Patanjali Ayurveda (PAL) is an India based consumer and FMCG company, headquartered in Haridwar (Uttrakhand), started by Yog guru Swami Ramdev and Acharya Balkrishna in 2006. The company came into prominence in the early 2010s, when it focused on igniting sentiments of being an 'Indian company' among the customers. Patanjali Ayurveda is a home grown business miracle of sorts with a mission to make India an ideal place for the growth and development of Ayurveda and anything natural for the rest of the world.

History

It is a registered company under the Company’s Act, 1956, having its registered office in New Delhi and its headquarters and manufacturing units located in Haridwar, Uttarakhand. The roots of the establishment date back to 1997, when Baba Ramdev and Acharya Balkrishna started the venture as a small pharmacy in Haridwar. In 2006, Patanjali Ayurveda Limited was established as a private limited company and subsequently converted into a public limited company in 2007, with an objective of establishing the science of Ayurveda in accordance and coordination with the latest technology and ancient wisdom.

Business Model

The company manufactures mineral and herbal products. However, the company has rapidly grown from medicinal and remedy based entity to a leading player in packaged food, water, beverages, pulses, spices, religious, personal care, homecare, dairy and other FMCG products. It also introduced the Coronil kit to cure Covid-19, which leads to controversies.

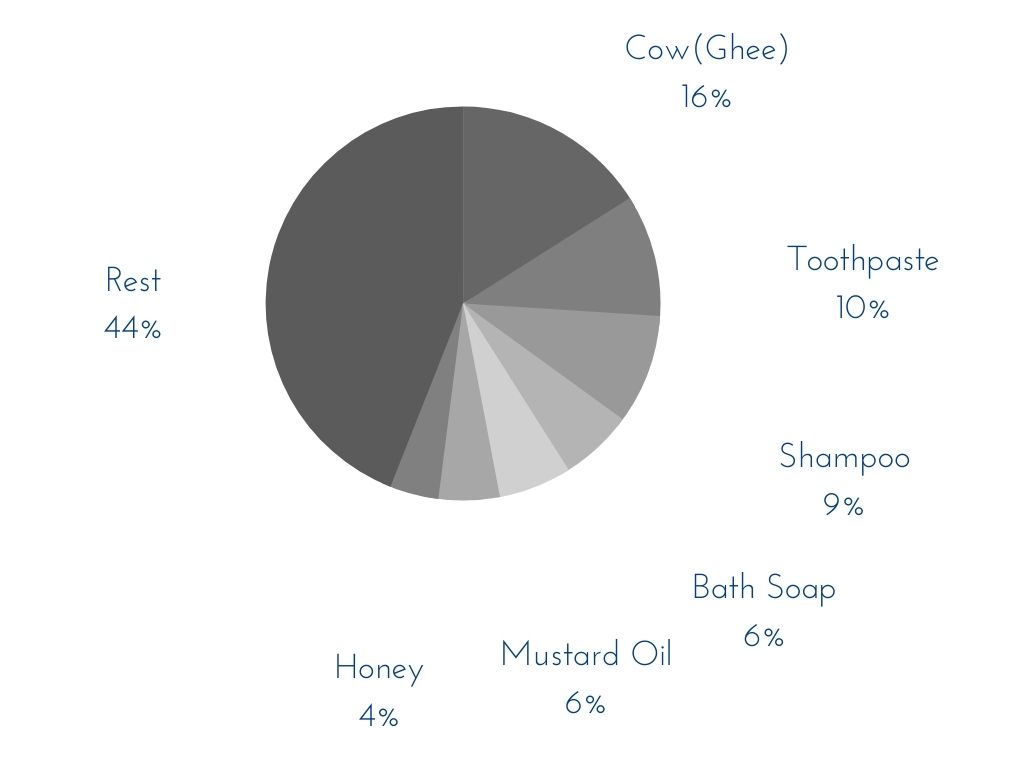

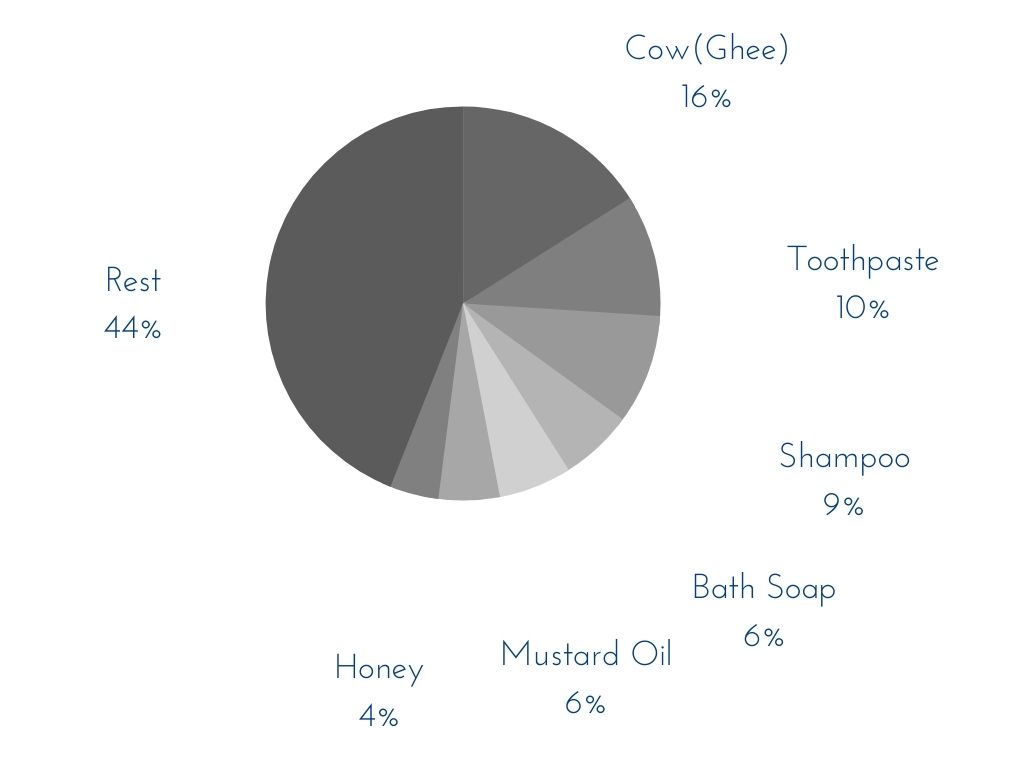

Patanjali most sold product is Cow(Ghee) with sales of

(1467 Crores), followed by Toothpaste

(940 Crores) and them Shampoo

(850 Crores). These three products contributes ~35% of the total sales.

Advertisement Strategies

Advertisement Strategies

Baba Ramdev, a well known and highly acknowledged name in Indian household, led the advertising campaign for the company. For any FMCG company, advertising and promotions typically account for 12–20 percent of revenue expenditure, but this was significantly taken care of by Baba Ramdev’s branded house strategy. A minimal advertising budget which included few commercials and with the employees acting as volunteers in brand promotion aided in cutting down on the advertising and promotion expenditure. All these were attributed to the fact that the company was void of any financial burden. The Patanjali Ayurveda is financially well placed, and the company was started with an investment of Rs 40 Crores, which was initiated by Baba Ramdev from his yoga camps, television shows on private channels, and donations.

