1. Steps taken to improve Profitability by Pharmeasy in Fy23

a) Marketing and growth expenses are reduced as a % of revenue from 7.9% in FY’22 to 3.3% in FY’23, with Q4’23 at 0.6% of revenue. It means total reduction of INR ~504 Cr in Fy22 to INR ~201 Cr in FY23.

b) EBITDA margins (normalised) improved from -13.6% in FY22 to -8.4% in FY23 and 1.6% in three months ended June 2023.

c) Increasing share of margin accretive private label in our products business from 0.7% to 1.4% during this period from FY22 to FY23.

d) They are now focussing on investing significantly in enhancing their cross-sell capabilities to offer high margin services to customers across the businesses. e) Significant savings were realized on our employee benefit expenses as we brought synergies across multiple acquired business by consolidating team and streamlining organisation structure.

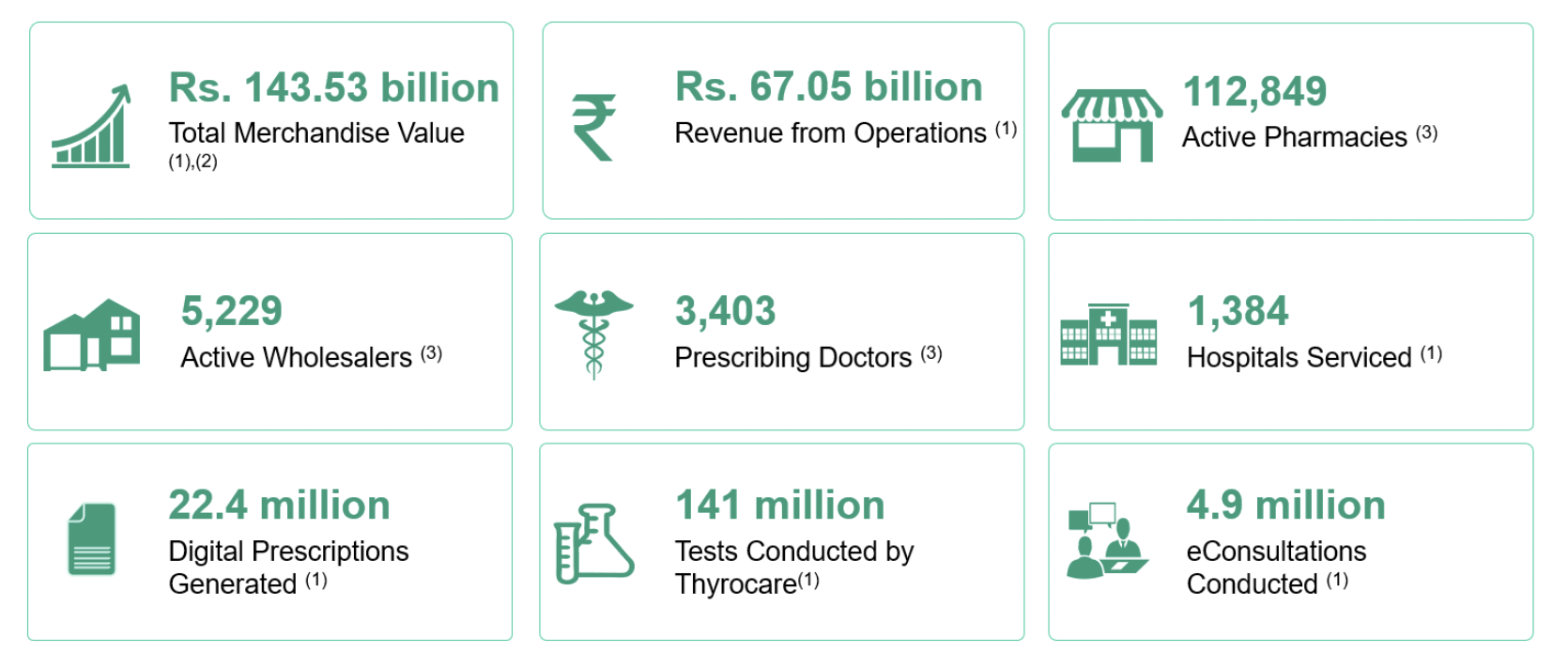

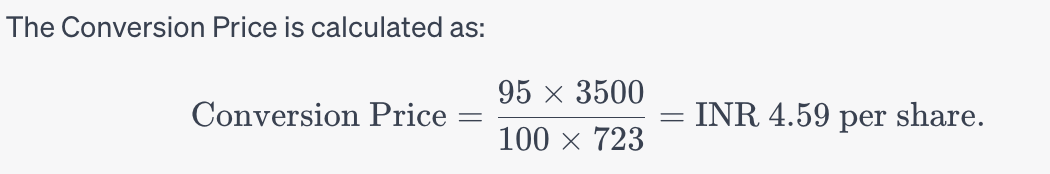

2. Pharmeasy Interesting Facts in Fy23

a) On the PharmEasy marketplace, the diagnostics business expanded due to cross-sell strategy. In Fiscal 2023, 50 lacs customers, or 13.8% of total PharmEasy consumers, used their diagnostic services.

b) Thyrocare business has now fully recovered from the Covid led sectoral growth in FY21 & FY22 and is now growing its non-covid business. Thyrocare revenue & sample growth of non-covid business has grown +22% (non-covid revenue growth), +39% (sample growth) YoY in FY23.

