Company Overview

Assam Carbon Products Limited is a market leader in Carbon and Carbon-related products with over five decades of industry presence. The company caters to diverse sectors such as Railway Traction, Cement, Steel, Sugar, Mines, Power, Petrochemical, and Chemical Process Industries.

The company commissioned its first plant 50 years ago and later entered into a joint venture with Morgans, a collaboration that lasted until 2016. This partnership helped Assam Carbon gain access to world-class technology, manufacturing practices, and machinery, strengthening its leadership position in India and across export markets.

In 2016, the company became an independent entity after acquiring all Morgan shares in India. Since then, it holds perpetual rights to manufacture products based on Morgan’s technology.

Assam Carbon operates manufacturing plants in Guwahati, Assam, and Patancheru, Telangana, employing around 350+ people. Its diverse product portfolio includes:

-

Carbon Brushes

-

Current Collectors

-

Railway Signaling Contacts

-

Carbon Seals & Bearings

-

Carbon Gland Rings

-

Steam Joints, Thrust Pads, Radial Bearings

-

Graphite Felt & Insulations

Q1 FY26 Financial Performance

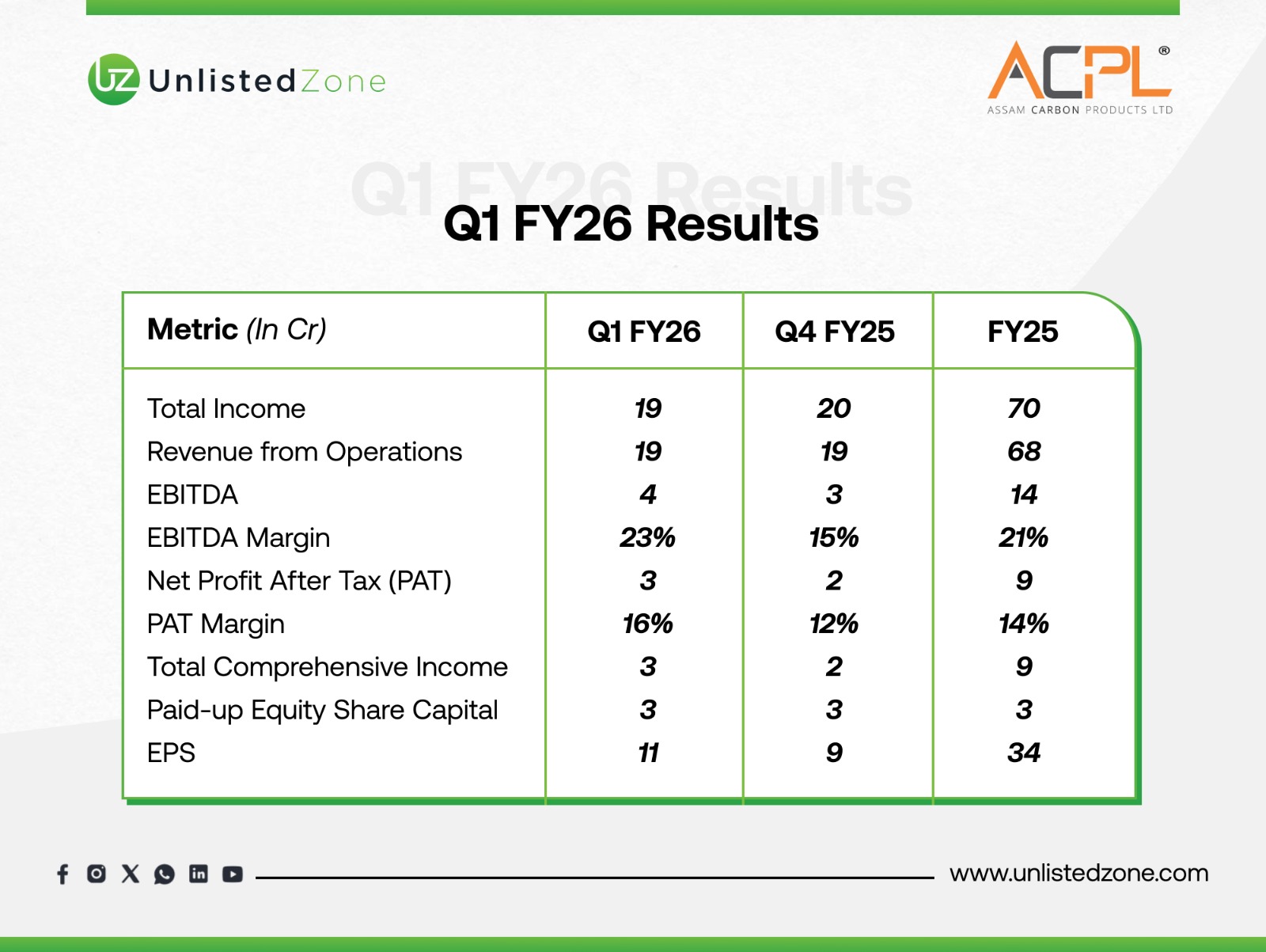

Below is the detailed financial performance of Assam Carbon Products Limited:

Key Insights from the Results

-

Stable Revenue – The company’s Q1 FY26 Revenue from Operations stood at ₹18.94 crore, showing only a marginal dip compared to ₹19.45 crore in Q4 FY25. This indicates steady demand across its product categories.

-

Significant EBITDA Growth – EBITDA surged to ₹4.43 crore in Q1 FY26 from ₹2.88 crore in Q4 FY25, reflecting operational efficiency and better cost management. The EBITDA margin improved sharply from 14.80% to 23.40%, highlighting stronger profitability.

-

Healthy Profitability – PAT rose to ₹3.01 crore in Q1 FY26 compared to ₹2.37 crore in the previous quarter, with the PAT margin expanding from 12.20% to 15.90%. This growth was driven by higher operating margins and stable revenue streams.

-

Earnings Per Share (EPS) – EPS for Q1 FY26 came in at ₹10.94, up from ₹8.63 in Q4 FY25, indicating improved returns for shareholders.

Conclusion

Assam Carbon Products Limited continues to showcase consistent financial performance backed by its diversified product portfolio and long-standing expertise in carbon technologies. The improvement in EBITDA and PAT margins in Q1 FY26 reflects strong operational discipline, even with stable revenue levels.

For investors tracking unlisted shares, Assam Carbon stands out as a niche industrial player with steady demand, high entry barriers, and a history of technological leadership. However, as with any investment in the unlisted space, one should conduct due diligence before taking exposure.

Disclaimer: UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information shared on our platform — including articles, posts, investment insights, and price trends — is solely for educational and informational purposes. We do not provide any buy/sell recommendations or financial advice. Investors are advised to do their own due diligence or consult a SEBI-registered advisor before making any investment decisions. Investments in unlisted and pre-IPO shares are subject to market risks, including liquidity risk.