Pricing

Baba Ramdev is running Patanjali with a sole objective of providing quality FMCG products with low price as compared to its competitors. Patanjali typically provides products with 10-30% cheaper than competitors. Along with that it has infused spirit in Indian audience to embrace

desi products and boycott MNC, who are here only to make profit.

Sales and Distribution

Patanjali Ayurveda sells its products through nearly 5,000 outlets. Patanjali also sells its products online. It has its footprints on some of the railway stations and airports Patanjali Ayurveda has tied up with various retail conglomerates like Pittie Group and Future Group, Reliance Retail, Hyper city. Patanjali Ayurved has also started its FMCG expansion in the form of dealership and distributorship channels across the country and expects wider growth in overseas distribution as well.

Patanjali forced MNC competitors to make Ayurveda Products

Seeing the rapid growth of Patanjali in the Indian FMCG space with its sales touching Rs. 10,000 crore specially around FY16-17, has forced other FMCG brands like Colgate, Nestle, Dabur and Hindustan Unilever rapidly focused on Ayurveda related products.

1. "

Colgate-Palmolive (India) market share had reduced from 57% in FY14-15 to 53% in FY17-18 due to Baba Ramdev Patanjali resurgence. Due to which they were forced to launch Vedshakti, an Ayurveda toothpaste, to counter Baba Ramdev Dant Kranti.

2. Consumer goods major, Hindustan Unilever (HUL) has launched herbal and natural supplements to compete with Baba Ramdev’s Patanjali.

However, after 2016-17, the Baba Ramdev was not able to maintain the quality, and has increased pricing of products which has resulted in reduction of sales. Moreover, the other MNC giants have made many changes in their products portfolio as per Ayurveda standards that helped them to regain lost market share. Due to which, Patanjali which was predicting to double its sales to over Rs. 20,000 crore in FY20 from FY16 has only achieved sales of Rs.9000 crore.