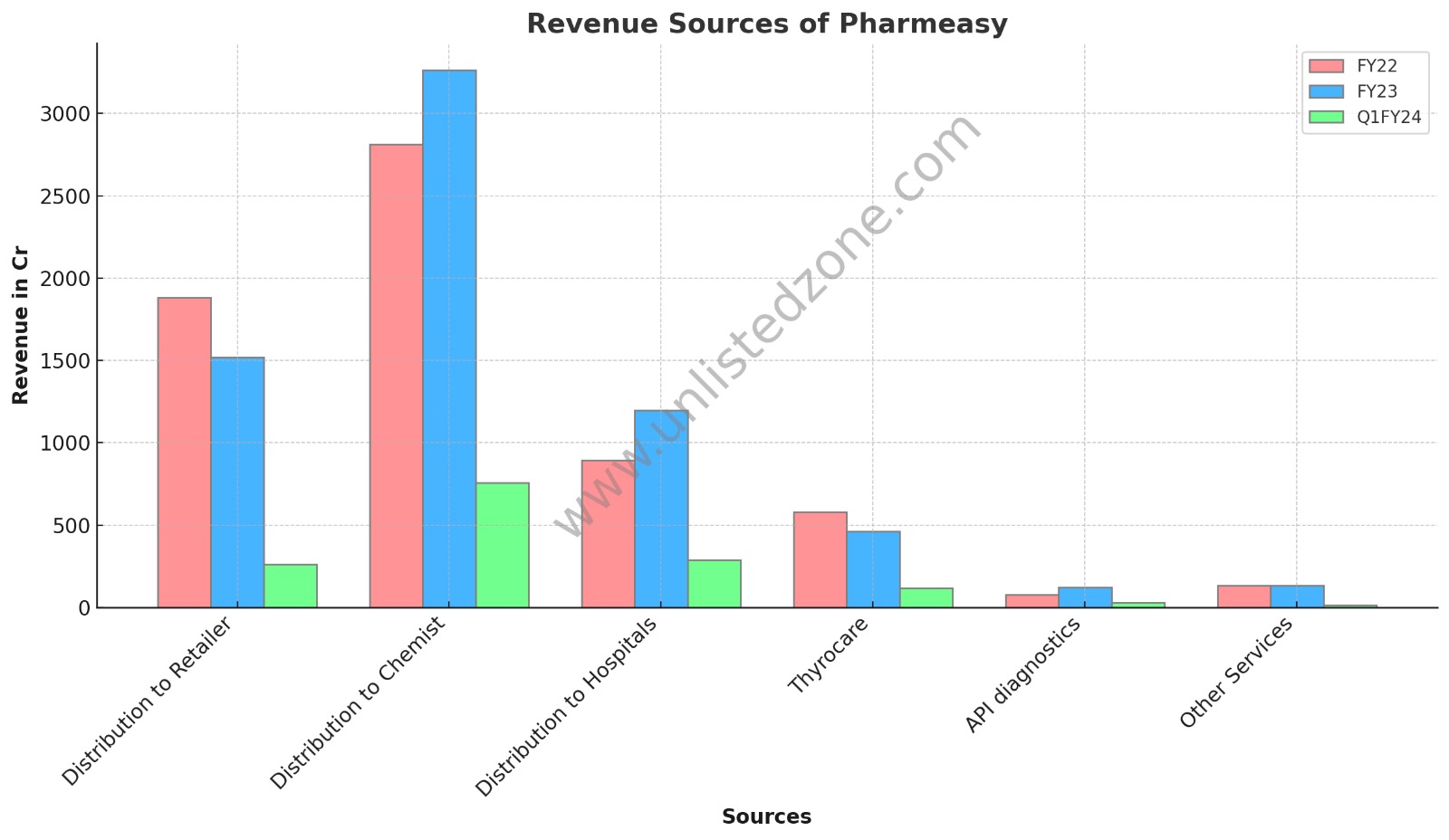

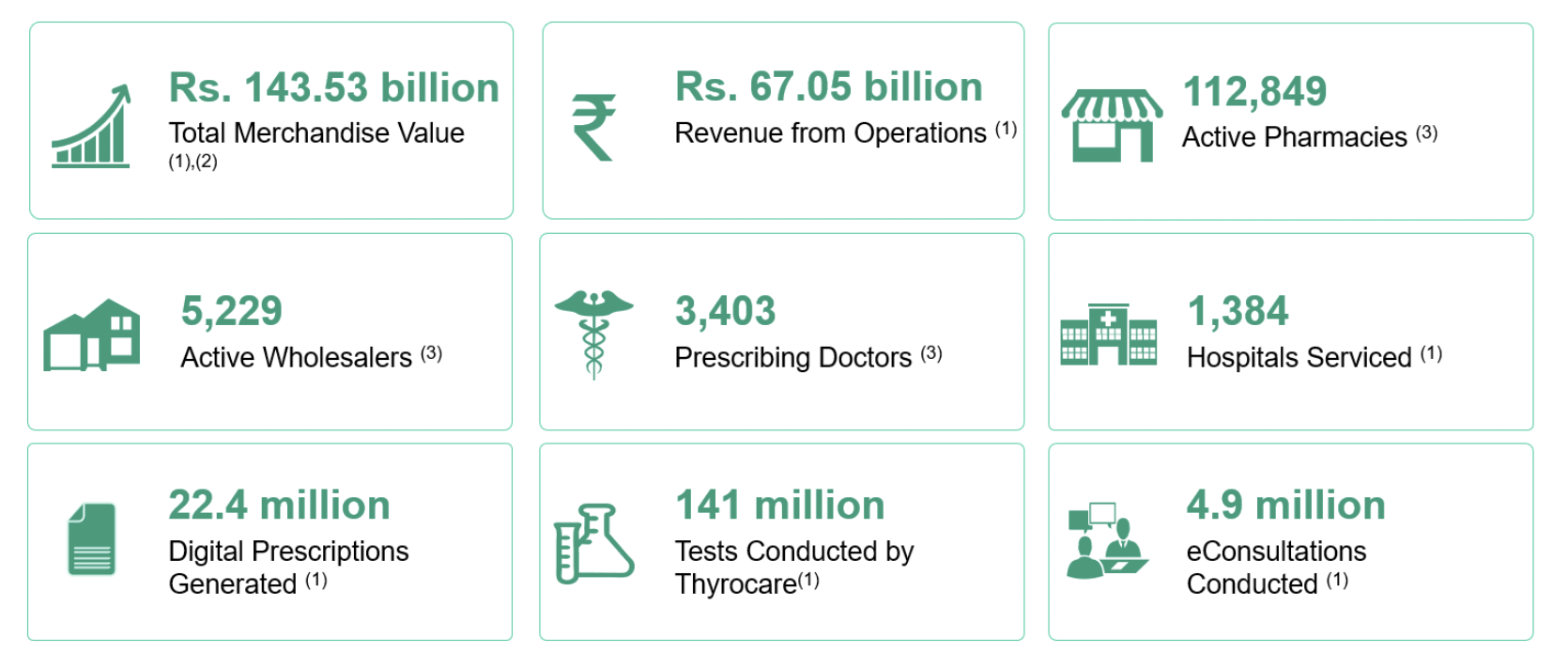

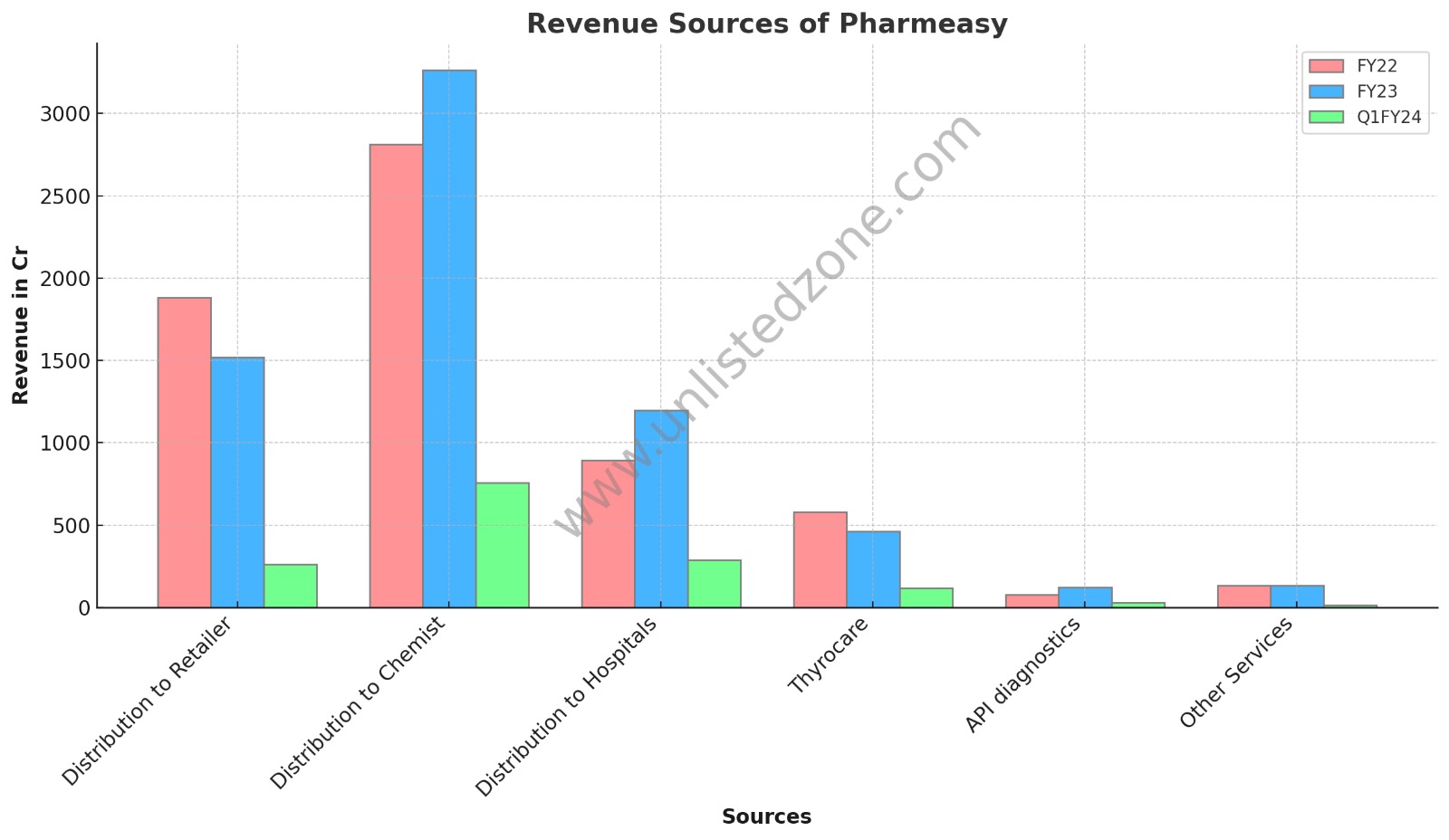

3. Revenue and Variable Expenses of Pharmeasy in Fy22, Fy23 and Q1Fy24

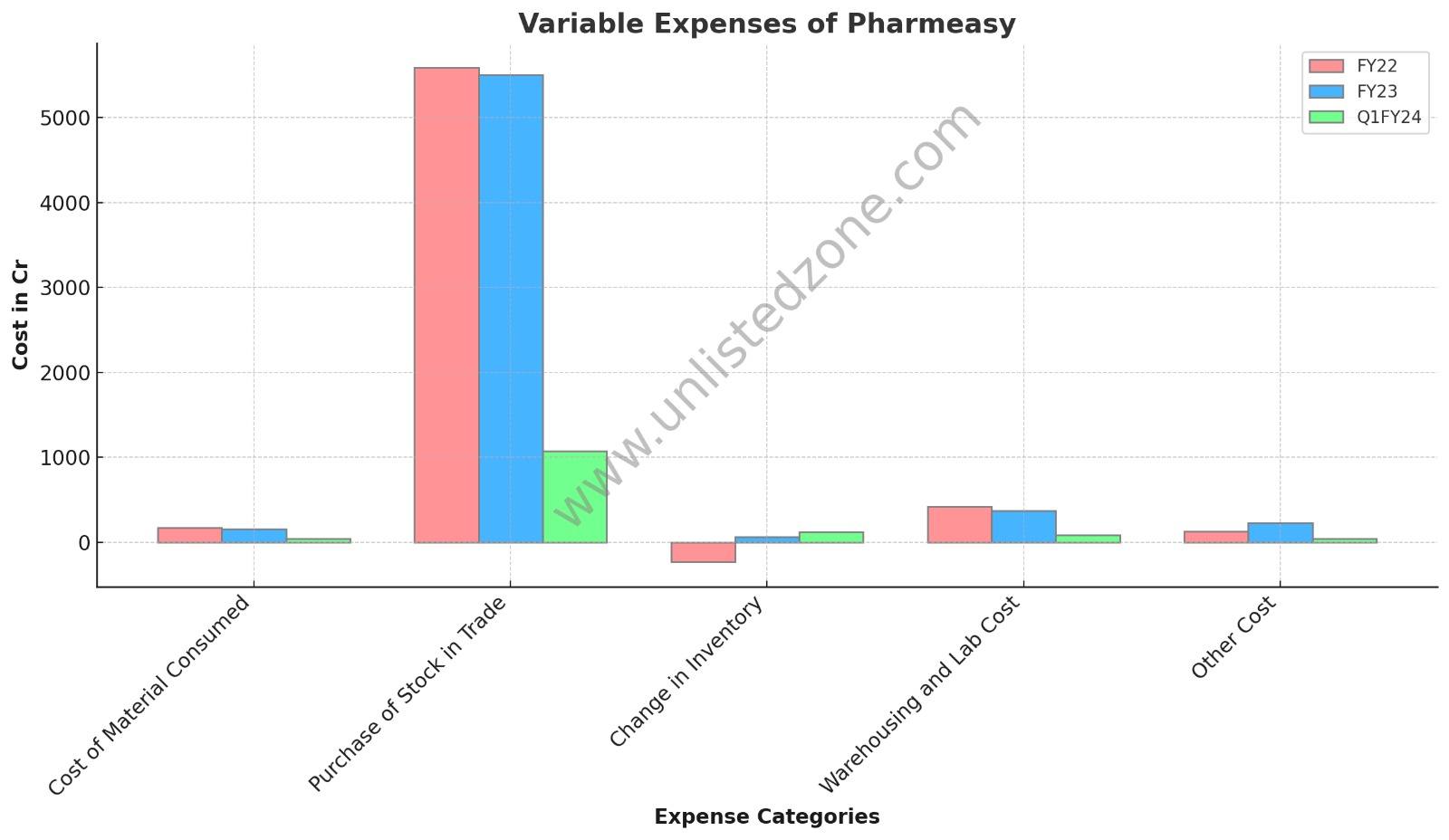

a) The revenue has increased by 5% from INR 6381 Cr in Fy22 to INR 6702 Cr in Fy23. Revenue from sale of goods increased by 6.8% to INR 5983 Cr in Fiscal 2023 from INR 5600 Cr in Fiscal 2022. All segments reported growth in FY22 and FY23, except for sale to Retailers, which grew in FY22 by about 52.7% but declined in FY23 by 19.3%. The historical growth was mainly due to increased marketing in FY22, which was reduced in FY23. The drop in FY23 sales to Retailers resulted from Management's strategy to prioritize profitability, disincentivizing low-value orders, and cutting marketing spends. This affected the Retailer segment, but there was growth in the chemists and hospitals network for other products.

b) Pharmeasy has significantly reduced the Sales and Promotion expenses by 281 Cr in Fy23. Overall, Other expenses have reduced from INR 1566 Cr in FY22 to INR 938 Cr in FY23. Reduction of 40%.

c) The Contribution margin ( Revenue - Variable Cost ) has improved slightly from INR 316 Cr in FY22 to INR 389 Cr in Fy23.

d) However, still due to high Sales and Administration expenses Pharmeasy is in losses. The losses has however, reduced considerably from 3970 Cr in Fy22 to 2283 Cr in Fy23.

