, the Virani brothers — Chandubhai, Bhikhubhai, and Kanubhai — ran a small canteen inside Rajkot’s Astron Cinema.

When people started asking for their wafers to take home, the brothers realised they were onto something big.

By 1989, Balaji Wafers Pvt. Ltd. was born.

Their success formula was simple — “Zyada Chips, Kam Hawa.”

While multinational players like Pepsi’s Lay’s sold glamour and air-filled packs, Balaji doubled down on value and volume —

They weren’t chasing cool; they were chasing consistency — and they won.

B) The Rise of a Regional Giant

Balaji focused on depth before width.

It first conquered Gujarat, then slowly expanded to Maharashtra, Rajasthan, and Madhya Pradesh — regions with similar taste profiles.

Over the years, it built a distribution network of over 1,200 dealers and 3 lakh retailers, all without celebrity endorsements or glitzy campaigns.

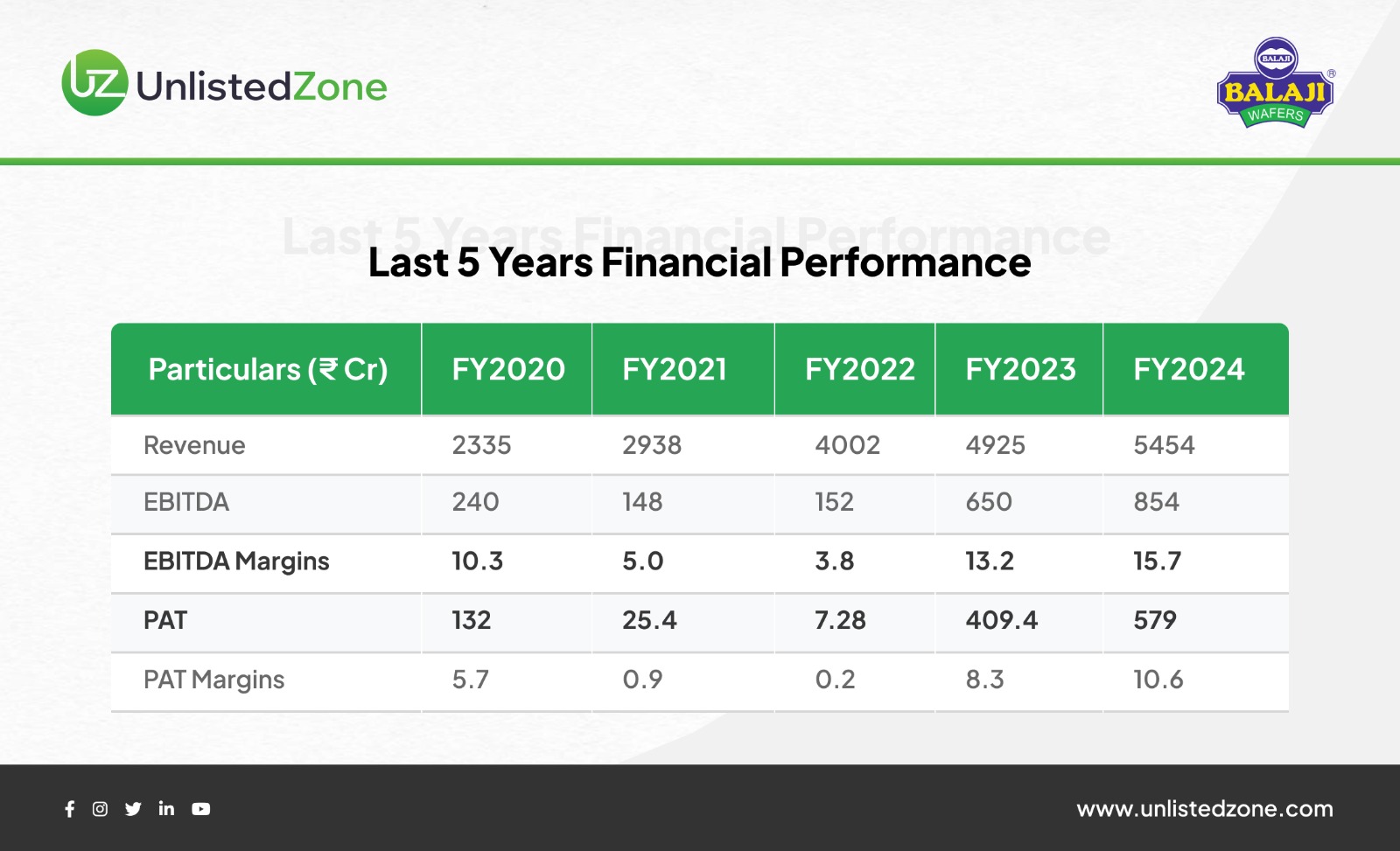

And the numbers? They speak for themselves:

That’s nearly 42% growth in profit YoY, and a 4-year CAGR of 45% — a phenomenal run for a family-run FMCG brand.

Balaji’s EBITDA margin stands around 13-15%, comparable to listed peers like Bikaji Foods and Haldiram’s, proving it’s not just growing — it’s growing efficiently.