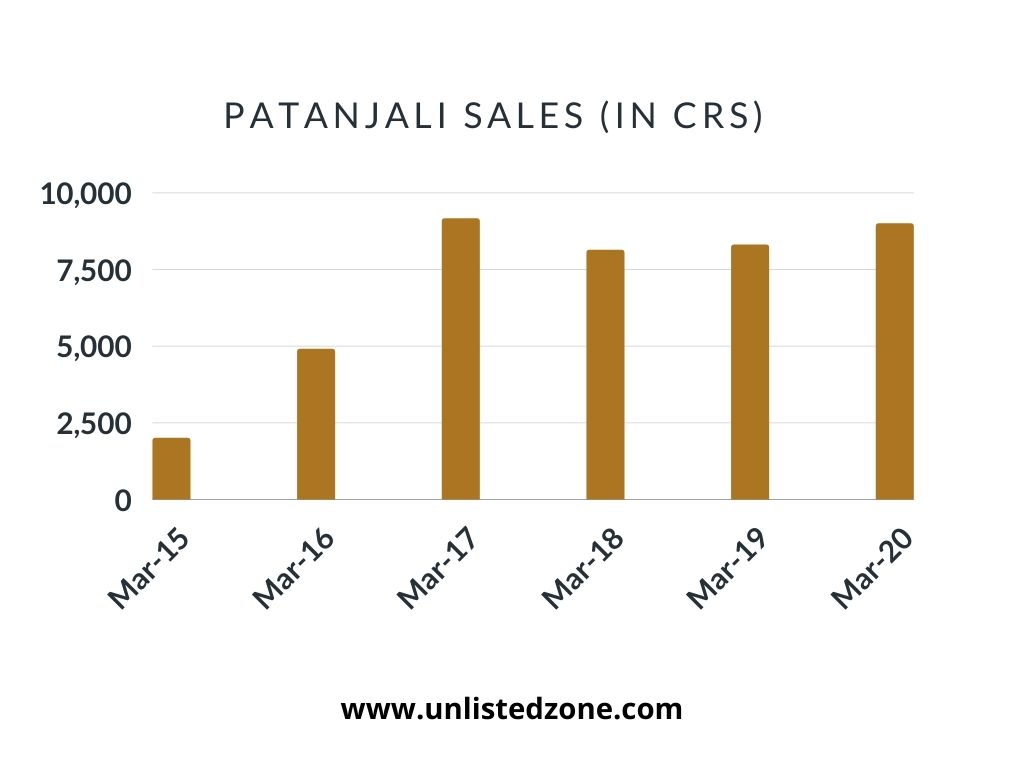

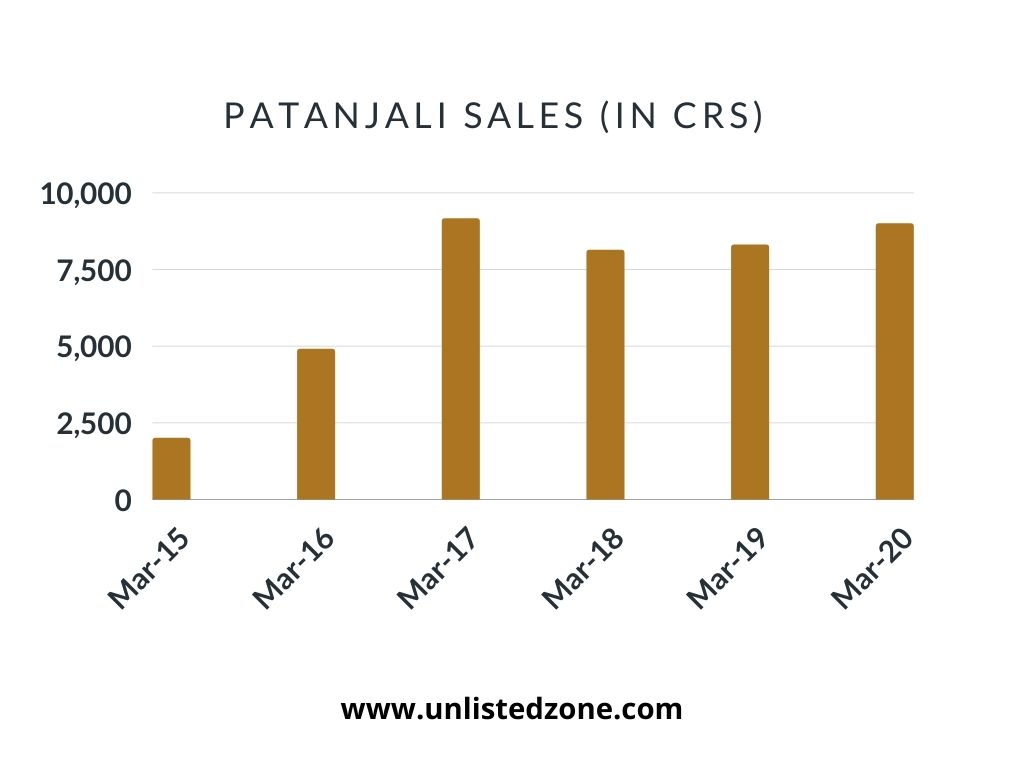

Patanjali was the fastest growing FMCG company in India. Global brokerages like CLSA And HSBC too attributed the same. In FY 2010-11, the company generated a revenue of Rs 100 crore, which jumped up to 95 times in next 10 years to Rs 9,500 crore in FY 2019-20.

Before the current downturn, the Haridwar firm had grown at almost 100 per cent year-on-year between 2014 and 2017. The company had also managed to push its turnover from nearly Rs 2,000 crore in 2014-15 to Rs 5,000 crore in 2015-16 before further doubling it to Rs 10,000 crore in 2016-2017.