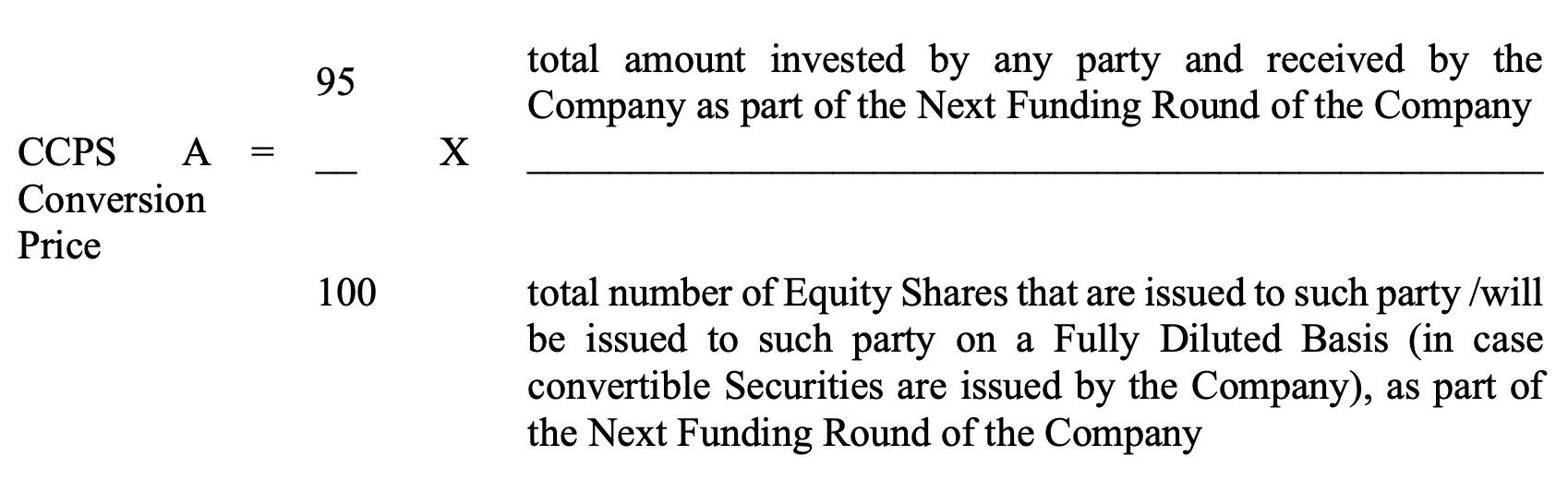

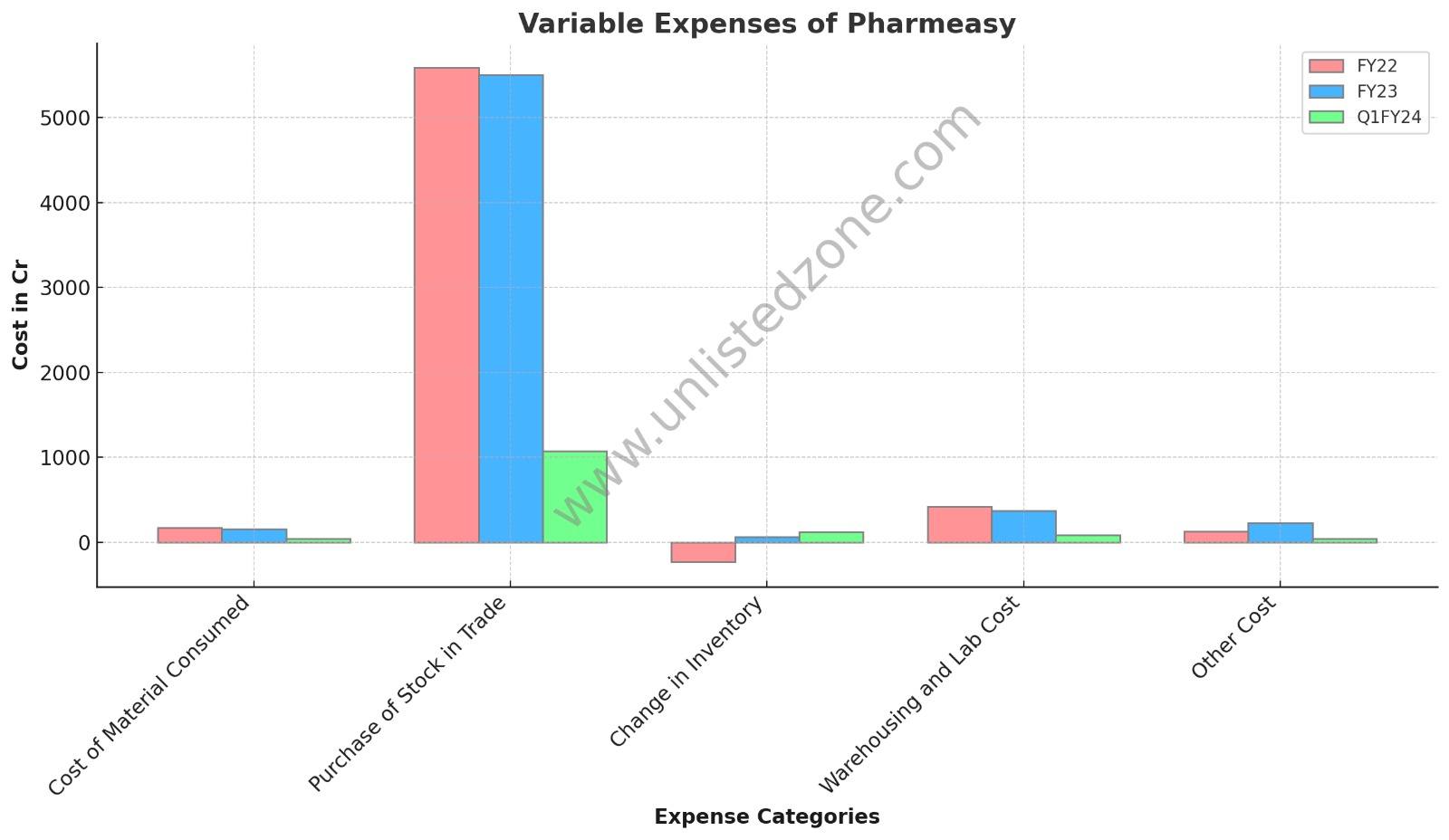

4. Capital Structure and Total Outstanding Shares of Pharmeasy

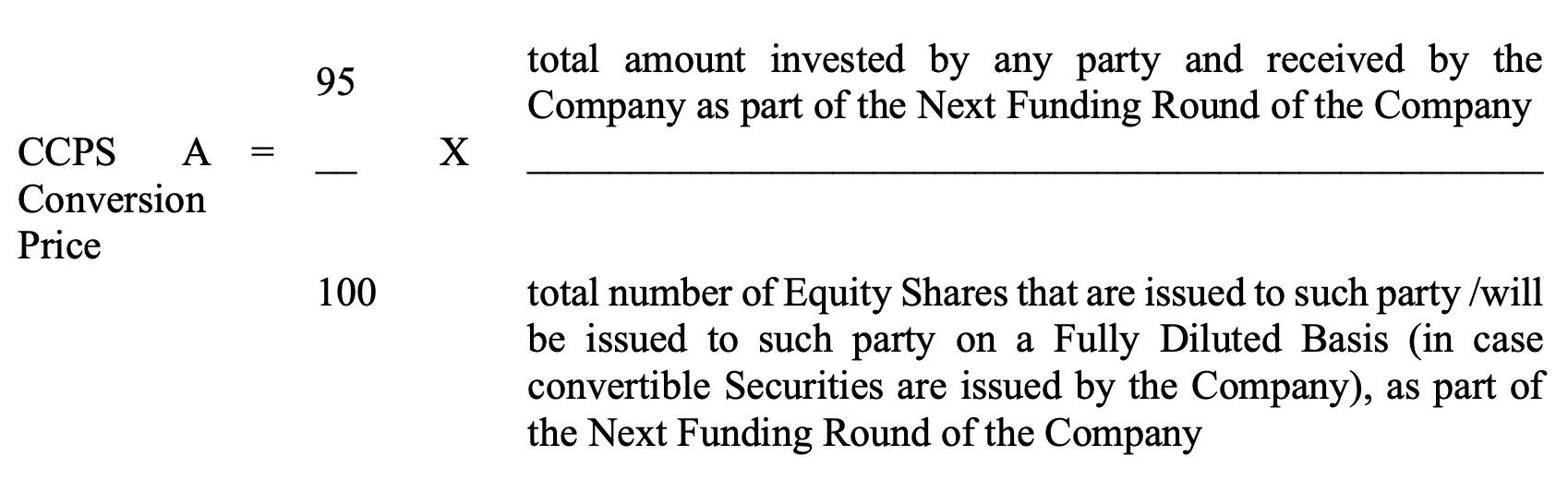

a) As on 31.03.2023, they have ~614 Cr Equity Shares and ~5.48 Cr Series A CCPS outstanding. b) These ~5.48 Cr Series A CCPS were issued via Right Issue in Sept and Nov-22, in three tranches at INR 100 per share thereby raising ~548 Cr. However, the conversion formula for these Series A CCPS into equity shares is as below.

Pharmeasy's Right Issue Details:

a) Pharmeasy is planning to raise approximately INR 3500 Cr through a Right Issue. b) The price per share for the Right Issue is set at Rs.4.84. c) The company will issue around ~723 Cr Series B CCPS.

Conversion Details for Right Issue done by Pharmeasy in Sept and Nov-22

a) Investors who participate in the Right Issue at Rs.100 will undergo a conversion process for their shares.

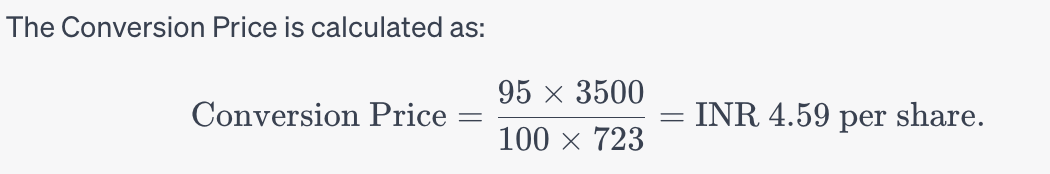