C) The Deal: Crunching the Numbers

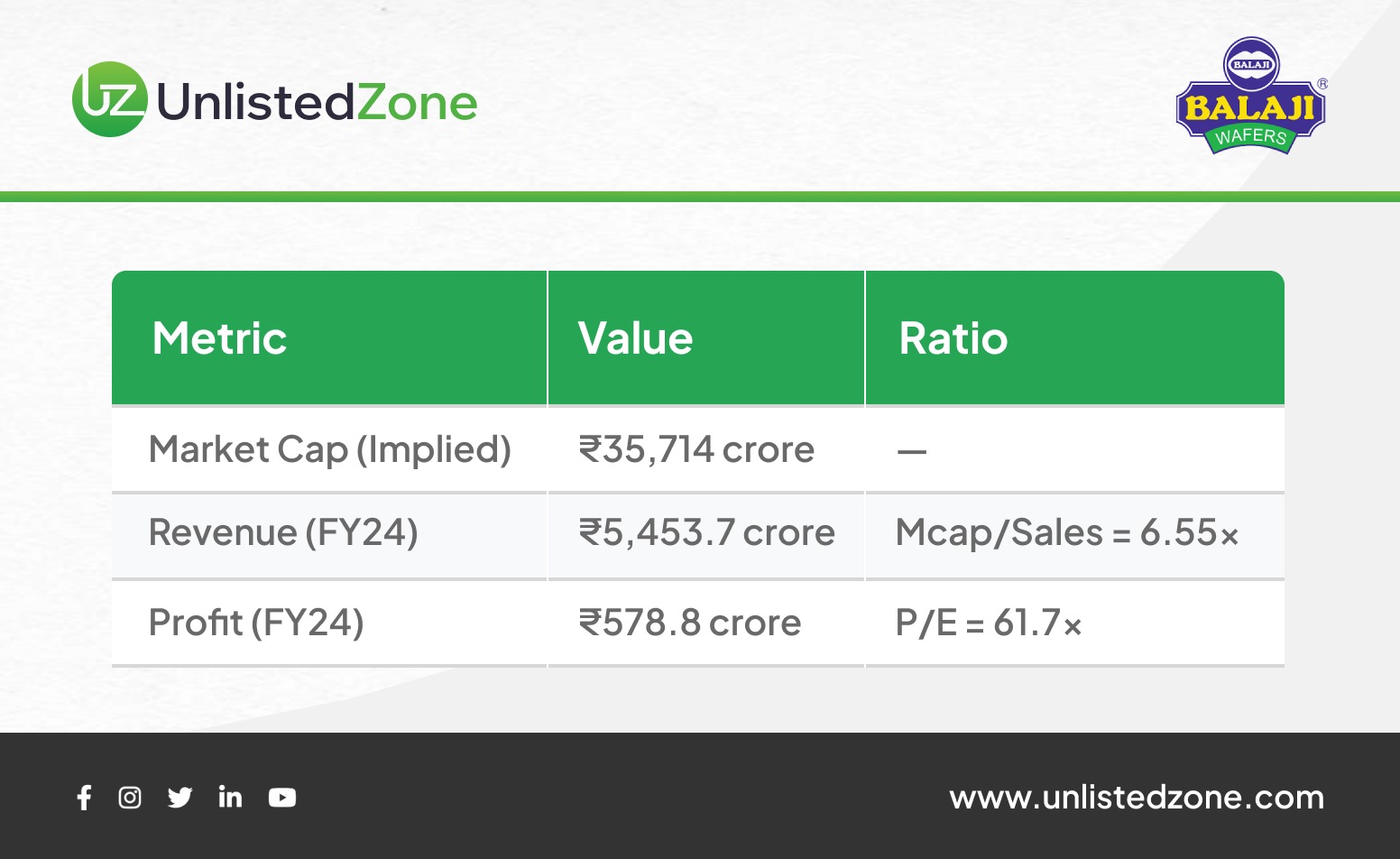

At ₹2,500 crore for a 7% stake, Balaji’s implied valuation comes to ₹35,714 crore.