Financial Growth

| Particulars( in Crores) |

Mar-15 |

Mar-16 |

Mar-17 |

Mar-18 |

Mar-19 |

Mar-20 |

| Sales |

2000 |

4,899 |

9,158 |

8,135 |

8,300 |

9,000 |

| COGS |

973 |

2,199 |

4,259 |

4,264 |

3,646 |

3,710 |

| Purchase of stock |

191 |

740 |

1,705 |

1,642 |

2,673 |

3,508 |

| Change in Inventory |

-60 |

-82 |

-115 |

-390 |

46 |

-303 |

| Employee Benefit Expense |

74 |

100 |

194 |

261 |

264 |

240 |

| Other Expense |

378 |

846 |

1,428 |

1,626 |

1,024 |

896 |

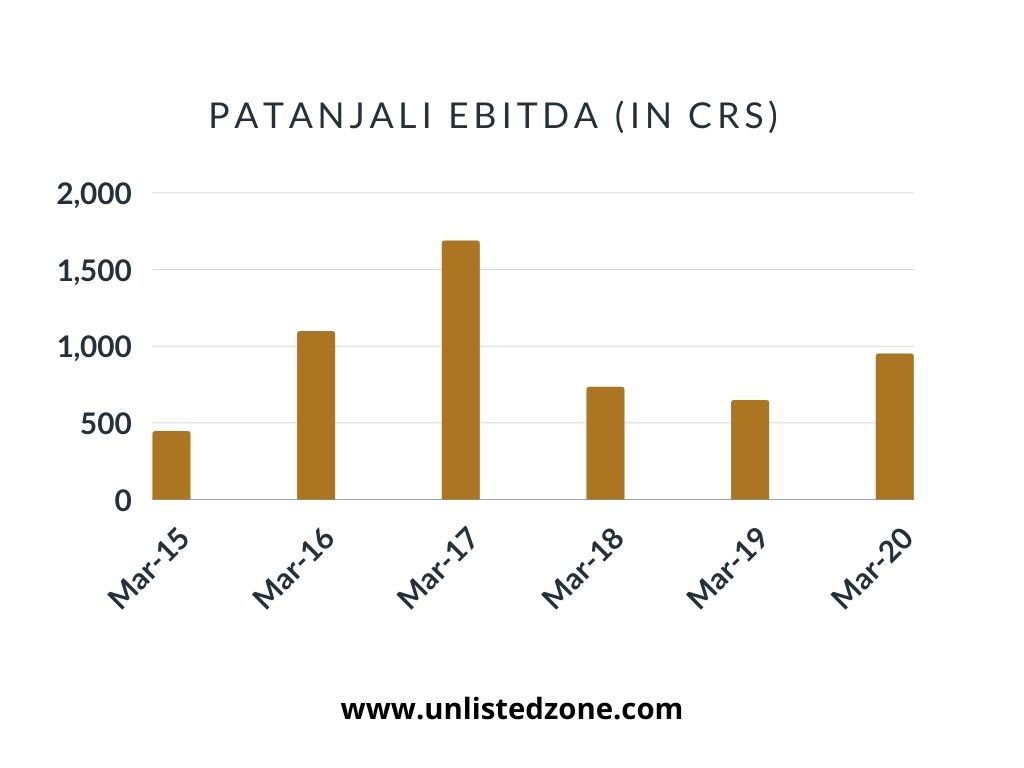

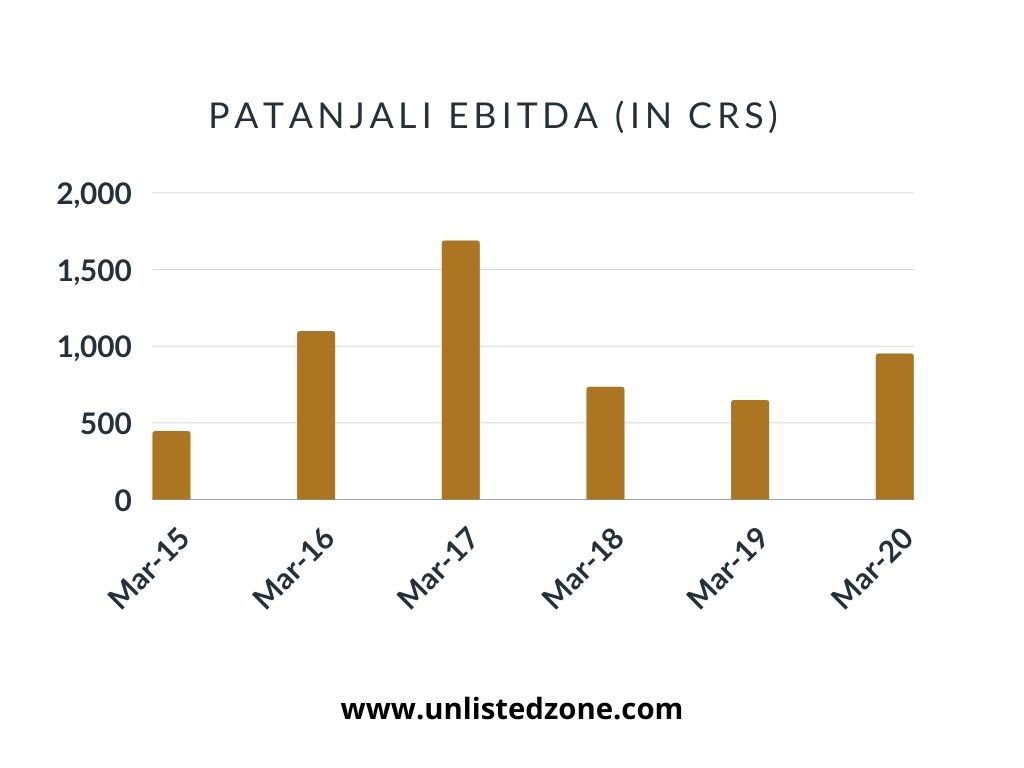