b) The Conversion Price is calculated as:

c) With this conversion price, for every 1 Series A CCPS, investors will receive 21 Equity Shares. d) As a result, the initial ~5.48 Cr shares will be converted into ~115.08 Cr shares.

Total Shares Post Right Issue:

a) After the Right Issue and conversion, the total shares outstanding will be:

b) Total Shares=614 Cr+115 Cr+723 Cr= 1452 Cr.

( Please note: We have not taken into Account the Anti-Dilutive rights of Shares held by investors in different classes prior to conversion to Equity Shares before IPO ).

5. Valuation of Pharmeasy

Currently, in the unlisted market the Pharmeasy Unlisted Share Price is INR 15 per share. Mcap = 15*1452 = ~21000 Cr ( Current Unlisted Market Price) = $2.6 Billion Mcap = 5*1452 = 7260 Cr ( Current Right Issue Market Price ) = $0.90 Billion

6. Conclusion

"The growth of Pharmeasy in FY23 has slowed down a bit. The primary reason for this is their retail business, where they have reduced marketing expenses and discounts. There has been a 20% decline in the retail sector and a 20% decline in the diagnostic business. On the other hand, there has been a growth of 16% in the distribution to chemists and 33% in the hospital business. Overall, looking at FY23, it seems to have been a year of consolidation for the company. Rather than focusing on growth, the company has emphasized profitability. This approach has reduced their loss from ~4000 Cr in FY22 to ~2200 Cr in FY23. In addition, they have aligned the operations of many of their businesses and have undertaken cost-cutting measures. If the proposed rights issue is successful, Pharmeasy will have the funds necessary for survival. The most significant advantage will be that they won't have to sell any of their businesses. As the company is focusing on reducing expenses, there's hope that in the next 2-3 years, the company might become profitable."