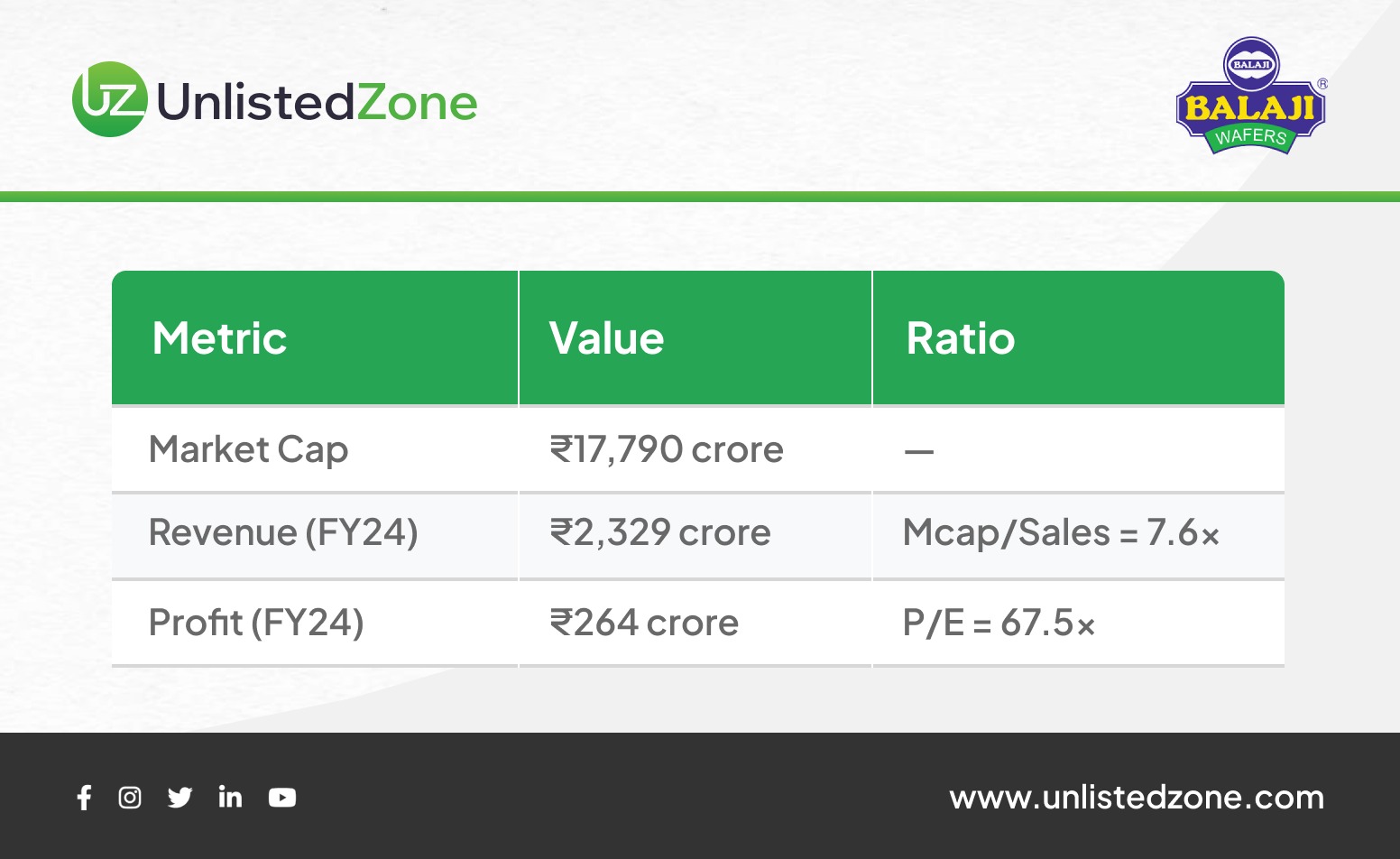

On FY24 financials:

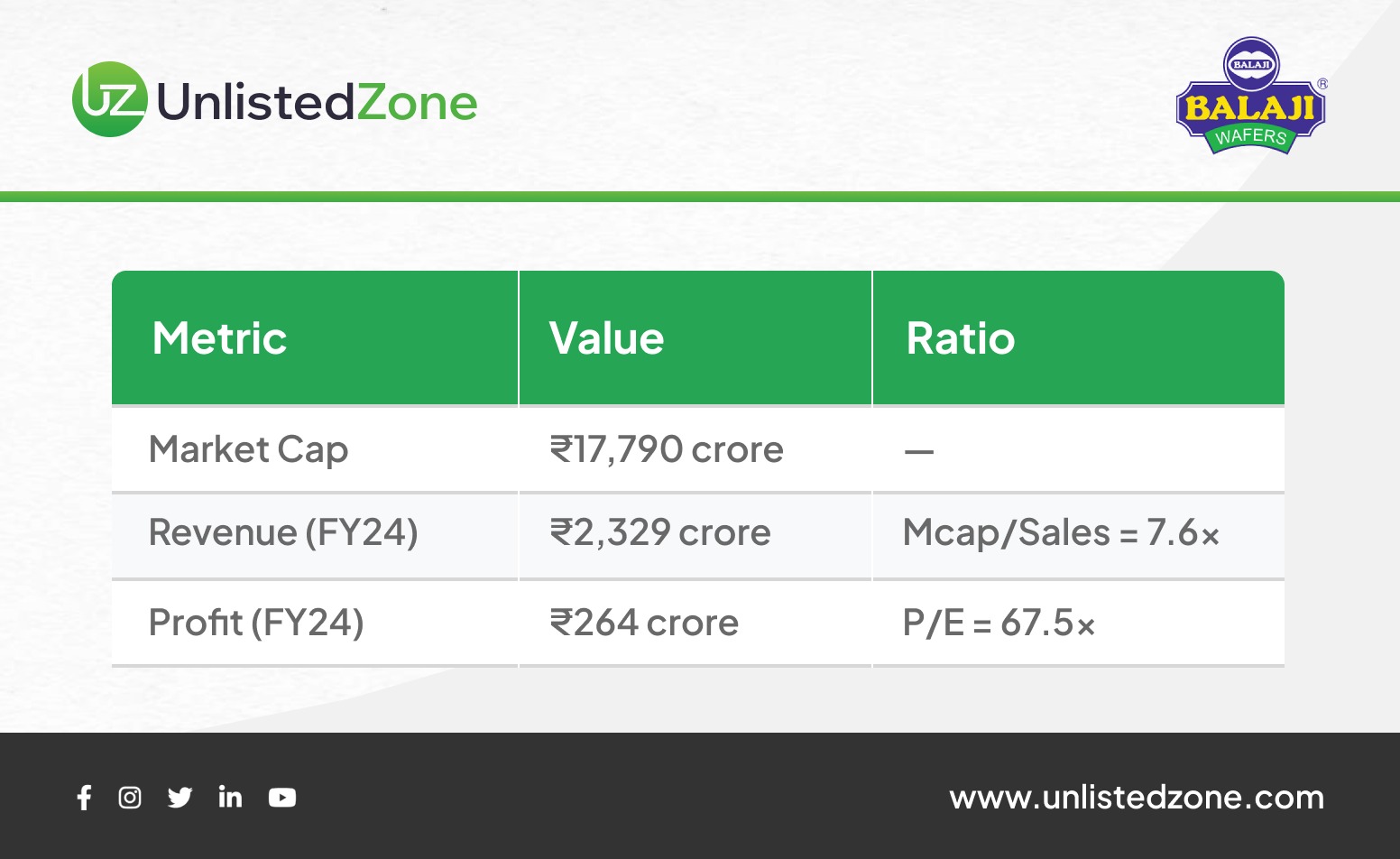

D) Peer comparison — Bikaji Foods (listed):

So, Balaji is being valued at slightly lower multiples than Bikaji, despite being twice the size and more profitable — a sign that the deal leaves some upside for investors.

E) The Secret Ingredient — “Value in Every Bite”

Balaji’s strategy has always revolved around one thing: the customer shouldn’t feel cheated.

Where others gave air, Balaji gave quantity.

Its flavours stayed rooted in Indian palates — Masala Masti, Tomato Twist, Chataka Pataka — the kind of names you see in local shops, not supermarket shelves.

This “value-first” identity made Balaji a household name across small towns, schools, and highway dhabas — places where brand loyalty runs deep.

Even as competitors fought on advertising, Balaji fought on trust.

So Why Sell Now?

For years, Chandubhai Virani proudly said, “We don’t need outside investors.”

So why a sale now — and why to General Atlantic?

Three reasons stand out:

-

The Next Generation Effect:

The younger Viranis want to take Balaji national — and that needs serious branding and marketing budgets.

-

Competition is Heating Up:

The ₹50,000 crore snack market is dominated by ITC, PepsiCo, Haldiram’s, and Bikaji. Competing nationally means big ad spends, pan-India logistics, and retail tie-ups.

-

IPO Benchmarking:

A 7% sale to a global PE player sets a valuation benchmark and helps Balaji prepare for a potential IPO over the next few years.

What’s Next for Balaji

Expect a shift from a regional powerhouse to a national FMCG challenger:

-

Aggressive branding – think celebrity tie-ups, sports sponsorships, and ATL advertising.

-

New product categories – baked snacks, extruded corn products, and premium offerings.

-

Tech-driven supply chains – to keep costs in check as it scales nationwide.

-

Professionalisation – bringing corporate governance and analytics-led decision-making, hallmarks of PE-backed firms.

UnlistedZone’s Take

-

The ₹35,700 crore valuation translates to ~62× FY24 earnings, which may sound expensive, but reflects the brand’s consistency, distribution muscle, and growth potential.

-

Unlike many legacy FMCG names, Balaji is still in its expansion phase — meaning double-digit growth could continue for years.

-

The General Atlantic entry isn’t just about money — it’s about credibility and structure. It paves the way for an eventual IPO or secondary sale at higher multiples.

-

For investors in India’s private market, Balaji’s story reinforces one lesson: great consumer brands take time, trust, and taste to build — but when they click, they create generational wealth.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.