| Operating Profit |

444 |

1,096 |

1,687 |

732 |

647 |

949 |

| OPM % |

22% |

22% |

18% |

9% |

8% |

11% |

| Other Income |

10 |

28 |

26 |

40 |

221 |

65 |

| Interest |

15 |

19 |

66 |

180 |

244 |

240 |

| Depreciation |

46 |

43 |

69 |

146 |

188 |

197 |

| Net Profit |

308 |

777 |

1,193 |

334 |

359 |

424 |

| No. of shares |

4.132 |

4.132 |

4.132 |

4.132 |

4.132 |

4.132 |

| EPS in Rs |

75 |

188 |

289 |

81 |

87 |

103 |

Key Financial Ratios

| Current Ratio |

1.69 |

1.68 |

1.45 |

1.27 |

1.23 |

1.33 |

| RONW |

45% |

57% |

46% |

13% |

12.00% |

11.30% |

| Free Cash-flow |

57 |

213 |

-17 |

14 |

500 |

-500 |

| D/E |

0.81 |

0.75 |

1.12 |

0.81 |

0.8 |

0.76 |

| Trade Receivable Days |

18 |

66 |

78 |

93 |

90 |

86 |

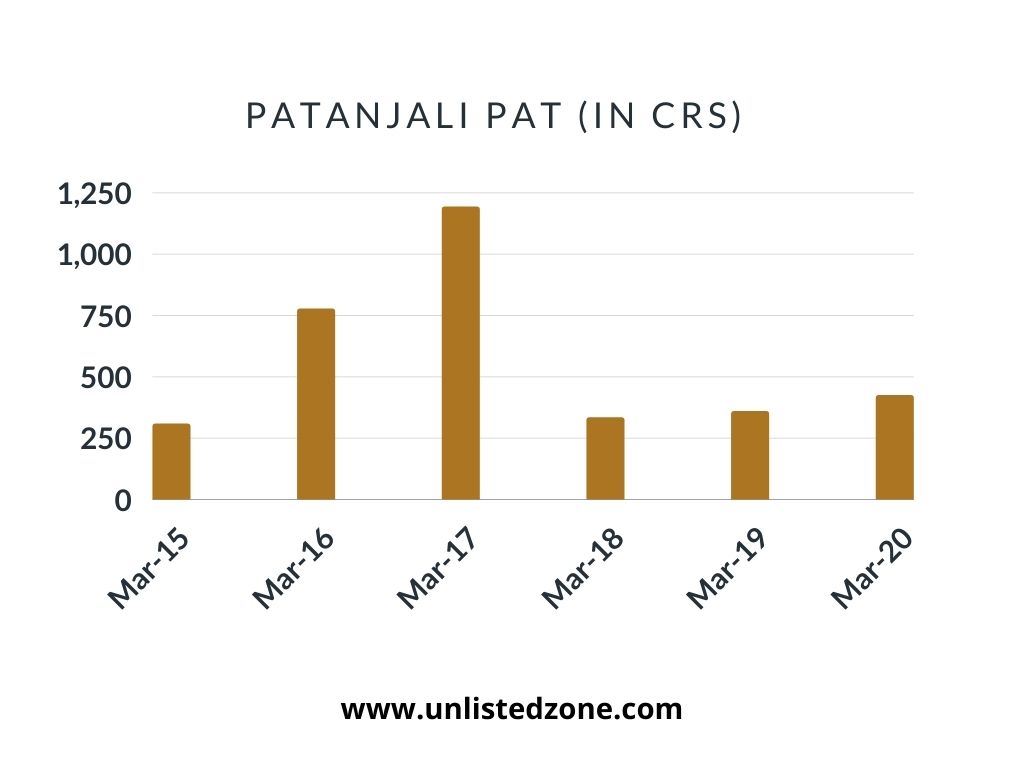

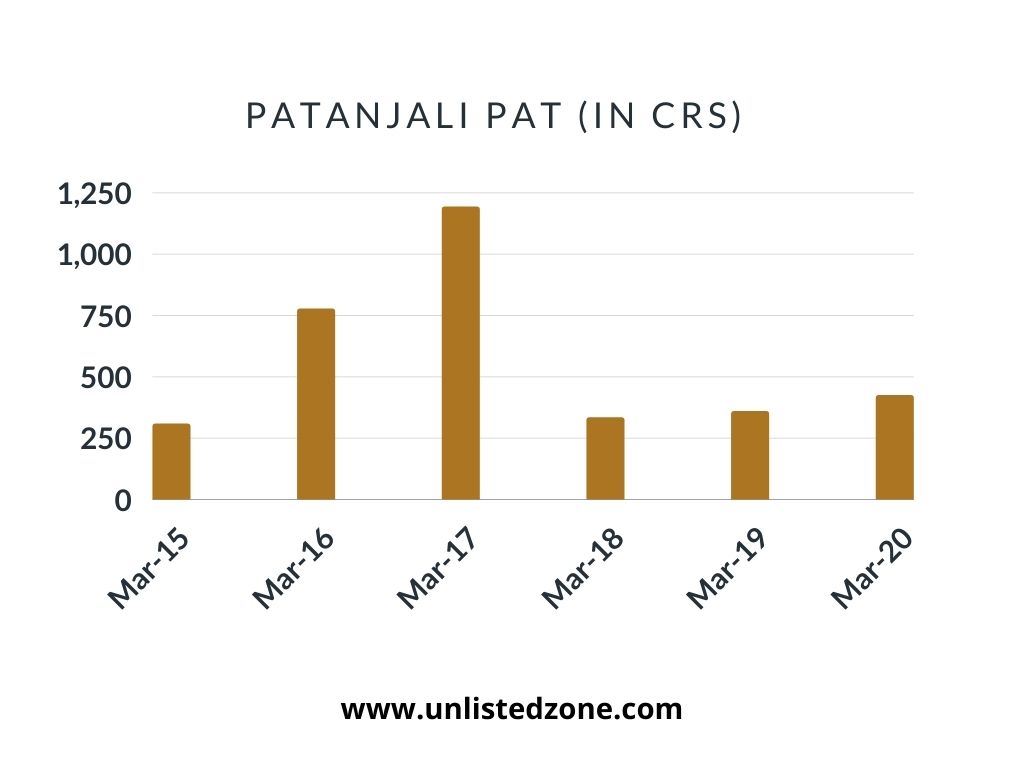

The company peaked a net profit of Rs 1,1193 crore in FY 2016-17 with an EPS of Rs 289. The net profit of the company declined to Rs 334 crores, Rs 350 crores and Rs 424 crore in next three fiscals, respectively and EPS plunged to Rs 81, 87 and Rs 103 during the periods mentioned above in the same order.

Shareholding Pattern

Acharya Balkrishna holds up to 98.6% stake in Patanjali Ayurveda. According to Forbes, His net worth stood at $2.22 billion (Rs 16,600 crore) as of October 2020. According to Hurun’s Rich List 2021, Balkrishna’s estimated net worth dipped by 32% in last year.

Acquisition

In December 2019, Patanjali acquired bankrupt Ruchi Soya Industries at a valuation of Rs 4,350 crore. It is a major soybean product player in India owing products like Mahakosh and Nutrela. The company was relisted on BSE and NSE. The scrip came in the controversies as it soared up to 8,800% in just six months. This led to the stock put under scrutiny by regulators and media. Ruchi Soya was highly under speculation as promoters held up to 99 per cent stake in the company.

Advertisement Strategies

Baba Ramdev, a well known and highly acknowledged name in Indian household, led the advertising campaign for the company. For any FMCG company, advertising and promotions typically account for 12–20 percent of revenue expenditure, but this was significantly taken care of by Baba Ramdev’s branded house strategy. A minimal advertising budget which included few commercials and with the employees acting as volunteers in brand promotion aided in cutting down on the advertising and promotion expenditure. All these were attributed to the fact that the company was void of any financial burden. The Patanjali Ayurveda is financially well placed, and the company was started with an investment of Rs 40 Crores, which was initiated by Baba Ramdev from his yoga camps, television shows on private channels, and donations.

Pricing

Baba Ramdev is running Patanjali with a sole objective of providing quality FMCG products with low price as compared to its competitors. Patanjali typically provides products with 10-30% cheaper than competitors. Along with that it has infused spirit in Indian audience to embrace desi products and boycott MNC, who are here only to make profit.

Sales and Distribution

Patanjali Ayurveda sells its products through nearly 5,000 outlets. Patanjali also sells its products online. It has its footprints on some of the railway stations and airports Patanjali Ayurveda has tied up with various retail conglomerates like Pittie Group and Future Group, Reliance Retail, Hyper city. Patanjali Ayurved has also started its FMCG expansion in the form of dealership and distributorship channels across the country and expects wider growth in overseas distribution as well.

Patanjali forced MNC competitors to make Ayurveda Products

Seeing the rapid growth of Patanjali in the Indian FMCG space with its sales touching Rs. 10,000 crore specially around FY16-17, has forced other FMCG brands like Colgate, Nestle, Dabur and Hindustan Unilever rapidly focused on Ayurveda related products.

1. "Colgate-Palmolive (India) market share had reduced from 57% in FY14-15 to 53% in FY17-18 due to Baba Ramdev Patanjali resurgence. Due to which they were forced to launch Vedshakti, an Ayurveda toothpaste, to counter Baba Ramdev Dant Kranti.

2. Consumer goods major, Hindustan Unilever (HUL) has launched herbal and natural supplements to compete with Baba Ramdev’s Patanjali.

However, after 2016-17, the Baba Ramdev was not able to maintain the quality, and has increased pricing of products which has resulted in reduction of sales. Moreover, the other MNC giants have made many changes in their products portfolio as per Ayurveda standards that helped them to regain lost market share. Due to which, Patanjali which was predicting to double its sales to over Rs. 20,000 crore in FY20 from FY16 has only achieved sales of Rs.9000 crore.

Patanjali was the fastest growing FMCG company in India. Global brokerages like CLSA And HSBC too attributed the same. In FY 2010-11, the company generated a revenue of Rs 100 crore, which jumped up to 95 times in next 10 years to Rs 9,500 crore in FY 2019-20.

Before the current downturn, the Haridwar firm had grown at almost 100 per cent year-on-year between 2014 and 2017. The company had also managed to push its turnover from nearly Rs 2,000 crore in 2014-15 to Rs 5,000 crore in 2015-16 before further doubling it to Rs 10,000 crore in 2016-2017.

Financial Growth

Advertisement Strategies

Baba Ramdev, a well known and highly acknowledged name in Indian household, led the advertising campaign for the company. For any FMCG company, advertising and promotions typically account for 12–20 percent of revenue expenditure, but this was significantly taken care of by Baba Ramdev’s branded house strategy. A minimal advertising budget which included few commercials and with the employees acting as volunteers in brand promotion aided in cutting down on the advertising and promotion expenditure. All these were attributed to the fact that the company was void of any financial burden. The Patanjali Ayurveda is financially well placed, and the company was started with an investment of Rs 40 Crores, which was initiated by Baba Ramdev from his yoga camps, television shows on private channels, and donations.

Pricing

Baba Ramdev is running Patanjali with a sole objective of providing quality FMCG products with low price as compared to its competitors. Patanjali typically provides products with 10-30% cheaper than competitors. Along with that it has infused spirit in Indian audience to embrace desi products and boycott MNC, who are here only to make profit.

Sales and Distribution

Patanjali Ayurveda sells its products through nearly 5,000 outlets. Patanjali also sells its products online. It has its footprints on some of the railway stations and airports Patanjali Ayurveda has tied up with various retail conglomerates like Pittie Group and Future Group, Reliance Retail, Hyper city. Patanjali Ayurved has also started its FMCG expansion in the form of dealership and distributorship channels across the country and expects wider growth in overseas distribution as well.

Patanjali forced MNC competitors to make Ayurveda Products

Seeing the rapid growth of Patanjali in the Indian FMCG space with its sales touching Rs. 10,000 crore specially around FY16-17, has forced other FMCG brands like Colgate, Nestle, Dabur and Hindustan Unilever rapidly focused on Ayurveda related products.

1. "Colgate-Palmolive (India) market share had reduced from 57% in FY14-15 to 53% in FY17-18 due to Baba Ramdev Patanjali resurgence. Due to which they were forced to launch Vedshakti, an Ayurveda toothpaste, to counter Baba Ramdev Dant Kranti.

2. Consumer goods major, Hindustan Unilever (HUL) has launched herbal and natural supplements to compete with Baba Ramdev’s Patanjali.

However, after 2016-17, the Baba Ramdev was not able to maintain the quality, and has increased pricing of products which has resulted in reduction of sales. Moreover, the other MNC giants have made many changes in their products portfolio as per Ayurveda standards that helped them to regain lost market share. Due to which, Patanjali which was predicting to double its sales to over Rs. 20,000 crore in FY20 from FY16 has only achieved sales of Rs.9000 crore.

Patanjali was the fastest growing FMCG company in India. Global brokerages like CLSA And HSBC too attributed the same. In FY 2010-11, the company generated a revenue of Rs 100 crore, which jumped up to 95 times in next 10 years to Rs 9,500 crore in FY 2019-20.

Before the current downturn, the Haridwar firm had grown at almost 100 per cent year-on-year between 2014 and 2017. The company had also managed to push its turnover from nearly Rs 2,000 crore in 2014-15 to Rs 5,000 crore in 2015-16 before further doubling it to Rs 10,000 crore in 2016-2017.

Financial Growth

The company peaked a net profit of Rs 1,1193 crore in FY 2016-17 with an EPS of Rs 289. The net profit of the company declined to Rs 334 crores, Rs 350 crores and Rs 424 crore in next three fiscals, respectively and EPS plunged to Rs 81, 87 and Rs 103 during the periods mentioned above in the same order.

Shareholding Pattern

Acharya Balkrishna holds up to 98.6% stake in Patanjali Ayurveda. According to Forbes, His net worth stood at $2.22 billion (Rs 16,600 crore) as of October 2020. According to Hurun’s Rich List 2021, Balkrishna’s estimated net worth dipped by 32% in last year.

Acquisition

In December 2019, Patanjali acquired bankrupt Ruchi Soya Industries at a valuation of Rs 4,350 crore. It is a major soybean product player in India owing products like Mahakosh and Nutrela. The company was relisted on BSE and NSE. The scrip came in the controversies as it soared up to 8,800% in just six months. This led to the stock put under scrutiny by regulators and media. Ruchi Soya was highly under speculation as promoters held up to 99 per cent stake in the company.

The company peaked a net profit of Rs 1,1193 crore in FY 2016-17 with an EPS of Rs 289. The net profit of the company declined to Rs 334 crores, Rs 350 crores and Rs 424 crore in next three fiscals, respectively and EPS plunged to Rs 81, 87 and Rs 103 during the periods mentioned above in the same order.

Shareholding Pattern

Acharya Balkrishna holds up to 98.6% stake in Patanjali Ayurveda. According to Forbes, His net worth stood at $2.22 billion (Rs 16,600 crore) as of October 2020. According to Hurun’s Rich List 2021, Balkrishna’s estimated net worth dipped by 32% in last year.

Acquisition

In December 2019, Patanjali acquired bankrupt Ruchi Soya Industries at a valuation of Rs 4,350 crore. It is a major soybean product player in India owing products like Mahakosh and Nutrela. The company was relisted on BSE and NSE. The scrip came in the controversies as it soared up to 8,800% in just six months. This led to the stock put under scrutiny by regulators and media. Ruchi Soya was highly under speculation as promoters held up to 99 per cent stake in the company.